Summary

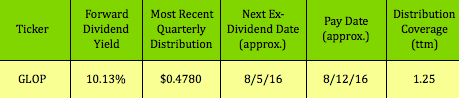

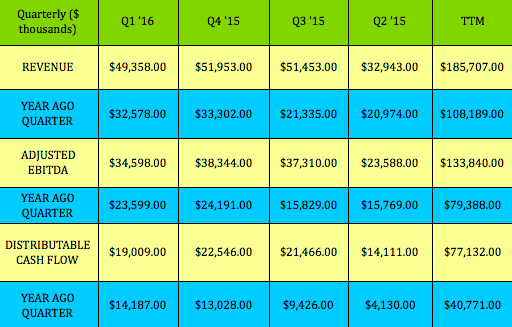

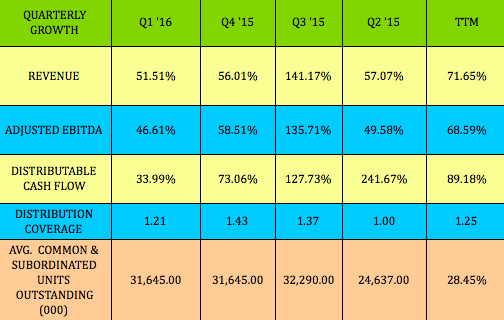

This stock yields over 10%, with 1.25x dividend coverage over the past four quarters.

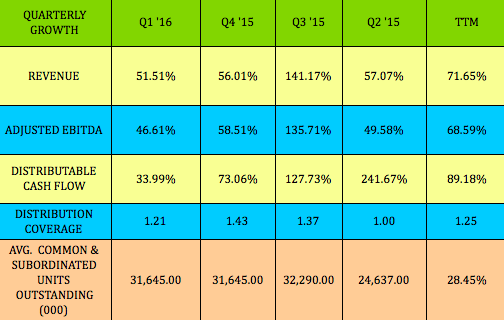

Cash flow grew 89% over the past four quarters and 34% in Q1 2016.

Revenue grew 72% over the past four quarters and 51% in Q1 2016.

Looming industry shortages are increasing demand for its services.

Looking for high-dividend stocks with strong growth metrics? Our recent articles have covered quite a few high-yielders in the energy-related shipping industry, which have been experiencing strong revenue and distributable cash flow growth.

Profile: GasLog Partners LP (NYSE:GLOP) acquires, owns and operates liquefied natural gas (LNG) carriers. As of 2/16/16, it had a fleet of eight LNG carriers, which operate under long-term charters with subsidiaries of BG Group. BG is owned by Royal Dutch Shell (NYSE:RDS.A) (NYSE:RDS.B). GLOP also has options and other rights under which it may acquire additional LNG carriers from its general partner GasLog Ltd. (NYSE:GLOG). The company was founded and IPOed in 2014 and is based in Monaco.

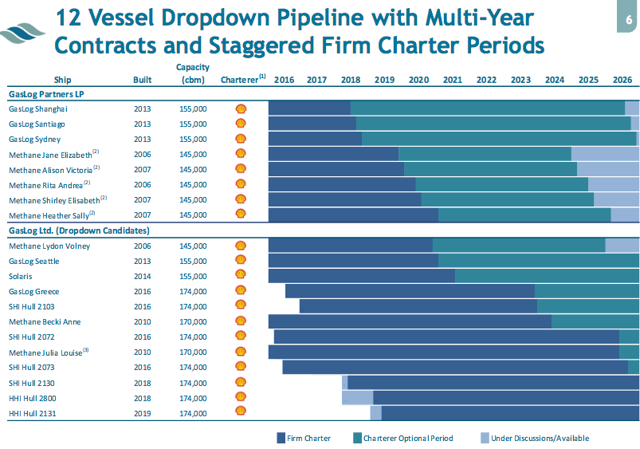

The future looks bright for GLOP - it has a dropdown pipeline of 12 vessels from general partner GLOG, all of which are on long-term contracts.

GLOG is a very supportive general partner. It may even exchange longer-term charters with GLOP in order to maintain and grow the distribution support. This is an interesting concept that we haven't run across before.

