Summary

- With my 2015 biotech value picks portfolio up 49.2% year to date, I decided to go through the same exercise to present picks for starting in Q2.

- My value biotechs starting Q2 2015 include QLT, Biota Pharmaceuticals, MEI Pharma, Endocyte, Tonix Pharmaceuticals, Loxo Oncology, Tenax Therapeutics, and Dara Biosciences.

- While returning 50% in one quarter is unlikely to be replicated, I believe that my value investing strategy in the volatile biotech space provides good upside potential while reducing risk.

Even with the pullback in biotech stocks this week with the iShares NASDAQ Biotechnology Index ETF (NASDAQ:IBB) down 3.9% and the SPDR S&P Biotech ETF (NYSEARCA:XBI) down 5.0%, it has still been a great quarter for biotech (two trading days left), with the IBB up 14.5% and the XBI up 17.9%.

Even better has been the success of my Top Biotech Value Picks of 2015 portfolio, which is now up 49.2% on the year (outperforming the XBI by 31.3 percentage points):

With the popularity of my 2015 Top Biotech Value Picks article (it was my most viewed article) and with its substantial success so far this year, I wanted to go through the exercise again this weekend to develop my top value biotech picks starting in Q2 2015 for the next twelve months.

As a reminder, I followed the rules of the 2015 Biotech Charity Contest on Silicon Investor to craft my portfolio (a contest that everyone should look to join in 2016):

-Starting value in virtual currency: $100,000

-Number of stocks: 8-10

-Allowable allocation per stock: 5-20%

-Performance measurement period: Close on March 31st, 2015 to close on March 31st, 2016

-Trading: No trading is allowed during the year

-Buyouts: Buyouts/reverse mergers are processed as they would be normally in the market. In the event of a buyout involving cash, the cash will be allocated to the other picks in accordance to the percentages chosen at the beginning of the year.

The main universe I analyze for potential investment is biotech stocks trading at 2x or less times book. In a nutshell, the goal behind my investment strategy is minimizing risk while maximizing upside, all while participating in the market's most volatile sector. The strategy worked very well in Q1 so far with one 200%+ gainer in Recro Pharma (NASDAQ:REPH), two reverse mergers with Targacept (NASDAQ:TRGT) and Regado Biosciences (NASDAQ:RGDO), and my spec pick up over 30% with Rosetta Genomics (NASDAQ:ROSG). Even better is the fact that there are only two names that are down, with the worst only down a bit more than 10%.

Without further delay, below are the Top Biotech Value Picks Starting in Q2 2015:

Note: I will be readjusting the prices and share amounts based on Tuesday's close for proper tracking starting at the beginning of Q2.

QLT Inc. (NASDAQ:QLTI) - 20% allocation. QLT Inc is a $196.6 million biotechnology company dedicated to the development and commercialization of innovative ocular products that address the unmet medical needs of patients and clinicians worldwide. Since Endo International plc (NASDAQ:ENDP) announced an offer to buy Auxilium Pharmaceuticals (NASDAQ:AUXL) afterhours on September 16th competing with the offer made by QLT on June 26th, QLT stock has declined more than 38%.

QLTI data by YCharts

On October 9th, QLT announced that its merger with Auxilium Pharmaceuticals (which had been very well-received by the market when it was initially announced in June) was terminated due to Auxilium receiving a superior offer from Endo. As a value biotech investor, QLT is a name that is always on my radar. While it can often be hard to find shareholder-friendly management teams in biotech, QLT has a history taking very shareholder-friendly actions as illustrated by the $200 million dividend paid out in mid-2013 and the merger that it had negotiated with Auxilium.

