Summary

About The Medical Equipment Industry

The Medical Equipment Industry deals primarily with medical devices.

"A medical device is an instrument, apparatus, implant, in vitro reagent, or similar or related article that is used to diagnose, prevent, or treat disease or other conditions, and does not achieve its purposes through chemical action within or on the body" (from Wikipedia).

Five main aspects worth being mentioned about this industry:

- It is strongly represented by institutional investors (for companies in the sample, institutional ownership stands, on average, at around 80%).

- In 2010, the healthcare reform in the US was enacted into law and subsequently a 2.3 percent excise tax on Class I, II and III medical devices was imposed. As a consequence, several cost-reduction initiatives have been conducted by many industry players.

- During the last several years, this industry has been strongly interested by M&A activity, leading to increased financial leverage, and some major spinoffs.

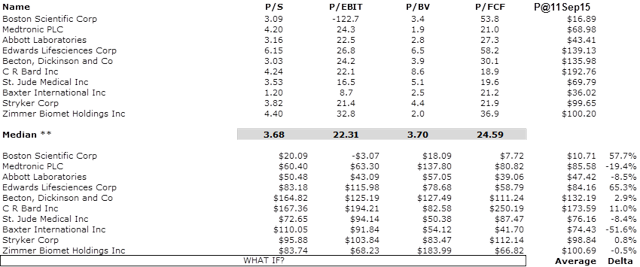

- The main financial ratios look quite high (median P/S and P/B: 3.6).

- In several cases, profitability has been impacted by litigation-related charges and impairments.

The following peer companies have been considered into this analysis

Boston Scientific Corp. (NYSE:BSX): A worldwide developer, manufacturer and marketer of medical devices that provide alternatives to surgery and other medical procedures that are typically traumatic to the body. Operating segments: Interventional Cardiology (28% of FY2014 net sales), Cardiac Rhythm Management (26%), Endoscopy (18%), Peripheral Interventions (12%), Urology and Women's Health business (7%), Neuromodulation (6%), and Electrophysiology (3%).

Medtronic plc (NYSE:MDT): A global player in medical technology that researches, designs, manufactures and sells device-based medical therapies to alleviate pain, restore health and extend life. Operating segments: Cardiac and Vascular (35% of 1Q 2016 net sales), Minimally Invasive Technologies (formerly Covidient; 34%), Recovery Restorative Therapies (25%), and Diabetes (6%). MDT acquired Covidien plc in January 2015 for $49.9 billion.

Abbott Laboratories (NYSE:ABT): Abbott's principal business is the discovery, development, manufacture, and sale of a broad and diversified line of health care products. Operating segments: Established Pharmaceutical Products (16% of FY2014 net sales), Diagnostic Products (23%), Nutritional Products (34%), Vascular Products (15%), and Other Products (12%).

Edwards Lifesciences Corporation (NYSE:EW): A global leading manufacturer of heart valve systems and repair products used to replace or repair patients' diseased or defective heart valves and hemodynamic monitoring systems used to measure a patient's cardiovascular function in the hospital setting. Operating segments: Transcatheter Heart Valve Therapy (41% of FY2014 Net Sales), Surgical Heart Valve Therapy (35%), and Critical Care (24%).

Becton, Dickinson and Company (NYSE:BDX): A global medical technology company engaged principally in the development, manufacture and sale of medical devices, instrument systems and reagents used by the pharmaceutical industry. Operating segments: BD Medical (54% of FY2014 net sales. Products: needles, syringes, intravenous catheters for medication delivery, sharps disposal containers...) and BD Life Sciences (46%. Products: systems for specimen collection, blood culturing, molecular testing for infectious diseases, fluorescence-activated cell sorters and analyzers, monoclonal antibodies and kits for performing cell analysis...).

C. R. Bard Inc. (NYSE:BCR): Bard is engaged in the design, manufacture, packaging, distribution and sale of medical, surgical, diagnostic and patient care devices. Operating segments: Vascular (28% of FY2014 net sales), Urology (25%), Oncology (27%), Surgical Specialties (17%), and Other (3%).

