Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

By Jason Napodano, CFA

This is a mission directive to all business development officers for large-cap pharmaceutical companies on how to build a potential world-class franchise in the treatment of Parkinson's Disease. And it will only cost you around $1 billion!

Parkinson's disease (PD) is a slowly progressing neurological disorder characterized by tremor, stiffness and decreased movement, and postural instability affecting approximately 0.4% of the population over age 40 and 1% of those over age 65. The disease arises from the death of dopamine-generating cells in the substantia nigra region of the midbrain, believed by many to be associated with the accumulation of a protein called alpha-synuclein into inclusions called Lewy bodies in neurons. The cause of PD is generally idiopathic, although some atypical cases have a genetic origin. The disease is named after the English doctor James Parkinson, who published the first detailed description in An Essay on the Shaking Palsy in 1817.

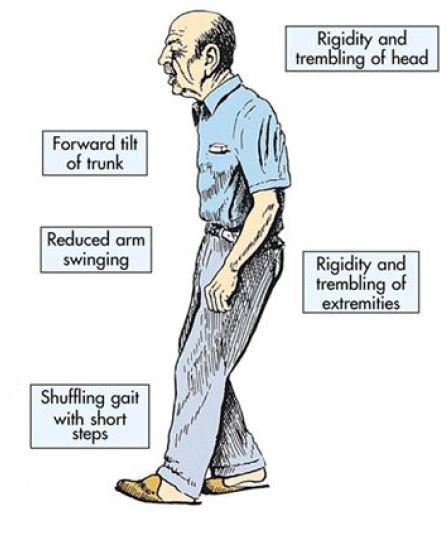

PD patients often exhibit marked reduction in motor control and an increase in parkinsonism (tremors, hypokinesia, rigidity, bradykinesia, and postural instability). Muscle pain and fatigue are common in association with these symptoms. The face eventually becomes masklike with open mouth and drooling, and speech becomes unclear and difficult to initiate. Postural instability becomes more prominent as the disease progresses, resulting in difficulty walking and maintaining balance. Without warning, voluntary movement may suddenly halt. Overall, patients with PD find it increasingly difficult to initiate and control movement as the disease progresses, leading to disability, isolation, and loss of independence.

As the disease progresses, patients often exhibit non-motor symptoms that include autonomic dysfunction, neuropsychiatric problems (mood, cognition, behavior or thought alterations, psychosis), and sensory and sleep difficulties. Parkinson's disease psychosis (PDP) is common in nearly 40% of PD patients a decade after initial diagnosis, and can often be induced by antiparkinson drugs (Poewe W, 2003). Visual hallucinations are the most common clinical manifestation of the psychosis, along with dementia, anxiety, depression, and insomnia common co-morbidities.

Treatment Options & The Problems That Exist For Patients

There is no cure or disease modifying agent for PD. Instead, physicians attempt to manage the symptoms of the disease through a multidisciplinary approach that may include pharmacological, social, and surgical options. The most common pharmaceutical treatment options are those, which look to increase the level of dopamine in the brain. These include dopamine replacement therapies (DRT) combined with dopa decarboxylase inhibitors, dopamine agonists, and MAO-B inhibitors. The treatment option is often tailored specifically for the patient based on the stage and severity of the disease and the balance between good symptom control and side effects resulting from enhancement of dopaminergic function.

The most commonly used DRT therapy is Levodopa. It has been available for over 30 years. Levodopa (L-DOPA) is converted into dopamine in the dopaminergic neurons by dopa decarboxylase. The administration of Levodopa temporarily diminishes the motor symptoms associated with the lack of dopamine in the substantia nigra. Unfortunately, only about 5-10% of L-DOPA crosses the blood-brain barrier. The remainder is often metabolized to dopamine elsewhere, causing a variety of side effects including nausea, dyskinesias and joint stiffness. Carbidopa, a dopa decarboxylase inhibitor, is commonly dosed with Levodopa to prevent L-DOPA metabolism before it reaches the blood-brain barrier. In fact, co-formulations of Levodopa/Carbidopa (Sinemet-CR) are available.

