News and data were good last week, and the market responded.

Many pundits attribute most of the gain to Central bank policy.

This focuses attention on the upcoming FOMC meeting, despite the avalanche of data and news reports.

Fed policy change is unlikely to occur and unlikely to matter, but the discussion could spark volatility.

Earnings reports have created both challenges and opportunities. There is some welcome advice.

The week ahead is loaded with data reports and earnings news. The FOMC has another meeting and rate decision. It occurs in the context of a nice stock rebound. The punditry will be asking:

Will the Fed put the brakes on the breakout?

Prior Theme Recap

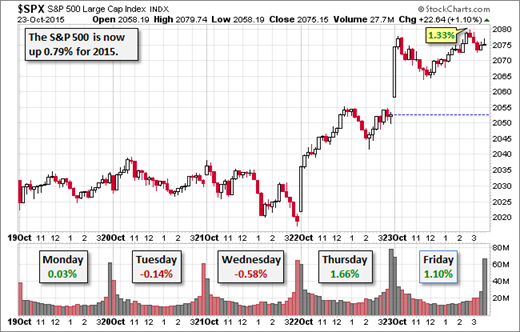

In my last WTWA I predicted that the market story would turn to housing, the subject of most of the week's data. That proved to be one of my worst predictions! My discussion of the theme is intended as preparation for the media focus, not just my own opinion. My personal conclusion was that the housing story was important, but others did not think so. It did get reasonable attention, but earnings stories dominated, with secondary attention to Europe and China news. By Thursday, it was all about the market breakout and getting back to breakeven on the year. To get the full story, let us look at Doug Short's weekly chart. You can clearly see the mid-week turnaround. (With the ever-increasing effects from foreign markets, you should also add Doug's World Markets Weekend Update to your reading list).

While I take a weekly focus, Doug's update provides multi-year context. See his full post for more excellent charts and analysis.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

This Week's Theme

We have a huge economic calendar, with more important reports than we have seen in many weeks. Whenever the week includes a Fed meeting, we expect that to command attention. While most do not expect a policy change, it remains possible and could dominate market discussion until Wednesday afternoon. Much of the most important data will not be known (even by the Fed) until later in the week. This is a perfect setup for pundit pontification!

I expect a weeklong Fed focus, with everyone asking:

Will the Fed put the brakes on the breakout?

The question implies two parts:

- Will Fed policy change?

- Yes. A rate increase would merely move toward normal.

- No. There is no sign of inflation and economies are weak. (Noah Smithat Bloomberg View and Paul Kasriel of Norther Trust).

- No. It would create too much dollar strength. (Bloomberg)

- It is too late. The Fed should have acted when the economy was stronger.

- Does it matter?

- Yes. The market strength rests upon worldwide liquidity. Changing this could halt the rally.

- No. It is all about technical analysis and which wave we are in. (Avi Gilburt at MarketWatch).

- No. Fed policy has done little to help the economy, so gradual cuts will make little difference.

- No. The economy is strong enough to deal with higher rates. (Christopher Swann, CNBC).

There are sources taking each of these positions. I expect all to be cited in the week ahead.

As always, I have my own ideas, reported in today's conclusion. But first, let us do our regular update of the last week's news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week's Data

Each week I break down events into good and bad. Often there is "ugly" and on rare occasion something really good. My working definition of "good" has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially - no politics.

- It is better than expectations.

The Good

The news of the week was mostly good.

- Government shutdown less likely. The apparent choice of Paul Ryan as House Speaker is a good signal on this front. Investors who join me as political agnostics should not care about the partisan issues, just the consequences. We know that the market hates the uncertainty brought on by a debate over raising the debt limit, so this is good news.

- Jobless claims. The lowest four-week moving average since 1973. (Calculated Risk)

- China GDP beats forecasts benefiting from stimulus. (Bloomberg)

- Central bank policy. China took aggressive action, but ECB President Mario Draghi needed only words. Paul Vigna of the WSJ captured the essence of the story in a few words:First there was the Fed, which backed off a rate hike in September, and seems unlikely to implement one at all this year. Earlier this week, the ECB chimed in, with President Mario Draghi dropping tea leaves the size of tires that the bank could and would expand its stimulus program later this year, if needed. Lastly, the PBOC joined the parade overnight. The People's Bank made two powerful moves: it cut interest rates by 25 basis points, and cut the reserve-requirement ratio for banks. The ratio dictates how much money banks need to keep on hand. Cutting it is viewed as a very blunt and powerful way to push money into the economy. They needed to do something. China's third-quarter GDP report was its worst showing since 2009, and most people think the real growth picture is even worse.

