- The return to lower lending standards and secondary financing including second lien mortgages like HELOCs should benefit TREE strongly.

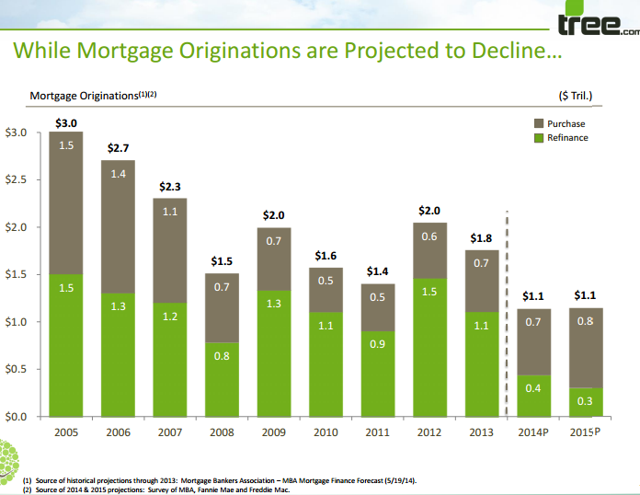

- Investors are expecting a decline in volumes as interest rise which is counter to what we think as lenders increase lead generation usage in order to offset refinancing declines.

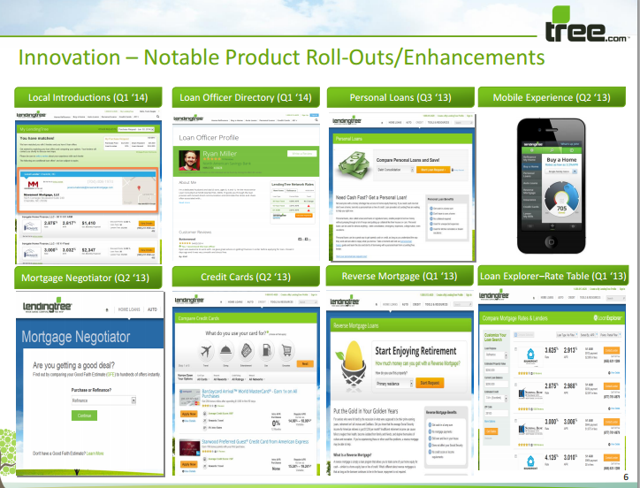

- New products, including many in the non-mortgage space, continues to enhance the company's growth trajectory.

Executive Summary

Since Tree.com (NASDAQ:TREE) sold its lending and mortgage origination business to Discover Financial nearly two years ago, the leftover business has largely been ignored by the market. The company has quietly morphed into a media and technology company that focuses on lead generation and analytics. The company's new marketing strategy and ad campaign should allow it to capture more mortgage marketing dollars and increase the volume of loans leads it generates. The shares have sold off by more than a quarter since its peak back in March. We think investors today will get that quarter back, and then some over the next year.

Long Thesis

Our long thesis rests on the company's strong management team, wide portfolio of products, strong lender growth, new product launches, and steep discount valuation to its peer group. We break out the upside catalysts below between short- and long-term drivers.

Short Term

- As refinancing slows dramatically, lenders will seek marketing channels to supplement their businesses slack.

- New products that have recently launched will create new revenue streams.

- Cross selling opportunities across their marketing engine through a common technology platform

Long Term

- TREE will grow their market share through higher purchase volumes and pricing capturing more market share.

Business Overview

TREE operates lendingtree.com, a mortgage lead generation business allowing consumer the ability to have lenders compete for their business. As their now 14-year-old slogan would state, "when banks compete, you win!"

TREE was spun out of InterActive Corp in 2008 after they purchased the firm for 5 years earlier. It was started by Doug Lebda back in 1998 while he was in business school. He came up with the idea while working for Price Waterhouse in Pittsburgh after becoming frustrating with the process of searching for a lender with the best loan terms.

After launching the site in 1998, he grew the firm exponentially eventually overseeing its IPO during the height of the internet boom in 2000. They quickly expanded into commercial real estate and other businesses through five acquisitions eventually reaching $300 million in revenue by 2003. In that year, InterActiveCorp (IAC) purchased them for approximately $726 million. Mr. Lebda kept working on his business taking on the role of CEO for IAC's lending and real estate businesses.