Despite these co-formulations, Levodopa carries significant risk of side-effects, including dyskinesia (involuntary movements). As a result, despite its effectiveness in reducing motor symptoms associated with Parkinson's disease, physicians often attempt to delay Levodopa therapy until the disease progresses to a more moderate-to-severe stage. Most early-stage PD patients start out on MAO-B inhibitors and / or dopamine agonists, or low-dose Levodopa. However, PD is a progressive and degenerative disease, and patients typically progress to the point where starting Levodopa or increasing the Levodopa dose is necessary in five years after initial diagnosis. After a decade on therapy, almost all PD patients require high doses of Levodopa, as well as surgical options including deep brain stimulation (DBS). As the dose and use of Levodopa increases, the incidence of Levodopa-induced dyskinesia (LID) also increases.

Levodopa also has a relatively short half-life, requiring dosing averaging three to four times a day. Peak plasma concentrations of Levodopa occur 60 to 90 minutes after dosing. Unfortunately, this is also when peak side effects such as dyskinesia occur. The hefty dosing requirement of Levodopa creates compliance issues, especially at night when patients may sleep through their dose schedule - dosing every six hours. The peaks and troughs associated with Levodopa create significant "on" and "off" treatment times for PD patients. On times are when the drug is in their system and they may be experiencing dyskinesia, and off times are when the Levodopa has left their system and the patient may experience akinesia (a frozen or rigid state).

Early-morning akinesia is often the first motor complication of the PD patient. It primarily occurs after the patient awakes from a nightlong treatment-free period. Patients with early-morning akinesia often also experience a delay in restoration of their motor function after taking their initial morning dose of Levodopa. This is known as slow or delayed "on" or latency to on given that peak Levodopa plasma levels do not occur until 60+ minutes after dosing. Patients may misguidedly take a higher than prescribed initial morning dose of Levodopa, hoping to obtain a quicker on. Unfortunately, this can lead to severe dyskinesia.

End of dose wearing off is characterized by declining mobility as the dose period progresses to its end. End of dose wearing off is the most common motor fluctuation in PD and thought to be caused by a reduced duration of action of Levodopa. It occurs in as many as 25% of patients within six months of the initiation of Levodopa therapy and as many as 50% within the first 18 months. The unpredictability of this sudden akinesia is particularly disturbing to patients, causing anxiety, depression and feelings of loss of control. Dose failure or failure to achieve on refers to the absence of any clinical response to a dose of Levodopa and most often occurs in patients who require frequent dosing.

A paper by Schapira et al in the European Journal of Neurology entitled, "Levodopa in the treatment of Parkinson's disease" (2009, 16:982-989), the authors note: "Early Parkinson's disease is associated with a prolonged response to Levodopa. Disease progression and Levodopa characteristics, e.g. short half-life lead to changes that result in a shorter duration of action with wearing off of motor benefit prior to the next dose. Peak dose dyskinesias also begin to appear. As neurodegeneration advances and the adverse effects of Levodopa accrue, clinical response becomes ever shorter and unpredictable with more pronounced dyskinesias." The figure below from the Schapira et al paper depicts the changing response to Levodopa therapy with disease progression. Patients with advanced PD exhibit poor disease control, greater risk of off periods and on time with dyskinesias.

The changes in Levodopa response noted in the picture above create significant quality of life problems for PD patients. According to an observational registry, Implications of Motor Fluctuations in Parkinson's Disease Patients on Chronic Therapy (IMPACT), the three most common issues facing patients on Levodopa therapy are wearing off (reported by 81%), sudden onset (42%) and latency to on (40%). The average duration of an off period was 50 minutes. Results were presented at the 9th International Congress of Parkinson's Disease and Movement Disorder in 2005.

This Knowledge, & $1 Billion, Gets You A World Class Franchise

There's no disease modifying agent to treat PD. Levodopa is the primary treatment agent to manage the motor symptoms, but patient response to Levodopa wanes over time, creating the need for akinesia rescue medications, and long-term use of Levodopa induces dyskinesia. Atypical antipsychotics, such as quetiapine or clozapine, are used to manage the psychotic symptoms, but quetiapine is not very effective and clozapine has nasty side-effects. There is clearly a void in the market around these three areas of treatment.

