Summary

ChromaDex has a product that can has multiple health benefits, including resistance to weight gain, improved control of blood sugar and cholesterol, reduced nerve damage, and longer lifespan.

If trials show positive results in humans, the company can go from a micro-cap stock to an industry leader.

A hearty amount of billionaires are betting on ChromaDex to win.

ChromaDex (NASDAQ:CDXC) is working on some truly "sci-fi" technology, and investors love it. CDXC is a low-volume, micro-cap stock that focuses on health products. I usually advise investors to stay away from these "day trader putty" stocks, as they usually move when big traders want them to, and the underlying companies are worthless. However, ChromaDex is not worthless. In fact, this company could be worth quite a lot in the future, if it plays its cards right.

ChromaDex is a biotech company focusing on proprietary ingredient technologies and intellectual property that address the dietary supplement, skin care and pharmaceutical markets. It has relationships with leading universities and research institutions (such as UIHC and UC Boulder) and is able to discover and acquire early-stage ingredient technologies that are protected by intellectual property. The company owns ingredient technologies such as NIAGEN nicotinamide riboside; pTeroPure pterostilbene and; PURENERGY, a caffeine-pTeroPure co-crystal. Five of its products are for sale to the public.

The Company’s Most Interesting Product - NIAGEN

While ChromaDex does have some interesting products, NIAGEN is what will make it go from a micro-cap unknown company to an industry leader.

NIAGEN, also known as nicotinamide riboside (NR), is a newly discovered form of Vitamin B3. The body converts NR into Nicotinamide Adenine Dinucleotide (NAD+), which is an essential molecule found in every living cell. The human body has the highest NAD+ levels at birth; as the body ages, these levels significantly decrease.

According to a University Of Iowa clinical trial, researchers have shown that NR is safe for humans and increases levels of the cell metabolite, NAD+, that is critical for cellular energy production and protection against stress and DNA damage. There was never a trial on humans done before this research which was done in collaboration between ChromaDex, Queens College and the University of Iowa. Previously, “studies in mice have shown that boosting the levels of this cell metabolite - known as NAD+ - can produce multiple health benefits, including resistance to weight gain, improved control of blood sugar and cholesterol, reduced nerve damage, and longer lifespan. Levels of NAD+ diminish with age, and it has been suggested that loss of this metabolite may play a role in age-related health decline,” started a research report published in the ScienceDaily research news publication.

"Now that we have demonstrated safety in this small clinical trial, we are in a position to find out if the health benefits that we have seen in animals can be reproduced in people," said Dr. Brenner, the lead researcher and a consultant to ChromaDex.

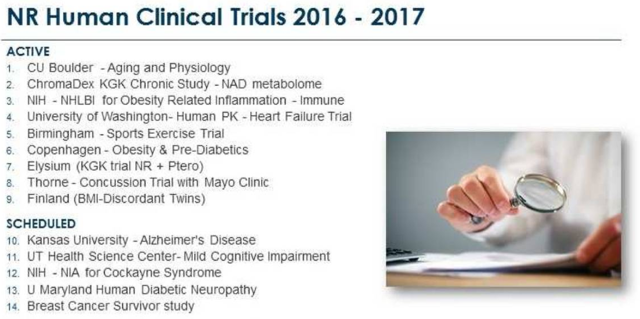

Multiple long-term clinical trials are in progress to see what effects increased NAD+ levels have on humans. If they replicate what has already been proven true with mice, NIAGEN may very well be an anti-aging pill. It could also be used to treat Alzheimer's, high cholesterol and other various ailments. This could be a major turning point in ChromaDex's history, as the company would see a much higher demand for its product, and because it controls the intellectual property relating to NR technologies, CDXC could move from a micro-cap to a small/mid-cap stock in a matter of months.

This potential from an investor's point of view can be seen by looking at CDXC on a graph. Each time there is a pivotal event, investors take note and buy in. On September 7th, ChromaDex partnered with Watsons for the TRU NIAGEN retail launch in Asia - and shares jumped almost 50%.

Each One Of These Could Be A Catalyst

(Source)

Q3 Earnings Report

The Q3 earnings call gave the company a lot more clarity. Financially it was very strong, reporting net sales of $6.1 million, which are up by 55% as compared to net sales of $3.9 million for the third quarter of 2016. Revenues related to NIAGEN were $4.5 million, which represented 73% of third-quarter net sales. Gross profit improved for the third quarter of 2017 at 47.9%, as compared to the third quarter of 2016 at 47.3%.

Operating expenses for the quarter were up by $3.3 million to $6.1 million, as compared to the third quarter of 2016 of $2.8 million, mainly due to the fact that CDXC is investing more in marketing, research & development. “As revenue and available financial resources continue to grow, the company plans to continued increase research and developmental efforts,” stated Kevin Farr, CFO, in the earnings call. This is great, as companies need to spend money to make money, and their spending remains proportional to their revenue.

