By Covettekid : Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

In a recent Seeking Alpha article I spoke of why a diversified portfolio of Mortgage mREITs should still be part of an income or dividend-focused investor's portfolio. The Agency mREIT sector still has some landmines to navigate - or at least potholes - notably any policy changes from Washington DC or any surge in prepayments as barriers to refinancing from HARP or other programs begin to fall. While the major banks are not in a position to handle a surge in refinancings, any blip up is likely to spook investors, even if it is temporary.

While waiting for the tea leaves to become clearer for Agency mREITs, investors should take a look at their close cousins, the Hybrid mREITs. Hybrid mREITs invest in portfolios of both agency and non-agency mortgage-backed securities (MBS). Like the Agency mREITs, there are different 'flavors' of Hybrid mREITs. Some have very low exposure to non-agency debt, others have higher concentrations. Some invest in the most senior tranches, some go for more speculative debt. Some use high levels of leverage on the agency debt and relatively high levels on the non-agency, others prefer lower levels on both (note: despite the word 'hybrid' common to both, Hybrid mREITs are not related to hybrid ARMs).

Aside from a few spikes down/up in 2009, the hybrid mREITs have actually been less volatile around their mean price-to-book than the agency mREITs: (click to enlarge)

The number of Hybrid mREITs has increased in recent years but even with recent dividend cuts, the sector is much more attractive than during the last down cycle in 2004-06 when the Fed jacked up rates 17 times:

A few things to look for if you want to successfully invest in Hybrid mREITs:

- Hybrid mREITs have credit risk: The non-agency debt is credit and economically sensitive, and if housing or the economy turn down you can suffer principal losses (unlike on GSE MBS). If you believe the economy or housing are going to head south, you probably want to look at the Agency mREITs for safety.

- Monitor your Agency-to-Hybrid Exposure: When credit risk is higher and the Fed is steepening the yield curve, you want to go heavier into Agency mREITs. When the economy is stronger and/or the Fed is tightening, you want more Hybrid exposure to mitigate interest rate exposure and benefit from credit improvement. I maintained a 4:1 agency/hybrid ratio for most of 2009-11 but lately it has been 2:1 or less.

- Use A Basket Approach: I recommend buying at least three-four Hybrid mREIT names over time. Diversifying credit risk among Hybrid mREITs is even more important than spreading interest rate risk among Agency mREITs. Invesco Mortgage (IVR) vaporized 25% of book value in a few months during 2011 while other mREITs reported flattish book value. At the time, IVR was considered among the best of the Hybrid mREITs and among the most conservative and it turned out they had mistimed their hedge and swap books.

- Not All Credit Risk is the same: A stock like Chimera Investment (CIM) lost 90% of its value during the Credit Crisis and has never come close to recouping half of its value. Other Hybrid mREITs suffered less-steep losses and were able to generate positive returns for shareholders over time for shareholders who held on. Make sure you know the non-agency exposure as a percent of the total investment portfolio and equity capital, as well as the type of non-agency bonds. Knowing the leverage on non-agency bonds is crucial. Are the bonds senior secured non-agency or 1st-loss tranche non-agency? Big difference!

- Credit Risk Is Not Linear: If a Hybrid mREIT has 10% or 20% of its portfolio in non-agency debt, it means that the percentage of the mREIT's equity that is in non-agency is much larger (depending on the leverage of the agency and non-agency sectors). An mREIT with 80% of the investment portfolio in agency GSE MBS could have 50% of its equity tied up in non-agency, thanks to the different leverage on both types of MBS. So if agency MBS do well but non-agency takes a hit (think 2011, or worse 2008), the Hybrid mREIT could do much worse than a pure Agency mREIT. Credit risk does not increase at a linear rate for either bond or mREIT investors.

With those introductions out of the way, here are five Hybrid mREITs that I believe will do very well in 2013 and beyond, especially if the economy or housing don't double-dip and/or the Federal Reserve doesn't hike rates both sooner and much more than is expected.

