Summary

PYPL's focus on strategic partnerships has allowed the firm to reduce competitive risk and drive up revenue growth.

PYPL's emphasis on its mobile segment should allow the company to benefit greatly from the m-commerce trend.

The firm's plans to monetize Venmo are expected to be an important growth driver in the coming years.

Due to its ability to enhance network effect, capitalize on the accelerating m-commerce trend, and develop new revenue streams, I believe PayPal Holdings, Inc. (NASDAQ:PYPL) is a company with great upside potential. The company is well-positioned in the market, considering its business qualities, financial health, historical growth, and potential growth drivers.

Business quality

PYPL’s two most distinctive competitive advantages lie in its sound security system and first-mover advantage. With 15 million transactions per day and more than $200 billion total payment volume (TPV) annually, PYPL has maintained losses within 27-31 bps of TPV, the lowest among the industry. The company utilizes artificial intelligence technology to review patterns of likely frauds from its customer data base, thus spotting potential fraudulent purchases. Since PYPL is one of the largest digital payment companies in the world, the company has a larger customer data base than its competitors that allows it to detect more fraud patterns.

As a pioneer in the global digital payment industry, PYPL enjoys first-mover advantage. While this isn’t necessarily a sustainable competitive edge, it has allowed PYPL to develop competitive edges such as network effect. For instance, as of 2017 Q2, PYPL reached 210 million customer accounts and 17 million retailer accounts. This large size of customer base and merchant coverage has prompted more retailers and individuals to join PYPL, thus creating an economic moat hard for competitors to replicate. Furthermore, operating in more than 200 markets, PYPL has overcome regulation issues in 200+ countries and regions and countless financial institutions over the years. As handling regulatory requests is extremely time-consuming, this also serves as one of PYPL’s strongest competitive edges.

Industry analysis

With more than 85% of global customer transactions involving cash and a $100+ trillion total addressable market according to PYPL, the digital payment industry has enormous growth potential. The fast-growing industry grew 19% in 2016 ($2,221 billion total transaction value in 2016) and is expected to grow 15% annually by total transaction value from 2017 to 2021. The huge market potential within the industry is expected to increase cutthroat competition and thus lower margins, with global firms such as Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Apple (NASDAQ:AAPL), and Square (NYSE:SQ) expected to attract more digital transactions worldwide. Going forward, adoption of mobile commerce and mobile payments is expected to be the main growth driver of the industry as smartphone penetration rate in mature and emerging markets continues to increase. M-commerce accounted for 11.6% of U.S. e-commerce in 2016 and is forecast to reach $284 billion, or 45% of the total U.S. e-commerce market in three years.

Management quality

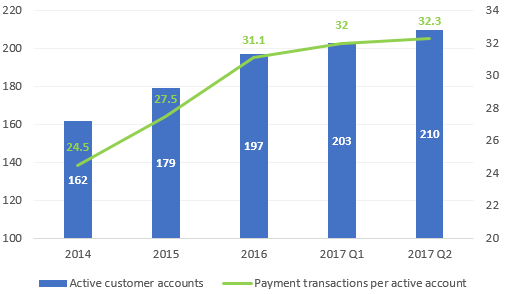

PYPL’s management team focuses on expanding PYPL's ubiquity and value of the PayPal brand through partnerships and new enhancements. The company has announced a number of partnership deals with competitors such as Visa (NYSE:V), Mastercard (NYSE:MA), and Apple in recent years to expand their market reach and provide existing users with more options. As a result, customer adoption, measured by active customer account growth, and user engagement, measured by payment transactions per active account, have both increased (Exhibit 1). PYPL managed to grow 6.6% in active customer accounts and 3.9% in payment transactions per active account in the first half of 2017, compared to 10% and 13% in 2016.

Exhibit 1. Active customer account growth ($mlns): 2014-2017 Q2

Source: PYPL analysts’ day

Furthermore, PYPL focuses on developing new enhancements to increase customer engagement. For instance, One Touch has been driving customer engagement and improving PYPL’s mobile performance by creating frictionless buying experience for buyers. As of 2017 Q2, over 60 million customer accounts and 5.5 million merchants opted in One Touch; payment volume from mobile devices increased 50% year over year, accounting for 34% of TPV ($36 billion). Other enhancements include PayPal Credit, which increases customer engagement and spend, and PayPal Working Capital, which drives merchant engagement and processing value. By extending the company’s market reach and deepening market penetration, PYPL has enhanced its powerful network effect.

