Summary

Another volatile week saw stocks selling off early and rebounding on Friday.

Trading continued to be linked to oil prices, although Fed news and negative interest rates were also cited.

Many see Friday's rebound as a temporary, short-covering respite.

There is a continuing focus on economic and geopolitical threats.

Leadership changes in the U.S. may increase market jitters.

The economic calendar is again light in a holiday-shortened week. There are a variety of important news items, but no dominant theme. I expect the punditry to seize the opportunity by asking:

What are the biggest market worries?

Prior Theme Recap

In my last WTWA I predicted that everyone would be talking about the high and rising worry about a recession. That was one of the most frequent media topics for the week, with some sources even choosing "looming" as part of the description. Fed Chair Yellen grabbed the spotlight for her testimony, but even that centered on economic concerns and what the Fed might do. Friday's rebound was notable in size, but left plenty of skeptics. As Doug Short notes, the rally came in concert with yet another mystery rally in oil prices. Skeptics saw short-covering action, with issues to be revisited this week. You can see the story in Doug Short's weekly chart. (With the ever-increasing effects from foreign markets, you should also add Doug's World Markets Weekend Updateto your reading list).

Doug's update also provides multi-year context. See his full post for more excellent charts and analysis.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

This Week's Theme

Earnings season continues, but the economic calendar is light in a holiday-shortened week. In most of the world there will be news on trading on Monday, which will set the tone for U.S. markets. With continuing worldwide volatility, I am not expecting a single issue to dominate next week. Instead I expect the pundits to be asking:

What is the biggest worry for investors?

2016 began with declining stocks and plenty of concerns. New candidates surface each week. Listed below are the most-noted worries. Those getting a lot of fresh attention are listed last. I have omitted the evergreen valuation and disaster scenarios.

- Stocks show technical weakness

- Almost breached important technical levels

- Lack of breadth

- Friday saved only by short-covering

- The stock market is clearly signaling recession

- Earnings growth weak and outlook weaker

- Strong dollar hurting sales, exports, and earnings of multi-national companies

- New variants on the "R word"

- Earnings recession

- Growth recession

- Manufacturing recession

- New recession definitions (e.g., slow growth)

- Self-fulfilling prophecy recession

- Falling commodity prices

- China weakness and capital flight

- There is an emerging leadership crisis

- Barron's cover featuring outsider candidates, Trump and Sanders

- Early takes on Justice Scalia's death

- Negative interest rates

- Declining dollar

- End of Fed QE policy

I did the list without even going to ZH for ideas, so there are probably more. Feel free to add anything important in the comments!

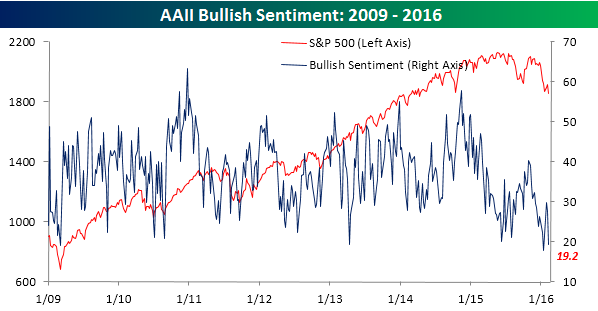

Scott Grannis reviews many of the issues in one of his helpful chart packs, accompanied by commentary. He reaches a mildly optimistic conclusion, despite the high level of fear revealed in this interesting indicator:

As always, I have my own opinion in the conclusion. But first, let us do our regular update of the last week's news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week's Data

Each week I break down events into good and bad. Often there is "ugly" and on rare occasion something really good. My working definition of "good" has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially - no politics.

- It is better than expectations.

The Good

On balance the news was pretty good last week, despite the market reaction.

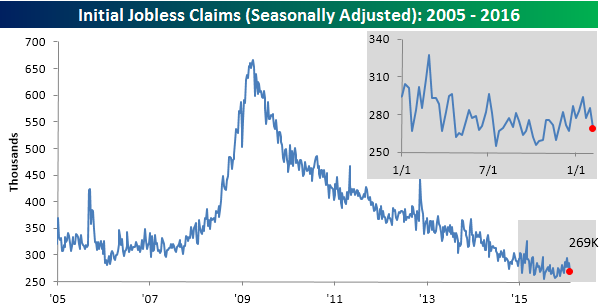

- Initial jobless claims have turned lower. Bespoke has both analysis of the data and great charts, including this one:

- Both job openings and the quit rate were strong. The WSJ reports the voluntary quit rate as the highest in nine years. This shows continuing expansion and confidence in job markets.

