Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Summary

- Bank of America reported disappointing results for the quarter due to litigation expenses.

- Bank of America has achieved some praiseworthy accomplishments regarding deposits and the rise in mobile banking.

- Legal payments and settlements have totaled $50 billion since the financial crisis, and it is hard to say when these challenges will come to an end.

- Despite these issues, Bank of America can deliver strong sustainable results in the long term, once it is free of its legal woes.

Bank of America (BAC) reported its results for the first quarter of 2014, and they were highly disappointing and astonishing compared to 1Q2013. All credit for the disappointing results goes to the high litigation costs the company experienced in the quarter. It is to note that ex-litigation Bank of America beat forecasts, as its profits before litigation expenses stood at 14 cents per share, in contrast to analysts' estimate of 5 cents per share. I am writing this article to assess whether or not Bank of America has some prospects and performance-based justifications that make its stock a worthwhile investment.

Key Performance Metrics

Bank of America reported total revenues of $22.8 billion for the first quarter of 2014, reflecting a 3% year-over-year decline. The drop in revenue was because of the fall in mortgage lending and bond trading due to high interest rates. This was the same problem faced by many other banks like JPMorgan (JPM) and Morgan Stanley (MS). However, Citigroup was not significantly affected, because it wasn't as exposed to the mortgage market.

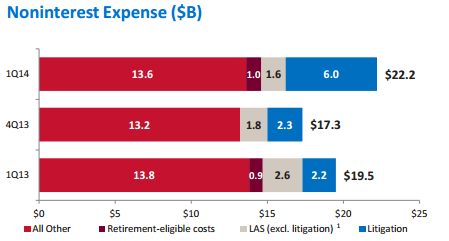

Bank of America achieved a net loss of $276 million, or EPS of $0.05 per diluted share in the quarter. It appears more awful when these losses are compared to the $1.5 billion net income equivalent of $0.10 per diluted share earned by the company during 1Q2013. No doubt, revenues were down in the quarter, but what caused the net loss was the $6 billion pertaining to litigation expenses and additional reserves for legacy mortgage-related issues. However, the performance of the bank in the latest quarter seems disappointing, but it is not that bad if we look at the company's ex-litigation performance during the quarter.

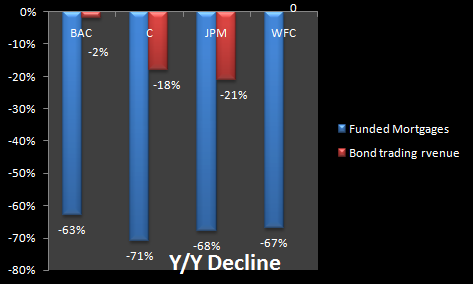

Mortgage revenues have seen a decline across the industry, as rising interest rates have not left any incentive for homeowners to refinance. All the banks that have reported results so far have been in the same scenario, and among them, Bank of America remains the best in this regard. The following graph illustrates the year-over-year decline in funded mortgages and revenues from bond trading. Bank of America had the lowest decline among the four big players, proving the resilience of its operations.

Source: BAC presentation & WSJ

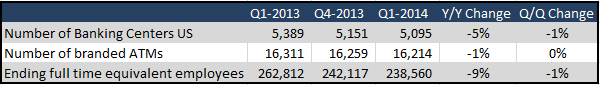

Bank of America has reduced its costs by 6% year-over-year, excluding litigation costs. The following table illustrates some of the company's actions that drove this cost reduction.

Source: BAC Press Release

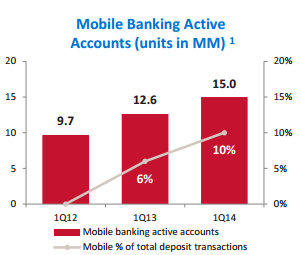

During the quarter, Bank of America reduced its headcount by 9% year-over-year by cutting 24,000 jobs. Over the year, the bank sold or closed 300 of its branches, equal to 5% of the total number of branches. The bank also reduced the number of its branded ATMs by 1% year-over-year. This was feasible because of the rising trend of mobile banking. According to the bank, the number of mobile banking customers grew 19% year-over-year to $15 million, and 10% of deposits now take place on mobile devices. Moreover, total deposits at the bank stood at a record $1.1 trillion, up $14.4 billion from the last quarter. Total deposits increased 3.5% year-over-year and 1.3% quarter-over-quarter.

Source: BAC presentation

The company's earnings before taxes and loan-loss provisions stood at $500 million in the quarter, down from $3.9 billion a year ago. This measure provides insight into the company's profitability, free of distortions caused by one-time items.