As the business development officer of a large cap pharmaceutical company, this void becomes an opportunity. We see an opportunity to build a potential world-class franchise for the treatment of Parkinson's disease psychosis, Levodopa-induced dyskinesia (LID), and a rescue medication for patients experiencing off-episodes between Levodopa dosing. And we think it can all be built for around $1 billion in cash.

Idea # 1 - Call Acadia Pharmaceuticals

Parkinson's Disease Psychosis is a debilitating psychiatric disorder that occurs in over 40% of patients with Parkinson's disease (Barnes et al, 2001). In the U.S., we estimate this is 500,000 patients. PDP is characterized by the presence of hallucinations and delusions. Hallucinations are most common and are often visual, but may also include somatic or other sensory phenomena. Delusions commonly involve paranoia, and can be profoundly disturbing and debilitating. PDP represents a major inflection point in the course of Parkinson's disease progression, and is the number one driver of why patients enter nursing homes or long-term care facilities.

Acadia Pharmaceuticals (ACAD) is developing pimavanserin, a potent and selective 5-HT2A inverse agonist designed to regulate the optimal combination of dopamine (D2) receptor blockade and 5-HT2A inverse agonism. It's a first-in-class drug that treats psychosis without completely blocking dopamine. The drug reduces symptoms of PDP without impairing motor function, a major side effect of current off-label antipsychotic use, and thereby significantly improving the quality of life for patients with the disease.

On November 27, 2012, Acadia announced the successful results from its pivotal Phase III trial evaluating the efficacy, tolerability and safety of pimavanserin in patients with PDP. Full data was just recently presented at the American Academy of Neurology (AAN) annual meeting in March 2013. We view the data as a "Home Run" for the company.

The primary endpoint of the trial was antipsychotic efficacy as measured using the "SAPS-PD" scale, which consists of 9-items from the hallucinations and delusions domains of the Scale for the Assessment of Positive Symptoms (SAPS). Pimavanserin met the primary endpoint in the Phase III trial by demonstrating highly significant antipsychotic efficacy as measured using the 9-item SAPS-PD scale (p=0.001).

Motoric tolerability was a key secondary endpoint in the study and was measured using Parts-II and -III of the Unified Parkinson's Disease Rating Scale (UPDRS). After 43 days on treatment, patients taking pimavanserin experienced a -1.69 change in UPDRS vs. -1.40 for the placebo. The results show that pimavanserin is non-inferior to the placebo (i.e. has no negative effects on motor function). We believe this is extremely important in the marketing of the drug because the leading off-label antipsychotic therapies, clozapine and quetiapine, negatively impact motor function and carry significant side effects such as increased parkinsonism, orthostasis, sedation, confusion, and drooling. Clozapine also requires weekly phlebotomy to monitor for potential agranulocytosis.

Another secondary endpoint was Clinical Global Impression Improvement (CGI-I), which was highly statistically significant in favor of pimavanserin (p=0.001). Management also assessed a number of exploratory endpoints, all which demonstrated strong support for the antipsychotic efficacy of pimavanserin. One secondary endpoint was the Caregiver Burden Scale, an assessment done by the caregiver to provide a quantitative assessment of burden associated with the patient's functional / behavioral impairments, the circumstances of at-home care, as well as the caregiver's health, social life and interpersonal relations. Results were statistically significant (p=0.012).

In our view, pimavanserin looks like a safe and highly tolerable drug. Safety and tolerability data from the previous Phase III studies, -012 and -014, are consistent with the findings from -020. Acadia also assessed the impact on sleep using the SCOPA-sleep scale, which was designed to enable the investigator to evaluate nighttime sleep and daytime wakefulness in Parkinson's patients. Pimavanserin demonstrated significant improvements on both nighttime sleep (p=0.045) and daytime wakefulness (p=0.012) on SCOPA.