Providing downside protection for shareholders is the company's $155.9 million cash balance as of year-end 2014, amounting to $3.04 per share. Shareholder equity sits slightly above this level. The main catalyst is that the company is currently up for sale and looking for a strategic alternative:

Following the termination of the Merger Agreement in October 2014, QLT has continued to review its strategic and business options, having engaged Greenhill & Co. to act as its advisor in connection with developing, and providing advice with respect to, various strategic and business alternatives for the Company. Strategic and business alternatives that QLT may consider include, but are not limited to, asset divestiture, partnering or other collaboration agreements, merger, reverse merger, reorganization or similar transactions, potential acquisitions, or recapitalizations.

Ideally the company would have some interested parties in mind from the previous search it completed when it identified the Auxilium transaction. Additionally, the company is pursuing options for its lead candidate, QLT091001, for the treatment of IRD in Europe:

In an effort to accelerate the commercial availability of QLT091001 as a treatment option, the Company is currently exploring with the EMA a submission of a Marketing Authorization Application ("MAA") in 2016 for conditional approval of QLT091001 for the treatment of IRD based on the existing clinical data. Advisory meetings with certain European regulatory authorities are scheduled for early 2015. The outcome of these meetings will determine whether the Company proceeds to submit a Marketing Authorization Application for conditional approval with the EMA and decisions concerning the timing of commencement of a pivotal trial.

With significant cash reserves, an ongoing search for a strategic action, and the company continuing to make progress with its lead pipeline candidate, I think that this presents one of the best risk/reward ratios in biotech currently. With institutional ownership greater than 70% and Baker Brothers, BVF, and Broadfin all involved, institutions clearly agree that this stock presents significant value, and I believe now is a great time to go long.

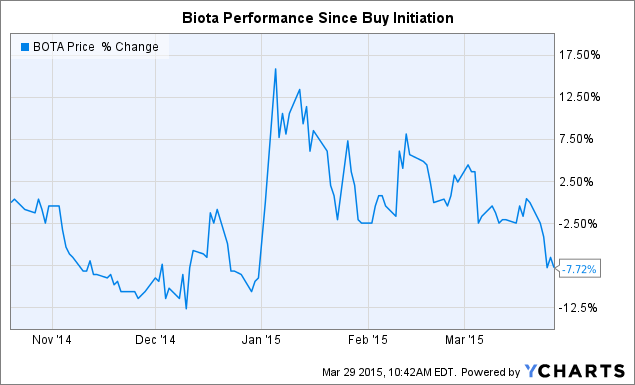

BOTA data by YCharts

Management continues to work to identify ways to bring value to shareholders. On February 26th, the company announced that it would acquire Anaconda Pharma for $8 million in cash and 3.5 million shares of Biota stock. Through this deal, the company acquired a pipeline led by AP611074, a direct-acting antiviral for the treatment of genital warts and recurrent respiratory papillomatosis. HPV types 6 and 11, the most frequent virally transmitted sexual diseases, cause both of these ailments. The company plans to begin a phase 2b trial for AP611074 in H2 2015.

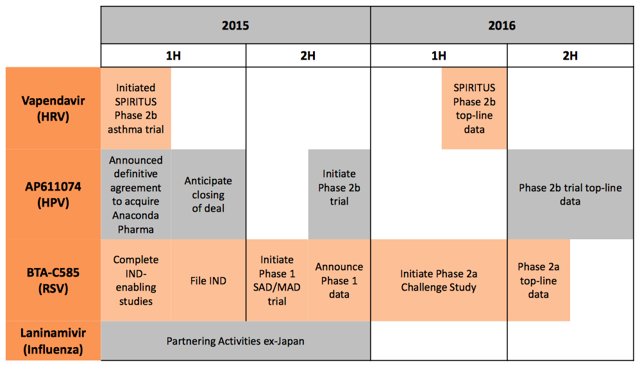

Additionally, the company recently began dosing in March for the phase 2b trial of vapendavir in patients with HRV and moderate-to-severe asthma with results expected in Q2 next year. A full list of pipeline catalysts is listed below:

Source: March 2015 Roth presentation

With $93.4 million in assets as of year-end (mostly cash, cash equivalents, and receivables) and $82.4 million in shareholder equity, the company is in good shape financially even with the $8 million outlay for the acquisition, deserving much more than a $79.7 million market cap. The company typically sees 75-80% of annual royalty revenues from Inavir and Relenza in the quarter ending March 31st, providing more near-term cash flow. Given solid financials and significant progress in the clinic, the market is being overly negative. The company was able to bring in an attractive asset through a small cash outlay and minimal dilution, making what was already an attractive stock an even better buy.