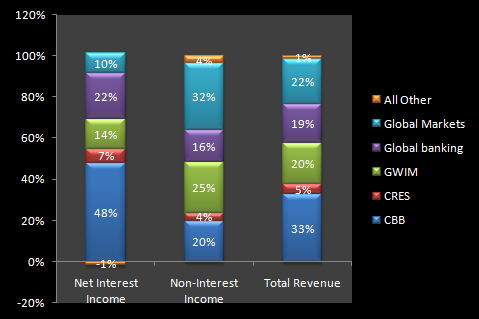

Segment-wise Performance

The following graph depicts the contribution made by each of the bank's segments to its interest income, non-interest income and total revenues. The consumer and business banking division of the company has the highest contributions, with 48% to interest income and 33% to total revenues. The global markets division, global wealth and investment management division (GWIM) and CBB made a significant contribution to non-interest income for global markets and global banking, and GWIM contributed 60% of total revenues in aggregate.

Data Source: Company Presentation

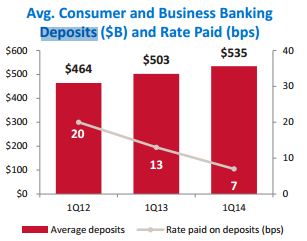

The global markets division's revenue slipped 0.4%, while its profit, before accounting for adjustments related to credit, went up by 3.1%. Income from the global banking unit fell 3.5% to $1.24 billion due to higher provisions for credit losses. The consumer and business banking unit remained a star performer, with a 15% rise in profits and a 4% decline in expenses during the quarter. The following graph depicts rising deposits at the CBB unit and declining rates paid to depositors.

Source: BAC Presentation

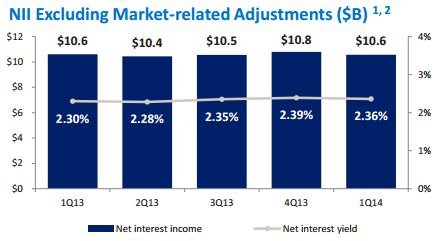

Bank of America earned a better year-over-year net interest yield, reflecting an uptick of 6 basis points, but it lagged behind Citigroup's 2.90% net interest margin. However, JPMorgan lagged behind both Citigroup and Bank of America, with a net interest margin/yield of 2.20%.

Source: Company Presentation

Litigation Issues

Litigation and associated payments are never good things for a company, its earnings, reputation and eventually for shareholders. However, most of the time they are considered one-time events that should be ignored while analyzing the company's statistics or forecasting its future results. In the case of Bank of America, it does not seem that litigation expenses are a one-time expense, as the bank has already paid $50 billion while resolving numerous legal disputes that arose after the financial crisis. It is important to note that a majority of the legal settlements made by Bank of America were in relation to Countrywide Financial Corporation that was acquired in the era of Kenneth Lewis, the previous CEO of the company.

Source: Wall Street Journal

This quarter also carried a $6 billion charge, which included $3.6 billion for the Federal Housing Finance Agency (FHFA) settlement. The remaining $2.4 billion was added to reserves for potential settlements of previously disclosed legal issues.

Source: Company Presentation

We cannot assume that these costs will end and will not appear in upcoming quarters, because according to the bank's chief financial officer Bruce Thompson, it is hard to predict the bank's legal costs. A report in The Wall Street Journal claimed that the company will soon settle with the Department of Justice to end investigations into whether the bank sold low-grade residential mortgage securities. However, a figure suggested for settlement by the government in March 2014 was way above the $2.4 billion reserved by the company for upcoming legal settlements.

Moreover, a regulatory filing in the month of February showed that Bank of America is being examined by higher authorities in North America, Europe and Asia for misconduct in foreign exchange markets. If the bank is found guilty at the end of the investigation, it may have to face legal fines or penalties.

Shareholders' Returns

During the first quarter of 2014, Bank of America repurchased its 87 million common shares worth $1.4 billion. For the second quarter of 2014, the bank previously announced its capital actions comprised of $0.05 dividend per share for common stock and a new share repurchase program of $4 billion. This dividend increase of 4 cents per share occurred after the company paid a $0.01 per share dividend for more than three years. If all $4 billion repurchases are made this year, then Bank of America will be repaying 3% of its capital to shareholders, and repurchases will pave the way for improved EPS in the coming quarters and years. The following is the total returns chart showing that Bank of America's investors were more rewarded than their peers in terms of price appreciation and dividends.

Source: YCharts

Final Thoughts

In conclusion, Bank of America has the guts to deliver outstanding results and generate revenues, but the problem arises when those revenues cannot translate into income for the company and its shareholders. The income is instead being transferred to the government or other higher authorities in the form of fines and legal settlements. Bank of America has strong growth prospects ahead from the recovering US economy and rising interest rates. This stock has upward potential once it recovers from its catastrophic legal issues. For contrarian investors, the current stock price dip may present a buying opportunity. Moreover, investors in general may find opportunity if they enter the stock at its currently discounted price.

No comments:

Post a Comment