- Bullish sentiment (a contrarian indicator) is back to bull-market lows. (Bespoke).

- Retail sales were strong. Bloomberg calls it a broad-based advance, highlighting online sales and figures with (low-priced) gasoline excluded.

The Bad

As always, some of the news was negative.

- Leadership worries. Early primary results have favored "outsider" candidates. In my 2016 preview I said that it was far too soon to draw conclusions about the Presidential election. Even though that was only a month ago, there have already been twists, turns, and surprises. That said, commentators note that markets prefer establishment candidates and stable leadership. Personally, we can and should each express our own viewpoints and vote our consciences. Our personal choices may not always be "market friendly."

- Michigan sentiment index declined to 90.7. This preliminary read was lower than last month's final number of 92.0, and also missed expectations by the same amount.

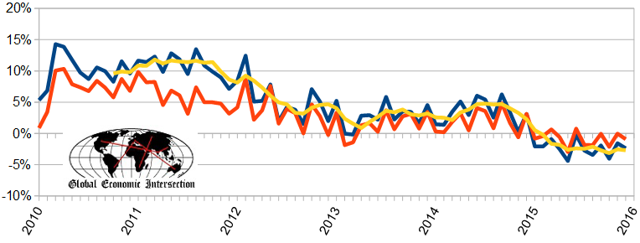

- Business sales and inventories are in contraction. Steven Hansen takes on a complex subject, showing many interesting takes on how to view the data. (Unadjusted - blue line, inflation adjusted - red line, 3 month rolling average-yellow line).

- Earnings for Q4 remain disappointing. While the earnings "beat rate" is OK, only 49% of companies are beating on sales. Guidance is 68-17 negative. The blended revenue growth would be slightly positive without energy stocks. (FactSet).

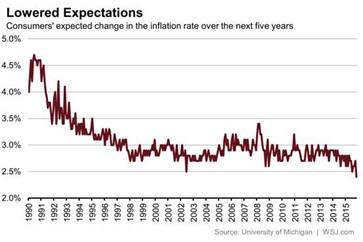

- Low inflation is bad (?) It is if you are the Fed, trying to raise inflation expectations. Data show an actual decline, although still above the Fed's target. (WSJ).

The Ugly

Cheating. This is more pervasive and important than you probably realize. We see the occasional story of a dishonest broker or insider trading. There are scandals in sports. Even my own world of top-level tournament bridge was recently rocked by revelations about several of the top professional partnerships.

In all of these cases, there are significant financial incentives. Steven Mazie reports on a scientific study that shows that winning begets cheating. Several different experiments show that winners in one game, randomly determined without their knowledge, will cheat on a subsequent game when having the power to do so unnoticed. And this happens with no financial incentive or even public acknowledgment.

But the upshot is troubling for people who care about the future of humankind. "It is difficult to overstate the importance of competition in advancing economic growth, technological progress, wealth creation, social mobility, and greater equality," the authors write. "At the same time, however, it is vital to recognize the role of competition in eliciting censurable conduct. A greater tendency toward unethicality on the part of winners ... is likely to impede social mobility and equality, exacerbating disparities in society rather than alleviating them." There may be no way to completely remove this flaw from human nature, but "[f]inding ways to predict and overcome these tendencies" would seem to be a mission well worth pursuing.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger. No award this week. Nominations are always welcome!

Quant Corner

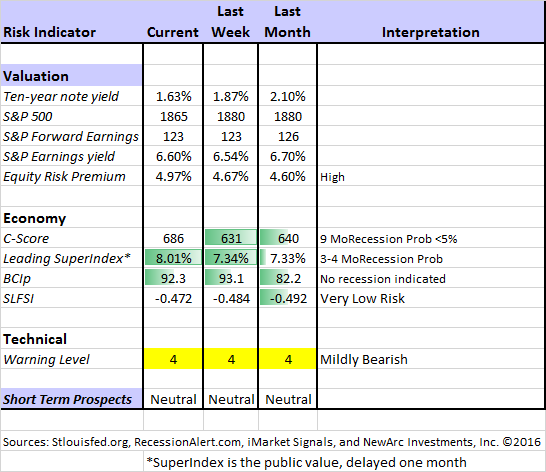

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. Beginning last week I made some changes in our regular table, separating three different ways of considering risk. For valuation I report the equity risk premium. This is the difference between what we expect stocks to earn in the next twelve months and the return from the ten-year Treasury note. I have found this approach to be an effective method for measuring market perception of stock risk. This is now easier to monitor because of the excellent work of Brian Gilmartin, whose analysis of the Thomson-Reuters data is our principal source for forward earnings.