- Housing data were strong. Calculated Risk reported updates and additional commentary on each report.

- Existing home sales

- Builder confidence

- Mortgage applications

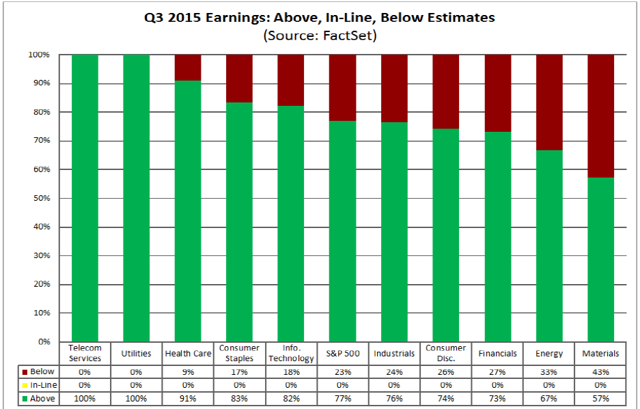

- Earnings beat rate. 77% of stocks are beating reduced expectations. (FactSet)

The Bad

There was some negative data, including some of the important earnings stories.

- Earnings commentary. The data showed success versus the lowered expectations, but the accompanying messages suggested continuing economic weakness. The weekly summary from Avondale is a helpful companion piece. They are using Seeking Alpha's excellent transcript service, which now includes over 100,000 earnings calls. This is a great service that I use on my stocks. You should, too.

- Housing permits declined. New Deal Democrat has a good story, noting that the overall trend is intact. This is an important indicator.

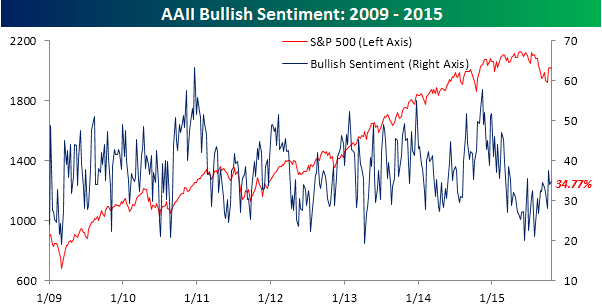

- Bearish sentiment is declining (a contrary indicator). Bespoke has the story and helpful charts.

- Earnings are poised for a second consecutive quarterly decline, currently estimated at 3.8% (FactSet)

The Ugly

Cheating in science and medicine. Faked data supporting academic articles with faked reviews and email addresses. (The New England Journal of Medicine). Perhaps authors should not be counted upon to suggest the reviewers? Sheesh!

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger. No award this week, despite the abundance of really bad analysis. I am thinking of starting a nominee section. This would include items that have obvious errors but which have not attracted any replies or refutation. Almost any two-variable chart these days is a candidate.

Quant Corner

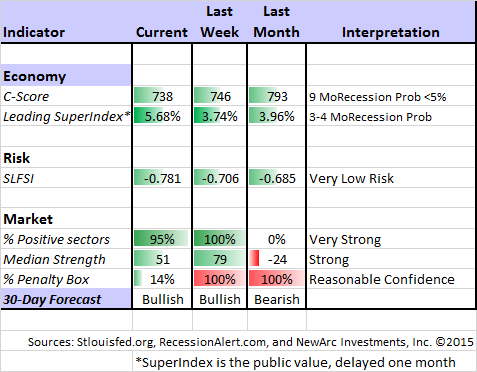

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured "C Score."

Georg Vrba: An array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. He gets a similar result from the Business Cycle Indicator. This week Georg updates one of his market timing methods, showing how to trade in gradations rather than all-in or all-out.

Doug Short: Provides an array of important economic updates including the best charts around. One of these is monitoring the ECRI's business cycle analysis, as he does in this week's update. The ECRI story is becoming repetitive and even more unhelpful. It seems too related to commodity prices, and only slightly changed from their failed recession forecast. It would be refreshing to see them do a complete reset and adopt a fresh approach.

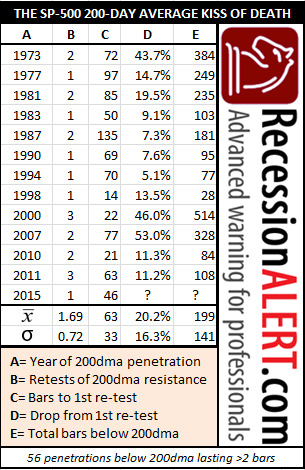

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting systems. These include approaches helpful in both economic and market timing. He has been very accurate in helping people to stay on the right side of the market.