St. Jude Medical Inc. (NYSE:STJ): STJ manufactures and distributes cardiovascular medical devices for the global cardiac rhythm management, cardiovascular and atrial fibrillation therapy, interventional pain therapy and neurostimulation devices for the management of chronic pain and movement disorders. Operating segments: Implantable Cardioverter Defibrillator Systems (31% of FY2014 Net Sales), Pacemaker systems (19%), Atrial Fibrillation Products (18%), Vascular Products (13%), Structural Heart Products (11%), and Neuromodulation Products (8%).

Baxter International Inc. (NYSE:BAX): BAX develops, manufactures and markets medical products (pre-filled vials and syringes for injectable drugs; intravenous nutrition products and solutions; infusion pumps and inhalation anesthetics; products and services related to pharmacy compounding, drug formulation, packaging technologies and to treat renal diseases - like dialysis equipment...).

Baxter spun off its BioSciences unit (specialized in treatments for hemophilia and other bleeding disorders; and plasma-based therapies to treat immune deficiencies and other chronic and acute blood-related conditions…) on July 1, 2015 as a separately traded public company named Baxalta (NYSE:BXLT) and retained a 19.5% ownership stake immediately following the separation.

Stryker Corp. (NYSE:SYK): Stryker is a global medical technology company. Its products include implants used in joint replacement and trauma surgeries, surgical equipment and surgical navigation systems, endoscopic and communications systems, patient handling and emergency medical equipment, neurosurgical, neurovascular and spinal devices. Operating segments: Orthopaedics (43% of FY2014 Net Sales), MedSurg (39%), and Neurotechnology and Spine (18%).

Zimmer Biomet Holdings Inc. (NYSE:ZBH): ZBH designs, develops, manufactures and markets orthopedic reconstructive, spinal and trauma devices, biologics, dental implants and related surgical products and provides other healthcare related services. On June 24, 2015, Zimmer Holdings Inc. completed its merger with LVB Acquisition, the parent company of Biomet, and changed its name to Zimmer Biomet Holdings Inc. (in a $13.35 billion transaction).

Among peer companies that haven't been considered into this analysis:

Cook Inc. and W.L. Gore & Associates (due to the fact they are privately held); many other minor competitors in the industry like Sorin Group, Endologix, Nevro Corporation, TriVascular Technologies, Lombard Medical, NuVasive, Globus Medical, Alphatec Holdings, K2M Group Holdings, LDR Holding Corporation, Orthofix International, Insulet Corporation, Tandem Diabetes Care... (due to their size).

The following is my findings and personal opinions in respect of values as of the 11th of September 2015.

Boston Scientific Corp.: Revenues experienced a negative compound annual growth rate - C.A.G.R. - of 3.4% during the period 2009-2013. More recently, revenues improved substantially but are forecasted to be flat by the end of FY2015 if compared to the previous year. Except for the financial year 2011, BSX has experienced a net loss during each year for at least the last 5 years. Among the reasons of such a persistent negative profitability are: litigation-related charges recorded in the amount of $1.036 billion, $221 million and $192 million during 2014, 2013 and 2012, respectively; and a goodwill impairment charge of $1.817 billion recorded in 2010. BSX looks currently markedly overvalued. Opinion: Sell. Horizon: Until next earnings date. (Share price: $16.89 at close on Sept. 11, 2015).

Medtronic plc: Sales have consistently improved for at least the last 5 years while operating income of the last reported financial year stands at the same level as it was in FY2011. The Z-score is good and the level of debt seems manageable. Operating cash flows are improving. MDT looks fairly valued. Opinion: Hold. Horizon: Until next earnings date. (Share price: $69.90 at close on Sept. 11, 2015).

Abbott Laboratories: During the last three and a half years, revenues were in an upward trend. Revenues' growth rate currently looks quite soft. Net income for the twelve trailing months is around $4.52 billion (P/E 14.3). It includes the effects of an after-tax $1.6 billion gain on the February sale of Abbott's developed markets branded generics pharmaceuticals business to Mylan Inc. (NASDAQ:MYL) in a deal valued at $5.77 billion. ABT currently looks overvalued primarily due to a free cash flow future growth rate estimated in the low single digit. Opinion: Sell. Horizon: Until next earnings date. (Share price: $43.41 at close on Sept. 11, 2015).