In April 2013, Acadia announced very positive news with respect to the timeline for filing the U.S. new drug application (NDA) for pimavanserin for the treatment of PDP. Based on the solid data from the Phase III study noted above, the FDA is amenable to accepting and reviewing the NDA for pimavanserin based on this data, along with data from previous and yet to be completed supportive studies. We expect all this data to be in hand and submitted to the agency by the end of 2014. The company is also having discussions with regulatory authorities for filing the pimavanserin application in Europe.

We do not think Acadia is going to out-license the U.S. rights to pimavanserin. In fact, they've made it pretty clear they want to push forward to commercialization in the U.S. themselves. The market value of Acadia is around $1.3 billion. Thanks to a recent financing, we expect Acadia to report roughly $210 million in cash on the balance sheet on June 30, 2013. That allows them some flexibility. There are an estimated 1 million Parkinson's patients in the U.S. and some 150 leading treatment centers. Acadia's open-label safety extension study of pimavanserin is taking place at 127 of these centers. The company believes it can effectively promote the drug in the U.S. themselves, and we agree.

But outside the U.S., in Europe or Asia for example, the market is far too expansive for Acadia to tackle alone. More clinical trials still need to be conducted. Thus, Acadia will probably look to partner pimavanserin outside the U.S. for upfront cash, back-end regulatory and sales milestones, and royalties on sales. Herein lies the opportunity for the first piece of the puzzle for a big pharmaceutical company to start in its effort to build a leading PD treatment franchise.

Spend $500 million. For $500 million, we believe pimavanserin can be licensed for territories outside the U.S. This includes $100 million upfront, $350 million in back-end milestones, and $50 million in committed future development in opportunities outside PDP, such as Alzheimer's disease psychosis (ADP). Expect to pay high-teens to low-twenties royalty on sales.

Idea # 2 - Call Addex Therapeutics

Levodopa-Induced Dyskinesia (LID) is a major side-effect of Levodopa use. LID is characterized by hyperkinetic movements, including chorea (abnormal involuntary movement), dystonia (sustained muscle contraction, abnormal posture), and athetosis (involuntary convoluted movements). It is most common at times of peak L-DOPA plasma concentrations (peak-dose dyskinesia), although it may also occur when plasma concentrations rise and fall (diphasic dyskinesia) or during off-time (off-period dystonia).

There are no approved treatment options for PD-LID. Approximately 50% of PD patients will experience LID after 4 to 6 years on Levodopa therapy. The number rises to 90% after 10 to 15 years. It is a significant problem for patients and physicians seeking treatment for PD. In fact, a survey of key opinion leaders (KOLs) in the Parkinson's treatment space showed that dyskinesia is the most important unmet medical need in the treatment of PD after a disease modifying agent (Datamonitor 2011).

Addex Therapeutics (ADXN.SW) is developing dipraglurant, an oral negative allosteric modulator (NAM) of the metabotropic glutamate receptor 5 (mGluR5), for the treatment of PD-LID. During the neurodegenerative process of PD, loss of striatal dopaminergic neurons results in an increase in gluatamatergic output from the substantia nigra. It has been shown that mGluR5 are abundant in the striatum and implicated in the excess glutamate activity observed in patients with PD. Addex has demonstrated that modulation of mGluR5 has anti-PD and anti-dyskinetic effects in a variety of animal models as well as early trials in patients.

For example, in a preclinical model of PD-LID, designed to be predictive of efficacy in humans, dipraglurant (immediate release 3, 10, and 30 mg/kg) or placebo was administered 30 minutes prior to Levodopa in a 4-way crossover protocol show a marked and statistically significant reduction in dyskinesia symptoms on the 10 and 30 mg/kg dose.

Addex completed a Phase IIa, randomized, double-blind, placebo-controlled study of dipraglurant in March 2012. Work from this Phase IIa trial was supported by a $0.900 million grant from The Michael J. Fox Foundation (MJFF). Results show that both dose levels, 50 and 100 mg, were well tolerated and there were no concerns arising from any of the safety monitoring parameters. Secondary endpoints in the study were exploratory, but centered on validated clinical measures for Parkinson's disease assessment, including the modified Abnormal Involuntary Movement Scale (modified AIMS), patient and clinician global impression of change (PGIC & CGIC), Unified Parkinson's Disease Rating Scale (UPDRS), and the Hospital Anxiety & Depression Scale (HADS).

