Summary

TOWR's recent announcement to pursue a sale of its European operations provides a clear and near-term timeline towards value realization for TOWR shareholders.

Even low valuations on current earnings for the European business imply bargain basement multiples for the best-in-class, growing and high-margin North American business.

Management clearly stated the main use of proceeds would be shareholder returns, implying up to 23% of the float could be bought back under management's leverage targets at current prices.

Furthermore, a European divestment makes the ultimate sale of the rest of TOWR much more likely, with the CEO incented to get the stock closer to $50 before retirement (end-2016).

Just a 6x multiple of Tower North America would imply a ~$46.5 price pro-forma for the European business sale, or ~58% upside from current.

Introduction: the power of incentives in action

As most value investors know, finding a cheap stock is only half the battle: you also need to identify clear catalysts that will move the market to recognize the cheapness. These catalysts could be many things - better earnings, cash flow inflection, restructuring, sale (or purchase) of businesses, etc - but the best thing you can hope for any value-based investment is for aligned management to both recognize the cheapness and take concrete actions to change the market's view.

While the stock has done well (rallying from ~$23 to $29.5 since I published), the recent news that TOWR is looking to sell its European operations sets the stage for further upside. Indeed, it is about as good news as you could expect, in that it delineates a clear path to value realization, by forcing the market to value the stock on a SoTP basis in short order (assuming a transaction is consummated as per schedule by end Q1 2016). More than that, though, management did a huge favor for investors by breaking out - for the first time - both the current earnings potential for Tower Europe, as well as the likely revenues and margin potential for Tower NA on a 2yr view, in the presentationdiscussing the rationale for the sale.

More than this, though - management outlined that the almost singular rationale for the transaction was their view that the stock was materially undervalued - to quote the presentation, "Demonstrate through sum-of-the-parts valuation what we believe is a major disconnect between TOWR's present stock price and the Company's intrinsic value" - and implicitly (on the call) that the majority of proceeds would go towards buying back stock. Management even did investors the further favor of outlining how quickly the process would be conducted (bids by December, decision in 1Q next year) - again suggesting the impetus for the CEO to get value realized quickly before he retires.

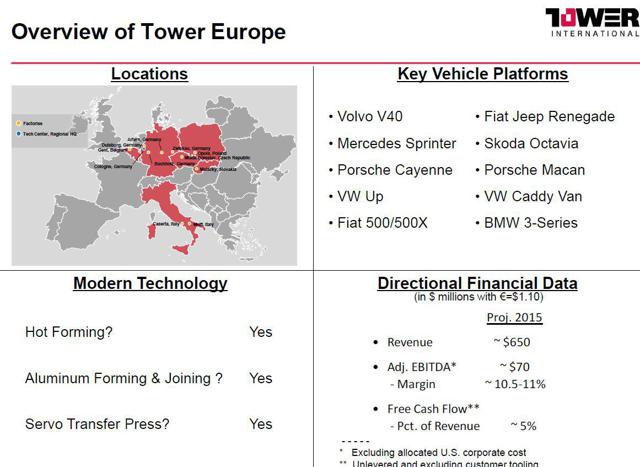

The European business and what it could be sold for

TOWR discloses the European business does $70mm in adjusted EBITDA for 2015 on a ~$650mm revenue base, or 10.5-11% adjusted EBITDA margins - these are above average for the TOWR group currently (~9.5%) and at least in line if not a touch higher than comparable stamping/body structure players. Moreover, as per the below slide, there are no facilities in problematic jurisdictions (regarding unions, etc.) like France or the UK (admittedly Italy has some facilities and is not the easiest place to restructure) but the primary facilities are in Eastern Europe (Poland, Czech Republic) as well as Germany (i.e., in close proximity to major European OEMs).

(Source: TOWR presentation)

You will also note that adjusted FCF/revenue (i.e., excluding tooling and unlevered by corp debt interest burden) is quite solid at 5%, implying unlevered FCF of ~$32-33mm this year.

This all supports the view that Tower Europe is a solid, perhaps slightly above average business in the body structural/stamping space, certainly NOT a distressed asset nor a forced sale. As the company stated in its presentation - it is looking to sell the business from a position of strength, to focus on its core NA ops and to create value for shareholders.