PYPL also strives to develop new revenue streams and diversify its business. For instance, the company acquired Xoom in late-2015 to explore cross-sell opportunities and expand its global customer base.

Financial quality

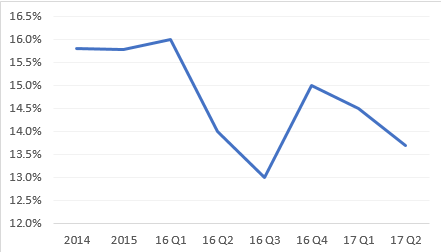

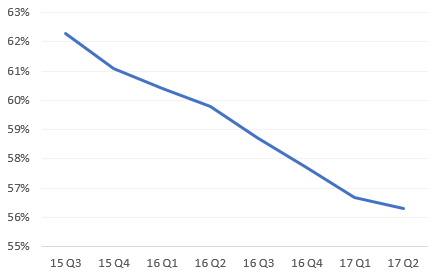

PYPL’s GAAP operating margin has declined in recent quarters (Exhibit 2). In 2017 Q1, the company’s margin was 14.5%, down 150 bps year over year; in 2017 Q2, operating margin was 13.7%, down 30 bps from last year. Margin decline was due to a couple of reasons. For one thing, Xoom, PYPL’s online international money transfer service the company acquired in November 2015, is not yet profitable. Substantial growth in Braintree, PYPL’s subsidiary that focuses on mobile and web payment services for merchants, also contributed to lower margins with its low take rate and high transaction costs. Lastly, PYPL’s focus on strategic partnership to reduce competitive risk contributed to margin compression due to an increase in transaction expenses (Exhibit 3).

Exhibit 2. GAAP Operation margin: 2014-2017 Q2

Source: PYPL annual report

Exhibit 3. Transaction margin: 2015 Q3 to 2017 Q2

Source: PYPL annual report

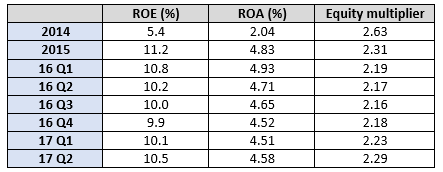

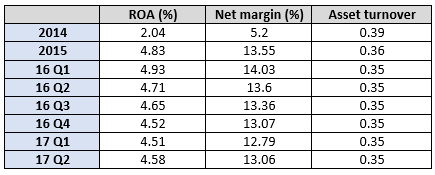

PYPL’s profitability can be further analyzed using DuPont analysis in the following.

Source: FactSet

As can be observed, though PYPL’s ROE has remained in the range of 10-11%, it has been on a downtrend since 2016 mainly due to a decreasing ROA. If we break down ROA into two parts as ROA = Net profit margin * Asset turnover, it appears that this decrease is a result of decreasing margins, as asset turnover has been stable over the quarters.

Source: FactSet

In terms of balance sheet, PYPL reduced all debt in 2015 Q3 and currently has zero debt. The main source of PYPL’s liability are funds payable and amounts due to customers.

Historical Growth

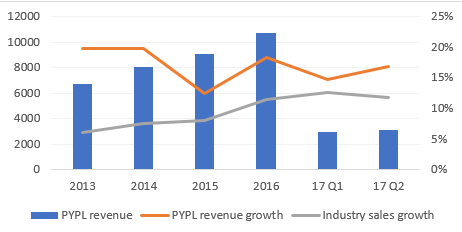

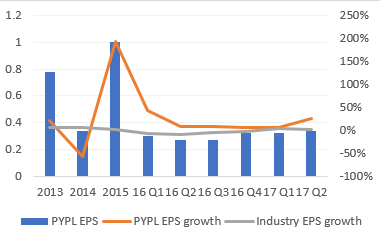

PYPL’s performance in revenue and EPS growth have both exceeded that of the industry in the past four years. The digital payment giant’s revenue maintained a growth rate of approximately 18% from 2013 to 2016 on a currency-neutral basis while growing 14.7% and 16.9% in the first and second quarter of 2017, respectively. The company also enjoyed high single-digit EPS growth in 2016 while generating EPS growth of 6.7% (Q1) and 25.9% (Q2) in 2017. This outperformance was primarily driven by growth in TPV, which grew by 26% in 2016 to $354 billion, 22.5% in 2017 Q1, and 23.5% in 2017 Q2. TPV increased mainly due to PYPL’s continuing expansion and deepening market penetration.