MEI Pharma (NASDAQ:MEIP) - 15.0% Allocation. MEI Pharma recently gained the attention of biotech investors in a bad way on March 23rd byannouncing phase 2 failure of pracinostat in front-line myelodysplastic syndrome, sending the company's stock cratering by over 69%. The stock continued its decline by dropping another 10% in the next four days of trading. While I always say that it's never smart to buy the drop on the first day as institutional investors will jump over each other headed to the exits with their thesis disproved and I often suggest waiting a few weeks before entering, I think it's reasonable to look to go long MEI at these levels given that the company actually does have upcoming catalysts even after this major setback.

(click to enlarge)

While pracinostat did not achieve a statistically significant result in MDS, the company will be presenting full phase 2 data in front line elderly AML at the European Hematology Association Congress in mid June, which Cantor believes could act as a substantial catalyst as it thinks duration endpoints are the best gauge of efficacy (as opposed to response rate). Some investors, including Seeking Alpha's Stock Doctor, have not given up and see upside for pracinostat in front line MDS based on duration and survival readouts expected at the American Society of Hematology annual meeting and exposition in early December. I highly recommend Stock Doctor's compelling piece on MEI from March 24th linked here.

For those that have lost confidence in pracinostat after the recent failure, the company has two additional drugs in ME-344 and PWT143 with phase 1b data from ME-344 in small cell lung and ovarian cancers expected this year. On top of all this, the company is well capitalized with almost $80 million in cash, implying an EV of approximately negative $18 million. Cash burn is reasonable given active trials in the clinic with total expenses coming in under $10 million in recent quarters. Given upside from pracinostat, potential of other assets in the pipeline, and respectable cash reserves, I believe that this is a great stock to get into looking for a rebound.

Endocyte (NASDAQ:ECYT) - 12.5% Allocation. Endocyte, one of my 2015 Top Value Biotech Picks, has been a slightly positive performance this year, gaining 1.1%.

ECYT data by YCharts

The name remains a great value play with cash reserves of $207 million as of 2014 year end and projections of at least $155 million of cash remaining at 2015 year end. The bull case that excites me centers on EC1456, a next generation small molecule drug conjugate with the extremely potent warhead tubulysin (EC1169). The treatment has been very well tolerated in the dose-escalating trial. The company expects to initiate trial expansion for EC1456 and companion imaging agent EC1169 in NSCLC, triple-negative breast, ovarian, and endometrial cancers in the second half of 2015 with a primary endpoint in mid-2016. Safety and efficacy from the phase 1 dose escalation trials is expected at ASCO in June. With the potential of $1 billion in peak sales for EC1456 in NSCLC according to Cantor Fitzgerald, I remain excited and look forward to upcoming data. Given a very low EV with a $263 million market cap and over $200 million in cash as of year-end 2014, this continues to be an intriguing investment for biotech value investors, given the limited downside and significant upside potential if EC1456 and EC1169 continue to show promise.

Source: March 23rd Investor Slidedeck

The company will be initiating two studies in Q2:

1. Phase 3 trial of TNX-102 SL in patients with fibromyalgia (AFFIRM study)

2. Phase 2 trial of TNX-201 in patients with episodic tension-type headache

Investors will get results from the phase 2 study in the last quarter of the year. I think TNX-102 SL in PTSD is an extremely interesting program given the significant need for treatment of PTSD for those in the military, which is the patient population that Tonix is targeting. This also is a program where the company might be able to partner with the Department of Defense given the significant need for an improvement in treatment, providing the potential for reduced R&D costs. It was great to see some very notable investors such as Broadfin and Sabby participating in the recent offering and management has been buying at these depressed levels.

