Summary

- Jason Industries is a fast growing and profitable global industrial manufacturing business that recently merged with a blank check company and became public.

- Due to lack of investor awareness and following among analysts the share price continues to trade in the pre-merger range, not reflecting any potential of Jason Industries.

- The company has long and profitable history of revenue growth and successful acquisition integration. Longstanding relationships with blue-chip customers and established reputation will ensure continuation of great financial performance.

- Peer valuation indicates 50%-55% upside. Management’s purchases of warrants signals at least 35% upside.

- Company’s chairman and management have proven track record and very high incentives to see share price grow.

Background

Background

Jason Industries (NASDAQ:JASN) is a global industrial manufacturing company with leading market share positions across each of its four segments: finishing, seating, acoustics and components. Jason was founded in 1985 and till June 2014 was a privately held company. It became public through a merger transaction, which was equivalent to an IPO just more hidden from the eyes of investors and media.

On June 30, 2014 Jason Industries was acquired by Quinpario Acquisition Corp (QPAC). Quinpario was a blank check company formed in mid 2013 byJeffry Quinn as a special purpose acquisition vehicle (SPAC) with the aim of affecting a merger. In its IPO (August 2013) Quinpario raised net proceeds of $177m by issuing 18.4m units at $10/unit (comprised of redeemable common stock and warrant). These funds together with additional borrowings are used to finance the merger.

Since incorporation QPAC was listed on NASDAQ and after the merger changed the name/ticker to Jason Industries and continued to trade on the same exchange. In this way Jason became a public company, however, it seems to have happened under the radar of the investment community as the share price remained unchanged - the market continued to value the equity as if no transaction has taken place (chart below).

Jason market cap stands at $205m and average daily volume is c. $2m. Quinpario warrants that were issued as part of IPO are also traded on NASDAQ under ticker (JASNW).

Source: Yahoo Finance price chart for Jason Industries/Quinpario Corp

Merger Structure and Dynamics

Source of Funds: QPAC acquired Jason Industries for a total consideration of $539m (6.75x 2013 EBITDA), which was split c. $300m for equity holders and $250m for debt cancellation with the balance attributable to working capital/cash adjustments and transaction costs. To finance the merger the following funds were used:

Amount

|

Type

|

Description

|

$144m

|

Cash held in the QPAC trust account

|

I have adjusted the Q2 balance of the trust account ($177m) for redemption of 2.5m common shares ($26m) and warrants ($6.6m) that has taken place right before the merger

|

$45m

|

Cash following issuance of QPAC preferred stock

|

Preferred shares carry interest rate of 8% payable in cash or new preferred shares. Each preferred share is convertible at holders option to 81.18 common shares - equivalent to $12.32 conversion price.

|

$420m

|

New debt

|

New credit facilities are comprised of $310m at LIBOR+4.5% and $110m at LIBOR+8%

|

$35m

|

Stock issuance to previous Jason Industries owners

|

3.5m new shares will be issued to previous owners of Jason Industries valued at c. $10/share. This stock will be one-on-one convertible to common stock of JASN

|

$644m

|

TOTAL

|

Source: Based on information within JASN merger prospectus

The remaining funds after paying the consideration for the sellers will be invested in the working capital of Jason Industries. This amount should be in the range of $75m-$100m depending on the various business combination expenses' company's pro-forma statements based on Q1 financials indicate combined cash balance of $75m.

