Summary

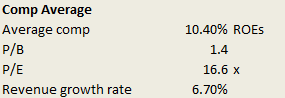

Atlas Financial is growing its top line and EPS by 35-50%, yet trades at 10x earnings, a 30% discount to its slower-growth commercial insurance peers.

Concerns that Uber will impact the company's business are misplaced. To date, it has been a growth driver.

Several larger competitors have left the taxi/limo insurance business, and pricing continues to move up in the high-single digits. ROEs are expected to reach the high teens in 2016.

Summary

Atlas Financial (NASDAQ:AFH) is an auto insurer operating in the profitable niche segment of insuring commercial transit vehicles, namely cabs and limousines. The company appears to be benefiting from the growth in commercial vehicles on the road, as well as capturing market share in its small fleet segment, one mostly ignored by the bigger commercial auto insurers.

Atlas Financial (NASDAQ:AFH) is an auto insurer operating in the profitable niche segment of insuring commercial transit vehicles, namely cabs and limousines. The company appears to be benefiting from the growth in commercial vehicles on the road, as well as capturing market share in its small fleet segment, one mostly ignored by the bigger commercial auto insurers.

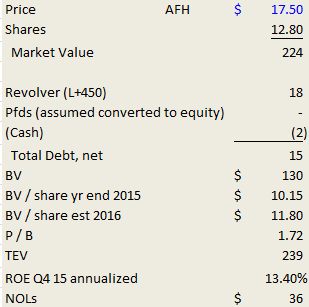

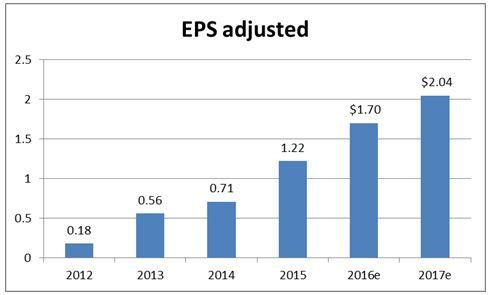

Despite the company generating organic growth last year of 50% in revenue and 70% in EPS, AFH can be picked up only 14x TTM earnings and 10x 2016 earnings. Its Returns on Equity (ROEs) are running near 14%, and are expected to be in the high teens in 2016. At the end of the day, however, growth is easy in the insurance world. The key is finding an insurer run by a conservative management whose primary objective is margin, not growth. And fortunately, Atlas Financial's management team fits the bill, with the added benefits of owning lots of stock and operating in a hardening (improving price) environment.

Basics

Business

Atlas provides "light" commercial vehicle insurance to cabs, limos and non-emergency paratransit vehicles. Through various subsidiaries, the company offers insurance in 41 states, sold through a network of roughly 260 independent, specialized agents. Importantly, agent compensation is directly linked to ROEs of business written, and not driven by volume.

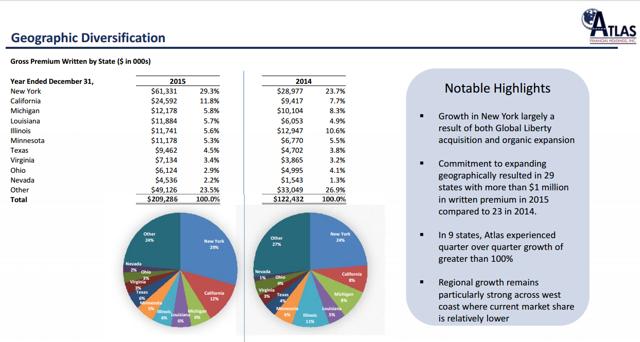

Here is a chart illustrating the company's geographic mix, with New York at the top of the list at 29% of premium written:

Among the 1-10 vehicle fleet operators, Atlas is the largest insurer in the US. Its average policy is only 2 vehicles. The market overall continues to transition away from large taxi fleet operators and more toward smaller owner/operators. Given the small customer focus, Atlas tends to obtain better pricing than its peers too, whose customers with larger fleets have better negotiating leverage.

The company does not outsource underwriting or claims management, and has a litany of managers who have worked in this niche for decades. Atlas gets high marks for its rapid turnaround of quotes when requested by agents, and also for rapid repair work, often done in 24 hours. This is critical for small owners, who only make money when they are operating their vehicles, and need repairs done quickly so that they can get back on the road.

