Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Summary

- Tegna is exposed to the growth of broadcasting and digital advertising.

- Super Bowl, political campaigns and the Olympics will be catalytic for the financial and stock performance of the company.

- EVA reveals upside in excess of 40%.

Classification

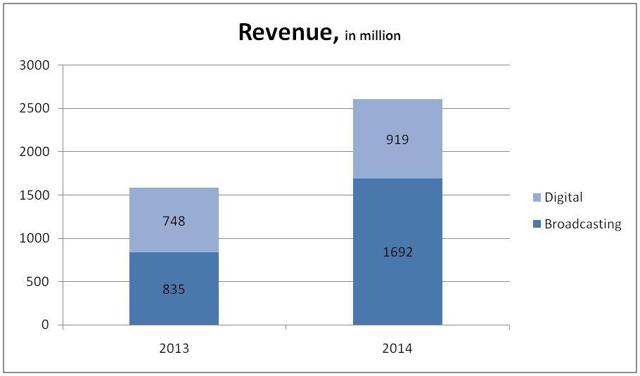

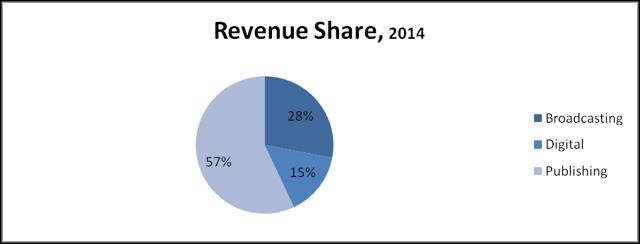

TGNA generates its revenue from broadcasting and digital activities. Both segments, in the past, have been bringing in significant amount of revenue. In 2014, before the split up, broadcasting revenue represented 28% of Gannett's total revenue, while digital represented 15%. The rest was generated by the company's publishing segment.

TGNA generates its revenue from broadcasting and digital activities. Both segments, in the past, have been bringing in significant amount of revenue. In 2014, before the split up, broadcasting revenue represented 28% of Gannett's total revenue, while digital represented 15%. The rest was generated by the company's publishing segment.

Source: SEC Filing, Gannett

Tegna's broadcasting segment generates revenue from core advertising, political advertising, retransmission fees, digital marketing and others. However, the company primarily relies on revenue from core advertising. Core advertising comprises local and national non-political marketing. In 2014, this particular service alone generated 61% of the total broadcasting revenue of the company.

Digital segment brings in revenue from the company's online subsidiaries, including cars.com, CareerBuilder, PointRoll, ShopLocal and others. The acquisition of Belo Corp. and a number of television stations of London Broadcasting Company increased the company's reach to more television households in the U.S. Its digital segment experienced an increase of 23% in 2014, which was driven by the acquisition of cars.com and increasing CareerBuilder revenue.

Source: SEC filings, Gannett

The broadcasting and digital segments have posted a strong performance in 2014. Since cars.com was acquired halfway through last year, we believe that a significant amount of benefit is yet to be realized in 2015. The acquisition of Belo Corp. and London Broadcasting Company will add value to TNGA in coming years.

Industry Prospects

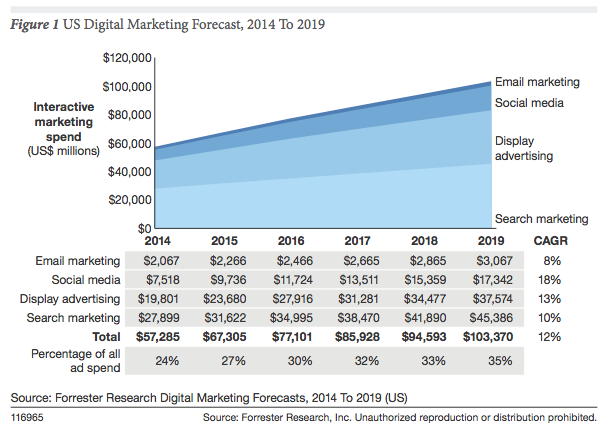

TGNA is exposed to the growth of digital marketing and broadcasting. According to Forrester Research, Inc., digital marketing spending in the U.S. will experience a healthy CAGR of 12% to reach $103 billion by 2019. Although marketing through search engines will remain of much greater significance, but spending on social media advertising will grow at a much faster rate.