The earnings call also reveals that the company is looking to file an IND relating to a Cockayne Syndrome cure/treatment using NIAGNEN’s technology. Cockayne Syndrome is a fatal neuro-degenerative disease which impairs the development of the nervous system. It also results in premature ageing, and most affected people usually do not survive past childhood. “We're pretty heavily focused on finalizing what we need to go for the IND. And now that we have finalized the last IND-enabling study, the IND-enabling study was designed around what we expect at least from a study-design standpoint,” stated Rob Fried, president and CSO. The company is on track to file by the end of 2017, and though it is a rare disease, if the drug is effective, it could be a very lucrative business opportunity.

ChromaDex is also focusing on building an international brand to sell NAIGEN directly to the consumer, called TRU NIAGEN. “Our main focus in 2018 is to grow TRU NIAGEN around the world,” stated Mr. Fried. To ensure the success of the brand, the company is reducing the number of NIAGEN brands in the marketplace. In March, it had more than 20 resellers of NIAGEN, which sold the products under their own brand name. “We have terminated the supply agreements to all but seven, and expect it to be less than five by year's end,” stated Mr. Fried in the earnings call.

Billionaire Investors and Influential Management

To further add to the "interestingness" of this company, we can take a look at its investors. Phillip Frost holds a total of 7.04% interest in the company and is the CEO and chairman of Opko Health, Inc., a biotech company with a market cap of $3.07 billion. Michael H. Brauser, a chairman in Cogint, has a 6.1% stake.

Now if we head over to ventures and funds that have invested in CDXC, it becomes even more interesting. Champion River Ventures, Ltd. is the largest investor in the company, controlling 12.0% interest as of November 3rd. CRV is directly controlled by Li Ka-shing, who is its sole shareholder and Hong Kong's richest person. A recent purchase agreement also shows that ICONIQ Capital (along with others) want in as well. ICONIQ Capital is Silicon Valley’s billionaire investors club. “Notable clients include Facebook CEO Mark Zuckerberg, Facebook COO Sheryl Sandberg, Napster founder Sean Parker, and Twitter/ Square CEO Jack Dorsey, among other high net-worth individuals,” states this research article.

For more information on the billionaires betting on ChromaDex, read thisarticle by a fellow Seeking Alpha contributor.

If we look at recent management changes, Kevin Farr was welcomed to the company as the chief financial officer. Mr. Farr joined the company from Mattel, where he spent the last 17 years as executive vice president and CFO. When asked why he moved from the seven billion dollar company to ChromaDex, he responded that:

“I'm a believer in NR and TRU NIAGEN, and I think there's a huge global opportunity. And look, I've been in the business for quite a while, and [I’m] done big large-cap companies. So I was quite excited to join the team with Frank and Rob. And I think the team is more entrepreneurial, and I think it's a great opportunity for us to grow a global brand and create a large company and be very successful.”

Mr. Fried told investors to “expect more management additions to come.”

Risks

Something that worried me occurred in the Q&A section of the Q3 earnings report, where a representative from Ladenburg Thalmann asked the following questions:

“How much more inventory, residual inventory do they have? Approximately how many quarters?... For the Watsons deal, you said they have approximately 6,000 stores. Is your product in all 6,000 of those? Or have you picked specific areas or specific stores for strategic purposes?”

In response to the inventory question, Mr. Fried answered:

“We don't know exactly how much inventory they have. We don't know their exact consumer sales.”

For the question regarding the Watsons stores, he replied:

“They have approximately 100 stores in Hong Kong and we believe it's in all of those 100 stores in Hong Kong... We expect that they will be because they are investing fairly effectively and aggressively in marketing. But we don't know the answer to that.”

This lack of knowledge reminded me that this is not a giant Wall St. powerhouse or an international biotech company. It is a thinly traded micro-cap stock which has the potential to maybe do something big. This is a risky investment. Investors buying in now need to remember this fact, and the fact that while it is a real company that can see some real growth, currently the stock is still in the realm of "day trader putty." It will go up and down, sometimes drastically.

(However, I would like to mention that this earnings call was very professional for a micro-cap company, and CDXC has great shareholder communications.)

Conclusion

Despite the risks, I do own a small position in the company. I will advise, however, to only invest money that you are OK with losing in the short term. It is a risky bet, but I feel it is worth this risk. If NAD+ is proven to have long-term anti-ageing benefits, ChromaDex will go from a micro-cap to an industry leader (and a tasty acquisition target).

Also, you can invest with the peace of mind that some really wealthy investors want this company to succeed.

Disclosure: I am/we are long CDXC.

By Wappinger Capital Research

Source: https://goo.gl/cLYstC

No comments:

Post a Comment