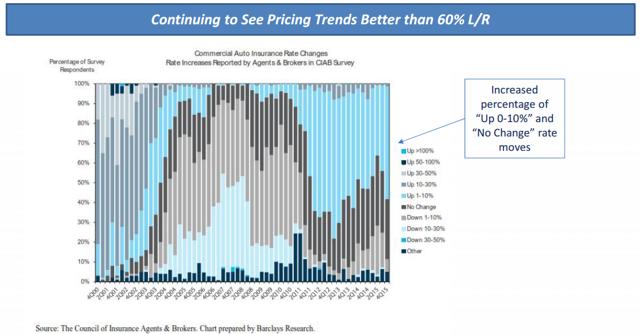

Big picture, the P&C industry generally operates in a "soft" or "hard" pricing environment. Soft environments are characterized by weak pricing owing to too much competition and capital. Margins tend to compress too. Ideally, investors want to capture insurers just as they transition into a hard pricing environment. Indeed, from 2004 until 2011, commercial Property & Casualty (P&C) operated in a soft environment, with the cycle turning in 2012 and continuing today. While bears may argue that it is late to this party, it is worth noting that these cycles tend to last for years at a time.

The overall commercial auto industry is around $29 billion in annual written premium, and currently averaging 8% ROEs. The taxi/transit niche here, however, is estimated at roughly $2 billion in annual premium, and grew 12% in both 2014 and 2015, according to management. Without new entrants into the market, and visibility on pricing for 12-18 months, it appears that this cyclical upswing will likely continue through 2017. Management believes that their segment will achieve 5-10% better ROEs than standard commercial auto insurers over time. They also are targeting 20-25% market share, versus only 10% today.

Below is a great overview of the pricing environment right now. You can see the soft environment from 2004 through 2011, as well as the current Q4 trends, with approximately 60% of policies pricing in the "up 1-10%" category:

Supporting the environment has been the exit of many peers from the industry, including CNA Financial (NYSE:CNA), Mercury General Corp. (NYSE:MCY) and Ullico.

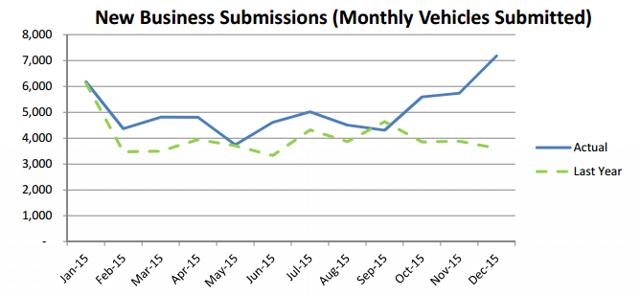

Here is a chart of application requests too. Demand for new policies appears to have accelerated in Q4 of last year:

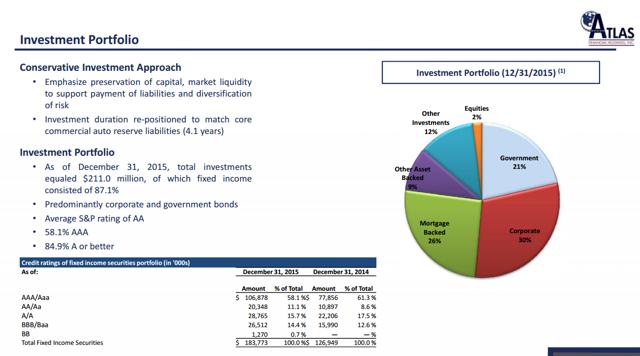

Unlike other insurers who rely on returns on their float to make money, at Atlas, its combined ratio was 87% last year (i.e., underwriting and claims costs as a percentage of premium revenue). Many insurers run right at 100%, relying on interest income and gains on their investment portfolio to generate earnings.

Atlas Financial's investment portfolio is duration-matched to its claims liabilities (which tend to run out after 3-4 years):

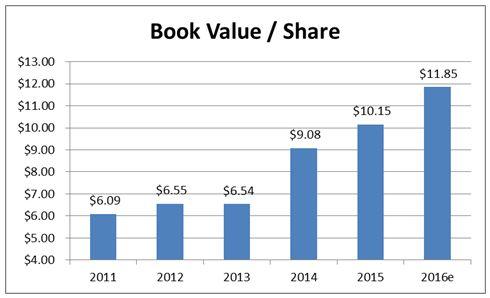

The overall EPS and book value per share story is solid since listing the stock.

Book value per share looks like this:

Recent Results and Projections

Fourth-quarter earnings seemed to disappoint investors this week. The stock fell 4% on Monday, largely as EPS at $0.32 missed street estimates of $0.35, and was only up slightly sequentially from the $0.31 reported in Q3. In fact, the stock has been flat over the past year despite solid results and continued favorable industry dynamics.