Our economic risk indicators have not changed.

In our monitoring of market technical risk, I am now using our new model, "Holmes". Holmes is a friendly watchdog in the same tradition as Oscar and Felix, but with a stronger emphasis on asset protection. We have found that the overall market indication is very helpful for those investing or trading individual stocks. The score ranges from 1 to 5, with 5 representing a high warning level. The 2-4 range is acceptable for stock trading, with various levels of caution.

The new approach improves trading results by taking some profits during good times and getting out of the market when technical risk is high. This is not market timing as we normally think of it. It is not an effort to pick tops and bottoms and it does not go short.

Interested readers can get the program description as part of our new package of free reports, including information on risk control and value investing. (Send requests to info at newarc dot com).

In my continuing effort to provide an effective investor summary of the most important economic data I have added Georg Vrba's Business Cycle Index, which we have frequently cited in this space. In contrast to the ECRI "black box" approach, Georg provides a full description of the model and the components.

For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured "C Score."

Georg Vrba: provides an array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. He gets a similar result with the twenty-week forward look from the Business Cycle Indicator, updated weekly and now part of our featured indicators.

Doug Short: Provides an array of important economic updates including the best charts around. One of these is monitoring the ECRI's business cycle analysis, as his associate Jill Mislinski does in this week's update. His Big Four update is the single best visual update of the indicators used in official recession dating. You can see each element and the aggregate, along with a table of the data. The full article is loaded with charts and analysis.

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting systems. These include approaches helpful in both economic and market timing. He has been very accurate in helping people to stay on the right side of the market.

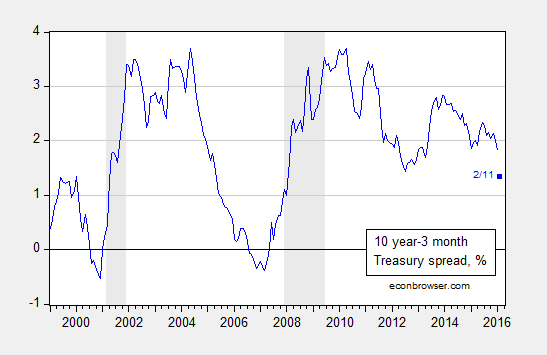

Econbrowser's Prof. Menzie Chinn updates a yield-curve based recession model. He notes that the model predicts recessions accurately about 78% of the time and non-recessions at an 85% pace. The current recession probability for the next year is about 9%.

Similarly, see Jim Picerno, who does a similar analysis and concludes as follows:

Meantime, let's keep reminding ourselves of a salient fact: every US recession has been accompanied by a plunging stock market but not every stock-market plunge has been accompanied by an NBER-definedrecession.

The Week Ahead

We have another quiet week for economic data. While I highlight the most important items, you can get an excellent comprehensive listing atInvesting.com. You can filter for country, type of report, and other factors.

The "A List" includes the following:

- Housing starts and building permits ((NYSE:W)). Potential for more gains?

- FOMC minutes . Even when you think there is nothing more to learn…...

- Industrial production . A sign of improvement in this sector would be very encouraging.

- Initial Claims (Th). A lot of attention to the recent volatility in the best concurrent news on employment trends.

The "B List" includes the following:

- PPI . No sign of inflation. It would take a few "hot months" to get serious attention.

- CPI ((NYSE:F)). See PPI.

- Philly Fed (Th). Gaining more attention as the first read on the prior month.

- Crude oil inventories . Attracting a lot more attention these days.

There is some FedSpeak on tap, but less than usual. Presidential campaigning will be intense before next weekend's primaries. The Chinese holiday is over, and some expect news on Monday, when U.S. and Canadian markets are not trading.

Earnings reports are still in full swing.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a "one size fits all" approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

WTWA often suggests a different course of action depending upon your objectives and time frames.

Insight for Traders

We continue both the neutral market forecast, and the bearish lean. Felix is still 100% invested, but with more conservative choices than last week. The more cautious Holmes is still about 1/3 invested. For more information, I have posted a further description -- Meet Felix and Oscar. You can sign up for Felix and Oscar's weekly ratings updates via email to etf at newarc dot com. They appear almost every day at Scutify (follow here). I am trying to figure out a method to share some additional updates from Holmes, our new portfolio watchdog. (You learn more about Holmes by writing to info at newarc dot com.

When might human traders do better than computers? Rob Carver has athoughtful comparison. As a manager employing computerized decisions in some programs, the topics reflect my own experience. The question of when a human should "override" a model decision is especially interesting. I frequently consider this when reviewing the decisions of Felix and Holmes.

