Summary

- Stellar's main product (KLH) is involved in 20 active clinical trials.

- Studies include cures for cancer, Alzheimer's, arthritis and AIDS.

- Stellar's valuation is only $125 mm vs. peers valued in the billions.

(Editors' Note: Stellar Biotechnologies trades on the TSX Venture Exchange,symbol KLH.V, with average daily volume of C$350,000.)

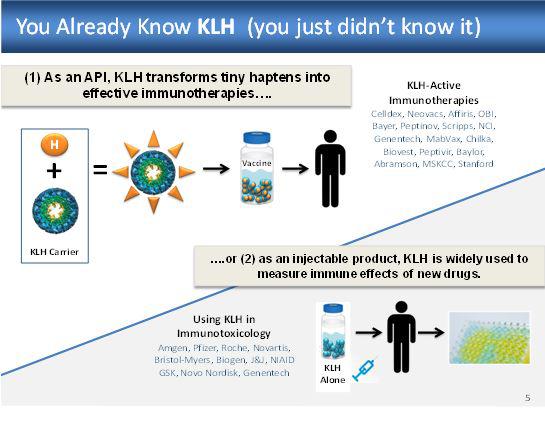

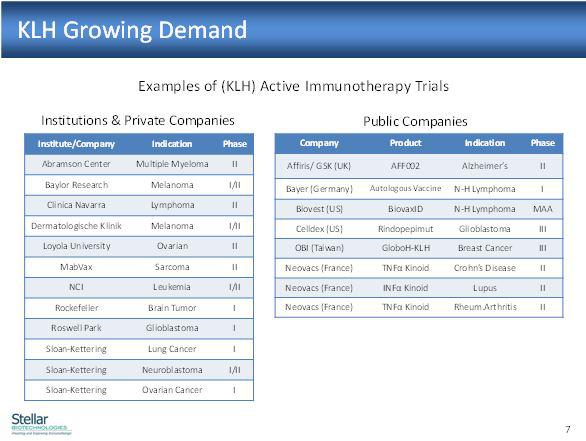

KLH is currently involved in a mind-bending 20 active human clinical trials where many of the world's finest drug developers are seeking to cure dozens of serious diseases. These include Alzheimer's, Arthritis, Cancer (over 20 different types, including a late stage 3 clinical trial for breast cancer), Lupus, HIV, MS, Asthma, hypertension, etc.

If even one of these new drugs go into production, the world's only sustainable KLH supply is from Stellar; they have revolutionized the KLH industry, turning this vital, natural protein into a renewable, quality resource.

KLH

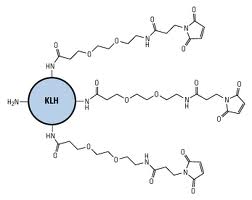

Keyhole Limpet Hemocyanin (KLH) is a potent immunogenic high-molecular-weight protein; i.e. a substance that naturally induces an immune response. KLH is a highly effective T-dependent carrier protein that induces MHC Class I and Class II-restricted immune responses via antigen presenting cells.

Sources: company unless otherwise noted

Sources: company unless otherwise noted

Active Immunotherapy uses a patient's own immune system by first activating then training it to recognize and kill tumor cells. This treatment may provide a viable alternative to chemotherapy or other therapies, dramatically improving quality of life.

Please review the selected list of active clinical trials below; note that these are not all present Stellar KLH users, but we believe they will become customers upon drug approval given Stellar's unique position.

Potent yet safe in humans, KLH is highly prized as a critical component of certain therapeutic vaccines including ones for lymphoma, bladder, breast, colon and other cancers.

In essence, the KLH-based drug alerts the immune system to something it doesn't see - like with cancer (such as the sugars on the surface of cells not normally seen) or a tumor. In this way, the body's own immune response is triggered.

KLH-based drugs seem to work best with smaller cancers or tumors, thus would be most applicable either in early stages or, for example, after a tumor was removed, thus effecting a final cure or prevent recurrence.