We suspect that noise from results (some adverse development in Q4) has been a contributor to stock weakness. Interest rate fears have gripped all banks and insurers lately too. However, with very little earnings generated from investment income, rate fears seem unjustified. It is worth recognizing that 2014, on an unadjusted basis, was a banner year, mostly due to the company realizing a big deferred tax asset. While the figures above in the chart normalize taxes, 2014 reported GAAP EPS was $1.56, followed by a $1.13 GAAP EPS number in 2015.

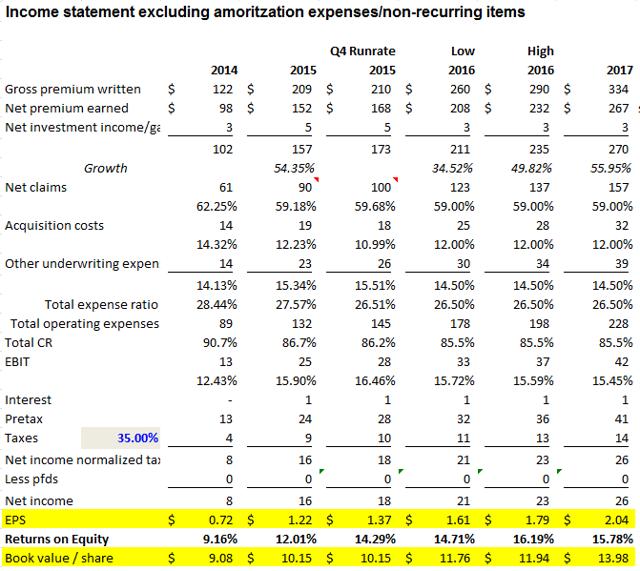

Here is a re-constructed income statement, excluding non-recurring merger costs and using a flat 35% tax rate across the board:

Several interesting notes here:

- Management continues to forecast 30-50% organic premium growth rates for 2016.

- Expect 15-20% of gross premiums ceded to reinsurers (namely Swiss Re (OTCPK:SSREF, OTCPK:SSREY).

- Atlas' net loss ratio should fall under 60% for 2016 (due to high-single digit price increases the company expects). This is at all-time low levels.

- The expense ratio should be around 26.5%.

- Tax rate guidance is 35%, but the company should actually generate more in the way of FCF/share given its $36mm in remaining NOLs.

- Q4 and 2015 earnings were impacted by $2.1 million in adverse development expenses on some legacy claims. $1.2 million of these originated from the Gateway Insurance pre-acquisition (i.e. policies written by different management). Gateway was a $14 million deal that closed in January 2013. It is unlikely these claims will recur in 2016. Run rate figures exclude this, but the 2015 earnings include it. Given that there only 35 open claims remaining, visibility appears good.

- Management believes they can generate "high teens" ROEs in 2016, although our modeling only assumes $1.70 in EPS and 15% ROEs. Admittedly, 2015 ROEs came in slightly below expectations given the adverse development charge.

- Despite rapid growth since the company's listing in early 2013, the combined ratios continue to improve. Given the short-tail nature of its liabilities, management appears to be maintaining price discipline, with only a small hiccup on adverse development, as discussed.

The upside case in the medium term is that the stock trades to a 15x multiple on 2017 earnings, which would put the equity over $30, for upside of almost 70% in 18-24 months.

The longer-term upside case assumes the company reaching its goal of 20% market share in its $2 billion niche. That is, assuming Atlas can write $400 million of premium per year and generate 10% underwriting profits (or at a 90% combined ratio, a reasonable mid-cycle estimate given scale for the company). This would put earnings per share in the $2.30-2.80 range. At 15x, AFH would trade to $34.50-42.00 per share.

Supporting these multiples are the following peer metrics (sourced fromBloomberg):

This comp list includes Safety Insurance Group (NASDAQ:SAFT), Infinity Property and Casualty Corp. (NASDAQ:IPCC), State Auto Financial Corp. (NASDAQ:STFC), Employers Holdings (NYSE:EIG), Selective Insurance Group (NASDAQ:SIGI), ProAssurance Corp. (NYSE:PRA), RLI Corp. (NYSE:RLI), Mercury General Corp., The Hanover Insurance Group (NYSE:THG), The Travelers Companies (NYSE:TRV), AmTrust Financial Services (NASDAQ:AFSI), Progressive Corp. (NYSE:PGR), Cincinnati Financial Corp. (NASDAQ:CINF), Intact Financial Group (OTCPK:IFCZF, IFC.CN), Argo Group International Holdings (NASDAQ:AGII), CNA Financial.

The downside case would likely be a softening of the market, perhaps coupled with poor underwriting results and more adverse development. To-date, higher frequencies (i.e., more claims per average insured) with some non-commercial auto insurers has been associated with an increase in miles driven (owing to low gasoline prices). However, on the commercial side, miles driven are not affected by gas prices, so investor concerns regarding higher frequencies appear unwarranted.