TGNA is exposed to the growth of digital marketing and broadcasting. According to Forrester Research, Inc., digital marketing spending in the U.S. will experience a healthy CAGR of 12% to reach $103 billion by 2019. Although marketing through search engines will remain of much greater significance, but spending on social media advertising will grow at a much faster rate.

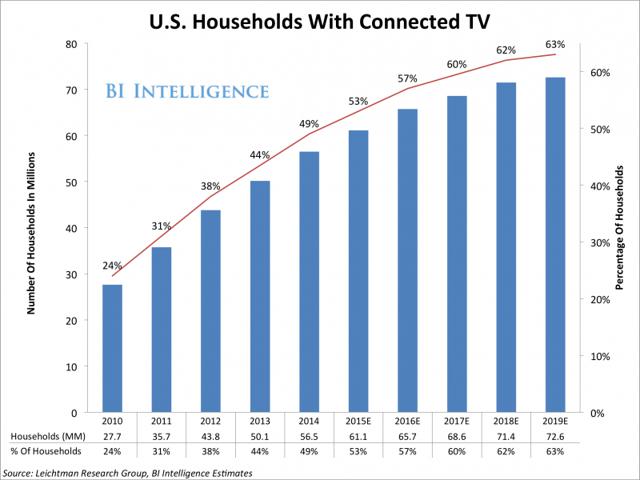

The company currently owns about 64 television stations, which enabled it to cover almost one-third of U.S television households. Any growth in television users will have a significant impact on TGNA's market share. Demand for connected TV , also known as smart TV, is on the rise. Business Insider, a research firm, has stated that in 2014, nearly half of the total U.S. households owned a smart TV. The firm predicts that this figure will reach 60% by the end of 2019.

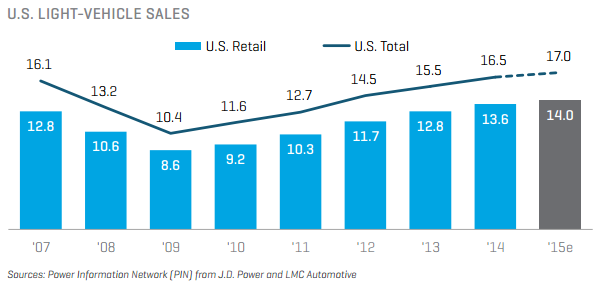

Due to the recent acquisition of cars.com, TGNA will be affected by trends in the U.S automotive industry as well as by the rate of urbanization. According to a document by OESA, future sales of total and retail new light vehicles will increase by 5.7% and 2.9%, respectively, in 2015.

The study further predicts that the total population in urban areas will grow to 269 million, 84% of the U.S. total population, and will continue its growth towards a figure of 312 million people by 2030. All in all, we expect revenue growth for TGNA in coming years, which will be fueled by an increased number of U.S. TV households, business spending on digital marketing, a growing automotive industry and urbanization in the U.S.

Thesis

Creation of two separate businesses enhances focus. The decision to spin off the publishing business from the broadcasting and digital segment will help Tegna to focus on its digital properties, especially marketing. Management of Tegna is planning to return $1.5 billion to its shareholders by maintaining a compound annual revenue growth of 7-9% and EBITDA margins between 32% and 37% for the next three years.

Creation of two separate businesses enhances focus. The decision to spin off the publishing business from the broadcasting and digital segment will help Tegna to focus on its digital properties, especially marketing. Management of Tegna is planning to return $1.5 billion to its shareholders by maintaining a compound annual revenue growth of 7-9% and EBITDA margins between 32% and 37% for the next three years.

