Summary

Now could be a great time for a takeover of Chesapeake Energy.

Friendly government policies and rising oil will spur M&A activity in the next 12 months.

Chesapeake's large natural gas and oil production in the US makes a great fit for Total SA.

Last week's earnings announcement by Total SA (NYSE:TOT) served notice to the markets that the company will be on the offensive going forward.

The company beat earnings on the top and bottom lines by a wide margin, earning $.96 a share on Revenues of $42.3B, beating street estimates by 8%. It also increased its dividend to 0.62 euros.

As I study the energy space, it appears to me that the best bang for the buck for Total SA may be buying Chesapeake Energy (NYSE:CHK) at a discount.

I recently wrote an article about BP plc (NYSE:BP) (which I believe is making a yearly low today) buying Chesapeake, but after more research, it seems Total SA would be even better served by buying this undervalued company.

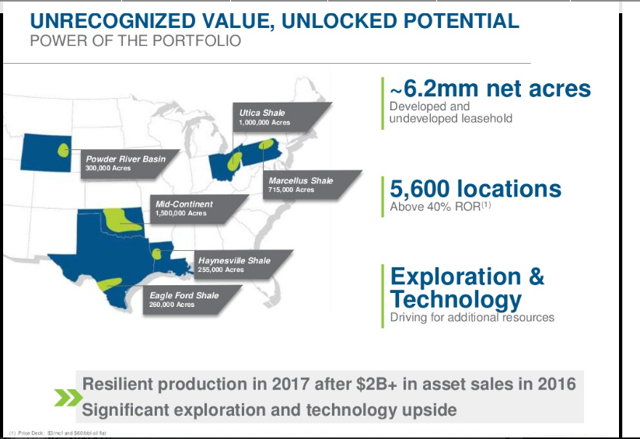

One of the knocks against Total SA is its lack of US shale presence. In my view, buying up Chesapeake would instantly give Total SA the world class US shale acreage that would otherwise take years to accumulate.

Chesapeake CEO Mr. Doug Lawler recently gave a presentation at the Credit Suisse Energy Summit where he shared some valuable information about the company and its future. I encourage interested investors to click on the link above for detailed information.

Chesapeake Energy, in my view, is a prime takeout target; the question is who will be the buyer? I believe that Total SA is taking a serious look at Chesapeake right now.

If I was the CEO, I would be salivating at the 5,600 locations and vast possibilities of increasing production and reserves by snapping up this undervalued business model.

Chesapeake Energy just announced that the company will add seven more drill rigs in 2017 and plans to increase production by 2%.

Total SA wants more access to US shale production and here you have it. The number one independent producer of natural gas in the United States. They could keep CEO Doug Lawler in place, who in my view has done a terrific job of managing the debt structure of the company.

Divestitures

Total SA could buy Chesapeake with stock and cash, retire $3B in debt and sell $3B to $5B in assets, and completely change the cash flow picture while adding 11B of proven BOE reserves.

Chesapeake has pulled back nicely in price right before driving season kicks into gear. While oil inventories are currently rising, I believe summer demand will be strong and the oil market, along with oil stocks, are very near to the yearly low.

Look at the chart of Chesapeake testing its 200DMA.

Carter Worth, a master technician who I respect, says that the 186DMA is a very important factor in the life of a stock. When it turns positive, that is confirmation that the bottom is in. One can see from the chart above that the event occurred last August.

I believe that $5.55 is the absolute bottom for this stock going forward. Any move to that direction, if it comes, will be met with strong buying pressure.

I own the stock here and am saving some powder, but would not be surprised to see it gap up, sending the shorts running for cover any day.

Conclusion

I believe the oil patch is about to see a consolidation period full of mergers and acquisitions in the next 12 to 24 months, as oil continues to rebound on strong demand; those entities strong enough to snap up good assets will be well served going forward.

Total SA is in a strong position with good earnings and strong cash flow. It could increase its US presence in a big way by taking over Chesapeake Energy and keeping management in place.

I am an owner of Chesapeake Energy and will continue to increase my position, understanding that there could be a quick test at the $5.55 level where I bought it at right after the election.

As always, do your own research and know your exit point before making any trade.

Disclosure: I am/we are long LYG,HIMX,BP,ADPT, CHK, SSYS.

No comments:

Post a Comment