Exhibit 4. Revenue and revenue growth compared to the industry

Source: FactSet

Exhibit 5. EPS and EPS growth compared to the industry

Source: FactSet

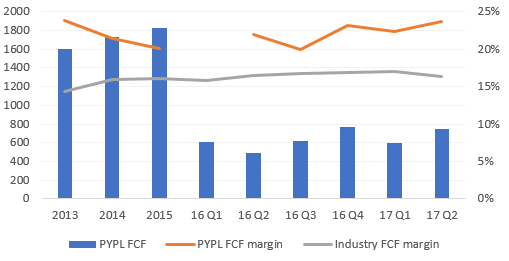

FCF margin has remained within 20-24% in recent quarters, generating approximately 20 cents of FCF for every dollar of revenue earned. The firm generated $2.5 billion in FCF in 2016, a 36%, or $665 million increase from the previous year. The increase in FCF during this period was mostly driven by higher cash generated from operating activities. The firm generated $603 million in FCF in 2017 Q1 and $747 million in Q2. PYPL’s ability to consistently generate strong cash flows has allowed the company to return large amounts of cash to shareholders. The company announced a $5 billion share repurchase plan in 2017 Q1 which will be effective after the completion of the previous $2 billion repurchase plan.

Exhibit 6. FCF and FCF margin compared to the industry

Source: FactSet

Growth drivers

As the world moves towards a cashless society, the digital payment industry enjoys an enormous growth potential that accounts for $100+ trillion total addressable market. PYPL, with its strong network effect and constantly increasing new enhancements, creates stickiness for its users and retailers. Thus, the company is expected to profit greatly from this global trend.

Additionally, PYPL has also been actively developing its mobile payment and mobile commerce segments in response to the upcoming m-commerce explosion. In terms of mobile payment, there is Venmo, the firm’s P2P payment platform, which has surged in popularity by incorporating social media features. The platform has enjoyed substantial growth in recent quarters, processing $6.8 billion in 2017 Q1, a 113% increase from the previous year, and $8 billion in 2017 Q2, a 103% increase year over year. Going forward, as the shift to mobile payments continues, Venmo is expected to maintain its high growth rate.

Though Venmo's take rate is currently low due to its lack of monetization, PYPL has announced its plans to capitalize on the platform. The firm plans to expand Pay with Venmo, the app that allows users to make purchases at retail stores using Venmo, by the end of 2017. PYPL anticipates Pay with Venmo to be available at millions of retailers, which will give a serious boost to the company’s revenue growth.

As for mobile commerce, PYPL focuses on Braintree. Braintree has helped a number of popular apps (e.g. Uber, Airbnb, StubHub) develop their payment gateways as growth in mobile payments spiked in recent years. The business segment currently processes over 1 billion transactions quarterly and has over 269 million Braintree cards on file as of 2016 Q1, a 108% increase from last year. In addition, TPV exceeded $50 billion in 2015, which is more than double than the $23 billion in 2014. The platform is expected to experience substantial growth as the mobile payment trend continues its acceleration, prompting more merchants to seek for payment solutions.

Risks

Though investors may be intrigued by PYPL’s growth prospects, there are also risks that should be taken into consideration, such as competitive risk, foreign exchange risk, and regulatory risk.

Although the global payment industry is still far from saturated, it is rapidly evolving and highly innovative, which may affect the competitive landscape negatively for PYPL. For instance, the shift from e-commerce to m-commerce has opened doors to established technology companies such as Apple, Google, Amazon (NASDAQ:AMZN), etc. In 2016, Apple Pay grew new accounts by 200% compared to PYPL’s 10%, while transactions increased 500% year over year in Q4. The technology giant’s renowned product, iPhone, has an estimated total installed base around 400 million, suggesting a huge potential customer base. As time moves forward, more financial and technology competitors may develop digital payment solutions that have similar functions to PYPL, intruding PYPL’s competency and lowering margins.

PYPL is also subject to foreign exchange risk as it operates in 200+ markets across the globe and has 47% of its revenue exposure in non-U.S. regions. The fluctuation of the U.S. dollar value versus currencies such as the British Pound and Euro impacts the translation of net revenues into the U.S. dollar. Additionally, cross-border trade, which generally provides higher margins than similar transactions that take place within a single market, is also subject to foreign exchange risk. While PYPL strives to hedge portions of its foreign currency translation and balance sheet exposure, it is impossible to eliminate these effects completely.

