3D printing, or additive manufacturing, is an exciting and dynamic sector. 3D printing has the ability to change the way products are developed, manufactured, purchased and acquired. Currently there are a variety of stocks that focus on 3D printing. For the investor seeking penny stocks in the 3D printing sector, there are fewer choices. 3D printing-related penny stocks include Tinkerine and Sigma Labs, Inc. Penny stocks present many risks, but for the investor looking for more speculative investments they can also provide attractive upside potential. (To learn more about penny stocks in general, see The Lowdown on Penny Stocks.)

Tinkerine

Tinkerine (TKSTF) is based in Canada and trades on the over-the-counter (OTC) market. The firm is focused on the consumer and educational 3D printing market and sells its Ditto Pro 3D printer, software, filament, and accessories. The Ditto Pro 3D printer has garnered favorable reviews particularly from Make: magazine and received the best 3D printing product award at CES Asia.

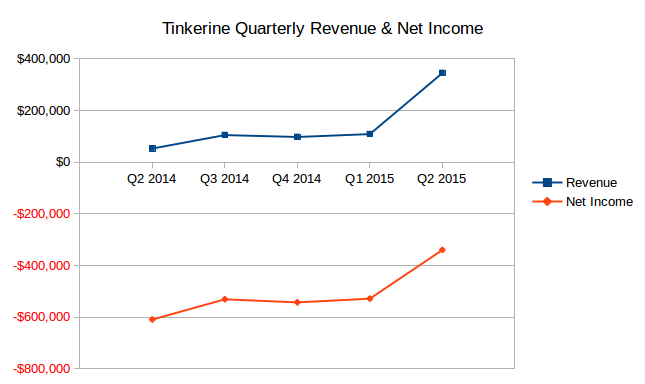

Tinkerine's second quarter of 2015 results show strong revenue growth with Q2 2015 revenue being more than triple first quarter 2015 revenue, growing from C$108,000 to C$345,000. (Tinkerine's financial results are presented in Canadian dollars). Second quarter revenue also was more than six times greater than the posted second quarter 2014 revenue of C$54,603. Despite the strong revenue growth, the firm continues to operate at a loss. In the 2015 second quarter, Tinkerine recorded a loss of C$340,076, but it is trending in a positive direction. The four quarters prior to Q2 2015 all had losses greater than C$500,000.

Tinkerine has shown some positive progress, but investors will have to rely on Tinkerine's ability to continue to raise additional financing until it can operate profitably and with positive cash flow from operations.

Sigma Labs

Another interesting 3D printing penny stock is Sigma Labs, Inc. (SGLB). Sigma Labs was established in 2010 and is based in New Mexico. The firm also trades on the OTC market. Sigma Labs sells a quality management system for additive manufacturing that can assess the quality of a product in real-time as it is produced. Sigma Labs' main quality assessment product, PrintRite3D, is targeted at the aircraft manufacturing industry for parts that are created using additive manufacturing.

Sigma Labs also has a 3D printing contract manufacturing product line. The firm recently acquired a state-of-the-art metal printer. Assuming Sigma Labs can secure customers for its contract manufacturing services, this product line should immediately contribute to revenue and net income growth.

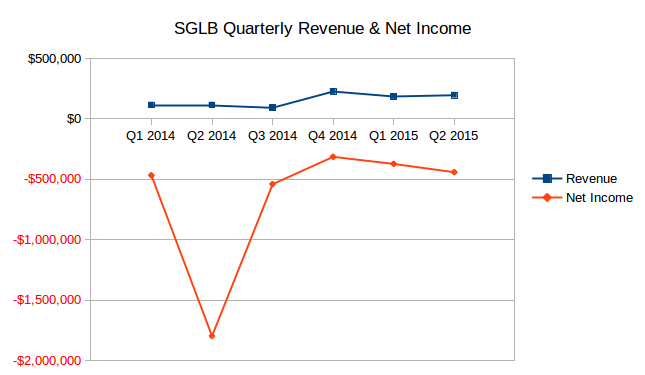

Sigma Labs' historical financial performance shows stagnant revenues and net income that has declined the last two quarters. Investors should be cautious as the firm has been unable to generate substantial revenue growth. Without substantial revenue growth or aggressive cost cutting, the firm will not obtain profitability.

There are some events on the horizon that could begin to grow Sigma Labs' revenues. As previously mentioned, Sigma Labs is expanding into contract manufacturing with its metal 3D printer. This product line could add additional revenue and profits. The firm appears to be generating some traction with its additive manufacturing quality assurance product line. Sigma Labs disclosed that it entered into an agreement with Honeywell International, Inc. (HON) to test Sigma Labs' PrintRite3D system. A successful test by Honeywell could lead to additional purchases from Honeywell and other customers.

The Bottom Line

For investors that understand the risks of investing in penny and OTC stocks, these two stocks can offer an interesting entry point into the 3D printing sector. Tinkerine has shown positive growth in Q2 2015 and has an award-winning product. Sigma Labs is adding additional product lines and has large corporations testing its quality assurance product. The 3D printing sector is competitive and fast changing; making once promising companies obsolete and catapulting some firms to large valuations. The risks with Tinkerine and Sigma Labs are high, but the upside could be substantial

By John Linton

Source: http://www.investopedia.com/articles/investing/091615/two-penny-3d-printing-stocks-watch-out.asp

No comments:

Post a Comment