While it is still a long way away, and we recognize it would be virtually impossible to develop a clinical study, the scientific theory seems valid that a KLH-based drug could act as a vaccine and prevent cancers in high-risk potential patients avoiding the horrors associated with diseases such as breast cancer, ovarian or cervical. We are certainly hoping for such. In this regard the Asian markets offer more promise in that users are not so restricted and are willing to try preventative medicine. For example, those determined as pre-disposed to certain cancers may opt for a KLH-vaccine - recent news regarding actress Angelina Jolie's preventative double mastectomy have brought this issue to attention.

The growing advancement of KLH-conjugated therapeutic vaccines and KLH-based diagnostic products is rapidly increasing the demand for GMP (pharmaceutical grade) KLH.

Source: biosearch

Source: piercenet

Source: Scripts.edu

Background

Founded in 1999, Stellar was initially funded through grants totaling $7 million from both the National Institutes of Health (NIH) and the National Science Foundation (NSF).

Stellar has generated KLH-related revenues since 2001; its customers and partners include multi-national pharmaceutical companies, world-renowned laboratories and research centers, as well as biotechnology companies and vaccine developers.

The Giant Keyhole Limpet can only be found on the coast between Central California and Northern Baja California. Source: klhsite.org

Stellar specializes in the production of KLH which is refined from the hemocyanin of the rare ocean mollusk, Megathura crenulata (the California giant keyhole limpet). The extreme complexity and very large size of KLH glycoprotein make it unsuitable for synthetic production; therefore it must be purified from its natural source, which is rare and diminishing in population.

Stellar has developed important intellectual property which relates to aquaculture technologies, spawning, selection and maintenance of the limited natural source, as well as processing, purification and engineering of specific GMP-grade stabilized formulations.

In a fortunate stroke, Stellar acquired faculties at the Port Hueneme Naval base as part of a base closure process, which gives them direct aquaculture access to the Pacific Ocean. The Company believes this was a once-in-a-lifetime chance to obtain a facility on the coast of California having direct access to the Pacific Ocean, smack in the middle of the limpets natural breeding grounds. With all permits in place, Stellar can now provide clean, traceable KLH from native source to finished product - a world-wide exclusive.

In 2012, Stellar Biotechnologies achieved an industry milestone in aquaculture science by successfully controlling the complete life cycle of multiple generations of the Giant Keyhole Limpet.

This section is very important:

We are aware of only two other companies in the world that provide KLH in GMP form. One, a Fortune 1000 company, Sigma-Aldrich, already uses Stellar's KLH… the other literally sends divers into the ocean to capture the limpets.

They extract the KLH - then the limpet dies.

Source: Stellar

Since GMP KLH (in clinical trial volume) sells for between $20,000 and $50,000 per gram, that is one valuable limpet. However, we do not believe ocean harvesting is a sustainable model and will most likely quickly exterminate the limpet population if even one new drug goes into production, especially since there is no batch control and harvesting is subject to natural events. In fact, we would expect the State of California to ban or restrict wild limpet harvesting before such a tragedy, as with the abalone or sea cucumber.

For this reason, Stellar's approach, although still perhaps a year or two away before the major demand appears, is unique in that 1) their patented process removes the KLH without killing the limpet and 2) they already have patent-pending re-production process and multi-generation breeding success at the aquaculture facility. It would take 5 to 10 years to replicate this facility, given the difficulty of permitting in California, and probably $20 million, giving Stellar a considerable advantage.

C. Diff Immunotherapies

Clostridium difficile (C. diff) is a major and growing cause of mortality and morbidity in hospital patients. It's a bacteria which is normally present in the intestine, but which can overgrow as a result of antibiotic use. It causes severe diarrhea and life-threatening intestinal conditions such as colitis.

