Summary

- Overstock.com is trading at a wide discount to my estimate of private market value.

- Management is introducing higher-margin service offerings such as Supplier Oasis and an insurance broker which should lead to incremental margin expansion.

- Clear tailwinds in eCommerce, a capital-light operating model and optionality in terms of monetizing developed in-house software and accretive capital allocation provide downside protection and significant upside potential.

It is quite possible that no other public company and/or its CEO is as controversial, or at least portrayed to be by the financial media, bloggers and knuckleheads in the Twitter Finance circle, as Overstock.com(NASDAQ:OSTK) ("Overstock" or "the company") and CEO Patrick Byrne. Whether Overstock is in the news for accepting Bitcoin as payment for goods on its site or for the long-running naked short-selling litigation lodged against the named defendants, Overstock is certainly not a darling on Wall Street or CNBC. Far from it. And the share price reflects as much.

Recently, Becky Quick invited Mr. Byrne to appear on Squawk Box to which I understand Mr. Byrne accepted, but then CNBC reneged on the offer. To me,the most interesting piece of the CNBC clip is the unabashed dismissal of Overstock by Joe Kernen and Jim Cramer as if the company is some sideshow at a circus. These are the types of contrarian ideas I like when people prima facie disregard investment opportunities.

Lost in the Wall Street and financial media well-documented vitriol over Mr. Byrne and his company is the value being offered to investors in Overstock shares at the current $400 million price. At that price, investors are able to buy a profitable sales/logistics/technology platform based business on track to produce around $1.5 billion in revenue this year, a clean balance sheet with net cash, an inventory-light third-party fulfillment ("3P") operating model and plenty of optionality given Overstock has hidden value in the form of internally-developed software that Mr. Byrne indicated on the Q2 earnings call the company may try to commercialize in the next couple of years.

Most importantly, investors get to own a 15-year old, profitable eCommerce retailer turned technology company at a distressed price (~0.3x sales), even though Overstock still looks at themselves as a start up with a long tarmac of growth ahead and is growing sales at a low double digit clip. With it commonplace these days for Web 2.0 start up businesses to garner monster 10x+ sales multiples in the private market, investors can buy established Overstock for much more rational prices in the public market.

Operating Model

To understand Overstock, investors must first understand the business model and why it is a terrific business for shareholders. A lion's share (about 90%) of Overstock's revenue comes in the form of commissions earned by selling 3P items through its sales platform, Overstock.com. Overstock collects payment from the customer up front (and doesn't incur any bad debt expense), then the 3P partner drop ships the item directly to the customer and invoices Overstock for some agreed-upon price. The difference is the commission earned by Overstock.

Overstock then pays its 3P partners 15 to 30 days later. To that end, Overstock has what is referred to in the insurance industry as "float," a negative cash conversion cycle and the ability to work with minimal working capital requirements due to the 3P selling model. At Q2 quarter-end, Overstock had about $37 million in working capital if one includes the $10 million in precious metals held on the balance sheet. Putting that in perspective, Overstock turned over its working capital about 9 times in the quarter, quite efficient.

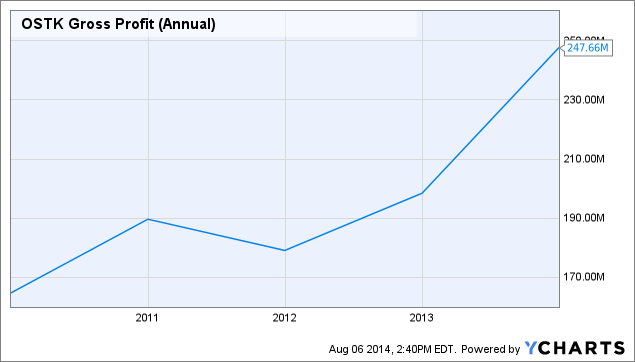

The way I think about Overstock and the internet is scale. The goal is to grow sales and gross profit dollars while keeping corporate overhead relatively fixed. As we can see from the chart below, gross profit dollars are indeed growing nicely. Note that Overstock did have some execution missteps in 2011 when they tried to rebrand to O.co (thereby attempting to tell consumers they aren't only in the liquidation business, but a 3P retailing platform as well). The business took its lumps, and bounced back generating $248 million in gross profits last year.