This week Dwaine warns about the difficulty of rebounding through the 200-day moving average once it has been breached for a "protracted time." He calls this situation the kiss of death, and presents the following table of results. We shall see.

While it's always good to be on guard, it seems that most of the evidence supports the argument that the economic expansion still has a ways to go.

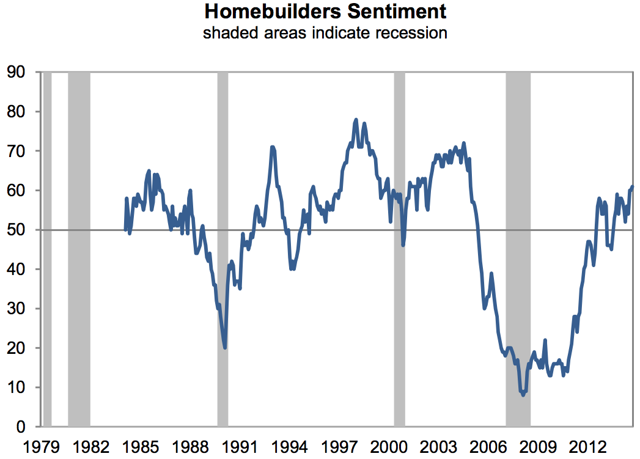

There is a chart for each of the six signs, including this one on homebuilder sentiment.

The Week Ahead

It is a huge week for economic data. While I highlight the most important items, you can get an excellent comprehensive listing at Investing.com. You can filter for country, type of report, and other factors.

The "A List" includes the following:

- FOMC rate decision (W). A focal point for the week.

- Q3 GDP (Th). The advance read is expected to be weak, and will be heavily revised. It remains an important headline story.

- New home sales (M). Key indicator in a key sector.

- Consumer confidence (T). The Conference Board version provides a good read on satisfaction with employment and also spending prospects.

- Michigan sentiment (F). Important for the same reasons as the Conference Board version, but with methodology I regard as better.

- Personal income and spending . Both are important for consumption as an economic driver.

- Employment cost index . Will signal labor market tightening and possible pressure on the Fed to start rate increases.

- PCE prices . The Fed's favorite inflation measure is expected to remain low.

- Chicago PMI . Always more important at the end of the week as a signal of the upcoming ISM report. Weakness expected.

- Initial jobless claims (Th). The best concurrent news on employment trends, with emphasis on job losses.

The "B List" includes the following:

- Pending home sales (Th). A good advance look.

- Durable goods .

- Crude oil inventories (Th). Current interest in energy keeps this on the list of items to watch.

Earnings remain important with plenty of big names on the calendar. FedSpeak will occur only after the FOMC meeting, mainly on Friday.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a "one size fits all" approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix has remained bullish, and we increased our commitment accordingly. The penalty box indicator dropped dramatically, increasing our confidence in the multi-week bullish call. For more information, I have posted a further description -- Meet Felix and Oscar. You can sign up for Felix's weekly ratings updates via email to etf at newarc dot com. Felix appears almost every day at Scutify (follow him here).

Tradeciety has some great advice from professional gambler Cathy Hulbert. Many of the psychology and money management issues are similar for those who have a real edge in these activities. If you have no edge, you should simply move on!

An edge is not enough if you cannot manage your emotions. Here are some examples of amateur mistakes:

The reasons for unnecessary and avoidable losses of amateur traders can often be attributed to the following 5 points:

- Revenge trading: you open a new position just after your stop is triggered, without seeing valid re-entry signals.

- Playing catch up: you want to make up for past losses, force trades and violate your rules.

- You flip through your charts without really knowing what you're looking for and then take trades that don't meet your criteria.

- You want to avoid losses and, therefore, widen your stop loss order or take it off completely.

- You miss a trading setup and then jump in too late, although you should have stayed out by then.

It is always good to have positive suggestions as well as mistakes to avoid. Dr. Brett is a reliable source for such advice. This week he has three important points that you would not think of on your own! A careful read of this would be time well spent for any trader. I especially like this suggestion:

Spend as much time learning from your trading as you actually spend trading - The ratio of practice time to performance time is a great predictor of elite performance, whether among Olympic athletes or chess champions.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are focused on limiting this risk. Start with our Tips for Individual Investors and follow the links.

We also have a page summarizing many of the current investor fears. If you read something scary, this is a good place to do some fact checking.

Other Advice

Here is our collection of great investor advice for this week.