Share count: When it comes to the final share-count after the merger, the situation is a bit more confusing. Initial look might scare some investors (and likely keep the share price depressed) as the company has recentlyfiled S1 indicating registration of 35m additional common shares, more than doubling the current share count. However, at a closer look only small part of these shares will be issued shortly or be dilutive to the existing holders. The table below illustrates the expected share count after the merger:

Amount

|

Type

|

Details

|

1.23m

|

Quinpario founder's shares

|

A total of 6.1m restricted shares issued to the founders of QPAC. 20% of these shares vested upon merger consummation and the rest will vest upon achievement of certain price hurdles (further 20% at $12/share, $13.5/share, $15/share and $17/share). Further details can be found in prospectus.

|

1.15m

|

Quinpario Private Placement shares (founders)

|

These were issued at the time of IPO to the founders in a private placement.

|

14.71m

|

Quinpario public holders

|

17.25m shares were issued at the time of IPO to the public holders. Out of these 2.54m were redeemed before the merger.

|

3.49m

|

Previous Jason Industries owners

|

These will be issued to previous owners. This stock will be one-on-one convertible to common stock of JASN.

|

20.57m

|

TOTAL

|

The remaining shares being registered in the S1 filing relate to:

- Potential conversion of 14m warrants - these will not be dilutive and will not happen before price is materially above $12/share;

- Potential conversion of preferred stock - again will not happen before price is materially above $12.5/share and might actually be beneficial for common holders as high interest bearing preferred stock will be extinguished.

- Unvested portion of founder's shares - these will be issued and dilutive only after share price meets certain price hurdles as described above.

Thus before the share price is at least 20% above current levels there will be no additional dilution from any share issuance. The total share-count that is quoted in the company's filings is different as it includes the full amount of unvested founders shares (c. 5m).

Capital structure: Based on pro-forma financial statements, Jason will have $425m of debt, $42.5m in preferred equity, $205 in common equity (20.57m shares at $10.05/share) and $75m in cash. Thus enterprise value stands at $597m. Before the merger, company had $260m in debt, so the debt load will be somewhat higher with Net Debt/2013 EBITDA=4.3. However, this should not be a big concern due to stable revenue/EBITDA base.

Management: In terms of management there won't be many changes - the whole of Jason Industries' previous executive team will remain in place and Jeffry Quinn will continue as a chairman of the merged company. This reminds me a bit of Buffett's acquisitions (except for high new debt load) where only the ownership of the company changes, but the whole management team still remains to run the business. Moreover chairman's/management's interests are well aligned with those of common stockholders- with material holdings in the company + shares vesting upon achievement of certain share price hurdles ($12-$17). I believe this adds to the likelihood that Jason's historical performance will be extended into the future.

Now let's turn to the Jason Industries' business itself.

Jason Industries - 4 market leading businesses

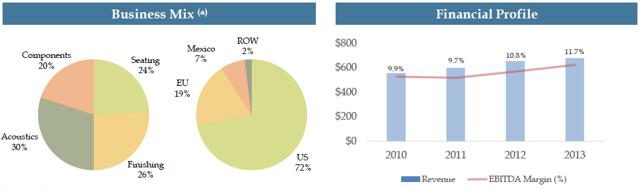

Jason Industries is an industrial manufacturer with 4000 employees and 33 manufacturing locations around the world. The company focuses on markets with sustainable growth characteristics and where management believes Jason is, or has the opportunity to become, the industry leader. It manufactures own branded as well as OEM products. Currently operations are categorized into 4 distinct industry sectors (share of 2013 revenues indicated in the brackets):

- Finishing (26%) business focuses on the production of industrial brushes, buffing wheels and buffing compounds that are used in a broad range of industrial and infrastructure applications.

- Seating (24%) business supplies seating solutions to equipment manufacturers in the motorcycle, lawn and turf care, industrial, agricultural, construction and power sports end markets.

- Acoustics (30%) business manufactures engineered non-woven, fiber-based acoustical products for the North American auto industry.

- Components (20%) business is a diversified manufacturer of stamped, formed, expanded and perforated metal components and subassemblies for rail and filtration applications, outdoor power equipment, small gas engines and smart utility meters.