MFA Financial (MFA): MFA Financial is one of the longest-tenured mREITs, having done its IPO back in 1998, one year after Annaly Capital Management (NLY) became the first publicly traded Mortgage REIT. Since the IPO, MFA has generated a 13.6% annual return, far outpacing the S&P 500's 1.9% return. The total returns of MFA and NLY since the late-1990s show the power of mREIT dividend compounding, even over several difficult economic and interest rate periods as they have far outperformed the S&P 500.

MFA has a portfolio that is 60% agency, 40% non-agency. However, the bulk of the non-agency debt has been purchased at deep discounts to par and is considered very high-quality debt. Other non-agency paper is made up of higher-up, protected tranches. In addition, MFA has an added kicker in that the reserves it has taken for credit impairments could be reversed if credit losses are not as bad as the original assumptions at the time of purchase. At Q3 2012, MFA had a $1.5 billion credit reserve or just over $4/share. If credit trends continue to improve, MFA has the potential to reverse these impairments and have an added boost for future earnings and book value - and dividends.

On the agency side, MFA has allocated more capital to 15-year fixed agency MBS (29% of MFA's agency book) in order to blend in more prepayment protection. The majority of the agency debt is newer 5/1 ARMs, which are not eligible for HARP. Q3 2012 prepay speeds on MFA's agency book increased to 21.6% from 20.4% in Q2, and the increase in prepayment-protected securities as well as the recent rise in interest rates should moderate prepayments in coming months.

MFA has been cutting the dividend a bit more than other Hybrids, but it just declared a $0.20 quarterly dividend. The yield is 9.8% at the current run rate, which isn't bad in this environment if it is at or close to the trough yield. Net interest margin (NIM) fell to 222 bp in Q3 2012 from 245 bp in Q2, enough to sustain the dividend at current levels if asset yields and leverage remain at current levels. The borrowing side of the balance sheet can also help fight NIM compression, as over $300 million in higher-cost borrowings (at over 4%) just came off the books last quarter. Overall leverage was 3.2x at Q3 2012, down from 3.6x in Q2; MFA took leverage down on the agency GSE debt as the Federal Reserve ramped up QE3.

MFA has a 4 million share buyback on the ready, should the shares trade at an appreciable discount to the most recent reported book value of $8.80/share. At 98% of that book value, even if it has cheapened a bit YTD with the rise in rates, MFA is a good value proposition given its credit reserves and battle-tested management.

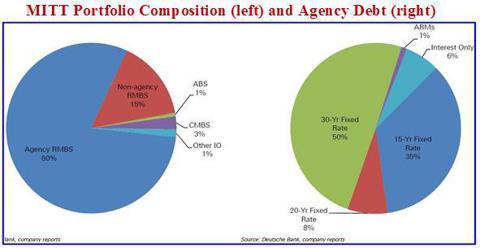

AG Mortgage Investment Trust (MITT): AG Mortgage came public about 18 months ago, so it is a relative newcomer to the Hybrid mREIT scene. MITT increased its non-agency debt share in Q3 2012, as did most of the Hybrid mREITs, to fight NIM compression. As of Q3 2012, 20% of MITT's equity was in non-agency MBS even though it makes up only 10% of overall MBS assets and 8% of the entire portfolio (MITT has some CMBS and ABS). By increasing non-agency debt, MITT was able to increase its net interest margin from 331 bp in Q2 to 348 bp in Q3 while most Agency mREITs were seeing substantial NIM compression and even some hybrid mREITs declined a bit. Leverage fell from 6.8x to 6.1x in Q3 2012 from the previous quarter as the preferred and common equity raises were directed more to lower-leveraged credit-sensitive assets.

