Summary

Five Prime trades at a ridiculously low enterprise value of ~ $280 Million after a $1.74 Billion deal with Bristol Myers Squibb.

Five Prime has other major deals with GSK and BlueBird Bio that could generate hundreds of millions in revenue.

Five Prime is sitting on ~$520 Million in cash and still has a highly effective discovery platform and wholly owned assets.

Sometimes the perfect storm happens when sector sentiment is highly negative and a deal changes the prospects for a stock so drastically that the overall market simply can not digest the new reality for that stock in a short period of time. This happened in early 2014 with Intercept Pharmaceuticals (NASDAQ:ICPT) with the release of their early NASH data, where the stock when up over a hundred percent on the news, and then went up ANOTHER 100% in the days after the release of the data as people realized what a transformation this was for the company.

I think this could be the case with Five Prime Therapeutics (NASDAQ:FPRX) after a recent $1.74 billion dollar deal with Bristol-Myers Squibb (NYSE:BMY). The math is just, well, absurd. As I write this, considering the deal, FPRX will have about $520 M in cash and has a $800 Million Market Cap. Let's look at the prospects for this $280 M enterprise value company.

Let's start with the obvious, the recently partnered FPA-008, a CSF1R antibody. FPRX has additional possible milestones of up to $1.39 B on FPA-008, plus royalty percentage of high teens to low twenties (from deal conference call), plus an opportunity to co-promote in the US. They received $350 Million up front for the deal.

Okay, so first of all, this is the kind of deal you would get for a Phase 3 asset with multi-billion dollar potential, not a Phase 1 asset. These terms are VERY favorable and unusual. So the question is, why? The analysts were badgeringmanagement on the deal call for more information, primarily around why did BMY pay this much? Well, FPRX management (and BMY) have seen recent clinical data on FPA-008 but they can't release it for data integrity reasons and because it has to be presented at an upcoming meeting. So how good do you think that clinical data is for BMY to put down $350 M up front? My guess is that the Phase 1 results to date are likely incredible, and we will see this data come out in the coming months.

I believe FPA-008 should be worth AT LEAST $700 million in value to FPRX, or 3x the current enterprise value of the company. But don't take my word for it, ask BMY. Nobody pays $350 million up front with strong royalties for access to an asset unless they think it could be a megablockbuster. For example, for Ibrutinib in cancer, J&J paid $100 million up front for ex-us rights. Ibrutinib is currently projected to do $6 billion in annual sales at peak.

But then it gets even more ridiculous. If FPA-008 is "A", it also has "B" through "F" to consider in valuing the company:

B. Five prime also has a partnership with GSK in skeletal muscular disorders and respiratory diseases, with potential milestones greater than $100 million. Let's assume the expected value of this is $40 million, based on a high chance of failure, but also significant cash upside if it succeeds. Many companies have much greater than $40 million enterprise values based solely on similar partnership deals with big pharma players.

C. Five prime also has a partnership with Bluebird Bio for Car-T, with potential milestones greater than $100 million. Let's assume this is also worth $40 million, in line with B above.

D. Five prime also has FPA-044, a FGFR2b antibody, in gastric cancer, which is unpartnered. This is a wild card and very difficult to value, but a phase 1 asset addressing a large population of high unmet need patients (gastric cancer) could be also considered to garner about $40 million.

E. Five prime has other out-licenses for which terms are not disclosed.

F. Five prime also has an extremely productive immuno-oncology discovery program, as evidenced by all of these partnerships, especially the recent one with BMY.

So lets say B, C and D are worth $40 million each, and E is worth $10 million. That's $130 million in Net Present Value right there. For F, given the technology platform's productivity and the scarcity value of immuno-oncology assets, you could easily value their platform at greater than $200 million. I think these are all very conservative numbers, but that puts Five Prime's enterprise value at $330 Million, without considering FPA-008.

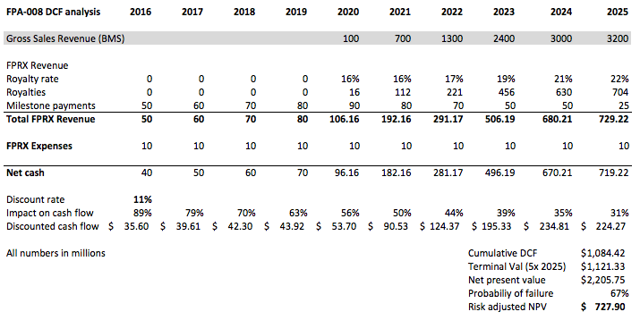

Let's take a closer look at FPA-008, because that should be the main value driver for this company. Below is a rough DCF cash flow analysis of the value to FPRX, assuming it has the potential to be a $3 billion dollar drug. While hard to determine for a phase 1 asset, this peak sales number is based on the huge deal value ($350 M upfront), comparison to other assets (this is 1/2 the peak projected potential of Ibrutinib, for example), and the fact that they are testing it in 6 different indications with Opdivo, BMY's immuno-oncology drug. You can play with the numbers, but the point is, it's NOT WORTH ZERO, and my expectation is more than $700 million given how much stock BMY is putting in it.

$700 million in value from FPA-008 and $330 million from B+C+D+E+F, FPRX would trading at closer to $60 per share to be more fairly valued, and I think that would still leave good room for upside.

There are always risks that FPA-008 or FPRX other candidates could fail, or BMY could pull out of the partnership at some point. However downside risk appears low with $520 million anticipated on the balance sheet for this current quarter. FPRX's yearly cash flow burn is likely to decrease after BMY takes on more FPA-008 expenses (BMY covers all development outside of a few smaller indications). Cash burn was about $40 million in the prior year. FPRX has no debt.

If you don't like discounted cash flow analyses compare the enterprise value to other immuno-oncology players like JUNO therapeutics (NASDAQ:JUNO), Kite Pharma (NASDAQ:KITE) or Aduro Biotech (NASDAQ:ADRO). For a company with this kind of a deal that validates their lead candidate, and such huge potential, the enterprise value is quite absurd.

In conclusion, FPRX is a dramatically undervalued company, resulting from, in my opinion, a market that is too shocked from biotech sentiment and a recent transformational deal to understand. But it may not stay that way for long. This could be a great opportunity for you take advantage of a moment of the mathematical absurdity, and make money.

No comments:

Post a Comment