Source: QPAC Investor presentation, May 8, 2014

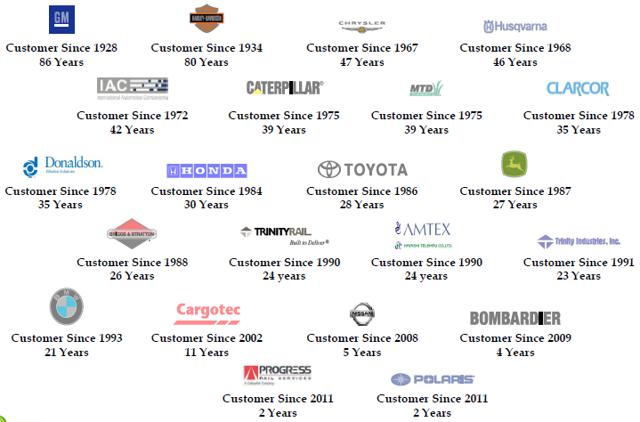

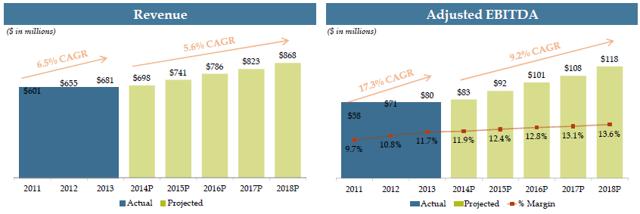

By focusing on niche markets, Jason has developed leading global positions across the industries it operates - e.g. No.1 in global static seating and No.1 in industrial and maintenances brushes. Jason's acoustic products are used in 70% of light vehicles in NA. In some product lines (turf care seats, buffing wheels and buffing compounds and automotive acoustical insulation) Jason is more than twice the size of the next largest direct competitor. Jason's management attributes this success to long standing relationships with the blue-chip customers (as shown in the chart below) and already established brand recognition. Jason's products are viewed as a choice for quality, dependability and value. This positioning allowed Jason to grow revenues from $70m in 1986 to $680m in 2013 (at 6.5% CAGR over the last few years) and earn respectable EBITDA margins of 10%-17% across its business lines. The obvious question is whether this performance can be sustained going forward. My short answer is that it can and I will detail the reasoning below.

Source: Jason's customers Investor presentation, May 8, 2014

Jason Industries - well positioned to outperform going forward

There are a number of factors which I believe will drive revenue growth and margin improvement going forward.

1. Strong relationships with the customers and diversified product base - the company is not dependent on a single customer or product. Entrenched relationship with existing blue-chip customers not only generates recurring sales on the existing product lines but also helps to introduce new products or cross-sell to the same customers. When discussing competition the management reveals:

"the cost to customers of switching from a current supplier's products to ours is high, and we believe certain of our competitors have established long-term and entrenched relationships with such customers. Such costs and relationships make it challenging to convince such customers to purchase such products from us instead of from their existing supplier."

Exactly the same applies for competition taking over existing sales of Jason - the switching costs for customers are too high to make it worth doing. Add to that superior product quality and reputation of Jason, and one ends up with a very stable revenue base.

Thus I believe Jason Industries has created a certain moat in its relationship with diversified base of blue-chip customers. This should deter competition eating into its market share and ensure company continues to generate superior EBITDA margins while growing the revenues.

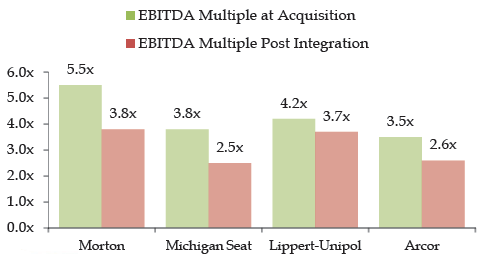

2. Proven acquisition platform with strong pipeline - Since its incorporation, the company has completed 38 acquisitions and successfully integrated them. By success I mean that post integration, EBITDA was higher (either due to synergies or efficiency improvements) than at a time of acquisition. On average, EBITDA multiple was reduced by c. 1.0x. The chart below illustrates this point for the last few acquisitions:

Source: QPAC Investor presentation, May 8, 2014

The number of acquisitions averaged 1-2 annually. However, since the financial crisis only a single acquisition has been carried out (Morton in 2011). Following the merger, company will have cash resources (c. $80m-$100m) for bolt on acquisitions. Also the company will likely receive further cash inflow if warrant holders convert to common stock at $12/share (potential cash inflow of a further $168m) providing further funds for M&A expansion. Management has already identified 45 potential targets and expects to reach $1bn+ in revenues by 2018 through acquisitions and organic growth.

