You probably hadn't heard the name Camtek (CAMT) until a week ago. That's when Camtek announced the launching of their "GreenJet" 3D solder mask inkjet deposition system. A short time after that, a huge buzz was created and Camtek's share prices rose more than 200% to their November 26th peak of $6.43 a share. While I think the buzz around Camtek being a 3D printing company is way off, I do believe that this new product line changes the company's business model and is about to fuel them to massive growth in the coming years. I'm a great believer in deep research. I believe that companies are valued in the long term by the underlying business and not according to the buzz on the streets. So I decided to delve into the Camtek story and share my findings with you. I hope you'll find my discoveries useful and that knowing these will help you better understand Camtek's business and possible prospects-which are quite amazing.

Prologue

I started covering Camtek about a year ago for the firm I work for, Gil Adron. Camtek drew my attention because it has a good exposure to the semiconductor industry, which is in the midst of a CapEx upcycle. As Camtek is positioned to profit from this upcycle, I started covering the company. Excluding the new GreenJet business, the company was positioned extremely well to enjoy the aforementioned upcycle. Camtek sells inspection tools to semiconductor manufacturers and various tools for the printed circuit board (PCB) industry. On November 22nd, Camtek's shares jumped about 25% on the Nasdaq. When the market opened that Monday, shares jumped to a high of $5.12, an increase of 93% from Friday's closing price of $2.65. PriorTech, Camtek's parent company, issued an announcement after the Israeli SEC asked them to clarify this sudden jump. The announcement was that to the best of their knowledge, they did not know of any material piece of information that could have caused the stock to surge. PriorTech denied the rumors it is about to place a tender offer on Camtek shares.

So, What's the Fuzz?

Camtek's new business is the GreenJet 3D printer for the deposition of a solder mask on PCBs. I'll explain that shortly. The use of the term "3D printing" can be confusing. The GreenJet is not a 3D printer in the way that it creates 3D objects nor in the way it creates a complete and functional PCB out of raw materials. The GreenJet 3D printer is meant to replace the manufacturing process of applying a solder mask on a PCB. After the next few paragraphs you will have a complete understanding of what the GreenJet does.

PCB

The purpose of a PCB is to connect electronic components together. For example, a computer motherboard connects a central processing unit (CPU), memory, and other parts of the computer together. The "connections" between various electronic components are called tracks. Tracks are made out of copper, which is conductive, and allows electrical current to flow between different components on the PCB. Here is an iPad Air PCB:

Source: iFixit

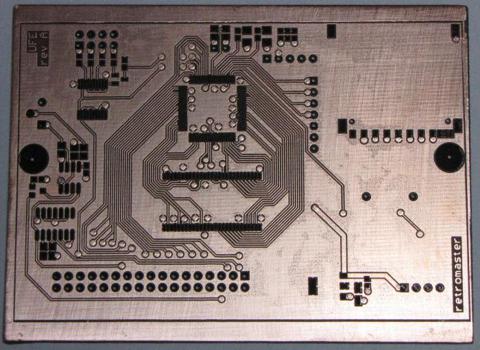

Here is a keyboard PCB:

A PCB with no electronic components attached.

Solder mask

You will probably recognize solder mask as the green layer that coats a PCB. The tracks of the PCB are coated with a layer of a nonconductive polymer to prevent oxidation. Because the tracks are becoming less and less spaced (size is a key in mobile electronics design), two tracks that are very close to each other can accidentally allow electrical current to flow between them and create an unplanned connection between some components on the PCB.

To understand what the GreenJet printer does, you'll need to understand the current manufacturing process the industry uses for applying the solder mask layer on the PCB.

The Solder Mask Process

Step 1: Applying the solder mask paint evenly on top of the PCB.

Step 2: Drying the paint in an oven.

Step 3: Exposing the solder mask to UV light according to the specific pattern of the PCB (the plot). This means that the UV light will hit all the parts except the shaded areas. The parts of the solder mask that did not receive any UV light will be washed off.

A PCB plot:

Step 4: Developing the PCB in a chemical solution. The chemical reaction removes the solder mask layer from the specific areas of the PCB to which the electrical components should be connected. Without removing the solder mask from those areas, the electric component can't be connected to the PCB.

The end result is a PCB on which an even layer of solder mask has been applied, with perfect "holes" where the electrical components are to be connected.

Before applying the solder mask:

After applying the solder mask"

Source: Retromaster's blog

Cutting to the Chase

Now that you understand the solder mask process, you can get the picture. The GreenJet 3D printing doesn't print or make a complete PCB. The printer replaces the four manufacturing steps with only one. The printer uses the digital PCB pattern design and applies the solder mask in the right places, skipping the "holes." This is why the printer can be compared to a 3D printer; it uses the same techniques and methods of a generic 3D printer. The GreenJet can save a factory substantial manufacturing space as it replaces 4 manufacturing phases. Instead of using multiple employees simultaneously, the factory can use only one employee to operate the printer. This means serious cost reduction for the plant, which can come up to 40%-50%. The printer solves some alignment issues that arise in the exposure phase (any deviation from the plot can result in "misses" when developing the PCB. So we can see there's a very good incentive for a PCB factory to adopt this technology.