C. diff related treatments in the U.S. and Europe are estimated to cost a total of over $7 billion. Effective treatment would not only provide a substantial revenue stream for Stellar, but also bring relief to the 300,000 new cases that hospitals are seeing annually, up three-fold from just a decade ago.

The patented technology allows Stellar exclusive rights to develop, manufacture and sell human vaccines to treat C. diff infections, from the Stellar technology.

The potential market size of this application alone would most likely be worth 5x Stellar's current $128 mm valuation.

Amaran Biotechnology Partnership

Taiwan-based Amaran invested $5 million in Stellar's September 2013 financing. KLH is a key ingredient in OBI Pharma's OBI-822 Active Immunotherapy drugs:

- Metastaic Breast Cancer: Phase II/III trials in U.S., Taiwan, South Korea, India, Hong Kong.

- Ovarian Cancer: Phase I/II for ovarian cancer in Taiwan

From the OBI website: "OBI is also devoted to developing next generation active immunotherapies for difficult to treat cancers, including lung, prostate, pancreatic, stomach, and ovarian."

We will have more on this specific trial in a further update, however, this could be the 1st "blockbuster" for Stellar, and we suspect this is the reason Amaran invested - a smart move to keep themselves 'close' to the only supply for such a critical ingredient.

Near-term catalysts and valuation objective

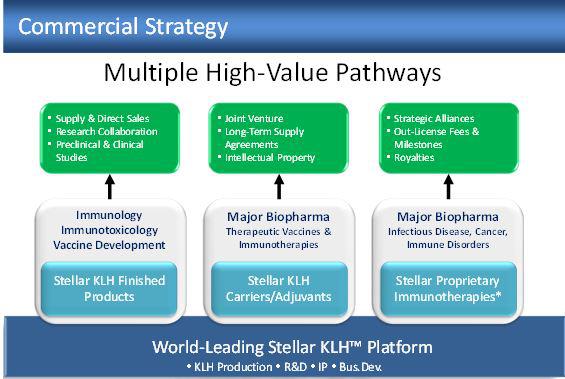

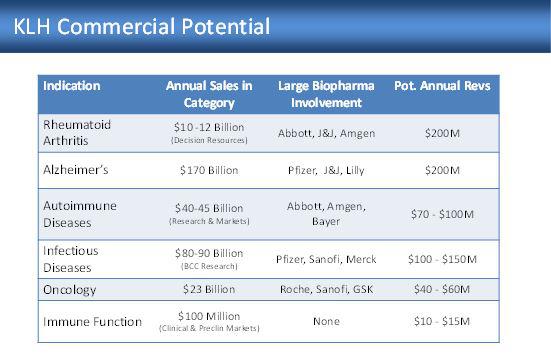

In addition to news from over 20 active clinical trials, from our conversations with management, we believe Stellar is active in seeking additional corporate partners. As the new class of therapeutic vaccines moves towards market, we would expect increased sourcing interest. Certainly, Stellar is getting close to achieving a "critical mass." As you can see in the chart below, the commercial potential is understandably enormous.

Given Stellar's current 78 million shares issued equates to a valuation of $125 million, and that the potential revenues from even one new drug could be over $100 million…and given that biotech companies routinely sell for 10 X sales, our estimate of "billion dollar potential" may turn out ultimately as very, very low.

Even one drug showing evidence of an impending move from clinical trial to manufacture would be enough, in our opinion, to raise the valuation to the $300-$500 million range. This could occur even if a smaller drug, such as Celldex's compound targeting glioblastoma (an aggressive form of brain tumor), currently in phase 3 trials, were to be approved. Although the KLH-related revenues to Stellar may be only $10-$20 million per annum, we believe it adds to the overall creditability and encourages additional development.

In the chart, please note the market size for some of the KLH-based drugs under clinical trial and the estimated revenues for Stellar. Our point being, only one or two of these is needed to be a "company maker."