Lastly, PYPL’s business is subject to regulations and policies and legal interpretations in the markets in which the company operates. As the payment industry grows, this may result in increased regulatory oversight and tighter enforcement of regulations that apply to PYPL. Also, as PYPL expands and localizes their international activities, the firm will be obligated to comply with the laws of more nations and markets.

Momentum

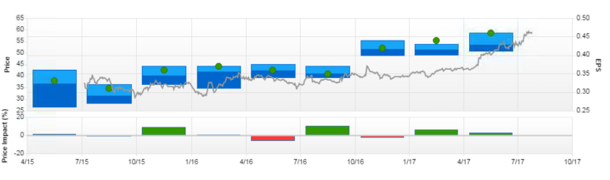

PYPL has an impressive earnings beat track record, exceeding analysts’ estimation every quarter since its separation from eBay (NASDAQ:EBAY) in 2015. That said, the company had two dips during last year while beating estimates. The first dip took place in 2016 Q2, when PYPL announced partnership news with Visa, raising investors’ concerns of lower transaction margins. Stock price dipped again later in 2016 Q4, this time because though PYPL’s performance was in line with average estimations, it was on the lower side of analyst expectations.

PYPL performed especially well in the first half of 2017, beating sales and earnings targets in both quarters while also announcing news of partnership deals with companies such as Apple, Samsung (OTC:SSNLF), Citi (NYSE:C), and Chase. This outperformance has prompted analysts to revise earnings estimation for future quarters upward and also drove up PYPL’s stock price. EPS target for 2017 Q3 increased from $0.41 to $0.43, while the target for 2017 Q4 was revised to $0.51 from $0.49. Stock price has appreciated 52% year to date.

Exhibit 7. Earnings surprise track record

Source: FactSet

Valuation

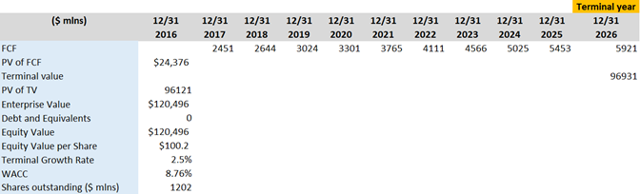

The 10-year DCF valuation indicates that PYPL’s intrinsic value is $100.2, suggesting a 61% upside potential. Revenue growth is projected to be in the range of 16-17.5% in the next three years and then start to decrease gradually. Such projection is based on the growth potential of Braintree and Venmo’s monetization, which is anticipated to have a larger impact in 2018 and 2019. In addition, as the mobile payment trend expands, PYPL’s popular enhancement One Touch is also expected boost the company’s TPV greatly as consumers and merchants seek for payment solutions that solve friction problems.

PYPL’s operation margin is forecast to decline over the years, from 14.6% in 2016 to 12.5%, on the basis of the company’s focus on strategic partnerships. Tax rate is projected by averaging the value of the past two years. For the WACC calculation, key inputs are as the following: a tax rate of 16%, PYPL’s beta 1.18, risk-free rate 2.13%, cost of equity 8.76%, and cost of debt 0% since PYPL has no debt.

Exhibit 8. DCF valuation

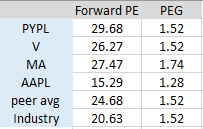

Exhibit 9 shows PYPL’s relative value compared to its major competitors and the industry. Relative to its peers and the industry, PYPL trades at a premium based on forward PE and is considered fairly valued based on forward PEG. The company's PE ratio translates into a projected earnings growth (22.7%) higher than its peers (Visa: 20.4%, Mastercard: 16.7%, and Apple: 8.4%). The company’s forward PEG translates into an expected growth rate of 19.5% for the next 12 months, which is slightly above PYPL’s own estimation (17-19% in 2017) but reasonable when considering the expected impact of Venmo’s monetization in the next two years.

Exhibit 9. Valuation multiples compared to peers and industry

Source: FactSet

Investment summary

Upon reviewing PYPL’s competitive edges, financial health, historical performance relative to the industry, growth drivers ahead, and impressive earnings surprise track record, the DCF model sets PYPL’s target price at $100, providing a 61% upside.

Disclosure: I am/we are long PYPL.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

By I - Schiuan Lin

Source : https://goo.gl/t6Lb9n

No comments:

Post a Comment