On the recent Q1 2016 earnings call, GLOP management stated:

"Our objective will always be to maximize visibility of GasLog Partners' cash flow and the stability of our cash distribution. Accordingly, in the future support from GP could take the form of exchanging certain GasLog Partners vessels for GasLog Limited vessels with charter ending in 2020 or later or charters of our vessels back to GasLog Limited or other means is yet to be determined."

(Source: GLOP website)

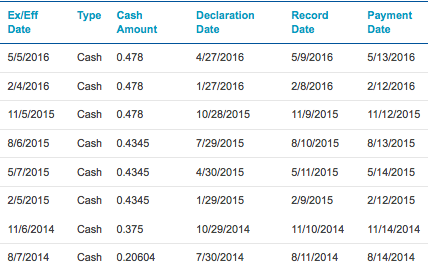

Distributions: GLOP's initial distribution was a pro-rated amount of $.20604 back in August 2014, and it has held it steady at $.478 for the past three quarters while many other energy-related stocks were slashing their payouts.

(Source: NASDAQ)

Its trailing 12-month coverage is 1.25x.

Our High Dividend Stocks By Sector Tables track GLOP's price and current dividend yield (in the energy section).

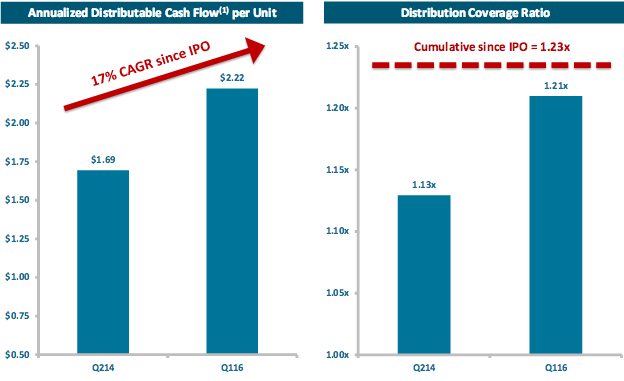

GLOP has had strong DCF growth and distribution coverage growth since its 2014 IPO.

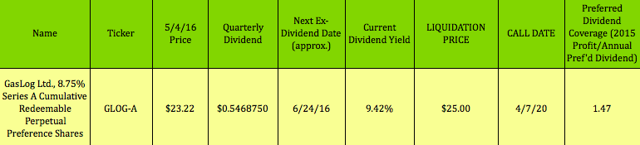

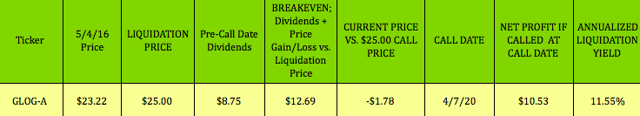

Preferred Distribution: GLOP's general partner, GLOG, has a preferred stock, which is trading below its call value of $25.00 and also yields 9.42%. The coverage for this payout is quite strong, at 1.47x.

Liquidation Yield: Although this is a perpetual stock, GLOG has the right to redeem it beginning on 4/7/20 at $25. This table illustrates your yield and gains if you were to buy it now and GLOG buys it back on 4/7/20. This combo of $8.75 in future distributions and $1.78 in price gains would give you an annualized yield of 11.55%.

Options: There are no call or put options available for GLOP, but you can see the details for over 30 other income-producing trades in both our Covered Calls Table and our Cash Secured Puts Table.

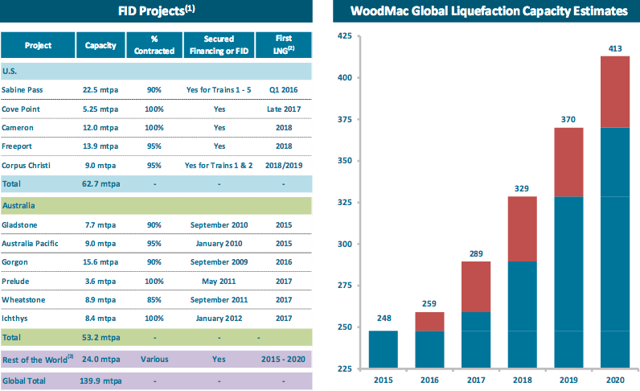

Industry Tailwinds: There will be major LNG production coming on in the world over the next few years. In the US, the Sabine Pass facility has already shipped its first LNG cargoes. GLOG owns the vessel which took the third shipment - it went to Brazil.