Results on the modified AIMS scale showed statistically significant improvement on days 1 and 14, with impressive and clinically relevant reductions in the dipraglurant group on all three periods tested (days 1, 14, and 28). Management will have to control the escalating placebo response in the next clinical study, as the Day 28 data just missed statistical significance.

Interestingly, there was no describable difference in the AIMS reduction trends for patients with an implanted electronic DBS (deep brain stimulation) device. DBS is a sort of pacemaker for the brain for patients with severe PD. This is encouraging and opens the door for potential dipraglurant use in this population.

Targeted reduction in Levodopa-induced dyskinesia severity over the entire 3 hour post Levodopa dose period (area under the curve) demonstrated solid results for dipraglurant at Day 14 (32.7%) and Day 28 (27.5%). The Day 14 AIMS AUC0-3 data was statistically significant (p=0.042) at Day 14, but missed at Day 28 due to lack of statistical powering and a meaningful reduction in the Day 28 AIMS AUC0-3 data for the placebo.

Patient and Clinician Global Impression of Change (PGIC & CGIC) and patient diary data also yielded encouraging results. The data showed no increase in "off" time seen with dipraglurant use - meaning that dipraglurant had no detrimental effect on the underlying Levodopa efficacy. In fact, by week 4 of the study, the mean "off" time for the dipraglurant group actually decreased by 50 minutes compared to no change for the placebo. This is suggestive of a beneficial (symbiotic) effect of dipraglurant on parkinsonian symptoms. UPDRS (motor function scoring) remained unchanged at all treatment visits during the 4-week program, again suggestive of no detrimental effect to the drug.

Similarly, an increase in "on" time effect without dyskinesia was observed for the dipraglurant group compared to the placebo in all 4 weeks of treatment. By week 4 of the study, patients in the dipraglurant group had an extra 2.3 hours per day of "on" time without dyskinesia. This is highly clinically relevant, and suggestive for a potential blockbuster opportunity.

Dipraglurant is an early-stage candidate than pimavanserin. The next step in clinical development is a Phase IIb study. Addex has stated they are currently seeking a partner with the expertise and capability to fully exploit dipraglurant's attractive commercial potential that includes potential indications in orphan indications such as Torsion Dystonia(DYT1). Note the new composition of matter patent just received in April 2013. Additional funding with the MJFF is a potential as well.

Spend $250 million. For $250 million, we believe dipraglurant can be licensed on a global basis. This includes $50 million upfront, $150 million in back-end milestones, and $50 million in committed future development in opportunities outside PD-LID, such as dystonia. Expect to pay mid-teens royalty on sales.

Idea # 3 - Call Cynapsus Therapeutics

Levodopa is the most widely used therapeutic agent for the treatment of PD. Unfortunately, Levodopa induces serious dyskinesia, as noted above, which is often treated by lowering the dose. This causes akinesia (rigidity) to return. It's an unfortunate situation where patients are fluctuating in clinical states between mobility and immobility, dyskinesia and akinesia, for periods ranging from a few minutes to a few hours.

The period between fluctuations are manifested in various scenarios, including a "wearing-off' phenomena where deterioration in the relief occurs before the next dose takes effect, but may be predictable given routine dosing schedules, or in an "on-off" phenomena where the transitions is more sudden and unpredictable. Clinical experience shows patients can switch from "on" to "off" and develop akinesia or rigidity in minutes or even seconds (Swope D M., 2004) with no discernible relation to a patient's dose schedule. Two other phenomena are the "delayed on," in which Levodopa's effects are substantially delayed, and "no on" (dose failure), in which no effects occur at all.