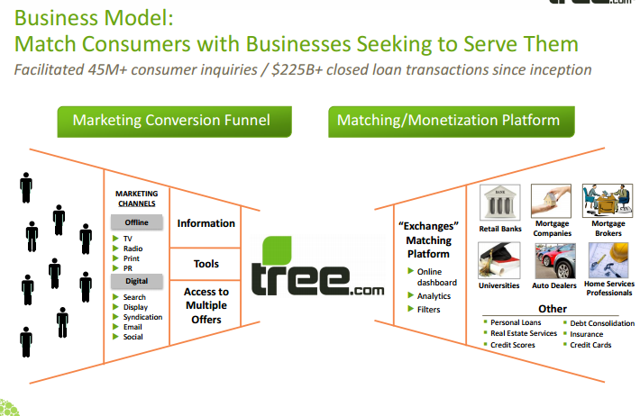

Today, the company is organized through four business segments: lending, auto, education, and home services. They operate under the brand banners: LendingTree, GetSmart, LendingTree Education, LendingTree Autos, LendingTree Home Pros and InsuranceTree. Together, the brands serve a similar purpose of allowing consumers to more easily comparison shop for loans and other services from multiple businesses and professionals that will compete for their business.

A quick look at the business model shows it relies on leads matching consumers with the appropriate underlying business:

(Source: First Quarter Investor Presentation)

LendingTree Loans Origination Business Sale

The sale of Home Loan Center (HLC) assets to Discover for $56 million nearly two years ago has released the firm from the originations business entirely. We view this as a significant positive as the firm is, as it always has been, a marketing technology company working within the media industry.

This will allow the company to focus on its core mortgage lead generation business while they branch out into other personal finance offerings, such as personal loans, credit cards, auto loans, educational loans, and the home services industry.

Marketing Leads Growth

The core mortgage lead business is still their bread and butter. The home mortgage side of the site has relationships with nearly 400 banks, lenders, and loan brokers offering a suite of loan options including the growing-in-popularity reverse mortgage business. This piece of the business is largely misunderstood by the market and investors. Many feel the company will see less demand in the near term thanks to lower refinancing demand as interest rates rise and home purchases slow. However, just the opposite is likely to play out.

According to the Mortgage Bankers Association, total mortgage application volume is down 37% yoy, while refinancing volume has dropped 50% of its level a year ago. When and if interest rates rise, refinancing will slow even more dramatically as it has in recent quarters. In fact, our estimation is that most people who could have refinanced, have and that the only ones left are those waiting for home equity values to hit a point where they are finally able to refinance. As home values continue to increase, a trickle of additional refinancing volumes should pull through.

(Source: Company Presentation Q1 2014)

This slack in the refinancing lender market especially, will lead to increased marketing for the originators. Given the slack they are likely seeing in staffing at their firms, in order to increase their business, they will increasingly turn to lead generators like the Lendingtree.com website. TREE's small market share within the lead generation industry will give it plenty of gains through market share growth. As demand for leads continues to outstrip supply, purchase volumes from lenders will continue to grow. TREE should also realize significant pricing power in this environment leading to improved margins in the back half of 2014.

This demand environment is compounded by several other factors. For one, TREE continues to increase the number of lenders in their network. Second, lending restrictions are being shed once again with new (old) creative financing offers being made available to low-qualified borrowers once more.

TREE believes it is capturing just ~1.5% of the total mortgage originations today. They continue to capture more share each quarter and have significant runway for future capture as well. In the last several quarters, TREE's mortgage product revenue growth has exceeded industry originations each time. We believe their talent and investments in marketing their brand is paying off with future share likely driven by:

- Current and future nationwide ad campaigns that reiterate the brand among consumers leading to more effective attraction in leads relative to peers.

- Traffic growth through strategic product development and marketing with a focus on returns on investment.

- Continual new product launches with a strong research and development channel.

- The persistent and continuous growth of the lender network drawing on more profitable lead generation.

Their strong investment in marketing has clearly paid off with one of the highest brand awareness in the industry at 71%, higher than CitiBank and Quicken Loans and just behind Wells Fargo and Bank of America. The company launched another nationwide ad campaign in the first quarter which is why adjusted EBITDA margin fell to approximately 11%, down from 16% in the fourth quarter of 2013, as they spent more on marketing and advertising.