If I had to pick a single most important article, it would be this thoughtful analysis from Chuck Carnevale -- Retirees: I Did Not Buy IBM To Sell; It's About The Dividend Income, Stupid. Chuck analyzes a problem that many investors currently share. You buy a stock based upon your methods, in which you have confidence. The stock declines. You feel like you made a mistake - buyer's remorse. That is when you are prone to making a bad decision. Chuck does a detailed description of his decision. Whether you agree about the stock or not, you will learn from the analysis. We have all been there!My case supporting investing in IBM is totally predicated on its generous current yield and my view of the safety and sustainability of its business. There is no shortage of positive and negative articles or reports across numerous financial blogs on IBM. Some of them contain important facts, but in my judgment, most of them represent simply the opinions of others. Personally, I prefer facts over opinions.

By the way - those who cite Warren Buffett's rule about not losing money should definitely read this article. Mr. Buffett does not worry about paper losses when the market disagrees with his own valuation. Losing money happens when you sell, just as Chuck explains.

See also Josh Brown on the difference between the methods used by traders and investors, using Valeant as an example.

Public Stock Picking is Difficult

The problem is how to get paid for your work. Those who analyze and write about stocks are under constant pressure to generate "actionable investment advice." It is all about page views. Chief Pundit Cramer generates so many recommendations that he is a walking bulls-eye for critics. One retired professor sought to achieve accountability when a Cramer article made some especially strong claims. While Cramer never accepted the friendly bet, the original challenge is a matter of public record. The picks did not fare well.MarketWatch has the story and the accounting on the 49 stock picks in question.

Stock Ideas

Hidden opportunities in small cap value stocks? Dana Lyons evaluates the evidence and offers a qualified, "yes.

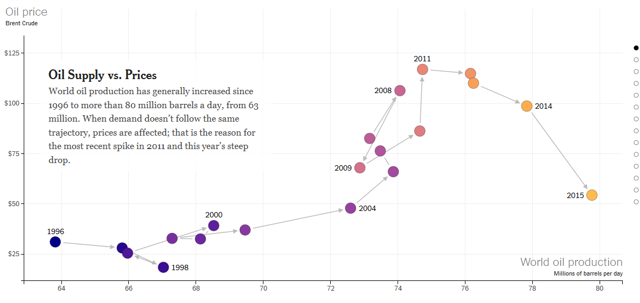

Finding opportunities in energy stocks depends on your understanding of supply and demand. This fascinating interactive chart from the NYTcannot be appreciated in the static form below, but it does hint at what we should be watching - U.S. and OPEC production.

Meanwhile, the IMF warns that the Saudi's need to change policy or risk running out of financial assets in five years. (Am I the only one who senses that the IMF is offering a lot of advice where it might not be needed or wanted?)

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for ten year. The average investor should make time (even if not able to read every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in this special edition. As always, there are several great links, but I especially liked the advice to check out your broker or advisor on FINRA's free site.

The 20% of brokers with the highest ex-ante predicted probability of investor harm are associated with more than 55% of the investor harm cases and the total dollar investor harm in our sample. Our findings suggest that investors have access to valuable information that allows them to discriminate between brokers with a high propensity for investor harm from other brokers.

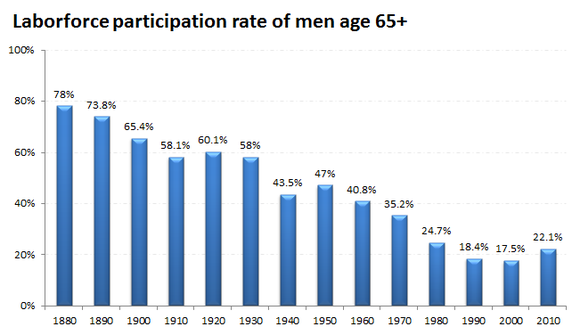

Few are really prepared for retirement, but this is not a big change. There was never a "golden age" for retirement. People used to work longer. Morgan Housel has a great survey of the historical data, including this chart.

Similarly, if millennials do not want to work until age 75, they need a plan! (Reuters)

Market Outlook and Portfolio Evaluation

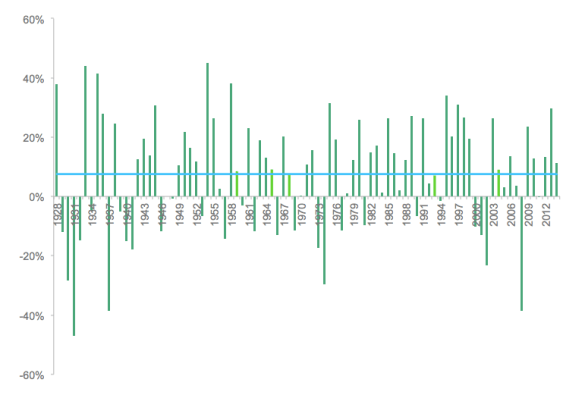

How should you analyze returns? What time period, interval, starting point?Michael Batnick takes up these questions. Most intriguing is the observation that the long-term average of 7.5% was rarely seen. Only 5% of the time was it even close! That is something to keep in mind.

