Summary

- Walgreens' second fiscal quarter results missed analysts' expectations, and were lower than the results of the second quarter of last year.

- Walgreens is going to close 76 stores, despite which its total store count will rise by 55-75 stores.

- Walgreens' earnings quality is deteriorating with the passage of time, however, its profit margin is rallying back to its 2013 level.

- Walgreens is an attractive long-term investment due to its bright future outlook and strong returns.

The Walgreen Company (WAG) is the largest pharmacy chain in the United States. The company reported its second fiscal quarter results on the 25th of March. For the quarter ended February 28th, the results posted by the company missed analysts' expectations, and lagged behind results of the comparable quarter last year. The focal point of this article is to evaluate the performance of the company with respect to the comparable quarter in various respects. I will be concluding the article with a recommendation regarding whether or not the stock deserves to be bought for investment purposes.

Top and Bottom Line Performance

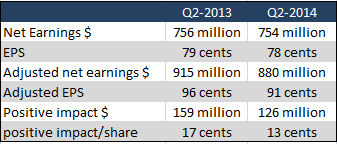

Walgreens generated revenues of $19.6 billion during the quarter, securing a 5.1% increase year-over-year. Revenue marginally beat analysts' expectations of $19.5 billion. Walgreens earned a net income of $756 million, or 78 cents per share, whereas the adjusted earnings were $880 million, or 91 cents. Earnings failed to beat analysts' expectations, since the estimates polled by Thomson Reuters equaled 93 cents. Latest quarter earnings can be compared to the comparable quarter in 2013, as illustrated in the table below.

Source: Company Press Release

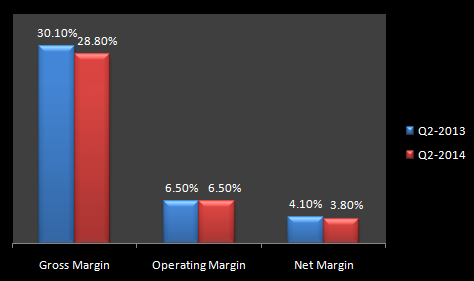

According to the company's press release, generic medicines were not introduced during this period at a fast track, and this hurt the company's earnings. A milder flu season was also one of the reasons why the company's earnings were not that impressive. Generic products that offer higher margins than the brand name medicines were introduced at a slower pace in the latest period, and that resulted in the company's gross margin shrinking from 30.1% to 28.8%. The company managed to report an operating margin of 6.5%, exactly the same as it earned last year. However, the net profit margin also shrank by 30 basis points.

Source: Company Press Release

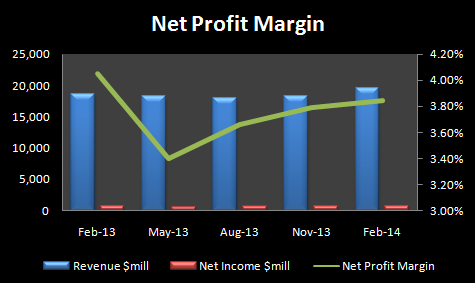

The graph below shows that the company's net profit margin is rallying quarter-over-quarter. Last year during February, Walgreens earned a net profit margin of more than 4%, and then in the next quarter, the margin plunged heavily. Since then, the margin is rising in every passing quarter, and has reached 3.8% in February of this year. However, it is still below the margin level earned during the second fiscal quarter last year.

Source: Bloomberg

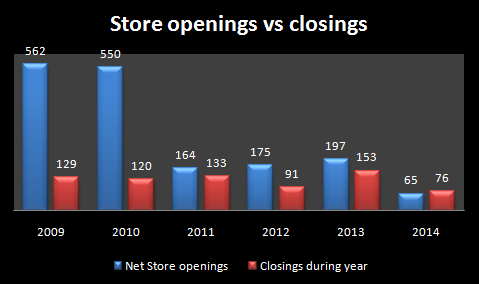

The company also announced its plan to close 76 stores during the second half of this year, and this will be reversing the company's recent expansion. Note that Walgreens had made regional acquisitions recently, including Kerr Drug's 76 retail drug stores and specialty pharmacy business for an undisclosed amount last year. However, Walgreens anticipates its store count will increase this year by 55-75 new stores. This closure plan is anticipated to bring charges of around $240 million to $280 million to the third and fourth fiscal quarters this year. However, the move will benefit the adjusted per share earnings by 2 to 3 cents during the next fiscal year. Looking at the net stores opened by the company over the last five years, one thing becomes evident: the pace of the opening of stores has reduced massively. However, every year, the number of stores closed fell short of net openings, but in fiscal year 2014 year-to-date, announced closings have surpassed the average net openings anticipated by the company for this year. However, some of the stores set to close are in the same area as other Walgreens locations, and thus, the company may be taking this step to avoid the cannibalizing effect of its drug stores. That can be described as a positive move in terms of results, rather than negative.