Usually I tend to be weary of companies that aim to grow through acquisitions, however, Jason management's historical track record of integrating businesses gives a lot of confidence. Besides, so far the acquisitions tended to be relatively small when taken individually, but together they have been key to Jason's growth strategy. The chart below shows Jason's cumulative revenue development excluding the organic growth of the acquired businesses.

Source: QPAC Investor presentation, May 8, 2014

3. Chairman and management highly incentivized to see share price grow -Chairman Jeffry Quinn owns >30% of the company if all the unvested shares are counted. However, for the remaining 4.9m of unvested shares to vest, the share price needs to reach hurdles of $12, $13.5, $15, $17 (vesting in equal amounts at each hurdle). To put it another way, Jeffry Quinn would get a bonus of $15m if share price reaches $12, then a further $16.5m if share price reaches $13.5 and so on. These are very significant amounts keeping in mind that Quinpario/Jason have been and is Quinn's main occupation over the last year and he is not receiving any material regular compensation for his work.

The bottom line is that Quinn is much incentivized to see share price increase and his historical track record (below) suggests that he should be able to achieve this.

Additionally, CEO David Westgate also owns c. 3.2% of the merged company, which is a holding of c. $6.5m. This compares favorably to the agreed salary of $1m annually.

4. Great track record of Jeffry Quinn and his crew - Before establishing Quinpario Jeffry Quinn was CEO and Chairman of Solutia (specialty materials and chemicals company) between 2004-2012. He joined the company right before its bankruptcy filing and led the company through its bankruptcy process and re-emergence in 2008. You can read more about the success story in here and here - basically Quinn has proven his abilities in large cost cuts and great capital allocation by selling unprofitable businesses and investing in the keepers. So if he did great in a struggling Solutia business and managed to turn it around at the time of financial crisis, I can only expect even better performance after he joins Jason Industries as Chairman.

After Solutia venture, Quinn and some other executives from Solutia were engaged in takeover and proxy fight for Zoltec (carbon fiber manufacturer) with the aim to make operations more efficient and create more shareholder value. Quinn's takeover and board fighting efforts eventually resulted in Zoltec being acquired by another bidder at a 90% premium compared with the last day of trading prior to Quinn's actions against the Zoltec's board. As Quinn and his crew had accumulated 10% of Zoltec in advance, the whole engagement with Zoltec resulted in at least 90% profit in less than a year.

Now the same crew has formed Quinpario Acquisition Corp and is leading the merger with Jason Industries. Therefore I would expect the results to be at least as good as in the previous ventures. There was no hurry to engage in the merger, as QPAC had time till 2015 to find a suitable target. Thus acquisition was likely done because Quinn and his crew saw bright prospects in Jason's business rather than the necessity to carry out some kind of transaction.

5. Lately improving margins - Jason Industries have significantly improved its EBITDA margin (from 9.7% in 2011 to 12.4% during Q1 2014) over the last couple of years, which allowed EBITDA to grow faster than revenues. This was mainly the result of aggressive cost cutting and successful integration of previous acquisitions. Jason's management team strategically removed $26m of costs during 2009 downturn, of which $22m were permanent. Further margin improvements are also forecasted going forward.