OSTK Gross Profit (Annual) data by YCharts

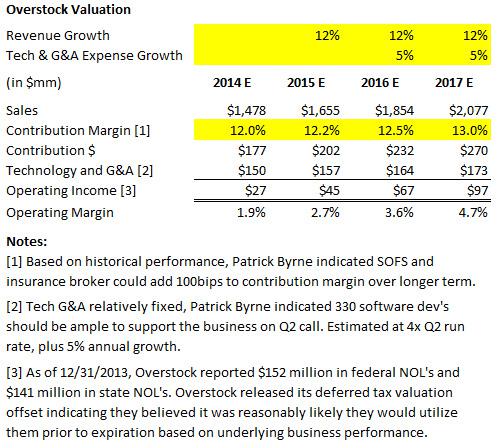

The question then is what level of net margins can Overstock generate at scale? Based on Overstock's current growth trajectory, operating model and my analysis, I think Overstock should be able to generate 4 to 5% net profit margins over the next few years. My model includes 12% compound annual revenue growth, slightly increasing contribution margins to 13% based on new higher-margin revenue streams (Supplier Oasis and an insurance brokerage business), and 5% annual growth in SG&A expense from the current run rate.

Historically, Overstock targeted a 12% contribution margin -- that is, 12% of sales are left over to cover fixed costs after all variable costs which works out to be about 23% gross margin, less 4-5% for fulfillment expenses and 6-7% for marketing expenses. Again, the idea here is that sales growth will result in more gross profit dollars to cover fixed overhead, thereby allowing net margins to expand.

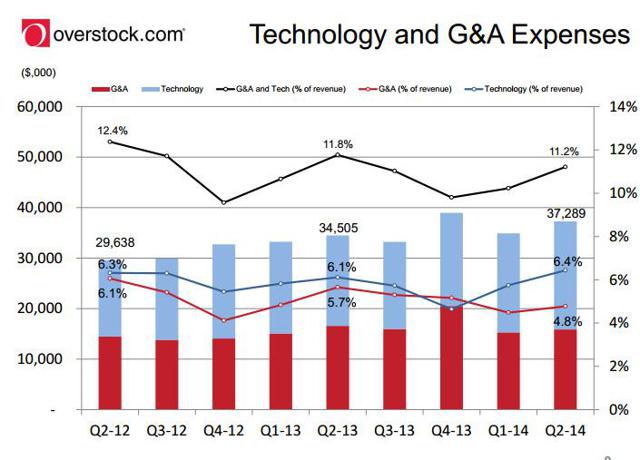

Readers may ask, isn't corporate overhead expanding? The answer is yes, it has over the last several years, but I think the growth in corporate overhead should begin to moderate given Overstock.com has reached an appropriate level of software developer headcount to drive its future growth. Overstock introduced a new slide in its earnings call which shows a breakout of its corporate overhead. One can see that administrative items have remained relatively flat (a good sign), whereas technology spending has increased. I would suggest that spending on the technology front is smart for a growth-oriented technology company, especially when Overstock used the extra resources to develop certain in-house technology that will potentially be commercialized in the future.

Mr. Byrne provided good detail into leveraging the technology spend on the Q2 conference call (transcript courtesy of Seeking Alpha):

The point is though I think that between 300 to 330 developers I think it's ample. We don't have this crave anymore if only we had more developers. We now have an appropriate amount of developers who can keep up with maintaining what we have improving it and also the new projects that were constant and some of these are very major projects, things like Supplier Oasis Fulfillment Services ("SOFS"). That's a major, major system that's been built. And so my point is I don't think we've got to grow to 330 to 600 and 900. At 330 it seems basically ample; there is not just the sense of backlog, constant backlog all the time.

