Video-streaming service Netflix continues to expand its reach. CNBC reports that the company

added more than 5 million net subscribersthis past quarter, bringing its subscriber base to about 110 million, globally.

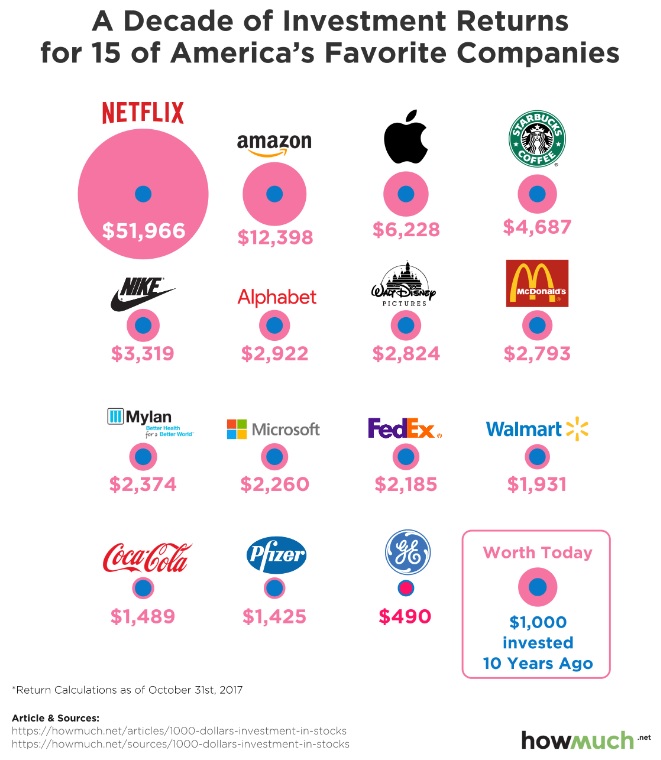

Financial website How Much,

took a look at some popular stocks in 2007 to find out how much a $1,000 investment in each would be worth now. It estimates a $1,000 investment in Netflix in 2007 would be worth $51,966 as of October 31 of this year, or more than 50 times as much.

Netflix's performance surpassed that of both

Amazon and

Apple.

In the graphic below, the blue dots are equivalent to a $1,000 initial investment, and the pink dots equal the investment's current total value.

"The larger the pink circle, the more your investment is worth," according to How Much. "If the pink fits inside the blue, then you lost money. The [graphic] assumes that you took any dividend paid out in cash and did not reinvest into the company by buying more stock."

While Netflix's stock has performed well, though, any individual stock can over- or under-perform

. Even though it's up 64 percent just in the last 12 months, some experts advise caution.

Competitors like Disney plan to

launch their own streaming services, which would likely pull content, and potentially viewers, from Netflix. "I think Netflix is in trouble when the big guys start coming after them," Laura Martin, an analyst at investment-banking and asset-management firm Needham & Company,

said in an interview with CNBC.

Still, many experts, including Jim Cramer, host of CNBC's "

Mad Money,"

aren't so bearish. That's due, in part, to Netflix planning to spend $7 to $8 billion on content next year, including for its own new shows, to take on the competition.

The company signed show-runner extraordinaire Shonda Rhimes to an

exclusive deal and completed an acquisition with comic book company Millarworld.

"Our future largely lies in exclusive original content that drives both excitement around Netflix and enormous viewing satisfaction for our global membership and its wide variety of tastes," the company

said in a letter to shareholders.

If you're just considering getting into the stock market, begin carefully and remember that past returns do not predict future results. That's why experienced investors like Buffett, Mark Cuban and Tony Robbins suggest you

start with index funds.

Index funds hold every stock in an index such as the S&P 500 and offer low turnover rates, attendant fees and tax bills. They also fluctuate with the market and eliminate the risk of picking individual stocks.

Shawn M. Carter

Source: https://goo.gl/f6XF17

No comments:

Post a Comment