Source: Annual Report 2013

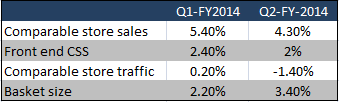

The following table compares store metrics for the first and second fiscal quarters, and the results seem a bit disappointing, as the comparable store traffic fell 1.4% in the latest quarter. Comparable store sales and front-end comparable store sales growth rate also fell short of the comparable quarter growth rates. However, basket size increased by 1.2%.

Source: Company Press Releases

Walgreens managed to gain 20 basis points in market share in the retail prescription market compared to last year, to 19%, but compared to the first quarter of fiscal 2014, it has lost 40 basis points of its market share, and is down from 19.4%.

Financial Condition & Cash Flows

For the quarter ended February 28th, 2014 cash flow from operating activities fell 31% year-over-year to $1,237 million, down from $1,799 million last year. Inventory at the end of the latest quarter had increased massively by 209%, from $93 million to $288 million. Cash dividends paid were almost 15% higher than the comparable period last year. Summing up all of these impacts, cash and cash equivalents at the end of the period were down 27% year-over-year. Here, I will look at the ratio of CFO to Net Income in order to analyze the earnings quality of the company.

Source: Press Releases & Yahoo Finance

The graphs above illustrate the fact that the company's earnings quality is deteriorating with the passage of time, since its cash conversion ratio has swiftly moved to less 1 from 1.54 in six months ended on February 28, 2013. The company's earnings quality had increased in the third quarter of 2013, but then resumed the declining trend. Also, in the 1st quarter of fiscal 2014, Walgreens saw a huge decline in its CFO, which drove its cash conversion ratio down.

The Road Ahead For Walgreens

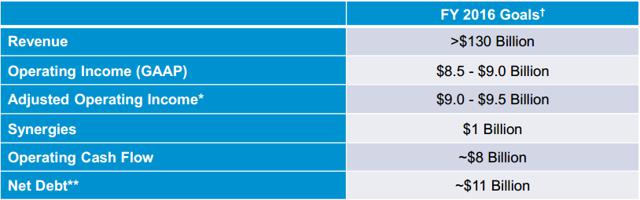

By 2020, national health spending in the US is expected to reach $4.6 trillionand comprise 19.8 percent of GDP. In 2014, health spending is projected to grow 8.3 percent. This projected acceleration in the growth rate, up from 5.5 percent in 2013, is primarily the result of the Affordable Care Act's coverage-related expansions. As the US economic recovery accelerates, same-store sales for Walgreens may rebound. This way, the company will be on its way to achieve its targets set for 2016.

Source: Company Presentation

Other than the economic recovery, there are some other factors that can also propel the company forward that I am going to discuss very slightly. The company plans to add 100 healthcare clinics to its existing count of 400 during the current year. Moreover, the company's strategic partnerships will also bode well for the company's future as it starts utilizing synergies.

Source: Company Presentation

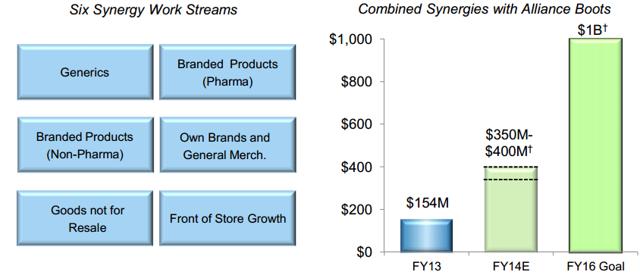

- Synergies with Alliance Boots Holding Ltd.

Walgreens aims to unlock the hidden potential in the US and abroad markets via transforming the way it brings capabilities to the market, and its merger with Alliance Boots Holdings Ltd. will really aid the company in propelling towards its goals. Walgreens' partnership with AmerisourceBergen Corp. and its controlling stake in Alliance Boots GmbH will help the company to lower its distribution costs, increase sales of specialty drugs, and improve profit margins. The strategic partnership with Alliance Boots generated $0.08 adjusted EPS accretion and combined synergies of $129 million for the quarter and $236 million YTD. For the full-year 2014, the synergies target has been raised from $350-$400 million to $375-425 million. In the coming quarter, it is anticipated that the synergies will contribute $0.13-$0.14 in terms of adjusted EPS. The company anticipates that the combined synergies with Alliance Boots will surpass $1 billion by 2016. The company's latest earnings presentation hints that the company is preparing for step two of the Alliance Boots acquisition, which implies that the company has seen some merits in Europe's largest pharmacy chain worthy enough that it is generating eagerness to acquire the rest of the company.

