Schlumberger Limited (SLB) retreated with the stock falling -0.51% or $-0.43 to close at $84.2 on light trading volume of 3.51M compared its three months average trading volume of 5.56M. The Houston Texas 77056 based company operating under the Oil & Gas Equipment & Services industry has been trending up for the last 52 weeks, with the shares price now 24.09% up for the period and up by 23.89% so far this year. With price target of $94.45 and a 44.99% rebound from 52-week low, Schlumberger Limited has plenty of upside potential, making it a hold with a view buy.

Schlumberger Limited supplies technology, integrated project management, and information solutions to the oil and gas exploration and production industry worldwide. Its Reservoir Characterization Group segment provides reservoir imaging, monitoring, and development services; wireline technologies for open and cased-hole services; exploration and production pressure and flow-rate measurement services comprising surface and downhole services; software integrated solutions, such as software, consulting, information management, and IT infrastructure services; consulting services for reservoir characterization, field development planning, and production enhancement; and petrotechnical data services and training solutions, as well as integrated management services. Its Drilling Group segment designs, manufactures, and markets roller cone and fixed cutter drill bits; supplies drilling fluid systems; provides pressure drilling and underbalanced drilling solutions, and environmental services and products; mud logging services; land drilling rigs and related support services; and well planning and drilling, engineering, supervision, logistics, procurement, contracting, and drilling rig management services, as well as bottom-hole-assembly, borehole-enlargement technologies, impact tools, tubulars, and tubular services. Its Production Group segment provides well services comprising pressure pumping, well cementing, stimulation, and intervention services; well completion services and equipment that include packers, safety valves, and sand control technology, as well as completions technology and equipment; artificial lifts; coiled tubing equipment and services, and slickline services; development, management, and environmental protection services for water resources; and integrated production and production management services. The company was formerly known as Socie´te´ de Prospection E´lectrique. Schlumberger Limited was founded in 1926 and is based in Houston, Texas.

Schlumberger Limited supplies technology, integrated project management, and information solutions to the oil and gas exploration and production industry worldwide. Its Reservoir Characterization Group segment provides reservoir imaging, monitoring, and development services; wireline technologies for open and cased-hole services; exploration and production pressure and flow-rate measurement services comprising surface and downhole services; software integrated solutions, such as software, consulting, information management, and IT infrastructure services; consulting services for reservoir characterization, field development planning, and production enhancement; and petrotechnical data services and training solutions, as well as integrated management services. Its Drilling Group segment designs, manufactures, and markets roller cone and fixed cutter drill bits; supplies drilling fluid systems; provides pressure drilling and underbalanced drilling solutions, and environmental services and products; mud logging services; land drilling rigs and related support services; and well planning and drilling, engineering, supervision, logistics, procurement, contracting, and drilling rig management services, as well as bottom-hole-assembly, borehole-enlargement technologies, impact tools, tubulars, and tubular services. Its Production Group segment provides well services comprising pressure pumping, well cementing, stimulation, and intervention services; well completion services and equipment that include packers, safety valves, and sand control technology, as well as completions technology and equipment; artificial lifts; coiled tubing equipment and services, and slickline services; development, management, and environmental protection services for water resources; and integrated production and production management services. The company was formerly known as Socie´te´ de Prospection E´lectrique. Schlumberger Limited was founded in 1926 and is based in Houston, Texas.

Galena Biopharma, Inc. (GALE) had a active trading with around 3.48M shares changing hands compared to its three month average trading volume of 2.2M. The stock traded between $2.03 and $2.35 before closing at the price of $2.05 with -13.87% change on the day. The San Ramon California 94583 based company is currently trading 11.41% above its 52 week low of $1.84 and -95.88% below its 52 week high of $49.8. Both the RSI indicator and target price of and $7.67 respectively, lead us to believe that it could rise over the coming weeks.

