Summary

This article examines the long-run performance of a strategy focused on low-volatility, high-dividend, small-cap stocks.

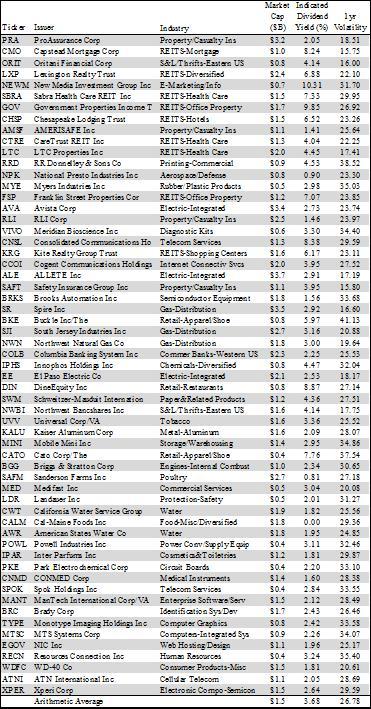

I have proven in past articles that this strategy in large caps has generated absolute and risk-adjusted outperformance versus the broader market.

The current vehicle replicating this index is currently too small and illiquid for me to invest.

The article lists the current 60 constituents of the index for readers to analyze potentially building their own portfolio.

Finally, the article discusses other lower-volatility and dividend growth small-cap strategies.

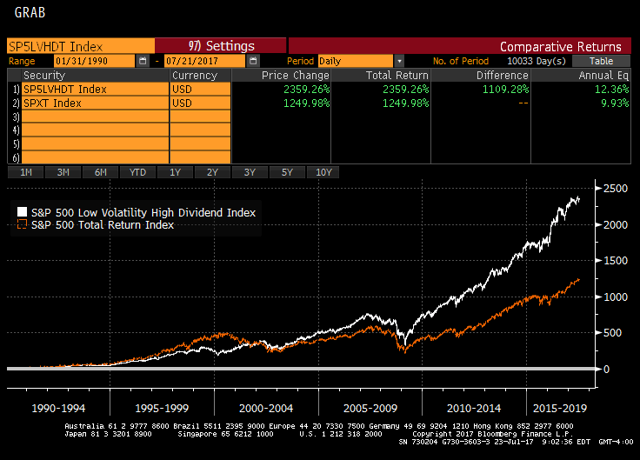

One of my favorite smart beta strategies selects from among the 75 highest dividend-paying S&P 500 (NYSEARCA:SPY) constituents, building a portfolio out of the 50 with the lowest realized volatility over the past year. As I showed in "A High Dividend Strategy That Works", this S&P 500 Low Volatility High Dividend Index, which is replicated by the PowerShares S&P 500 High Dividend Low Volatility Portfolio ETF (NYSEARCA:SPHD), has strongly outperformed the broader S&P 500 (SPY) over a sample period dating back to 1990.

Buoyed by the success of SPHD, which returned over 22% in 2016 including reinvested dividends, PowerShares has launched a small-cap cousin of that large-cap index. That index selects from among the 90 highest dividend-paying S&P 600 (NYSEARCA:IJR) constituents, building a portfolio out of the 60 with the lowest realized volatility over the past year. The index is weighted by dividend yield and includes sector caps.

The replicating fund, the PowerShares S&P SmallCap High Dividend Low Volatility Portfolio (BATS:XSHD) is a nascent fund launched in December 2016. It has only gathered $7 million of assets but continues to be a fund referenced to me by many readers on Seeking Alpha. This article will seek to examine whether this high-dividend, low-volatility segment of the small-cap universe generates alpha.