The last time they launched a nationwide ad campaign was back in the second quarter of 2013, which also saw a commensurate fall in adjusted EBITDA margins. However, in the subsequent two quarters, adjusted EBITDA and adjusted EBITDA margins jumped significantly to 14% and $5.4 million after one quarter and 16% and $5.9 million after two. We believe that the firm will see a comparable jump in EBITDA in the fiscal second and third quarters this year. This despite what we think is sandbagged guidance from management calling for adjusted EBITDA between $4.5-$5 million, up 0% to 11%.

As we noted, investors have soured on the stock as interest rates have risen (a bit) and are expected to rise further. However, we think the shares provide a decent value given the post refinance boom scenario which we think will play out. We think lenders will want to keep their origination volumes as they were during the refinancing (and purchase) boom over the last few years. In order to maintain that business, they are likely to boost marketing spending so as to not have to shed loan officers and capacity.

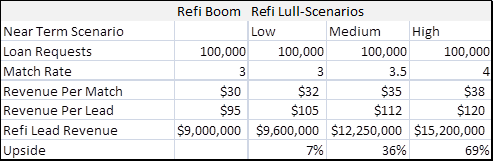

The scenario will generate more leads with higher "matches" multiples leading to higher revenue per match and per lead. We think this could boost refinance lead revenue by as much as 20% in the near term on the same number of loan requests. A similar scenario will likely occur on their purchase lead revenue with higher "matches" and revenue per lead. Below you can see the potential:

(Source: Author's Calculation)

In the first quarter, we saw the start of such a scenario playing out with overall market trends slowing materially as total mortgage market originations fell by 50% while Tree.com revenue from mortgage products jumped a strong 35%. While revenue could increase significantly from here, the variable marketing margin would likely decline due to the cost per lead increasing. However, while cost per lead could increase as much as one-third, marketing margin would fall just 400 bps thanks to the operating leverage. In the end, sales will rise, pricing and leverage will offset some of the variable market decline, and overall profitability will increase considerably.

The adding of more lenders to the platform is a strong driver for revenue growth over the next two years. Over the last year, they have added 50% more lenders to nearly 400 while using their sales teams to expand the amount of wallet with existing partners. While still not at the level of Bankrate or Zillow, they are catching up quickly. This is being fueled by the exiting of the lending business which many lenders likely felt was a conflict creating tentativeness on their part for joining the platform. Lender growth only looks poised to accelerate from here.

Non-Mortgage Business Growth Driver

The non-mortgage business growth has been a strong driver for the company's growth profile over the last few years. In the first quarter 2014, non-mortgage revenue increased 108% yoy and 11% sequentially to $5.8 million but is still just 14.5% of total revenues. This segment operates the LendingTree Education, Autos, and Home Services divisions. Under these banners, the company matches consumers with lenders for personal loans, credit cards, student loans, reverse mortgages, home equity lines, and other personal financial loans.

In the first quarter, the company noted particular strength in its reverse mortgages and personal loans. The autos business, which is primarily a loan-based comparison shopping service, also contributed significantly to revenue growth. Management noted that in the months ahead, they anticipate adding more loan-based products centering on comparison shopping offerings which leverage the LendingTree brand.

While the piece of the business that is non-mortgage is still relatively small (at just 15% of total revenues) it is growing at an exceptional pace with new products likely to accelerate that growth further from the 100%+ year-over-year growth rates.

| 1q 2014 | 2014 | 2015 | 2016 | |||||

| Mortgage Revenue | 34.2 | 86% | 142 | 86% | 157 | 85% | 174 | 83% |

| Non-Mortgage Revenue | 5.8 | 15% | 23 | 14% | 27 | 15% | 34.5 | 17% |

| Total Revenue | 40 | 165 | 184 | 209 |

New Products

The company has launched several new products over the two years in both the mortgage and non-mortgage sides of the business. The recent investor presentation has a slide which I pasted below which is a fantastic review of the products launched since the start of 2013.

(Source: First-Quarter Investor Presentation)

The primary product launch was Loan Explorer which went live a little over a year ago entering the lucrative mortgage rate table market. Instead of asking for lenders to bid on them, the product allows consumers to see current, real-time rates, side by side, for an easy-to-view comparison window. One of the issues in the industry today is the amount of data that sites require potential borrowers to input into their websites. This is mainly to create leads for their loan officers as they typically require an email address and phone number which is then immediately given to officers who then pester consumers. The new Loan Explorer allows consumers the ability to see current rates from a large supply of lenders without having to input tons of personal data. The new site is also additive to their core mortgage product providing a potential feed for cross selling.