A quick word on software development and as Overstock.com as a technology company, rather than solely an eCommerce retailer. Along with Overstock's core business, the growing 3P platform (17% 3P revenue growth in Q2, 13% consolidated growth), investors are also investing capital towards a company that has plans to monetize scalable and high-margin software in the next couple of years. To that end, I think investors can think of Overstock as less of a retailer -- only 10% of sales are proprietary and they hold only about ~$25 million of inventory -- but more as a sales, logistics and technology platform. Value is really driven by Overstock's large customer base, highly trafficked web banner, its 2,500 3P supplier relationships and the potential for commercializing internally-developed software. Mr. Byrne commented on the earnings call:

We have an innovation management system that we built in-house and other Enterprise 2.0 technologies and there is discussion of why don't we go commercialize these. These are better than anything that's available that we see in the marketplace. I don't want us to get distracted now, but one of the reasons for building the new building with this much space to grow is once we're in it two years from now, that's kind on the top of my list of things to do. We probably need to start another company whose goal is to commercialize Overstock's technology. But I just don't want to do it for a few years, we got enough things to turnaround out here.

This provides investors optionality given the value inherent in software coupled with a built-in customer base of 2,500 3P partners to sell into. Put differently, I don't know what, if any, value should be ascribed to the "disruptive" Enterprise 2.0 software referenced in the Q2 earnings call, but investors aren't paying anything for it today given the distressed multiples at which Overstock already trades, and Mr. Byrne clearly has this important initiative on his radar screen.

Valuation

To value Overstock, I simply took a blended approach of a Price/Sales and forward Price/Earnings multiple, using a 0.75x P/S and 20x forward P/E multiple, yielding an equity value of ~$1 billion, or about $42 per share based on 24 million shares outstanding.

While there is reason to believe that those multiples are less than scientific, my previous due diligence and experience with another eCommerce banner,Vitacost.com (NASDAQ:VITC), leads me to believe strategic buyers generally value eCommerce properties on a sales multiple. Vitacost was not yet GAAP profitable and had a proprietary sales model, rather than a more attractive 3P model, and it was purchased by Kroger (NYSE:KR) for ~0.6x EV/Sales in July 2014. Given Overstock is in the early innings of what appears to be sustainable, low double-digit revenue growth coupled with margin expansion, I think Overstock deserves at least the multiples described above.

Another way to look at Overstock's valuation is how much would it cost a strategic player to replicate the business? That includes brand recognition/identity, customer base, physical/digital infrastructure, supplier relationships, technology platforms, etc. We can speculate how much that is, but I think it is significantly more than $400 million, especially when compared to the amount of time it would take to grow a business to a $1.5 billion run rate.

Take, for example, Kroger's rationale for buying Vitacost:

This moves us forward a couple years, so that is avoided spend that we would have had if we tried to develop these capabilities in house. So we are avoiding the spend on that. We are also avoiding the natural start up expenses of trying to launch a dot com platform on our own. So this moves us forward several years, and not only helps us avoid the pitfalls of a start up of our own, but also the expenses that would have run through the income statement.

We also know TJX (NYSE:TJX), a brick & mortar competitor in the off-price market, is spending significantly on its eCommerce platform and that they are behind the curve in developing their omni-sales channel strategy. I'm not saying TJX is considering a bid for Overstock, but a relevant question is how much would TJX pay for Overstock to avoid the cost of building out their own eCommerce capabilities and capture additional market share? I think 1x sales would not be unreasonable, and likely a bargain for a strategic buyer, given the rationale provided by Kroger for the Vitacost deal, and because Overstock has certain advantages over Vitacost. Stated differently, I believe there is a wide margin of safety to Overstock's private market value at the current $400 million price.

Capital Allocation

According to Mr. Byrne, the Board of Directors ("BoD") is actively considering and/or discussing a share buyback at BoD meetings. However, the company is currently in the process of securing a ~$75 million mortgage to finance a new corporate HQ in Salt Lake which is a constraining factor in the share repurchase talks. In addition, Mr. Byrne indicated on the earnings call that the company is cautious regarding the future state of the economy and wants to maintain a robust financial position in the event of a recession.

