By Scott Matusow:Disclosure: I am long ETRM.

This week, I cover 5 companies I feel have strong trading catalysts that could help traders profit nicely. I use a combination of chart technicals and speculation value for each company and their respective catalysts. While biopharma catalyst trades can be very profitable, there is considerable risk involved with them. Failed data releases, dilutive cash raises, and overall market conditions can play a strong role in determining the direction each stock might take.I start the list off for this week with the company I feel offers the best potential catalyst trade to the upside; let's take a look.

EnteroMedics Inc. (ETRM)

According to company press releases, conference calls, and my correspondence with investor relations, Phase III data from its Recharge study on its flagship product, The Maestro System, is due to be released around mid Q1. In 2009, traders bet the stock to near $30 a share on anticipation of the company's "EMPOWER" study succeeding. But, after it ultimately failed to meet both its primary and secondary endpoints, the stock tanked to below $10 a share, and became somewhat forgotten by the market.

After the failure of the EMPOWER study, the company stated;

Based on the analysis to date, the control arm of the trial, which was intended to be inactive, apparently provided a low-intensity blocking signal that introduced VBLOC Therapy in human subjects.After the addressing the issues and meeting with the FDA, the company made some modifications to the system, and designed a new Phase III trial.

"The ReCharge Study," requires the company show a 10% greater Excess Weight Loss (EWL) from randomization with the Maestro System after 12 months of VBLOC therapy compared to control by BMI method, and to observe clinically meaningful responder rates in the treatment arm of 20% and 25% EWL from implant at 12 months (not statistically based).

In 2010, the company's Australian cohort showed results that easily surpasses the new trial's requirements. In the Australian cohort, a total of 83 subjects were enrolled at two centers, with 61 subjects implanted. Main outcome measures were morbidity, mortality, and excess weight loss at 12 months. Results include;

As we can see from above, the numbers easily surpass the endpoints defined in the new ReCharge Study. The statistical difference from the cohort study is 32% and with an even greater mean EWL, blowing away both Arena's (ARNA) and Vivus's (VVUS) anti-obesity drug treatments Belviq and Qsymia, respectively.

- Mean 12-month EWL was 25% for the treatment group and 17% for the control group;

- Weight loss was linearly related to hours of device use; subjects with greater than or equal to 9 hours/day use achieved 37% and 21% mean EWL (treated versus control, p = .02); and

- No therapy-related serious adverse events or deaths were reported across the entire study population.

Considering all the factors here, I expect EnteroMedics to announce positive data sometime around the middle of February.

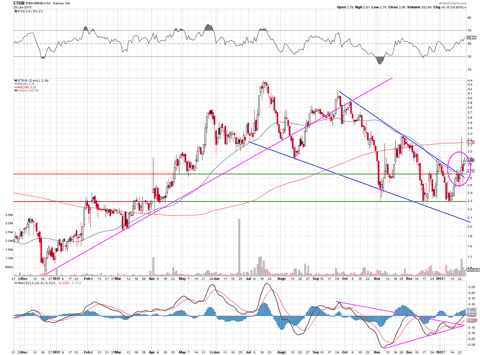

(click to enlarge)

The chart above indicates to me that the stock has found two bases, one at $2.30, another at $2.65, and has recently broke its mid-term down trend line. With this consolidation above $2.72, I expect much more upside in the short term, with $3.30 as being the first level before making a second move to $4.40 or higher.

Morbid obesity is an ever growing problem worldwide, and having the option of a device like the Maestro System as a choice over gastric bypass surgery and potentially dangerous pills could really make a difference in the lives of those who might need it. It could also mean big dollars for the company, which in turn would mean huge gains for the company's stock holders. Both traders and investors should keep a close eye out on this one as I feel it has strong potential to be a multi-bagger this year.

Auxilium Pharmaceuticals (AUXL)

In the third quarter of 2012, Auxilium completed enrollment in its Frozen Shoulder Phase IIa. Top-line data from the XIAFLEX study is expected in the first quarter of 2013.

Frozen Shoulder, which doctors call adhesive capsulitis, is frequently caused by injury that leads to lack of use due to pain. Rheumatic disease progression and recent shoulder surgery can also cause Frozen Shoulder. Among those with diabetes, 10% to 20% of these patients suffer from Frozen Shoulder, and patients 40-60 years of age see a rate of 10% affected by the condition.

There is a decent size market for Frozen Shoulder, so I expect anticipation of positive results here to add some upside catalyst trade value to the stock.

(click to enlarge)

The chart above shows that the stock has dropped significantly since its breakout, but now finding good torrent support, and consolidating in the mini channel. An inverse head and shoulders appears to be forming, indicating a possible break to the high side again.

Perhaps another reason to trade Auxilium to the long side is the recently announced pricing of $325.0M of 1.50% convertible senior notes which are in due 2018. The conversion rate is equal to an initial conversion price of about $24.17 per share, which is over 30% higher than the company's last closing price of $18.34. Considering the data catalyst, a strong cash position, and a much higher initial conversion price for the convertibles over the stock's current price, Auxilium might be poised to make a nice run higher in the near term.

Keryx Biopharmaceuticals (KERX)

I list Keryx because the company is over a month late in reporting the top line data for its Phase III drug Zerenex. Another Seeking Alpha writer remarks:

Reasons for the Phase III data delay include: 1) Trial complexity - many parameters to be measured per patient, such as TSAT, ferritin levels, hemoglobin, and IV iron and ESA (erythropoietin stimulating agent) requirements for patients in the trial; 2) Year-end issues (hurricane Sandy, vacations, etc.); and most importantly, 3) Query resolution, or the process of making sure all the data are entered and accounted for, prior to releasing results. Nevertheless, we believe that queries by the CRO conducting the study have wrapped up and that the company will release results imminently, perhaps later this week.The above writer might be ultimately proven correct in his assessment, but investors and traders should consider alternative viewpoints as well.