Brett Steenbarger continues to suggest important and novel ideas about trading. This week he writes about having the macro wind at your back, and how to handle that happy news.

More importantly he gives some tips on how to spot the moves of big institutions.

It's a common mistake to become tunnel visioned during times of market stress and only follow the position(s) you are trading. That blinds us to the waxing and waning of macro themes and the influence of large market participants. You may not trade the markets thematically yourself, but it helps to have those themes at your back--and certainly not in your face.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are focused on limiting this risk. Start with our Tips for Individual Investors and follow the links.

We also have a page (recently updated) summarizing many of the current investor fears. If you read something scary, this is a good place to do some fact checking. Pick a topic and give it a try.

Many individual investors will also appreciate our two new free reports onManaging Risk and Value Investing. (Write to info at newarc dot com).

Other Advice

Here is our collection of great investor advice for this week.

If I had to pick a single most important source for investors to read, it would be this short post from Tadas Viskanta. He speaks clearly and effectively to investor concerns about how they are doing and second-guessing decisions. He notes the weak start to the year by some famous investors, and also advises tuning out the so-called "authority figures" on financial TV. His key advice? Cut yourself some slack!

See also the Investment News report on some of the top fund managers, down 20-25% in spite of their long-term success records.

Stock and Fund Ideas

Three Warren Buffett picks are on sale. (Matthew Frankel at TMF).

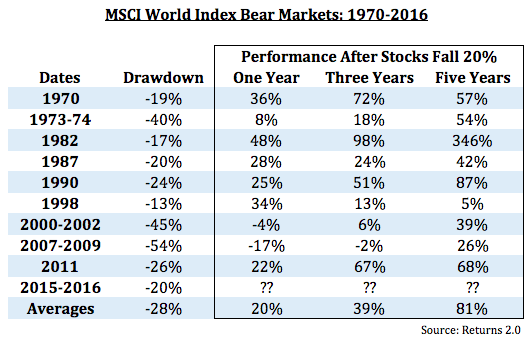

Ben Carlson cites data showing the historical rebound of global stocks following a bear market. He also supplies a list of what has been working and what has not - at least so far.

Tough times for solar stocks. (ETF.com).

Energy Prices

Last week. (MarketWatch)

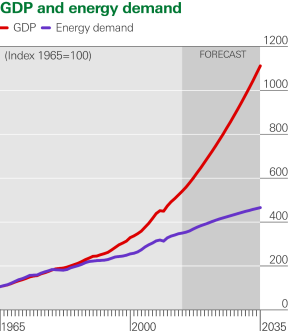

Long term. BP's annual energy outlook is a great data source.

Watch out for….

Guaranteed income certificates. David Merkel has a nice post on investment charlatans with a good specific example.

Non-traded REITs and BDC's. FINRA accuses broker of bilking Native Americans for over $11 million.

Special care is required when investing in these vehicles. You had better know what you are doing, and understand the risks.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if not able to read AR every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in this special edition. There are several great posts, but I especially liked this advice from Carl Richards(NYSE:NYT) about the need to accept uncertainty. Check out the stories about medical examples. You might also review my recent piece on the costly craving for explanations.

Final Thoughts

Investors do not understand worries, uncertainty, and scary headlines. If there were no "headwinds" then the market would be more richly valued. Most people have heard the expression, "wall of worry" but few understand it.

Almost six years ago, when the DJIA was at 10K and many were expecting it to go to 5000, I made my controversial Dow 20K call. There were many market worries, which are now mostly history. Instead, we have moved on to a new list of challenges. (Check out the story here).

The market gradually rises as fears are surmounted and earnings rise. There will be a time to become more cautious, or even bearish. That time will be indicated by data, not by fear-inducing headlines and speculation.

For many weeks I have noted that traders and others with a very short time frame should reduce risk. Investors should be seeking opportunity.

My noted neighbor to the North is Brian Wesbury. (Wheaton and Naperville once contested the location of the County Seat. Wheaton took the records and Naperville folks met at the Pre-Emption House to plan a raid. Somewhere during the night, the plans became muddled. Rumor has it that strong drink was involved).

Brian also wrote this week about whether recession was "looming" and how to interpret the market action. His conclusion (similar to mine last week):

This is a correction, not a turning point for the stock market. Our models, with stocks driven by interest rates and corporate profits, not sentiment, suggest the market is still significantly undervalued.

It's not often you get recession level prices when there is no recession.

Put money to work, don't run away.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

By jeff Miller

No comments:

Post a Comment