At Q3 2012, MITT's portfolio consisted of agency MBS (80%), non-agency MBS (15%), CMBS (3%), Other IO/ABS (2%). The agency MBS portfolio (see below) consisted of 15-year fixed rate (35%), 20-year fixed rate (8%), 30- year fixed rate (50%), ARMs (1%), and IOs (6%). MITT targets agency MBS with lower loan balances as well as new production securities to minimize prepayment exposure. The company reported a CPR of 6.2% during Q3 while the CPR for September was just under 7%. Over half of the agency assets are in prepayment-protected securities and the Q3 2012 portfolio composition (left) and agency breakdowns (right) are shown here:

MITT issued preferred stock a few months ago to augment earnings and dividend leverage without causing share dilution. Undistributed earnings rose to $1.19 per share, thanks to $1.03 Q3 core EPS handily beating the $0.81 consensus. The dividend cushion adds some protection to MITT if earnings soften temporarily due to further tightening investment spreads. With agency MBS prepayments behaving very well in Q3 2012 and the shift to non-agency augmenting NIM, MITT should not be under the same pressures as other mREITs to cut its dividend, especially if rates continue their recent mild upward trajectory (the slowing of prepayments offsets the immediate loss of book value). Management fees fell from 140 bp in Q2 to 90 bp in Q3 as assets ramped up, thanks to share offerings and the preferred deal.

AG Mortgage is run by veteran mortgage traders at Angelo Gordon & Co. who have experience in managing complex interest rate products to help the agency side, along with extensive credit experience to help manage the non-agency side of the balance sheet. MITT yields 13.2% based on the most recent quarterly dividend and with a book value of $23.71 (up almost 9% in the quarter), the shares are at a modest 102% P/B.

Two Harbors Investment Corp (TWO): Trying to differentiate itself a few quarters back, the management of TWO decided to not only manage mortgage-backed securities with credit and housing exposure, but to actually own homes directly. This side-track into direct home ownership was far different than managing liquid - or even illiquid -- MBS of either the agency or non-agency variety. Homes are extremely illiquid and can take months or years to liquidate, as opposed to days or weeks for even difficult-to-sell MBS. Thankfully, Two Harbors contributed the properties and some cash into a new operating REIT called Silver Bay Realty (SBY), of which TWO owns 48% of the publicly-traded shares.

TWO's own MBS portfolio is pretty straight-forward: low-balance, high loan-to-value, and other prepayment-protected securities. TWO has purchased a large number of deeply-discounted non-agency MBS; these securities were the riskier tranches that were sold at fire-sale prices in 2008-09 and saw continued selling thereafter from banks that needed to raise capital and delever. Even with high rates of default and losses, these securities are likely worth more than the original purchase price or the current market price. 82% of the portfolio is fixed-rate assets and the agency/non-agency split is 84/16.

Leverage fell in Q3 to 3.8x from 4.3x in Q2 2012. NIM fell to 310 bp from 360 in the same time period. But book value soared 15% to $11.48 per share. The core dividend was maintained at $0.36 (total payout was larger since TWO elected to pay out undistributed gains from earlier quarters), resulting in an annualized yield of 12.3%. P/B was 98% based on stated end-Q3 data, but likely cheapened up a few percentage points since as yields have risen (prices fallen) for both agency and non-agency debt.

Investors in TWO should keep an eye on Silver Bay's stock price. It's done well out of the gate and could be a long-term winner since the assets were purchased on the cheap, but the underlying assets are an illiquid, highly cyclical asset class with an occupancy rate of under 85% for the most recent quarter. Most property management companies have occupancy rates in the 90s.

TWO increased its previously authorized share repurchase program to 25 million shares from 10 million shares, but as with the other mREITs' figure, this will likely only come into play if shares are at 90% of book value or less.

Javelin Mortgage Investment (JMI): Javelin Mortgage is brought to you by the same folks who manage Armour Residential REIT (ARR). Like Armour, JMI figures to be one of the more aggressive mREITs within the sector. This includes higher leverage on both agency and non-agency debt, though so far the non-agency bonds have been of good quality and modest leverage. Like ARR, Javelin has elected to pay its dividend monthly, which appeals to many retail investors. The initial dividend was $0.23 but figure future monthlies should come down to $0.20; that still gives you a 12% dividend yield at current prices.

