The U.S. organic food market would reach $45 billion by the end of this year.

The company is on track to achieve an estimated top-line growth of 10% for the fiscal year 2015 and it will translate into 3-Year revenue CAGR of more than 18%.

Recently, the company reported first $1 billion quarterly revenue.

The WhiteWave Foods Company (NYSE:WWAV) is a rapidly growing packaged food and beverages company that market its products in the U.S. and Europe. WhiteWave produces plant-based foods and beverages, coffee creamers and beverages, and premium dairy products. WhiteWave is a former subsidiary of Dean Foods (NYSE:DF) and was spun off in an IPO in 2012. While WhiteWave derives its revenue being an organic and fresh food company, it divides its business into three operating categories; Americas Foods and Beverages, Americas Fresh Foods and Europe Foods and Beverages.

Aggressive Acquisitions Are Helping

The organic and natural food market size is still very small and each market participant holds a small pie of overall market. Before spin-off, WhiteWave was itself a small company with revenue and earnings per share of $2 billion and $0.72 in 2011, respectively. With the help of strong growth in its plant-based products and various acquisitions, the top and bottom-line of WhiteWave is now expected to reach $3.78 billion and $1.17 - $1.18, respectively.

WhiteWave has adopted aggressive acquisition strategy and acquired various rapidly growing companies in different organic and natural food categories over the past couple of years. The Americas Fresh Foods segment of WhiteWave is basically the Earthbound Farm business. WhiteWave strengthened its portfolio of organic products when it acquired Earthbound Farm on January 2014 for approximately $600 million. While Earthbound Farm added $575 million the top-line last year, it opened a window of opportunity for WhiteWave to grow in the organic packaged salad, organic fresh fruits, and vegetables.

The fresh fruits and vegetable category, which now accounts for 12% of total organic food sales in the U.S., will continue to grow double-digit in the coming years. To benefit from this growth opportunity, Earthbound Farm introduced several ready-to-eat products during the ongoing year, including three neworganic salad kits. The company is putting its efforts to improve the supply of products, and despite challenging conditions, the Americas Fresh Foods segment returns to revenue growth during the third quarter.

WhiteWave made another acquisition and purchased So Delicious, a dairy-free beverages, and frozen foods company for $195 million. Most recently, WhiteWave bought Vega, a nutrition food company, for $550 million and Wallaby for $125 million. WhiteWave's expansion into the high-growth categories is a smart move, which will solidify the long-term growth momentum. These recent additions will enable WhiteWave to posted net sales growth of approximately 13% - 14% and adjusted diluted earnings per share of $0.34 to $0.35 during the fourth quarter. Thus, taking the full year adjusted diluted earnings per share $1.17 - $1.18.

Industry Dynamics Will Continue to Support the Momentum

According to Organic Trade Association, the organic food market size was only $3.4 billion in 1997, which was less than 1% of total food sales at that time. The growth momentum started in 2000, and since then the U.S. has become the largest organic food market. Now the organic food market size is $36 billion, or 5% of total food sales in the U.S. The highly fragmented organic food market, in which each player holds a very small market share, would reach $45 billion by the end of this year.

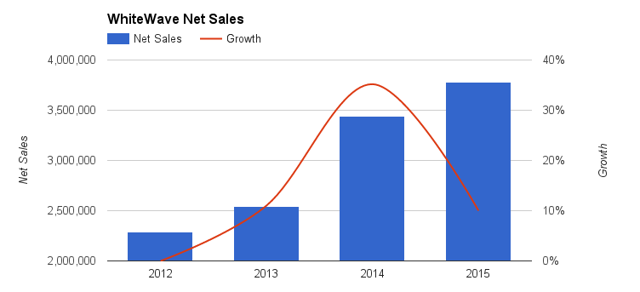

Source: Company Financials

WhiteWave has been successfully able to maintain its growth momentum after the spin-off. The company is on track to achieve an estimated top-line growth of 10% for the fiscal year 2015 and it will translate into 3-Year revenue CAGR of more than 18%. WhiteWave earns roughly 15% of its total revenue from outside the North America and its presence in Europe will continue to play an important role to deliver double-digit growth in the years to come.

The Europe Foods and Beverages segment's revenue increased by 20% on a currency-neutral basis during the third quarter and operating surged 39% on a reported basis. According to TechNavio's forecast, the Organic Food and Beverages market in Europe will grow at a CAGR of 6.83% by the end of 2019. Although the currency headwind will remain a challenge in the short-term, the strong volumetric growth across the product portfolio, particularly Alpro brands, will continue to boost the revenue and earnings.

Yogurt - A High Growth Opportunity

While the global organic food market is projected to register a CAGR of over 16% during 2015 - 2020, certain categories, such as yogurt, are likely to grow at a higher pace driven by changing consumers' breakfast habits in the U.S. WhiteWave's yogurt sales increased 34% during the third quarter, outpacing other products. WhiteWave is experiencing significant growth in Silk yogurts as it continues to expand distribution and market reach.

WhiteWave completed the acquisition of Wallaby a couple of months ago. The addition of a leading organic yogurt, such as creamy Australian-style yogurts and Greek yogurt, will strengthen the competitive position of WhiteWave against its rivals. Thus, the integration of Wallaby With WhiteWave's Alpro and Horizon yogurt brands will unlock even bigger long-term growth opportunity.

Final Words

WhiteWave's revenue and earnings are growing at an impressive pace. Recently, the company reported first $1 billion quarterly revenue. The top-line reflected 17% growth during the first quarter and its sales were ahead of estimate by $25.14 million. WhiteWave successfully leveraged top-line gain into operating profit growth of 25%.

Source: Ycharts

WhiteWave's shares have appreciated more than 19% over the past twelve months driven by strong bullish sentiment. However, the stock price is down more than 14% over the past three months due to all-time high valuation. The only concern regarding this stock is a pretty high forward PE of 30.8x. However, WhiteWave deserves a premium valuation primarily due to its strong fundamentals, smart acquisitions of high-growth companies, solid presence in a rapidly growing market and a proven history of delivering double-digit growth. WhiteWave is a pretty solid stock to buy as a long-term investment, but I would suggest to wait for a while to buy at further weakness.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

By Bull's Run

No comments:

Post a Comment