What It Means for the Business

Now comes the fun part. After we understand what this new business is all about, we can start crunching some numbers. Camtek mentioned that the market for this printer is a $600M-$700M one. This new business also enjoys a different business model than Camtek used to have. As is the case for any printer in the world, 3D or not, it enjoys the razor blades business model; that is, Camtek will sell printers and the "ink" (the solder mask paint) it consumes. In any similar model, consumables (ink) revenues are much higher than the nonconsumables (the printer) revenues. I think it is safe to assume a 15/85 split in favor of the consumables. Camtek's CEO, Roy Porat, confirmed this assumption, which implies $600M/$100M between ink sales and printer sales, respectively. I prefer taking the higher end of the company's expectations (as the value proposition of the printer is pretty substantial). According to Roy Porat the printer will come with a $300K-$350K price tag. Applying these assumptions gets us to the following:

Printer ASP in $

|

$350K

|

Printer share of market size in $

|

$100M

|

Ink share of market size in $

|

$600M

|

Ink consumed by a machine annually

|

$2.1M

|

Source: my analysis

You can easily see that the big portion of the opportunity is ink sales. Camtek announced that a first printer will be installed for evaluation in the beginning of 2014. If everything goes smoothly, I assume the evaluation will take a few months. I sum up my predictions in the following table:

Year

|

2014

|

2015

|

2016

|

2017

|

Installed Base

|

0

|

5

|

15

|

30

|

Printers Sold

|

5

|

10

|

15

|

35

|

Printer Sales

|

$1.75M

|

$3.5M

|

$5.25M

|

$8.75M

|

Ink Sales

|

$4.2M

|

$21M

|

$46.2M

|

$109.2M

|

Total GreenJet revenues

|

$6M

|

$24.5M

|

$51.5M

|

$118M

|

Numbers are rounded for simplicity. I assume sales of printers will be spanned evenly across the year.

I think the above assumptions are on the conservative size; in 2017 the $118M in revenues represent 16.8% of the TAM. The bottom line will be substantially affected. Consumables usually bear very high gross margins. If we assume 80% gross margins for ink sales, 40% gross margins for the printers, and about 20% of operating expenses for the new business, we get to the following:

Year

|

2014

|

2015

|

2016

|

2017

|

Incremental Net Income

|

$2.8M

|

$13.3

|

$28.7M

|

$67.2M

|

Incremental EPS

|

$0.9

|

$0.44

|

$0.95

|

$2.2

|

Core EPS

|

$0.25

|

$0.20

|

$0.10

|

$0.15

|

Total EPS

|

$0.31

|

$0.64

|

$1.05

|

$2.35

|

The core EPS has a cyclical nature and is affected by the semiconductor industry and its capital expenditure (CAPEX) cycles. EPS calculations are based on 30M shares.

Valuation

Taking a P/E of 20, Camtek should be worth $20.5 a share by 2016 earnings and $47 a share by 2017 earnings, which will represent a market cap of $1.4B. This is about 10 times today's market cap of ~$140M; that is, a 10 bagger. To reach this valuation the company will have to execute its strategy with great precision. At these levels, however, the risk here is somewhat limited. The company is about to enjoy a strongupcycle in semiconductors' CAPEX, which will benefit the company and limit the downside, not to mention the $0.70 in cash per share. All of this leads us to a favorable risk\reward profile.

What Can Go Wrong?

- Competition- Another company can get into this business. For now Camtek is the only one.

- Ink substitutions- The ink the company developed could be reverse engineered and compete with the company's own product. Just think of replacement coffee capsules, which are designed to fit a certain coffee machine. On the other hand, Camtek's ink is qualified with theIPC, which assures its quality. The solder mask plays an important part in determining the PCB quality so companies can be expected to care for quality solder mask ink. That said, anything can be copied these days.

Epilogue

To conclude, a month ago Camtek was a promising play given the upcoming upcycle of semiconductor companies' CAPEX. Today it is far more promising. Peter Lynch said, "Invest in what you know." Investing in Camtek can't be based on the buzz around Camtek and 3D. Every Camtek investor should do his or her due diligence and understand the business behind the stock. The new printer could prove itself very significant to any PCB manufacturer; the value proposition it carries is very high. I would suggest basing your investment thesis on down-to-earth assumptions and not the assumption that Camtek invented some magical 3D printer that can print complete PCBs. In this case, I think the recent interest in Camtek is justified, though not because Camtek entered the "hot" 3D printing market (which it didn't). Camtek seems to offer great value to the PCB market; of course, it is wise to follow the first printer's adoption rate and acceptance. After the printers have proved their value to the first PCB manufacturers, I think that rapid adoption will follow.

Additional disclosure: Gil Adron is long CAMT, PriorTech (trades on TSE)

By Jonathan Fishman

Source:http://seekingalpha.com/article/1871771-camtek-untangling-the-3-d-printing-story?source=email_tec_edi_pic_0_0&ifp=0

By Jonathan Fishman

Source:http://seekingalpha.com/article/1871771-camtek-untangling-the-3-d-printing-story?source=email_tec_edi_pic_0_0&ifp=0

No comments:

Post a Comment