Summary

- Geron has a drug with unprecedented clinical efficacy, a hoard of cash, billion dollar JNJ drug deal and under $300M enterprise value.

- Revealed during earnings call that 20 patients (MF, MDS and AML) from Mayo Clinic pilot study remain on Imetelstat (12-24 months), illustrating efficacy and response durability.

- With JNJ going full force with Imetelstat, Geron is looking to acquire new drug candidates to diversify.

With the biotechnology sector hitting new highs every day and small biotech stocks sporting billion dollar valuations with minimal drug data, there are not many bargains left on the market. A little over a month ago, I recommendedthe small cap biotech MEI Pharma (NASDAQ:MEIP) as a good investment and the stock has since gained ~70%. The more I look for new biotech bargains, the more I come back to Geron (NASDAQ:GERN). I cannot find another company with, a drug candidate with unprecedented clinical efficacy like Imetelstat in a high unmet need disease, a billion dollar drug deal with Johnson & Johnson (NYSE:JNJ), a hoard of cash, and an enterprise value under $300M (market cap minus cash). There was also a hidden gem in the analyst question section of the earnings call yesterday, describing that there are still 20 patients remaining on the drug for at least 12-24 months in the Mayo Clinic trial. This is extremely significant, which I'll discuss below. I'm also impressed with the focus on the company wanting to acquire new drug candidates, now that JNJ has taken on the responsibility of all Imetelstat-related research. These factors make the investing risk minimal and the potential rewards high. With clinical trials ramping in 2015, I think the stock is set up for significant gains. The company has never been in a better position in its history and is a clear buy at current levels.

Video: Clinical Trial of Imetelstat in ET or PV

A Phase 2 clinical trial to evaluate the activity of imetelstat in patients with essential thrombocythemia or polycythemia vera who require cytoreduction and have failed or are intolerant to previous therapy, or who refuse standard therapy.

History Lesson

I've been following the Geron story for a long time but never actually invested in the company, until reading over the Imetelstat efficacy data in Myelofibrosis (MF) presented by Dr. Tefferi of the Mayo Clinic at ASH, December 2013. For the first time ever, a drug was able to cause complete and partial remissions in intermediate and high-risk MF patients, occurring in ~23% of patients (5/22) in the small pilot study. The overall response rate was ~41% (9/22), but I was focused more on the unprecedented remissions occurring in this patient population in which there are no disease modifying drugs currently available, resulting in a median survival of only 1-3 years. Investors were also excited sending the stock into the $7 range. However, the stock took a major hit when the FDA put a hold on Imetelstat clinical trials, due to persistent low grade liver functionality test abnormalities (LFTs) being observed in patients receiving Imetelstat for years in a small scale Thrombocythemia (ET) and Polycythemia Vera (PV) trial. Since Geron was not focused on ET or PV, but MF, I knew the clinical hold would be temporary. As expected, the clinical hold was released once the Mayo Clinic and Geron were able to supply the FDA with their plans for MF and all the LFT data requested. Although the FDA was pleased with what they saw, the stock never fully recovered, bouncing around, but settling around $3 per share. Following nothing but more good news from Dr. Tefferi, where the response rate remained ~40% with additional patients added to the trial, and a major billion dollar partnership announced with JNJ for licensing rights, the stock has remained in the $3 range for no apparent reason.

Imetelstat will succeed in Myelofibrosis

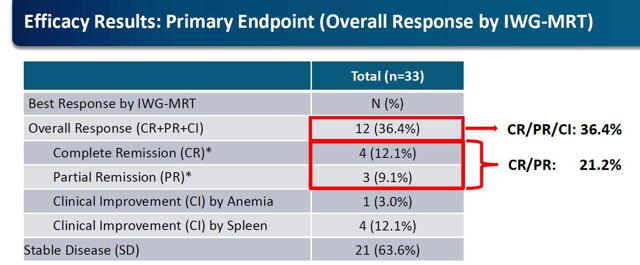

To me, there is not an easier call in biotech right now. Treatment for Myelofibrosis is not like most other disease states, where you will have some efficacy in the standard of care placebo typically used in clinical trials in which a novel drug is compared. It is a known fact that there will be absolutely, positively no complete or partial remissions in the placebo group of the upcoming Phase II clinical trial. I don't think I can be any clearer. Imetelstat is the only drug to ever achieve disease modifying activity in this high-risk population. The small pilot study with Imetelstat achieved 4 complete and 3 partial remissions in 33 patients. Dr. Tefferi stated,

We have never seen this kind of complete response.