Edwards Lifesciences Corporation: Growing revenues, operating income and equity during at least last 5 years. At least 5 years of improving net income. High Z-score, low debt/equity and pays no dividend. Albeit a very good and promising company, EW looks now markedly overvalued. Opinion: Sell. Horizon: Until next earnings date. (Share price: $139.13 at close on Sept. 11, 2015).

Becton, Dickinson and Company: Growing revenues during at least last 5 years. Robust overall profitability. On March 2015, the company acquired CareFusion in a deal valued at $12.54 billion. Low Z-score (which means some financial fragility). High debt/equity (1.8). Looks now overvalued based also on reduced operating cash flows and higher capex. Opinion: Sell. Horizon: Until next earnings date. (Share price: $135.98 at close on Sept. 11, 2015).

C. R. Bard Inc.: Growing revenues during at least last 5 years. During last reported quarter, as the year earlier, BCR recorded a net loss which reflects litigation charges. Good Z-score and low debt/equity. Looks currently undervalued. Opinion: Buy. Horizon: Until next earnings date. (Share price: $192.76 at close on Sept. 11, 2015).

St. Jude Medical Inc.: Revenues and operating income have been relatively flat over the past several years. STJ started paying dividends quite recently (from FY2011). Z-score is good, debt/equity is around 1, but more debt will come from the Thoratec acquisition signed on July 21, 2015 ($3.7 billion in new debt expected). With $1 billion of free cash flow realized in the last twelve months, STJ looks currently moderately overvalued. Opinion: Sell. Horizon: Until next earnings date. (Share price: $69.79 at close on Sept. 11, 2015).

Baxter International Inc.: Increasing revenues during at least the last 5 financial years, and more recently, on the downward partially due to decreased sales of cyclophosphamide as the result of a generic competitor entering the U.S. market. Pays regular dividends and Z-score is fine. High debt/equity ratio but without taking into account the effects of the Baxalta spinoff (the value of the company's investment in Baxalta as of July 1, 2015 was approximately $4.3 billion) which will be presented as a discontinued operation starting in the third quarter of 2015. Based also on company growth projections, BAX looks fairly valued. Opinion: Hold. Horizon: Until next earnings date. (Share price: $36.02 at close on Sept. 11, 2015).

Stryker Corp.: Growing revenues in the high single digit during at least the last 10 years, but overall profitability has been impacted by Rejuvenate and ABG II Modular-Neck hip stems' recalls started in 2012. At the end of 2014, Stryker entered into a settlement agreement to compensate eligible U.S. patients. Probable losses to resolve the matter have been estimated between $1.7 billion and $2.54 billion, and in July 2015, they made initial payments totaling $1.08 billion. High Z-score and low debt/equity ratio. Currently, SYK looks substantially overvalued. Opinion: Sell. Horizon: Until next earnings date. (Share price: $99.65 at close on Sept. 11, 2015).

Zimmer Biomet Holdings Inc.: Growing revenues during at least last 6 years. During last reported quarter, profitability has been impacted by special items related with the Biomet merger and a net loss of $158 million has been recorded. The overall financial soundness has been impacted by the merger as reflected by a low Z-score of 1.7 and a debt/equity ratio of 1.2. Currently, Zimmer looks fairly valued. Opinion: Hold. Horizon: Until next earnings date. (Share price: $100.20 at close on Sept. 11, 2015).