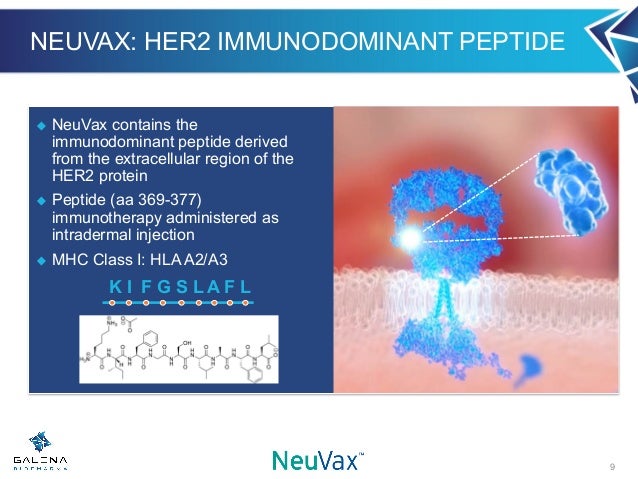

Galena Biopharma, Inc., a biopharmaceutical company, focuses on developing and commercializing oncology therapeutics that address major unmet medical needs. The company’s lead product candidate, NeuVax (nelipepimut-S), is in Phase III clinical trials for the prevention of recurrence in early- stage and node-positive breast cancer with low to intermediate human epidermal growth factor receptor (HER2) expression; Phase IIb clinical trials in combination with Herceptin for HER2 1+/2+ node-positive and high-risk node-negative breast cancer treatment; and Phase II clinical trials in combination with trastuzumab for node positive and negative HER2 IHC 3+ patients. It also develops GALE-301 (folate binding protein), which is in Phase IIa clinical trials for the prevention of recurrence in patients with ovarian and endometrial cancers; GALE-302, a version of the E39 peptide that is in Phase 1b clinical trial for investigating a novel vaccination series; and GALE-401 (anagrelide controlled release), which is in a Phase II clinical trial for the treatment of patients with myeloproliferative neoplasms to lower elevated platelet levels. Galena Biopharma, Inc. has strategic development and commercialization partnership with Dr. Reddy’s Laboratories Ltd. for NeuVax in breast and gastric cancers. The company was formerly known as RXi Pharmaceuticals Corporation and changed its name to Galena Biopharma, Inc. in September 2011. Galena Biopharma, Inc. was founded in 2003 and is based in San Ramon, California.

Galena Biopharma, Inc., a biopharmaceutical company, focuses on developing and commercializing oncology therapeutics that address major unmet medical needs. The company’s lead product candidate, NeuVax (nelipepimut-S), is in Phase III clinical trials for the prevention of recurrence in early- stage and node-positive breast cancer with low to intermediate human epidermal growth factor receptor (HER2) expression; Phase IIb clinical trials in combination with Herceptin for HER2 1+/2+ node-positive and high-risk node-negative breast cancer treatment; and Phase II clinical trials in combination with trastuzumab for node positive and negative HER2 IHC 3+ patients. It also develops GALE-301 (folate binding protein), which is in Phase IIa clinical trials for the prevention of recurrence in patients with ovarian and endometrial cancers; GALE-302, a version of the E39 peptide that is in Phase 1b clinical trial for investigating a novel vaccination series; and GALE-401 (anagrelide controlled release), which is in a Phase II clinical trial for the treatment of patients with myeloproliferative neoplasms to lower elevated platelet levels. Galena Biopharma, Inc. has strategic development and commercialization partnership with Dr. Reddy’s Laboratories Ltd. for NeuVax in breast and gastric cancers. The company was formerly known as RXi Pharmaceuticals Corporation and changed its name to Galena Biopharma, Inc. in September 2011. Galena Biopharma, Inc. was founded in 2003 and is based in San Ramon, California.

Tenet Healthcare Corp. (THC) saw its value increase by 1.97% as the stock gained $0.29 to finish the day at a closing price of $15. The stock was higher in trading and has fluctuated between $14.06-$34.08 per share for the past year. The shares, which traded within a range of $14.57 to $15.23 during the day, are down by -31.82% in the past three months and down by -45.73% over the past six months. It is currently trading -0.13% below its 20 day moving average and -12.91% below its 50 day moving average. Analysts believe the company can continue to increase in value to reach at $26.94 a share over the next twelve months. The current relative strength index (RSI) reading is 42.98.The technical indicator lead us to believe there will be no major movement any time soon, hold.

Tenet Healthcare Corp., together with its subsidiaries, primarily operates acute care hospitals and related healthcare facilities. The company operates through three segments: Hospital Operations and Other, Ambulatory Care, and Conifer. Its general hospitals offer acute care services, operating and recovery rooms, radiology services, respiratory therapy services, clinical laboratories, and pharmacies. The company also provides intensive, critical, and coronary care units; physical therapy, orthopedic, oncology, and outpatient services; tertiary care services, including open-heart surgery, neonatal intensive care, and neurosciences; quaternary care services for heart, liver, kidney, and bone marrow transplants; quaternary pediatric and burn services; gamma-knife brain surgery; and cyberknife radiation therapy for tumors and lesions in the brain, lung, neck, and spine. In addition, it offers clinical research programs related to cardiovascular and pulmonary diseases, musculoskeletal disorders, neurological disorders, genitourinary diseases, and various cancers, as well as drug and medical device studies. Further, the company operates freestanding ambulatory surgery and imaging centers, short-stay surgical facilities, and Aspen’s hospitals and clinics. Additionally, it offers operational management for patient access, accounts receivable management, health information management, revenue integrity, and patient financial services; communications and engagement solutions; and clinical integration, financial risk management, and population health management services. As of December 31, 2015, the company operated 86 hospitals, 20 short-stay surgical hospitals, and approximately 475 outpatient centers; and 9 private hospitals and clinics, as well as 249 ambulatory surgery, 20 imaging, and 35 urgent care centers in the United Kingdom. Tenet Healthcare Corp. was founded in 1967 and is headquartered in Dallas, Texas.

No comments:

Post a Comment