Source: QPAC Investor presentation, May 8, 2014

Valuation - 50%-55% upside

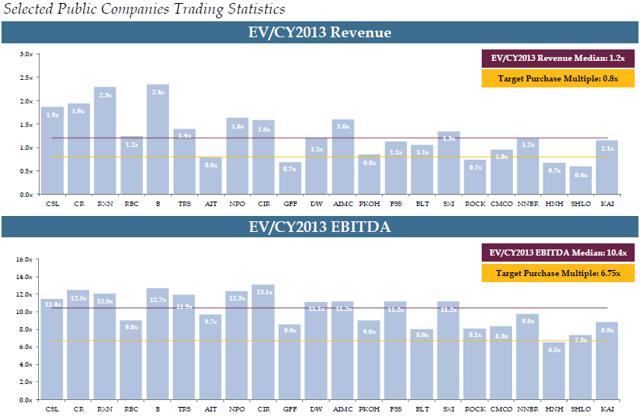

Jason Industries was acquired at 0.8x 2013 Revenues and 6.75x2013 EBITDA, which is significantly below the comparable industrial goods manufacturers in the market as shown in the tables below. These companies across the group have very similar EBITDA margins to Jason and have shown comparable growth rates recently, thus the discount to peers seems to be undeserved. Actually only a single company (Handy & Harman) is trading at a lower EBITDA multiple compared to what Jason was acquired for.

Source: QPAC Investor presentation, May 8, 2014

If valued in line with the industry median, the fair value of the share price would be c. $20-$21, which is 100% upside to where the company is trading currently.

1.2 x Revenue multiple

|

10.4x EBITDA multiple

| |

Enterprise Value

|

817

|

832

|

less Debt

|

-425

|

-425

|

less Preferred

|

-42.5

|

-42.5

|

add Cash

|

75

|

75

|

Equity Value

|

425

|

440

|

Current no of shares

|

20.6

|

20.6

|

Value per share

|

20.6

|

21.3

|

Source: author's calculations

Obviously, if share price reaches similar levels, founder shares will vest, warrant holders will exercise and preferred holders will also convert to the common. This would cause the share count to increase to 41.9m (14m from warrant conversion, 3.7m additional founder shares and 3.6m from preferred conversion), cash balance would increase by $168m (14m warrants exercised at $12/share) and preferred stock would be eliminated. The result of these changes on share valuation is indicated in the table below.

1.2 x Revenue multiple

|

10.4x EBITDA multiple

| |

Enterprise Value

|

817

|

832

|

less Debt

|

-425

|

-425

|

less Preferred

|

0

|

0

|

add Cash

|

243

|

243

|

Equity Value

|

635

|

650

|

Current no of shares

|

41.9

|

41.9

|

Value per share

|

15.16

|

15.51

|

Upside

|

51%

|

55%

|

Source: author's calculations

Thus even taking into account full dilution from all the possible sources, Jason Industries still remains undervalued relative to peers, with 50%-55% upside from the current levels. Also it is worth keeping in mind that the dilution will start happening only when share price is above $12 (so at least 20% upside without any dilution whatsoever) and as I will show in the next section, the dilution is unlikely to be material before the share price reaches $13.5 (35% upside).

Also I believe these estimates are quite conservative as they are based on 2013 financials. Jason Industries H1 2014 revenues are 6% higher and EBITDA c. 10% higher YoY (based on Q1 figures). Thus the company is likely to appear even more undervalued when 2014 financials will be published.

Management and majority of shareholders signal at least $13.5/share valuation

Upon the merger share/warrant holders of Quinpario Acquisition were given a choice either to participate in the merger or have their shares/warrants redeemed. Only 2.5m common shares opted for redemption at $10.26. Situation with warrant redemption was even more interesting, as illustrated by the timeline below:

- May 6 - the company commences a tender offer to purchase up to 9.2m of its outstanding warrants at a purchase price of $0.75 per warrant;

- June 4 - tender offer expires and only 2.7m warrants are tendered;

- June 5 - tender offer is extended till July 7;

- June 18 - tender offer price increased to $1.00/warrant;

- July 7 - the offer expires with hardly any tendered warrants;

- July 7 - tender offer is extended till July 21 at an increased price of $1.5/warrant;

- July 21 - tender offer expires with 4.4m tendered and 14m remaining outstanding;

There are three key takeaways from this. Firstly, management (which is literally Quinn) was very eager to buyout warrant holders and has increased the offer price 3 times. The price at which the warrants were purchased indicates company value of at least $13.5/share ($12 exercise price + $1.5 warrant price), thus Jeffry Quinn must think that the shares have at least 35% upside. Secondly, majority (75%) of warrant holders were still unwilling to tender even with the increased offer price, which also shows that most of them believe the company is worth more than $13.5/share. And lastly, most of the common shareholders also expressed their belief in the future of Jason Industries and its management by voting for business combination rather than getting their shares redeemed.