"We have top performing assets with expansive scale in growing, in-demand sectors, strong and dependable cash flows, and industry-leading margins, all of which will provide us with ample flexibility to invest for growth while providing attractive returns to our shareholders," says TGNA's CEO.

Political and sporting events will fuel growth: Sporting events like Super Bowl 2016 and Olympics 2016 will result in increased TV viewership in the US. Super Bowl is a prestigious NFL sporting event that has a history of capturing enormous viewership every year. The last Super Bowl event was able to increase its viewership by 2.2 million to a new peak of 114.4 million. With more people watching the event each year, we expect the 50th Super Bowl 2016 to trend even higher. The U.S. presidential elections of 2016 further support our bullish view. TGNA anticipates its 25 stations will be covering Senate races and seven media stations will cover governor races. Reuterspredicts the political advertisement spending in the TV broadcasting segment will increase and surpass $6 billion in 2016, capturing the highest shares across mediums. We believe that increasing viewership in 2016 amid events like Super Bowl and the Olympics, along with an expected increase in political advertisement spending will boost Tegna's financial performance in 2016 and will be catalytic for stock price growth.

Cars.com and CareerBuilder may sprout growth for the digital segment. CareerBuilder anticipates growth in its revenues for 2015. Findings of a national survey, conducted on behalf of the company, states that in 2015,36% of employers will be willing to expand their permanent workforce, which is an improvement of 13% compared to 2014. Further, the demand for services in emerging fields like cyber security, cloud technology, anti-terrorism, alternative energy sources indicates that the demand for labor force is expected to rise. According to the CEO of CareerBuilder:

"The U.S. job market is turning a corner as caution gives way to confidence. Hiring in 2014 was broad-based, including encouraging activity among small businesses and hard-hit sectors like manufacturing and construction. The amount of companies planning to hire in 2015 is up 12 percentage points over last year, setting the stage for a more competitive environment for recruiters that may lend itself to some movement in wages."

Cars.com was acquired in October 2014 as a part of Gannett's digital business segment. Through this acquisition, the company has diversified its product portfolio even further by taking a step in the online automotive industry. The acquisition will allow TGNA to use its broadcasting expertise, e.g. advertisement and local programming, to improve the number of site visits per month. Cars.com has recently announced its new service and repair online feature, which will allow Tegna to penetrate into the repair and maintenance segment of the automobile market. Jesse Toprak, chief analyst at Cars.com,says:

"We expect sales to continue on a very positive trajectory, with the industry set to hit 17.1 million units in 2015."

Despite being a specific purpose website, cars.com holds a 341 Alexa rank, and globally, the company has surpassed

55 website in last three months. With realization of combination synergies and introduction of new repair feature, cars.com will witness substantial growth in 2015.

55 website in last three months. With realization of combination synergies and introduction of new repair feature, cars.com will witness substantial growth in 2015.

Video Call Center will become a major part of the industry. The broadcasting industry is becoming competitive, what with different TV stations competing for ratings and ad sales. Businesses will be looking forward to invest in features that will give them a competitive advantage. We believe VCC(Video Call Center) will allow TGNA to achieve just that. VCC is an invention of Tom Wolzien that allows broadcasters to produce shows through video calls from smartphones or computers. The place where the feature really shines is the fact that VCC can be utilized without the need of going into a control room. This will enable its users to create qualitative and interactive programming from anywhere in the world without incurring expensive studio and control room expenses. Within five years, video caller television will be a mainstay among broadcast stations, cable networks and web services seeking to extend viewer interaction, says Wolzien, founder, creator and chairman of The Video Call Center. We believe TGNA's investment into Wolzien's VCC will enable it to stand out against its competitors in terms of interaction and low-cost programming.