Source: Company Presentation

2. AmerisourceBergen

Similarly, Walgreens is going to benefit from a 10-year partnership with AmerisourceBergen. Under this partnership, the latter supplies Walgreens stores with branded and generic drugs. Walgreens' efforts to streamline its supply chain will bring cost savings to the company, other than providing it with a foothold outside of the US market.

Potential Threat

Walgreens may see its profits under pressure due to potential reforms regarding the $340 billion Drug Pricing Program. This program was arranged to provide discounted pharmaceuticals to the poor, uninsured, and most vulnerable. Walgreens alone accounts for 45% of all 340 billion contract pharmacy arrangements. There have been some inconsistencies in contract pharmacies regarding the way prescriptions are treated as 340B eligible or uninsured patients pay the full non-340B price for their prescriptions. As a result of the findings, Senator Charles Grassley has written a letter to theWalgreens' CEO demanding an explanation of the company's participation in the 340B program. With more data and reports on their way, if they provide evidence of bungled management of the program by hospitals and pharmacies, they may prompt potential reforms by Congress for putting the 340B house in order. Moves made to ensure the benefits of the program reach its intended recipients will change the profit outlook for Walgreens as well, along with other players in this space.

Competitor Analysis

Although Walgreens is the largest drug store chain in the US, it is facing competitive rivalry from a rapidly-growing business named CVS Caremark Corporation (CVS). CVS is the second-largest pharmacy chain, and it announced it would stop selling tobacco products by the end of this year, bearing a $2 billion hit on revenues, and credited the move as a step towards a healthier USA. This move exerts pressure on other players in the industry like Walgreens to come up with their perspective. Walgreens has mentioned that it aims to provide its customers with a full-fledged product portfolio, out of which they will be choosing what suits them best. This is an appreciated stance by Walgreens, since consumers coming to buy tobacco products yield more front-end sales. However, the company should move its focus towards healthier options like e-cigarettes that serve cravings without too much harmful effects. Wells Fargo analysts anticipate that the e-cigarette market will surpass the multi-billion tobacco market in the US within a decade. In short, Walgreens needs to continually evaluate its product offerings to ensure it meet the needs of customers.

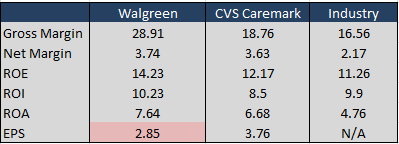

If we compare Walgreens with its rapidly-growing competitor and the industry, it becomes clear that in every respect, Walgreens is leading the industry and its peers. Walgreens is earning a gross margin that is well above the industry and Caremark. However, the difference between the net margins earned by the two companies is meager. This implies that Walgreens is struggling to manage its expenses that hinder the gross profit from trickling down to the bottom line. Although Walgreens surpasses the industry and Caremark Corp. in terms of return measures it earns on its equity, assets, and investment, it fails to generate earnings per share comparable to the latter. Caremark generates EPS of $3.76, that is 1.3 times Walgreens' EPS.

Source: Reuters

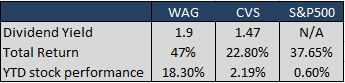

Comparing the returns to investors in the form of dividend yield and stock price appreciation, Walgreens has outperformed CVS and the S&P 500. In terms of total return, Walgreens has left CVS and the S&P 500 well behind, and it is the same result if one looks at the YTD stock performance of Walgreens in relation to the other two.

Final Take

Walgreens has a lot of opportunities, and has the guts, as evident by its merger with Alliance Boots and partnerships with Theronas and AmerisourceBergen, to avail those opportunities. Walgreens needs to put its defensive plan in action in order to retain its customers and enhance consumer traffic within stores. If Walgreens fails to take reasonable measures, it will see its store traffic deteriorating and its margins shrinking, and that would not bode well for the future of the company. Whatever the circumstances, Walgreens has been awarding its shareholders with better-than-industry dividend yields and total return measures that make it a stock worth investing in.

Source:seekingalpha.com

No comments:

Post a Comment