Subcutaneous injections of apomorphine (Apokyn) have proven to be effective in the treatment of "on-off" fluctuations in PD within 5 to 15 minutes, and last for 45 to 90 minutes. Trials have shown consistent reversal of "off' period akinesia, a decrease in daily Levodopa requirements and consequently a decrease in the amount of "on" period dyskinesias. Advantages of apomorphine include a quick onset of action, lower incidence of psychological complications, and a relatively short half-life. For these reasons, it is an ideal "rescue therapy."

Unfortunately, subcutaneous injections of apomorphine have proven to be impractical for patients entering a period of "wearing-off" or switching from "on-off" given most patients impaired motor function, diminished dexterity, and aversion to frequent painful injections. Imagine a Parkinson's patient with serious dyskinesia attempting to give themselves a precise subcutaneous injection. Or picture a completely frozen patient experiencing psychosis, dementia, hallucination, or delusions being approached by a caregiver holding a needle.

Apomorphine is a very effective drug, but Apokyn is simply the wrong delivery. Development of alternative formulations of apomorphine has been met with little success. For example, oral administration of apomorphine tablets has required high doses to achieve the necessary therapeutic effect because apomorphine administered by this route undergoes extensive first-pass metabolism. Intranasal administration produced transient nasal blockage, burning sensation and swollen nose and lips. Finally, sublingual administration of apomorphine tablets caused severe stomatitis on prolonged use with buccal mucosal ulceration in half the patients treated (Deffond et al, 1993).

Apokyn was protected under the U.S. Orphan Drug Act of 1983 that guaranteed market exclusivity for the drug for seven years. This exclusivity expired last year, and Cynapsus Therapeutics (CTH.V) was the first company to secure a U.S. patent for a new sublingual film formulation of apomorphine, APL-130277, in April 2013.

APL-130277 is a simple concept. Cynapsus is not developing a new chemical entity with novel mechanism. The product is an astutely designed re-formulation of an existing approved and known-to-be effective drug. Management at Cynapsus held a pre-IND meeting with the U.S. FDA confirming the path to approval is bioequivalence to the reference product, subcutaneous apomorphine, via the 505(b)(2) pathway. The company seeks the same indication for use as Apokyn, reducing risk that the FDA comes back and asks for new efficacy studies. We see low clinical development risk here.

The Michael J. Fox Foundation is funding the bulk of the next clinical study, a pilot study dubbed CTH-103, to further characterize the APL-130277 formulation. It's a great endorsement of the drug's potential to have the MJFF involved. Assuming that pilot study is successful, we expect Cynapsus to move quickly into a pivotal bioequivalence, dubbed CTH-201, and long-term safety study, dubbed CTH-301, in 2014. Management is targeting a new drug application in 2015. So although APL-130277 may not be as sexy as dipraglurant, it may be on the market around the same time as pimavanserin and offer a very nice #2 position product to detail. It will not cost as much as either pimavanserin or dipraglurant to develop either. Cynapsus secured $6.7 million in cash in March 2013, which we find to be sufficient to fund operations through the CTH-103 pilot study. The registration study and safety study will cost only another $10 to $15 million.

Spend $200 million. For $200 million, we believe APL-130277 can be licensed on a global basis. This includes $50 million upfront, $125 million in back-end milestones, and $25 million in committed future development. Expect to pay mid-teens royalty on sales.

There you have it! For just under $1 billion, $950 million to be exact, we predict a large pharmaceutical company can build a leading Parkinson's disease franchise by striking deals with Acadia Pharmaceuticals, Addex Therapeutics, and Cynapsus Therapeutics. The $50 million left over can be used for building a sales force and promoting the products.

All three companies are interesting investment opportunities on a stand-alone basis, but together they create a potential very attractive suite of PD-focused products for specialty promotion. Addex Therapeutics trades on the Swiss-Six under (ADXN.SW), and in the U.S. on the OTC as (ADDXF.PK). Cynapsus is based out of Toronto, Canada, trades on the Toronto-Venture (TSX) exchange under (CTH.V), and on the OTC under (CYNAF.PK). We recommend buying the primary-exchange listed shares for both Addex and Cynapsus.

No comments:

Post a Comment