Value opinion on the Medical Equipment Industry based on DCF analysis

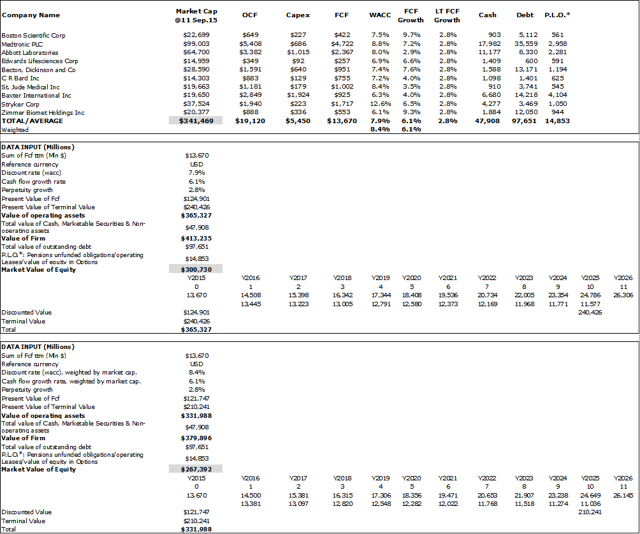

To reach the fair value of this bundle of stocks compared with its market price, the following steps were conducted:

- The added free cash flows of this bundle of companies (considered as a whole) have been projected to the future and discounted back by employing as weighted average cost of capital: a) the average of each single company WACC weighted for market capitalization, and b) the average of each single company WACC;

- The sum of the operating leases, stock options and retirement and post-retirement unfunded obligations for each company have been estimated and subtracted from the total market value of equity;

- The appropriate short/medium and long-term FCF future growth rate of the bundle a) Weighted for market capitalization, and b) Unweighted for market capitalization has been estimated by looking back into the financial reports of each target company to see how it performed in the past. With the bundle meaningful enough, then the entire Medical Equipment Industry overvaluation might be inferred. The resulting figures are as follows (millions of dollars):

a) (Weighted)

FCF TTM: $13.67 billion, WACC: 8.4%, short-medium term FCF growth rate: 6.1%, long-term FCF growth rate: 2.8%, value of cash, marketable securities & non-operating assets: $47.91 billion, financial debts: $97.65 billion, and estimated value of operating leases, stock options, retirement and post-retirement unfunded obligations: $14.85 billion.

The final computed figure gives an estimated result of fair value of the bundle of companies equal to $267.39 billion, which compared to the current market price of around $341.47 billion, shows an overvaluation of almost 27.7%.

b) (Unweighted)

FCF TTM: $13.67 billion, WACC: 7.9%, short-medium term FCF growth rate: 6.1%, long-term FCF growth rate: 2.8%, value of cash, marketable securities & non-operating assets: $47.91 billion, financial debts: $97.65 billion, and estimated value of operating leases, stock options and retirement and post-retirement unfunded obligations: $14.85 billion.

The final computed figure gives an estimated result of fair value of the bundle of companies equal to $300.73 billion, which compared to the current market price of around $341.47 billion, shows an overvaluation of almost 13.5%.

Financial soundness, measurable by the Altman Z-score index*, has resulted in a high aggregated value equal to 3.24 (weighted) and 3.62 (unweighted) which both stand over the "grey" zone.

*For an explanation both of the Z-score index and of the proprietary WHAT-IF analysis, which follows, please review my previous article on the Domain Names Sector here.

Check of Value opinion on the Health Care Equipment Industry based on proprietary WHAT-IF analysis

**Due to the specificity of the bundle of companies chosen here, instead of an average value the median value has been computed.

Value opinion on the Medical Equipment Industry based on DCF analysis: Tables

By Plexor

THIS ARTICLE DISCUSSES MY OPINION AND REASONABLE EFFORT HAS BEEN USED TO ENSURE ACCURACY OF THE INFORMATION PROVIDED. HOWEVER, THERE MAY BE INACCURACIES DUE TO HUMAN OR OTHER ERROR. THOSE INACCURACIES INCLUDE, BUT ARE NOT LIMITED TO, INCONSISTENCIES, OMISSIONS, AND SPELLING MISTAKES. NO RESPONSIBILITY IS ASSUMED FOR ANY ERRORS OR FOR THE CONSEQUENCES OF RELYING OR ACTING ON THE INFORMATION PROVIDED IN THIS ARTICLE. IN NO EVENT WILL THE CONTRIBUTOR BE LIABLE FOR ANY DIRECT, INDIRECT, SPECIAL OR CONSEQUENTIAL DAMAGES, NO MATTER WHAT THE CAUSE.

No comments:

Post a Comment