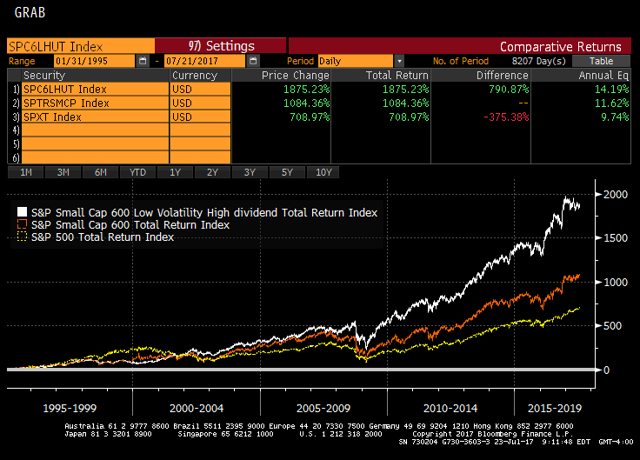

The chart below graphs the S&P 600 High Dividend Low Volatility Index versus the S&P 600 and the S&P 500.

In backcasted index data back to early 1995, the S&P 600 High Dividend Low Volatility Index appears to show promise versus the broader S&P 600 and its large-cap cousin, the benchmark S&P 500.

How does this small-cap strategy generate this outperformance? As I showed in "Smart Beta Over Generations: Size," small caps have historically outperformed - with a notable exception. High-volatility small caps have historically generated negative returns. Volatility can be a way to screen for the potential for financial distress, and using volatility as a screen has kept this index away from stocks that pay high dividend yields simply because the market is questioning the future of the firm through a low share price relative to its dividend.

Despite this tremendous long-run performance, at this point, I do not believe the XSHD is investable. Given the very low assets under management, tracking error is elevated. Year to date, the fund has underperformed its index by 53 bp - a figure that is outsized relative to the 30 bp expense ratio. While the creation/redemption process in exchange-traded funds can offer investors another path towards liquidity, the creation unit size of 50,000 shares ($1.2 million) is likely too large for retail investors and about 15% of total AUM. Investors wishing to enter and exit the fund are likely to be met with wide bid/ask spreads given the low trading volumes.

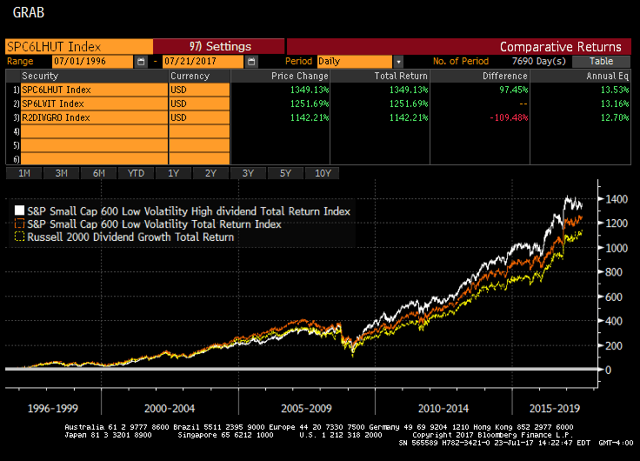

In previous articles, I have examined two strategies that share some similarities with the underlying index for XSHD. The S&P SmallCap 600 Low Volatility Index (NYSEARCA:XSLV) focuses on the 120 lowest-volatility constituents of the S&P 600. The Russell 2000 Dividend Growers(NYSEARCA:SMDV) focuses on companies in the Russell 2000 (NYSEARCA:IWM) that have increased their dividends for at least 10 straight years.

All three index strategies have delivered strong returns. For perspective, the S&P 500 generated only 8.37% annualized returns over that time span. I believe the S&P 600 Low Volatility High Dividend strategy has merit, but do not think there is an appropriate replicating vehicle at this point. For Seeking Alpha readers interested in further examining the underlying constituents of the strategy, I have tabled the current holdings of XSHD below. As one can see, the fund is currently heavily tilted towards REITs and Financials and materially underweight Energy.

I will continue to monitor XSHD as the fund matures. As it scales and becomes more liquid, it my be an interesting portfolio complement.

Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance and investment horizon.

Disclosure: I am/we are long IJR, SMDV, XSLV, SPY, SPHD.

By Ploutus

Source: https://goo.gl/HN1dbm

No comments:

Post a Comment