With all of this LNG production coming on, you would think that shipowners would be furiously ramping up their fleets...but they're not. In fact, there's a looming shortage of vessels in the LNG shipping industry as the vessel order book has declined.

These factors will only serve to strengthen the demand for GLOP's and GLOG's LNG vessels.

(Source: GLOP website)

Earnings: GLOP has put up some very strong growth numbers over the past four quarters as it has grown its fleet.

But all is not perfect in GLOP-vill. Its revenue, EBITDA and DCF declined in Q1 2016 vs. Q4 2015.

What happened? A scheduled drydock, which occurs every five years per vessel, knocked around $3.5 million off of distributable cash flow vs. Q4 2015.

So, how badly did it affect coverage? It slipped to 1.21x, which is still a strong ratio. Looking at the year-over-year numbers and the trailing 12-month numbers, there are some heady percent gains in all categories, thanks to the addition of two dropdown vessels in Q3 2015.

Looking ahead to Q2 2016 earnings, management stated on the earnings call that another vessel, "the Methane Rita Andrea, entered a scheduled dry dock early in the second quarter and this is now completed. This will lower GasLog partners' second quarter distributable cash flow by approximately $3 million. We don't have any more scheduled drydocks until 2018, which provides investors with clear cash flow visibility."

So, if we deduct $3M from the Q4 2015 DCF of $22.546M and GLOP maintains its $.478/unit payout, coverage will probably improve to around 1.24x in Q2 2016. After Q2, it should improve markedly as GLOP's DCF gets back to $22.5M level.

No Dilution In Sight: GLOP did a secondary offering in 2015 to pay for the two new vessels. Concerning 2016 however, CEO Orekar stated on the Q1 earnings call that "despite the recovery in our unit price we do not feel that the current unit price reflect the appropriate value for GasLog Partners to be issuing units today." That's good news for the immediate future.

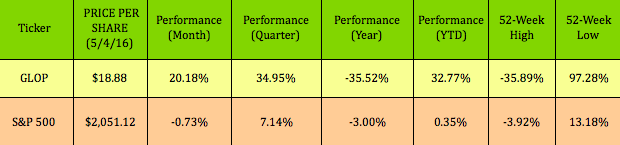

Analysts' Price Targets: Like many other energy-related stocks, GLOP has come roaring back in 2016 - it's up over 35% year-to-date, but, as is also typical, it got so beaten down in 2015. That it's still down over -35% for the past year.

GLOP is now 13.51% below analysts' mean price target of $21.43.

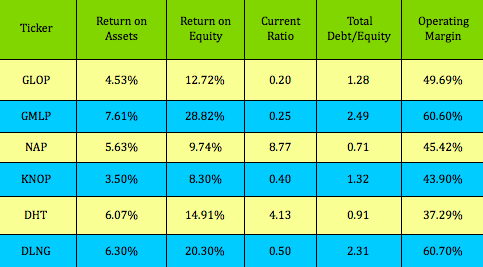

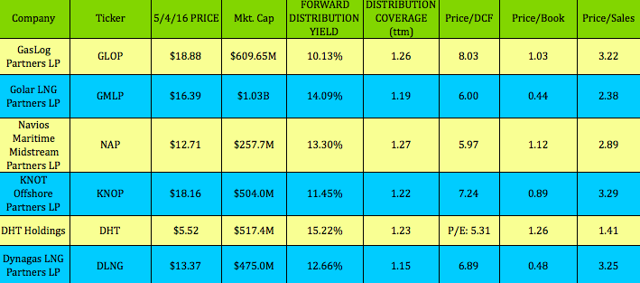

Valuations: We've added GLOP to this valuation table to compare it to these other shipping stocks that we've covered in recent articles: Navios Maritime Midstream Partners LP (NYSE:NAP), KNOT Offshore Partners LP (NYSE:KNOP), DHT Holdings (NYSE:DHT), Dynagas LNG Partners LP (NYSE:DLNG) and Golar LNG Partners LP (NASDAQ:GMLP).