For some reason, Stellar's IPO was via entry into the Canadian markets and the stock languished mostly unknown until 2013, when it finally started moving. In 2014, we expect Stellar to list their shares on a US exchange - basically as soon as the stock trades over $2. We would encourage investors to buy ahead of this event as most biotech funds and investors do not buy shares listed on the Canadian venture exchange. We suspect Stellar could really pick up some traction and the shares move to the $3 level in short order.

Indeed, we saw Stellar present to a full house at a recent institutional investor conference and suspect they will have an increasing professional audience.

The early bird gets the worms

Many years ago one of our clients funded a start-up called Cheniere Energy (LNG). Although Cheniere is worth $12 billion today, we will vouch that, in the early days, there was no "blessing" from CNBC's Jim Cramer and nary an "analyst" in sight.

Cheniere shares have gone from $1 to $54 since the '08 crash, primarily because they locked up the best-located properties for a new, unknown industry - the manufacture and transport of liquefied natural gas . By the time the market and competitors caught on, Cheniere owned the best property; the majors (like Chevron) had to come and grovel for a deal.

Sure, natural gas is a world apart from curing cancer, Alzheimer's, or AIDS, but Stellar is similar in that they have obtained a prime physical location and an early-mover advantage, which puts them at least 5 years ahead of any sustainable competitor. Stellar thus could become the "go to" source for an entire new class of drugs, in addition to a "play the field" approach for investors.

Risk Factors

Because it's too complex to be synthetically created, KLH must be harvested. Stellar has the sole aquaculture facility for the GMP production of KLH; however, it is possible that a synthetic method to produce KLH will be created which could dramatically affect Stellar's future sales and earnings. In addition, other competitive aquaculture facilities may be developed, and even though Stellar's limpets are raised in a safe, out of ocean environment, they still are living creatures and may be subject to disease.

Probably the biggest risk to Stellar could come from an Asian or other competitor who steal some limpets and try to raise them in Asia. However, Stellar's proprietary production process tracks every gram from every limpet and provides a detailed record for GMP standards, and we do not think legitimate KLH users or Big Pharma will be buying black market bootleg supplies.

The biotech industry has had a remarkable run for some time and all bull markets end. This could be disruptive to Stellar's share price. However, our thesis for investing is that Stellar's valuation, compared to any peers, is so low it should do well regardless over the next several years as more clinical trials morph into drugs. In this regard we think it highly unlikely that all 20 clinical trials fail, but it could happen and also some sort of controversy could arise as part of these clinical trials.

Stellar's shares have been consolidating and trade with good volume in the U.S. - source: StockCharts

Conclusion

Stellar is an entirely different company than when we first looked at them 3 years ago; progress has been enormous and we see no reason for that to not continue.

Stellar has a unique, proprietary niche within the biotech industry - as the world's sole sustainable KLH provider, an essential ingredient in a whole new class of drugs.

With nearly $17 million in cash, Stellar is in a fine shape as the monthly burn rate is only $400K-$500K - they are not a cash guzzler. Stellar does not pay for the clinical studies involving the KLH-based therapies, which we believe offers investors significantly less risk than peer biotech companies.

In the near term we expect these drugs to move forward. We also believe investors have a natural bridge ahead, in that at $2 USD the shares should qualify for a full US listing, thus opening Stellar to a whole new world of professional investors. We could envision a rather rapid ascent (upon US listing) to $3 - given comparable biotech valuations - and given that Stellar is the world's exclusive key supplier in a whole new class of drugs.

With only 78 million shares outstanding, our $7 target price is a market valuation just over $500 mm, which is a price where we ultimately believe one of the dozens of cash rich biotechs - with inflated shares - would seek to own such a valuable supply; a likely exit, in our opinion.

Biotech investors may wish to take some profits in the more richly-valued names and allocate the capital into Stellar. The next two years look promising, whichever way the market goes.

Disclosure: I am long SBOTF.

Source:http://seekingalpha.com/article/2113983-stellar-biotechnologies-low-risk-biotech-provider-with-significant-upside

No comments:

Post a Comment