Right now the market is completely owned by Bankrate.com and Zillow.com but as the company can generate strong site visitation, revenue from the product will increase rapidly and they will be able to increase the number of lending partners and compete with the big players. Currently, Bankrate.com and Zillow.com charge big money per click, so by leveraging their core business, TREE can have a CPC much lower than the big players and build their user base quickly.

The launch of the reverse mortgage and credit card shopping platforms were large steps towards a full suite of personal financial products. The reverse mortgage market is a $15 billion industry and growing at an approximate 20% CAGR. The demographic story in the country is driving the market with 77 million retiring baby boomers fueling the growth in these loans over the next decade. With many of the larger lenders exiting the market (Wells Fargo and BofA), consumers are going to need to look for smaller lenders to fulfill their needs. TREE has built one of the few platforms that allows consumers to comparison shop for these types of mortgages similar to traditional amortizing mortgage products.

The credit card product is another strong one and potential for significant growth over the next few years. They allow users to quickly compare cards, including the benefits, interest rates, and fees, on the platform given just the users credit score. While there are many smaller sites and a few large ones that perform similar functions, we think TREE will be able to capture significant share of the fast growing business leveraging their core brand.

A few months ago, the company launched LendingTree Education, a new student loan shopping experience for private student loans. Students and parents can compare private student loan offers that are customized to the requested loan amount and school being attended. The borrower then has the ability to compare loan rates and features to find the best fit for their needs.

According to the College Board, private student loans accounted for 39% of undergraduates' funding, and 64% of graduate students' funding last year. Total education borrowing totaled over $110 billion during the same time period. Analysts see private student loans growing significantly in popularity as borrowers seek mechanisms to bridge the funding gap between the tuition bill and the federal financial aid received.

The proliferation of ancillary products to complement their core mortgage operation allows the firm to diversify away from being a one-function shop to the premier destination for personal financial information and shopping.

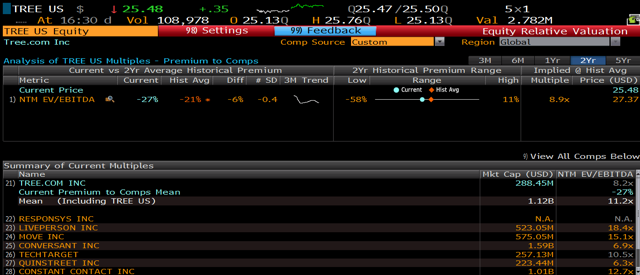

Valuation

The stock is very cheap especially compared to its primary competition, while containing, what we believe is better underlying trends and fundamentals. The company is currently trading at an enterprise value of just $195 million after backing out the $85 million of cash (no debt) from the market cap. We think the company is likely to surpass expectations given the sour sentiment surrounding the stock and the shares are likely to get some nice bids as investors find the name once again.

The name is largely flying under the radar with just three analysts following the stock and one of those having stale data. Secondly, while the company does issue guidance, they seem to provide very conservative estimates. This bares out with the company beating on the top line six out of the last six times, with several of those upside surprises being greater than 10%.

At $195 million of enterprise value, and the company expected to earn approximately $29 million in adjusted EBITDA next year, the shares are trading at under 7x that figure. We believe the company can generate adjusted EBITDA levels of nearly $50 million by 2017 (for reference, the company earned approximately that back in 2006 during the last housing boom). This will be driven by the core business but increasingly from their non-mortgage products.

I used three different valuation methodologies to assess the intrinsic worth of the shares. First, a comp-based valuation comparing the company to bankrate.com and zillow.com and then a complete internet lead generation peer group. Bankrate and Zillow trade at ntm EV/EBITDA multiples of 11.5x and 77.3x, respectively. Compare that to the current ntm EV/EBITDA ratio for TREE of 8.2x. While the 77x multiple for Zillow is excessive, we think the 11.5x ratio for Bankrate is fair. If the company earns adjusted EBITDA of $21 million this year, which we feel is quite achievable, and we apply an 11.5x multiple, the EV would be $241 million or 24% above the current valuation. Using the fiscal 2015 $28 million estimate yields an intrinsic value of approximately $36 per share or 41% upside from here.