While I appreciate and understand the caution, I urge the Overstock BoD to consider a meaningful buyback at current prices. One innovative way to increase value for continuing shareholders would be to seek a $75 to $100 million long-dated note from its largest shareholder, Fairfax Financial, and conduct a Dutch auction to repurchase shares at no higher than $20 per share. Fairfax would benefit and protect its equity investment by owning a credit against Overstock, earn interest on the note and materially increase its equity stake at attractive prices. Fairfax is also very-well capitalized and a note of this size would be relatively immaterial.

Overstock would benefit by not having to go working capital negative while taking about 20% of its outstanding shares off the table, and would maintain ample working capital to operate the business should the economy regress into a recession.

This, in my opinion, would create significant long-term value for Overstock shareholders and is an attractive risk/reward way to allocate available capital while considering the HQ commitments and working capital needs to maintain a robust balance sheet. I urge the BoD and Fairfax to consider this option.

Key Risks

Overstock is clearly levered to the US consumer and housing industry via its large percentage of home furnishing sales. These are macroeconomic risks for which I am not qualified to assess.

What I am more interested in from a risk perspective is the evolving competitive environment, consumer behavior and buying patterns. Overstock competes vigorously in the eCommerce space which is characterized by relatively low barriers to entry, but also has tailwinds relative to brick & mortar retailers. We know about the Amazons (NASDAQ:AMZN) of the world. From my view on the evolving industry, key threats come fromAlibaba who is entering the market via a new 3P web banner, 11main.com. Start up houzz.com is gaining traction on its platform with over 20 million active users, and a unique selling model -- a user-content generated platform and a SaaS revenue stream from selling subscription advertising services to house remodelers, interior designers, architects and others, and now a commission-based revenue model for goods sold through its site. Houzz.com recently raised $150 million at a $2.3 billion valuation, or nearly 6x Overstock's valuation. I don't know the particulars of Houzz's fundamentals or growth rates, but that is a pretty wide disparity to Overstock's current $400 million valuation.

I was pleased on the Q2 conference call, though, that Overstock management indicated they aggressively monitor the market and continuously look for opportunities to partner -- "co-opetition" as Mr. Byrne described -- with young start ups, thereby expanding both user bases (Overstock currently receives over 250 million visitors a year) and potentially generating incremental sales for each web banner. Overstock understands they have a moat to protect (stated brilliantly by President Stormy Simon on the Q2 call), and I believe Overstock keeps close tabs on this rapidly evolving industry. Given Overstock's large customer base with attractive demographic characteristics and a growing Club O membership (276 thousand), management is also evaluating new ways to monetize their platform, including recent initiatives to provide end-to-end fulfillment services (Supplier Oasis) for suppliers at "disruptive prices" relative to Amazon Fulfillment Services, and ancillary financial services offerings such as a private-label credit card and an insurance brokerage platform to offer more value for its customers.

Yes, competition is a risk, but the internet is a scale game and there are plenty of ways for Overstock to continue as a double digit revenue grower for years to come in my opinion.

Conclusion

Overstock currently trades at a wide discount to my estimate of its $1 billion of underlying equity value right now, or around $42 per share. As such, I believe Overstock represents a compelling and asymmetrical investment opportunity with 150% upside over the medium term, with more if the company continues to execute and drive profitable revenue growth.

The business has eCommerce tailwinds, a clean balance sheet with net cash and a very nice, working capital-light 3P operating model which is a great benefit to shareholders in terms of owner earnings at scale. Moreover, investors also receive a pro rata share of the underlying software technology being developed in-house, but which is yet to be commercialized.

Finally, investors are betting on proven jockeys -- although the financial media would have you believe otherwise -- that have grown sales from $1 million in 1999 to an expected $1.5 billion this year, and who are focused on driving incremental growth through higher-margin revenue streams from SOFS and the insurance broker.

Put differently, Overstock is one of, if not my highest conviction idea, and it makes up a large holding in the portfolios I manage at current prices.

Sauce:http://seekingalpha.com/article/2392465-overstock-com-a-high-conviction-idea-with-150-percent-upside

No comments:

Post a Comment