But assuming 94% combined ratios, 8% points higher than today, and the low end of guidance gets me approximately $1 in EPS. At 14x, that is $14 per share - downside of about 20%.

Ride-Hailing Services

There is a lot of concern regarding Uber (Private:UBER) and other app-driven ride-hailing services. With roughly half of Atlas' premiums related to cabs, there is worry that its business could decline as cab ridership inevitably falls.

To-date, however, Uber has been actually a net positive for Atlas. While Atlas does not write policies for UberX (the inexpensive, low-end cars), it does write policies for UberBLACK drivers. According to the company, it has added more Uber BLACK drivers than it has lost on the taxicab side (where it is not losing business, actually). Indeed, Uber has simply expanded the market overall.

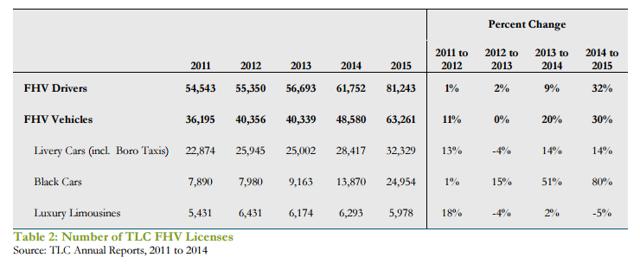

In New York, the biggest state for Atlas and Uber, the number of For Hire Vehicles (FHVs) on the road has actually grown significantly since 2011. Below is a good table from the NY Taxi & Limousine Commission illustrating this (these figures exclude Uber):

According to the NYT&LC, prior to 2012, 93% of all yellow cab rides originated in either core Manhattan (below 110th Street) or at the airport. Now, with Uber on the scene, Boro Taxis have been approved and are becoming much more prevalent. These are cabs designed for picking up riders in the non-Manhattan boroughs. As the company says, the market overall is simply expanding rapidly with competition, and while per cab ridership likely falls, the number of cars keeps going up.

Outside of New York, regulations are still being drawn up. In states like California and Illinois, there are no commercial insurance requirements yet. This seems likely to change, however. In my mind, it would only take one uninsured fatality in California before regulators begin to require commercial insurance. Individuals who use their cars for both personal and commercial purposes (like UberX drivers) cannot rely on personal auto insurance to cover them while they are searching for or transferring passengers. Drivers lacking legitimate commercial insurance could become a source of significant problems for Uber/Lyft (Private:LYFT) at some point.

My worst case: the number of Atlas-covered taxis drops by 20% over the next 5-10 years (a 10% hit overall). The number of UberBLACK and other commercially insured drivers grows by 50% (but assuming a 5% base, implies net growth of only 2.5%). This would equate to around a 7.5% decline in premium overall. However, as Atlas continues to gobble up market share, these losses could be entirely offset, resulting in flattish or perhaps even continued growth in earnings (depending on pricing and share gains).

Conclusion

The company has forecasted organic growth for 2016 of between 35% and 50%. At 10x earnings, this stock appears way too cheap given growth and where its peers trade. While some worry about Atlas growing too fast, underwriting appears solid to-date. This is, after all, short-tail insurance (1-year policies), with only a few claims lasting beyond that. Given the fact that Atlas has been writing this business for decades (going back to 1925, in some form), it does not appear the company is simply going after growth without maintaining discipline. It is re-capturing market share lost while the company was capital-constrained (under ownership of Kingsway).

It is worth listening to a few calls or speaking to management here, as investors can gain comfort that this team is not comprised of fly-by-night managers, but rather, a long-term thinking, conservative group that owns a lot of stock. Scott Wollney, the current CEO, was a star at Kingsway, and today owns 3.4% of Atlas' shares.

Finally, Atlas Financial claims that it can reach its growth targets this year without an equity raise. Leverage can be increased up to 2.0x (net premium to book) from around 1.5x today, and a new revolver plus reinsurance can bolster growth too without the need for an external equity raise. Lots to like.

Sources: Financials including 10-Ks, 10-Qs, presentations, management calls, conference calls, Barclays research, NYT&LC website/research

Disclosure: I am/we are long AFH.

By Thomas Lott

Thanks a lot for sharing this amazing knowledge with us. This site is fantastic. I always find great knowledge from it. Niche trade credit

ReplyDeleteAs a rule they didn't need to experience criminal cases or fabrication cases since they had utilized content that was very not quite the same as those utilized in the first item. Be that as it may, the customer who used to buy those items, particularly the first run through buyers got fleeced in light of the fact that they had bought the item just by taking a gander at its logo structure. logo design service

ReplyDelete