Valuation

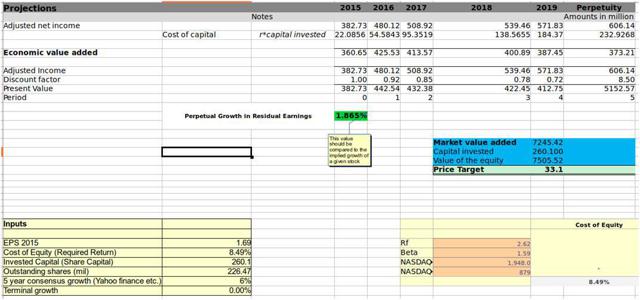

P/E- and EVA-based valuation methods are used to value Tegna's stock. Discounted EVA reveals that the stock is undervalued. See the calculations below:

P/E- and EVA-based valuation methods are used to value Tegna's stock. Discounted EVA reveals that the stock is undervalued. See the calculations below:

Assumptions

- The low end of EPS estimates is used for 2015 and 2016. 6% growth is assumed during 2016-2020. No growth is assumed in perpetuity.

- CAPM is used to calculate the cost of equity. S&P 500 is used as a proxy for market returns.

- Incremental earnings are assumed to increase the cost of equity.

Source: Focus Equity

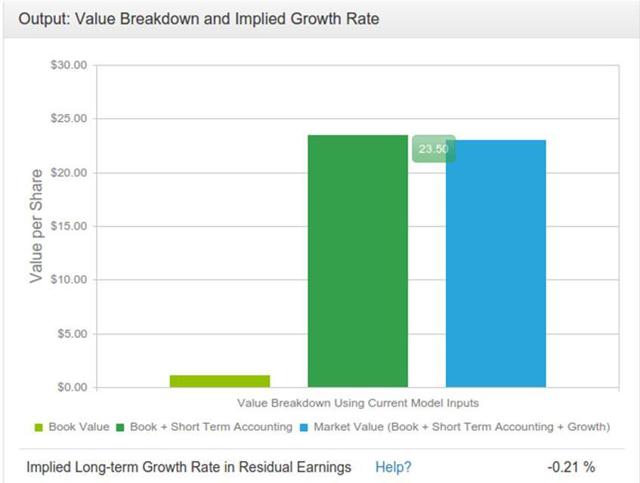

The valuation table reveals an upside of around 40% for TGNA's stock. Note that the company is confident to achieve 10% growth in revenue during the next three years, while our earnings are projected on 6% earnings growth, making this valuation a prudent estimate. The table also shows that the company will achieve perpetual growth of 1.86% in residual earnings, based on current assumptions. Let's compare this figure with the implied growth of the company.

Implied growth of -0.21% means that even with zero forward growth in earnings, the stock is trading at a discount. To be more specific, the earnings should decline -0.21% in perpetuity for TGNA to achieve its current market value. But the valuation table above shows that Tegna can achieve 1.8% growth in residual earnings, indicating that the stock has quite an upside to it. As a rule of thumb, implied growth lower than the perpetual growth of a given company's earnings indicates undervaluation. Tegna's stock certainly depicts that.

The stock is trading at a forward P/E of around 10, while the S&P 500 trades at around 18. The S&P 500 is actually a little expensive, but even if it were trading around 15, Tegna will still be relatively cheap considering it's trading around 10.

In conclusion, Tegna is a strong buy, given visible catalysts like the presidential election campaign, Super Bowl and Olympics 2016. Spinning off the publishing business will redirect management's focus on growing the digital business. Not to mention, television broadcast still holds the top spot in terms of advertisement spend. The valuation model also demonstrates significant value in the stock. Tegna's stock will award value investors, especially in the next twelve months or so.

Additional disclosure: "This publication is for informational purpose only and reflects the opinion of Focus Equity’s analysts. The opinion doesn't constitute a professional investment advice. Our technology analysts, Soid and Usman, compiled this research piece. Focus Equity is a team of analysts that strives to provide investment ideas to the U.S equity investors."

By Focus Equity

No comments:

Post a Comment