The best six months for stocks are (finally) upon us. (Mark Hulbert).

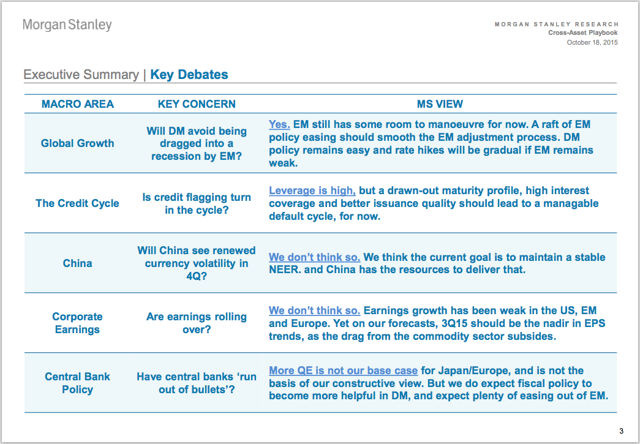

Morgan Stanley's summary of the key macro questions (via BI).

Final Thoughts

Will the Fed alter policy? Will it matter?

On the first question there are conflicting signals from excellent sources - much better than the ill-informed opinions that make up most of the news flow on this subject. It is interesting to note that both sources see a vibrant internal debate at the Fed, where the discussion is free and wide-ranging. Both sources provide some "inside baseball" that you will not see elsewhere.

Dovish. A rate increase is not imminent, and is likely to be delayed until mid-2016. Tim Duy, a leading expert on Fed watching, draws this conclusion from a speech to business economists by Fed Governor Lael Brainard. Prof. Duy raves about the implications of this exciting speech. (Only a true expert and policy wonk could reach that conclusion, but that is why we should pay attention). Brainard is a real all-star, with outstanding academic credentials, consulting experience, and award-winning work for think tanks and government. His key takeaway? She may join with an important Fed coalition that is less committed to an early rate hike.

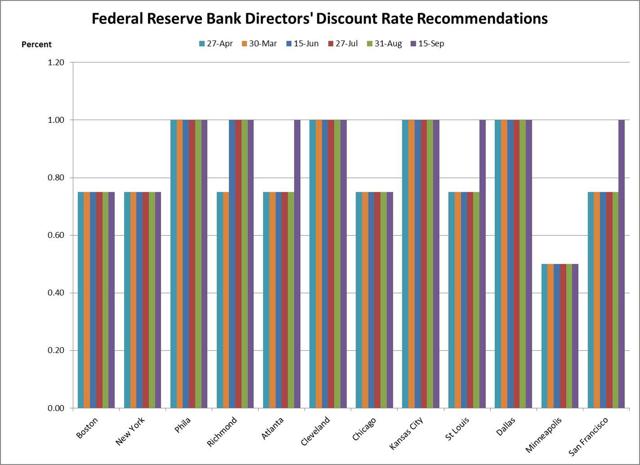

Hawkish. The Fed bank boards are more supportive of an increase in the discount rate. For some years this rate has been 50 basis points above the fed funds rate, so it is an indicator of opinion about a rate increase. The bank presidents are frequently more hawkish than the appointed Governors, and their voting rights on the FOMC go through a rotation. Even so, an excellent and experienced observer, Bob Eisenbeis (via Barry Ritholtz), shows the dramatic shift in the positions of the bank boards.

My own guess is "no change" at this meeting, but I have not ruled out a December shift.

Turning to the question of whether a policy change will matter for your investments - it is not likely unless you are focused on short-term returns. The stock market skeptics believe two things:

- The entire rally has been based upon central bank policy and increased liquidity

- Even a gradual withdrawal of policy accommodation constitutes "tightening."

This leaves us with the ongoing market dilemma - time frames. Are we trading or investing? The former is a matter of psychology, while the latter rests upon your determination of the actual value of each potential investment.

A change in Fed policy is unlikely, but if it happens, it is not really important for long-term investors.

No comments:

Post a Comment