GLOP has the strongest distribution coverage of this group, but nearly the highest price/DCF valuation, as the market has rewarded its strong coverage and business model in 2016 (All of these companies operate on long-term charters, with the exception of DHT, which has a mix of long-term and spot-rate business).

GLOP is trading at right around its book value, not the highest or the lowest in the group, and certainly not a premium valuation.

Financials: GLOP's ROA is the second lowest, but that should improve over the next quarter, as it earns more money from the two vessels it added in Q3 2015. Its current ratio isn't so swell either, but...

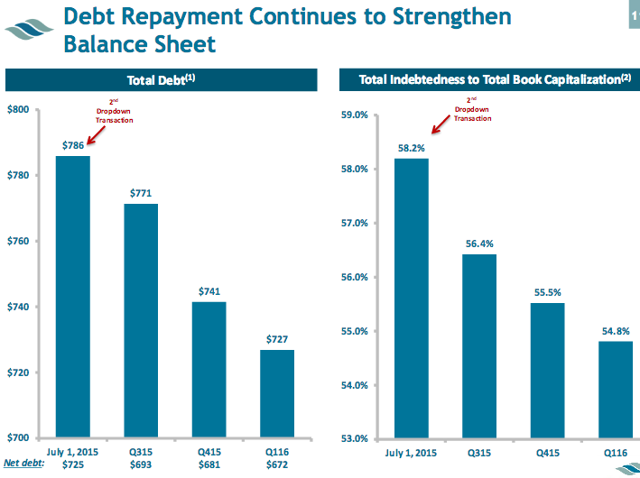

Paying Down Debt: Management keeps hacking away at the company's debt load, steadily strengthening GLOP's balance sheet each quarter. In Q1 2016,it utilized excess cash flow again to further reduce the total debt balances by $14.6M, including 10 million of an inter-company loan with GasLog Limited, which can be redrawn at any time. As it said on the earnings call, "this debt pay down is accretive to our distributable cash flow on a per unit basis."

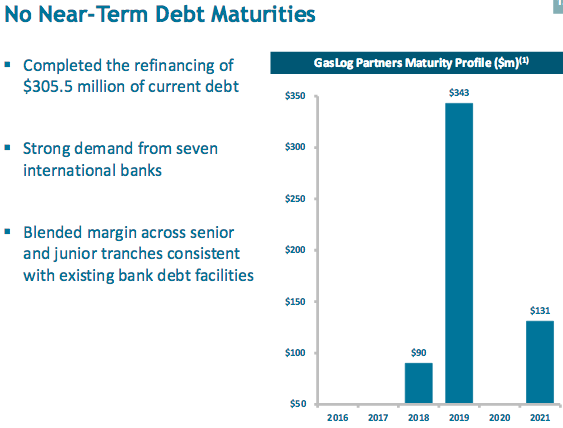

With the refinancing of its debt, GLOP now has no maturities until 2018.

(Source: GLOP website)

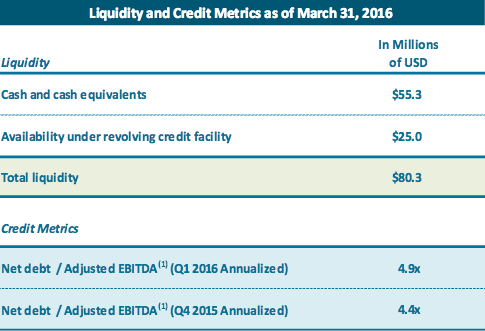

Liquidity:

All tables furnished by DoubleDividendStocks.com, unless otherwise noted.

Disclaimer: This article was written for informational purposes only. Please practice due diligence before investing in any investment vehicle mentioned in this article.

Disclosure: I am/we are long GLOP, GMLP, NAP, DLNG, KNOP.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

By Double Dividends Stocks

Sauce:http://seekingalpha.com/article/3971838-high-dividend-stock-yields-10-percent-30-percent-cash-flow-growth-strong-dividend-coverage

No comments:

Post a Comment