Surprisingly, after business combination, JASN common was trading at $9.9/share and warrants (JASNW) at $1.24/share, below the redemption prices a month ago and without any reflection of the upside from the merger.

Why the opportunity exists?

I believe the main reason why Jason is so cheap is that outside investors are neither aware about it nor about the recent transformation from the blank check company into growing and profitable business with a proven management. There are no analysts following the company. So it seems that there simply aren't any informed buyers and company continues to trade in the same range as before the transaction. Had Jason Industries IPOed, it would have received much more attention from both analysts and media, but current merger transaction was a rather 'silent and the only coverage I managed to find were the company's PR releases around the merger date.

Also the latest results (10-Q in August) do not yet reflect the financials of Jason Industries, but rather show only the number of the predecessor Quinpario. Due to this, the company does not yet appear in any screens.

At the same time, merger structure was not the most straightforward and potential issuance of new shares might appear confusing and be putting off some investors right away. However as I have shown the dilution is unlikely to be material before share price reaches $13.5 and even taking full dilution into account there is still 50%-55% upside.

Catalyst

I believe a big catalyst for the share price will be release of Q3 results, which will already reflect financials of Jason Industries and likely strong growth in both revenues and EBITDA. Also going forward, the company is likely to raise its public profile through earnings conference calls, news releases, etc. Eventually some analysts will start following it as well. As the awareness about the company and its management gradually increases, the share price should approach closer to its fair valuation.

Risks

There are two main risks I see in this investment - the first one being high debt load and the second relatively high exposure to cyclical automotive/motorcycle sectors.

High debt load can be a blessing and a curse for equity holders. If company gets into distress, high leverage usually wipes out equity holders. On the other hand for companies with stable revenues and earnings, high debt brings benefits of tax shield and leveraged equity returns. I believe Jason Industries belongs to the latter category. Its revenues and EBITDA are growing and it produces plenty of cashflow to repay the debt. The net debt coverage ratio stands at 4.3xEBITDA. Interest payments would have consumed $27m out of $80m of 2013 EBITDA (I ignore interest on preferred as these can be paid in new preferred shares), which looks more than manageable. 2014 EBITDA seems to be even higher meaning that interest payments will be even less of the burden.

As for automotive exposure, currently c. 40% of revenue is derived from automotive and motorcycle sectors (mainly in US and Europe). Both of these are fairly cyclical and have experienced boom years recently. Thus Jason Industries is quite exposed to potential cyclical downturn in these sectors. On a positive side, management plans to diversify away from these sectors and share of revenues from automotive and motorcycles is forecasted to be in the range of 25% by 2018. Also Jason will focus further expansion into emerging markets and new geographies, which should reduce the risk further.

Conclusion

Jason Industries is a fast growing and profitable global industrial manufacturing business that recently merged with a blank check company and became public. Due to lack of investor awareness and following among analysts, the share price continues to trade in the pre-merger range, not reflecting any potential of Jason Industries. The company has created a certain moat in its longstanding relationships with diversified base of blue-chip customers which will help it to grow revenues and improve margins going forward. Peer valuation indicates 50%-55% upside. Management's purchases of warrants signals at least 35% upside. Company's chairman and management have proven track record and very high incentives to see share price grow.

Disclosure: The author is long QPAC.

Source:http://seekingalpha.com/article/2440765-jason-industries-hidden-ipo-of-a-proven-business-with-proven-managemen

No comments:

Post a Comment