*From ASH 2014 investor presentation

JNJ will begin the Phase II clinical trial for MF in the middle of 2015 and for myelodysplastic syndrome (MDS) at the end of 2015. One hidden gem revealed in the earnings call yesterday was that there are 15 MF patients who remain on Imetelstat. Considering the enrollment of the Mayo Clinic trial ended in January 2014 in which 60 MF patients were enrolled, the fact that 25% remain on treatment for at least 12-24 months is extremely impressive. It illustrates that these 15 patients are still receiving a benefit from the drug and likely in remission. Again, for high-risk MF the median survival is only a little over a year, so this is impressive to say the least.

All signs point to Imetelstat being effective in MDS patients

I keep reading that the MDS data must not be impressive, since Dr. Tefferi has not presented it yet. During earnings, it was stated again that Dr. Tefferi is expected to present the data sometime in 2015. This delay may be spooking investors, but I think all signs point to an efficacy signal in MDS. First, Geron has seen the data, but cannot comment on it until Dr. Tefferi presents. Geron and JNJ would not be starting an MDS Phase II clinical trial at the end of 2015, if the data was not impressive. In addition, during the earnings call, it was stated that 4 out of the 9 MDS patients enrolled in the Mayo Clinic trial remain on the drug. Again, nobody infuses a drug every 6 weeks for at least a year, unless they are receiving a clear benefit. The presentation of the MDS data by Dr. Tefferi will be a catalyst for the stock in 2015, with a high probability of success. To be honest, I am not counting on much more than MF and MDS for Imetelstat. However, there have been some efficacy signals in AML in patients and strong supporting preclinical data. I'm sure if there's anything there, JNJ will capitalize on it.

Geron looking to diversify as JNJ takes over Imetelstat

One thing was clear from the earnings call and that is JNJ is extremely interested in Imetelstat and is taking over all R&D related activities. To me that is great news. They will wring the rag and get every little bit of potential out of this drug from MF to AML and hopefully beyond. Geron will therefore, layoff 1/3 of redundant workforce since JNJ is taking over. Geron's senior management will then go on the hunt to acquire new drug compounds to diversify. They reiterated this point numerous times and have made a committee to head the efforts. It appeared to be the theme of the call. With Imetelstat essentially being consumed by JNJ, going after new compounds is the next logical move for Geron. Sitting on a hoard of cash, they will likely be able to find some promising drug candidates.

Financials and Risks

Geron is cash heavy right now with over $170M in the bank, which includes the $35M upfront payment from JNJ received in December 2014. In 2015, management expects a burn rate of $38M with $17M being their share of the Phase II clinical trials. With JNJ sharing development costs, Geron is sitting pretty, financially. Obviously, there are risks involved with any small biotech company, the objective is to mitigate them. Currently, Geron has only Imetelstat and if it fails, the stock will suffer big. JNJ can also decide not to continue with the deal following the Phase II trial readout. However, I believe the risks associated for at least the MF trial are extremely low.

Conclusion

I'm constantly on the lookout for biotech bargains. The more I search the more I realize, how big a bargain Geron currently is. Imetelstat is a slam dunk for MF efficacy and all signs point to a benefit in MDS and possibly AML. The partnership with JNJ, who has turned Pharmacyclics (NASDAQ:PCYC) into a $17B company with their leukemia drug partnership, and the huge cash position removes a nice chunk of associated risk. Catalysts in 2015 will include MDS data from Dr. Tefferi, enrollment and trial design for MF and MDS, the designation of Orphan Drug status for Imetelstat and likely fast track designation for MF indication. The clinical efficacy data for Imetelstat is as strong as ever, the cash position is as high as ever and they landed a partner in JNJ who can take the drug through approval in several indications. I can't seem to find any data that would justify the current low valuation of the company. I am adding heavily and expect ~30% increase in next 3 months.

By Stock Doctor

No comments:

Post a Comment