Should Zerenex demonstrate that it can meaningfully help manage anemia in dialysis patients and ultimately in pre-dialysis patients (those with Chronic Kidney Disease), the drug could have multi-hundred million-dollar potential. As we see it, the odds of Zerenex repeating prior clinical results are high, and the upside to KERX could be significant if it does.

One such viewpoint for the Phase III data being late hinges on comments offered by Martin Shkreli in an article he wrote for TheStreet.com covering another company back in December, 2012. Shkreli remarks;

Clinical trials taking longer than expected usually means someone made bad assumptions about the way control-group patients would behave. When a company tells you results from a cancer drug trial are being pushed back, don't think, "Hurray, the drug must be working!" Instead, run away, scared.Last month, Amicus (FOLD) finally released its Phase III top line data for its 6 month study for its clinical drug Amigal, designed to treat Fabry disease. The 6 month trial failed to meet its primary endpoint. After six months, 13 of 32, or 41%, of Amigal-treated patients demonstrated a kidney response compared to 9 of 32, or 28%, of the placebo controlled patients. The results failed to show the required statistical advantage of Amigal over the placebo control arm.

Also in December 2012, Oncothyreon (ONTY) saw Phase III data fail for its drug L-BLP25, being developed for the treatment of unresectable stage III non-small cell lung cancer (NSCLC). L-BLP25 did not meet its primary endpoint to improve overall survival (OS) significantly.

Shkreli's exact comment was offered towards cancer drugs, yet Amicus's Amigal is not designed to treat cancer. However, both of the above companies had one point in common; both data releases were delayed significantly.

(click to enlarge)

The chart shows that the stock rallied hard, breaking its up-channel only to fill the gap and drop back down. The chart looks bearish to me, and may be poised to drop further on the failed breakout.

While data from Zerenex's Phase III trial is overdue, this does not necessarily mean the data will be bad. However, success in the market in large part heavily relies on predicting future events by establishing a clear trend in past events. While Zerenex is not designed to treat cancer, again, neither is Amicus's Amigal. I consider Martin Shkreli to be a smart man, so it's my opinion that the best course of action concerning Keryx is to carefully weigh all factors, pros and cons, before either going long or shorting the stock. I personally take a bearish stance on the data release based on the factors I have mentioned above.

Exact Sciences Corporation (EXAS)

EXAS is running the pivotal trial for Cologuard, a multi-marker molecular diagnostic screening test for the early detection of colorectal cancer.

Full results of the trial are expected in the current quarter. If the results are positive, the company plans to file for Pre Marketing Authorization (PMA) in the same quarter. Results from its 900 patient study demonstrated 98% sensitivity for cancer, which is a high number for detecting the pre-cancers, with 83% sensitivity for high grade dysplasia and 57% for pre-cancer. All sensitivities were reported at a specificity of 90%.

A company with a strong diagnostic test to detect for colorectal cancer has considerable speculation value in my strong opinion -- the earlier cancer is detected, the better the chances are of treating it into remission.

EXAS has been trading strongly to the upside since its 52-week low of $8.82 in November of 2012, and currently trades at $11.42, not far from its 52-week high of 12.30 set in October of 2012.

(click to enlarge)

The chart above looks to me to be setting up for a cup and handle breakout. Although I would like to see this formation take longer to occur, I still like the prospects here for a move to the upside. The stock should find support at $11 before a possible strong breakout above $12.

With the anticipation of very good results from its total data release for its 900 patient study, I would expect EXAS to challenge its 52-week high shortly.

Celsion Corp. (CLSN)

Data from the company's Phase III HEAT study, a pivotal study of its clinical drug ThermoDox is expected by the end of this month. ThermoDox, in combination with radiofrequency ablation (RFA), is designed to treat primary liver cancer.

On Tuesday of last week, Celsion entered into an agreement with Zhejiang Hisun Pharma for the development of ThermoDox in China. Hisun agreed to a $5 million upfront payment to Celsion, with Celsion agreeing to provide Hisun support for its ThermoDox manufacturing development program.

According to Celsion, it believes it could receive "several hundred million U.S. dollars" from Hisun over the next decade.

I remarked in my January 3rd article:

The stock seems to have run into a triple top situation while I did not see a move yesterday to support the likeliness of positive data here. However, this does not mean the data will be bad. It means with all the volatility, that there is no clear indicator either way.On January 16th, the stock was halted from trading after it plunged from $9.40 down to $6.17 on what appeared to be a "bear raid" after being downgraded the same morning from a "buy" to a "sell" rating by Brean Capital.

In my opinion, this is actually a good sign as many bear raids are designed to get short sellers out of a potential bad position, helping them to avoid a margin call situation when a stock price rises too far and fast. In Celsion's case, it is my opinion that this is what transpired, as the stock rebounded the very same day to close at $8.10, up sharply from its intraday low of $6.17.

(click to enlarge)

The stock has been in a strong up-channel and appears to be overextended at these levels despite its pullback. The chart can break either way on data, but I lean towards the upside here. Short sellers possibly wanting out of their Celsion position on an apparent bear raid indicates to me that it's a good chance the company's HEAT study will produce positive results.

No comments:

Post a Comment