As for potential multiples for this business, recent auto parts transactions have implied healthy multiples in the space. In September 2014, ZF Friedrichshafen bought TRW Automotive (NYSE:TRW) for 7.5x LTM EBITDA. Admittedly, there is minimal direct product overlap between TOWR and TRW but the margin profile and growth rates were similar at the time of the acquisition. Elsewhere, one of TOWR's main competitors, Magna, (NYSE:MGA) acquired a transmission supplier, Getrag (again, not a direct product comp to be fair) at a higher multiple (8.8x EBITDA), given a superior growth trajectory. Meanwhile, public company direct comps - Magna and Martinrea - trade in the 5-5.5x range.

Putting it all together, I do not think 6x 2015 EBITDA is an unreasonable price, though in the interests of conservatism and acknowledging that management wants to run the process quickly, I believe a price of 5x EBITDA would be the base line minimum accepted by management and should be readily achievable. A number of TOWR's largest direct competitors are based in Europe - names like Benteler (Austria, ~$8bn revenues), Gruppo Magnetto (Italy, ~$1.7bn revenues), Gestamp (Spain, ~$7bn revenues), Kirchhoff (Germany, $1.4bn revenues) - have much larger revenue bases, and serve the same OEM clients. Acquiring TOWR's European ops would make both strategic and financial sense for any one of these, and 5x current year EBITDA - with the European business still in a nascent recovery - would be paying effectively no control premium versus public comps. As such, I view a deal at this level as highly likely to get done.

Impact of Tower Europe sale on TOWR capital structure

At 5x adjusted EBITDA, the Tower Europe sale would generate ~$350mm in pre-tax proceeds for TOWR consolidated. While I am not a tax expert, as perthe 10-K, TOWR has ~$176mm in foreign NOLs, most all of which are valid through 2016 (though some may relate to regions outside Europe). As such, the sale proceeds should be mostly, if not entirely shielded from taxes, but let's be conservative and assume post-tax cash proceeds of $300mm.

Net debt as of Sep '15 is $341mm and per my estimates will be ~$322mm at end of year (adjusting for $48mm in cash from China JV sales against a step-up to $70mm in capex from new program ramps). Netting off Tower Europe against this would leave the remainder of TOWR with ~$20-25mm net debt against whatever EBITDA the North America business (as well as legacy South American ops and remaining Asian JV) can generate. We will assume South America has zero value, as it has been modestly loss making and let's assume Asian ops, which are now de minimis post the sale of most of the JVs, are a zero too and instead focus on the North American business.

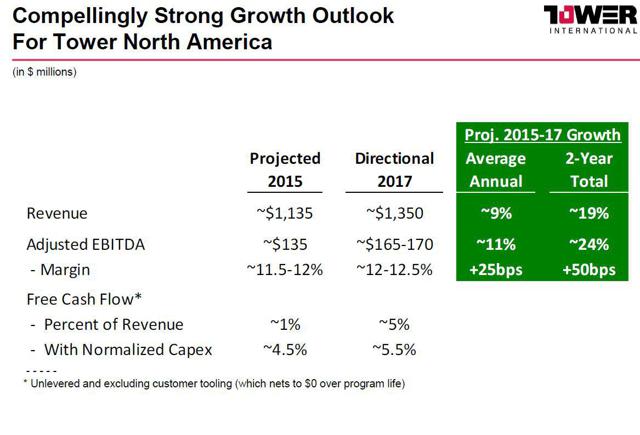

Thankfully, TOWR management has also provided greater clarity into the earnings power of the North American business as it ramps new client wins in the next two years:

(Source: TOWR presentation)

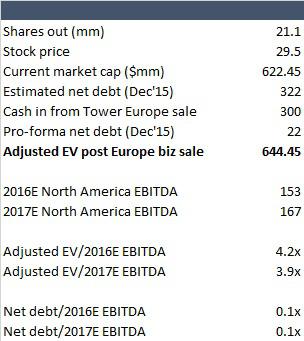

Pro-forma for a potential Tower Europe sale, the recent stock move (to $29.5), and assuming South America/Asia JV are a net zero AND the company can execute as per the above slide, what's left of TOWR will be delevered almost completely (to ~0.1x) and will trade under 4x 2017 EBITDA for a business with well above sector average growth rates, margins, and excellent FCF potential:

(Source: my estimates, company filings)

Indeed, on the call to discuss the potential Tower Europe sale, management reiterated that it views 1x levered as the right level of debt to place upon this business in a steady state - suggesting the company could turn right around and buy ~$150mm in stock - or 23% of the current market cap - to return capital to shareholders. Given the CEO's stock price-based incentives, I would expect this would be conducted sooner rather than later (i.e., as soon as there is clarity on the European business sale, potentially even before that deal closes).

The likely 'end-game' and final thoughts on valuation

Of course, while management trumpeted on the call how this transaction could clarify the growth proposition and value of Tower North America, and how it would give the company additional resources to grow, the inescapable conclusion of most observers (well, at least to my mind), is that the rump Tower North America is clearly 'in play' and is being slimmed down for a sale. Post the sale of most of the China business, and assuming the European sale goes through, the remaining footprint would be a much easier swallow for either Magna or Martinrea - and also more strategically aligned with those two companies' core NA operations (in such a scenario, the problematic South American assets could be divested or wound down as well).

Frankly I view it as much more likely that what's left of TOWR is sold or merged by year-end 2016 in such a way as to crystallize the remaining value for the CEO prior to his end-2016 retirement (as I postulated in my original piece). In fact, it would not shock me at all to see all of TOWR bought in one bite during the current bidding process (though this is not my base case scenario).

Irrespective of a sale of whatever is left if/when Europe is gone, I would fully expect a market re-rate given the company will be delevered, no longer exposed to the problematic VW group contracts (a point not stressed in the presentation but clearly a positive given the current uncertainty there), and solely focused on the fastest-growing and highest-margin opportunity in North America. Consolidated, TOWR trades at 5.0x 2015E EBITDA now; a 5-6x multiple on 2017E earnings a year from now would not strike me as particularly aggressive, and would represent a stock in the $38.5-$46.5 range.

These multiples would still be well below takeout multiples for this business, would still imply generous FCF multiples for the remaining operations, the CEO would still be highly incented to get the stock much closer to $50 in a hurry, and would have the ability to purchase around a quarter of the outstanding float. As such, I lean much more towards the higher end of this range and thus fully expect the stock could trade to the mid-high $40s over the next year. This would represent ~58% upside from current ($46.5 vs. $29.5), and given the clearer catalysts now obviously in play, I added to my position on the recent news.

Risks

Other than operational/executional issues (which I purposefully did not discuss here as the recent quarter was fine but not newsworthy), by far, the biggest risk is if the European business cannot be sold. While I view that as quite unlikely given the motivated nature of TOWR management and - I believe - their willingness to accept a low price but not a bargain basement one, it is always a possibility and would represent a meaningful negative. In this scenario, the stock would likely fall ~10% to where it was trading prior to this news and TOWR would have to simply execute on its growth plan to prove to the market a) it can generate the cash it promises in 1-1.5 years' time and b) that it deserves a higher multiple as a result of this growth.

Additional risks like FX, VW production volumes, and softness in Brazil should be mostly well known at this point but they could always get worse as well.

Conclusion

TOWR management's recent announcement to pursue a sale of its European operations provides a clear and near-term timeline towards value realization for TOWR shareholders. Even low valuations on current earnings for the European business imply bargain basement multiples for the best in class, growing and high-margin North American business. Management clearly stated the main use of proceeds from the sale would be shareholder returns, which, coupled with guidance for long-term leverage around 1x, implies the ability to buy back almost a quarter of the float at current levels. Furthermore, a potential European sale makes the ultimate sale of the rest of TOWR much more likely, as the CEO is highly incented to get the stock up closer to $50 per his performance agreement, before retiring at year-end 2016. BUY TOWR

Jeremy Raper

Source: http://seekingalpha.com/article/3679276-tower-international-update-potential-unit-sale-opens-path-to-50-percent-upside

No comments:

Post a Comment