If we expand the comps valuation and include the entire peer universe of lead generation companies, we see a mean EV/EBITDA of 11.2x, which is 27% above the current multiple for TREE.

(Source: Bloomberg EQRV Function)

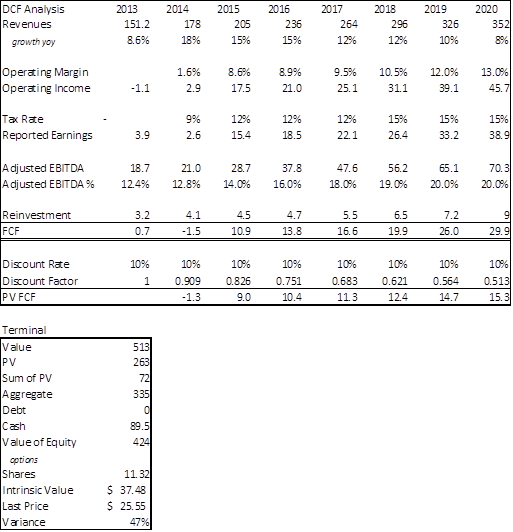

Second, a discounted cash flow, while not the best method to be used here, can be informational. Our model is detailed below along with the various inputs. The assumptions for top-line growth and operating margins are close to the consensus estimates through 2017. Again, we feel these figures are understated. The intrinsic value appears close to $37.50 per share, a 47% premium to the current trading price.

(Source: Author's Calculation)

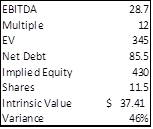

Third, an EV/EBITDA model, which we feel the most appropriate method for valuing the company. At an expected $28.7 million in adjusted EBITDA for fiscal 2015, and applying a 12x multiple to that figure, gets us an enterprise value of $345 million. Adding back the cash of $85.5 million results in an implied equity valuation of $430 million of $37.40 per share. That is a 46% variance from the current trading price. Even if you account for further share issuance from option exercises, we still see the value of the shares closer to $35 each.

(Source: Author's Calculation)

In summation, we feel the shares are worth between $35 and $38 per share based on the true earnings power of the company. The shares are likely trading at such a discount to that level for several reasons including the rising interest rate potential- despite the increase revenue generation TREE is likely to garner, poor recent operating results as they wind down their HLC assets, and a broken story as the company suffered so mightily following the housing bust. The company is asset-lite with minimal capex needs to support the business. The non-mortgage growth is likely to create a floor beneath the shares as the numerous new products boost the top line and start to move the needle and contribute to earnings this year. The downside is thus, fairly limited providing an asymmetric return potential.

Catalysts

The following are the catalysts that are likely to boost the share price:

- Loan standards and average credit quality are falling again allowing a large population of previously unqualified borrowers to search lenders.

- The rising interest rate environment has held the shares back but are likely to lead to increased marketing spend by lenders to offset lower refinancing volumes.

- New product growth has been nothing short of amazing and is growing at triple-digit rates. The non-mortgage pieces are starting to augment top- and bottom-line growth helping to diversify the business and provide downside risk protection.

Risks

A pronounced downturn in the housing industry as well as a credit contraction would be the two largest potential risks facing the company today. The company is still tied heavily to the housing market, whether through low interest rates fueling refinancing demand or through new home purchases. A healthy housing market will continue to drive the company's profitability until the non-mortgage pieces become large enough to offset it. Meanwhile, most of their businesses are derived from personal financing, primarily through loans- personal, home equity, education, credit cards, auto etc. Credit contraction, either through a cyclical downturn or through regulatory action would also harm the company's prospects.

Conclusion

TREE is an underfollowed and unloved stock that is largely being held back due to erroneous beliefs that higher interest rates will severely curtail their future growth. However, given their highly recognized brand in the industry, the over capacity of mortgage officers looking for other sources of business, relaxation of lending standards, and the new products within the space, the firm should be able to capture significant market share while seeing increased volumes and pricing. This will more than offset the decline in refinance and new purchase activity associated with higher rates. Additionally, the pace of new product launches that are growing at exceptional rates, are increasingly augmenting the top and bottom lines. We see shares trading in the high $30s over the next twelve months.

No comments:

Post a Comment