While market conditions will determine the specifics, most analysts see 2013 year-end somewhere in the vicinity of 66% agency and 34% non-agency portfolio allocation and about 60-40 capital allocation between agency and non-agency.

JMI intends to maintain high ARR-like leverage on the agency portion, about 9x, while being flexible in going 1-3x on the non-agency portion of debt. Depending on the agency vs. non-agency composition, the blended average leverage ratio should be within a range of 6-8x. As of mid-November (JMI started trading in October), the portfolio was 89% agency, 11% non-agency with leverage in the mid-7s. These numbers will shift in Q1 2013 as JMI is able to ease more into non-agency debt rather than chase these assets, which showed strong price performance in recent quarters: (click to enlarge)

JMI is already the highest-leveraged of the hybrid mREITs and that will probably continue going forward. Given the relative youth of the ARR/JMI management team compared with some of the other veterans in this field, this is another reason not to chase yield or go with only one or two names, but to diversify using my "basket approach." JMI is a small-cap mREIT with a very tiny market cap of only $150 million. With premiums to book value scarce, equity offerings growing the market cap might be sporadic, so liquidity could be lacking for a few quarters. In the meantime, JMI is selling at 98% of Q3 2012 book value.

American Capital Mortgage (MTGE): This hybrid mREIT is managed by the same team managing American Capital Agency (AGNC). It commenced operations in August 2011. As with the ARR-JMI pairing, this allows CIO Gary Kain and his team the ability to keep each of the mREITs narrowly defined as either agency or hybrid, each sticking to its own knitting. CIO Kain noted, despite low rates, the company will be managed conservatively (lower leverage, more hedging) until it has better clarity on the next Fed move, resolution in Europe, and the direction and level of interest rates post-QE3.

MTGE's portfolio was 92% agency, 8% non-agency as of September 30:

Here's American Capital Mortgage's non-agency breakdown (right side) as of September 30:

As you can see, there is a heavy amount of prepayment-protected securities (LLB, HARP) in the agency portfolio (left side). The non-agency bonds are situated in the upper-tranches. Kain & Co. ran AGNC with higher leverage than peers and so far MTGE is in the upper ranks of the hybrid mREITs with Q3 2012 leverage of 6.6x. Book value at Q3 2012 was $25.21, so shares are essentially at book value.

NIM in Q3 was 180 bp, with this figure rising into the end of the quarter as MTGE moved into cheaper, higher-yielding bonds and sold lower-yielding, more expensive paper. The team overseeing MTGE, like that for AGNC, has proven to be made up of deft traders over the last few years and during its time managing debt portfolios at Freddie Mac so that activity can be expected to continue. MTGE is currently yielding 14.4%.

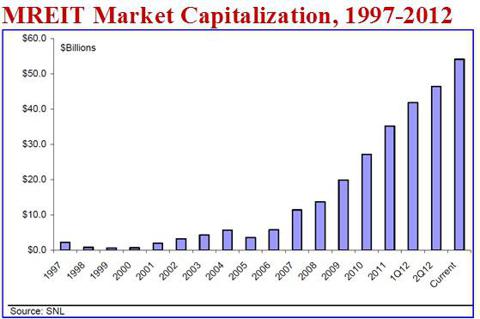

Between the Agency and Hybrid mREITs, investors have a much larger, diversified, and more liquid pool of investments that can navigate different interest rate and credit cycles. The sector has come a long way since the IPOs of NLY and MFA some 15 years ago:

With a much larger pool of investors, heightened investor and analyst coverage, and a growing role in mortgage finance now that Fannie Mae and Freddie Mac are downsizing, both Agency and Hybrid mREITs should have many more years of growth and investment opportunities before them. That translates into bountiful investment opportunities for dividend and income investors, needing only to decide the proper allocation between the two sectors. With the wind at their back right now, this is a good time to increase allocation to Hybrid mREITs in general, and the five names listed above.

No comments:

Post a Comment