Source: openinsider.com

For those looking for more detailed coverage, I recommend following Jason Napodano. One interesting detail of note from the Roth investor presentation in March is that the CEO noted the company would likely work with a big pharma partner with TNX-102 SL in fibromyalgia and TNX-201 in episodic tension-type headache. With a low enterprise value and cash reserves making up well over half the market cap, I believe Tonix presents a lot of value at current levels.

Loxo Oncology (NASDAQ:LOXO) - 10% Allocation. Loxo is a developer of targeted cancer therapies with a market cap of $224 million that ended the year with $113 million in cash, cash equivalents, and investments. Loxo is led by TRK inhibitor LOXO-101, which the company is pursuing in TRK-positive patients. The company will be presenting phase 1a data evaluating the safety, maximum tolerable dose, and PK of the compound in patients with advanced solid tumors at AACR on the afternoon of 4/21/15. An excerpt from the AACR abstract discusses results of the trial so far, illustrating a well-tolerated compound and compelling profile:

To date, data are available for 8 patients including patients treated at each of the first two dose levels, 50 mg QD and 100 mg QD. LOXO-101 has been well tolerated; the MTD has not been reached and no adverse events have been reported more than once other than fatigue (two patients; related but not serious) and syncope (two patients; unrelated and serious).Maximum plasma concentrations of LOXO-101 were reached 30-60 minutes following dosing and exposure increased in approximate proportion with dose. Mean values of Cl/F, V/F, and half-life were 0.5 L/h/kg, 2 L/kg, and 3.5 h, respectively, and were independent of dose. Exposure was similar following the single dose and on Day 1 and Day 8 of repeated dosing in all subjects. The unbound drug levels of LOXO-101 appear sufficient for approximately 98% inhibition of TRKA/B/C at peak concentrations with once-daily dosing of 50 or 100 mg.

The company expects to start phase 1b for the compound in H2 2015. Additionally, the company will be providing initial pipeline preclinical data and timeline update in H2 2015. Furthermore, the company has two undisclosed programs where it is performing IND-enabling work such that it could have an additional program enter the clinic in H1 2016. Loxo has guided that it will burn between $30-33 million in 2015 and has sufficient cash reserves into 2017. For more on what makes LOXO unique, I recommend the well-written article by Bay Area Biotech on the targeted oncology space.

Institutions clearly agree that this is a great opportunity with over three-quarters of outstanding shares held by institutions, including Orbimed, BVF, and Baker Bros. With substantial institutional ownership, a lengthy cash runway, and much excitement in store for this emerging pipeline, this is an extremely promising biotech with compelling long-term prospects.

Tenax Therapeutics (NASDAQ:TENX) - 7.5% Allocation. Tenax is a $88 million biopharmaceutical company concentrating on treatments for critical care patients. The company is well capitalized with over $50 million in cash and marketable securities on the books as of January 31st. The company has guided that cash burn will be in the range of $14-15 million for 2015 with the current cash balance being sufficient to fund operations through fiscal year 2017. The company's pipeline is led by Levosimendan, under development to reduce morbidity and mortality of cardiac surgery patients at risk for low cardiac output syndrome. The asset is currently in phase 3 under an SPA with the FDA. The company expects interim analysis from this phase 3 trial named LEVO-CTS for efficacy or futility determination after 50% and after 70% of planned primary endpoints to both occur late in 2015. Additionally, the company is collaborating with the Imperial College of London on a phase 2 study of Levosimendan in adult patients with septic shock aiming to reduce the incidence and severity of acute organ dysfunction. Data will be released for this study in 2016. Furthermore, the company has stated in its most recent corporate update that it's looking to identify "potential additional candidates that fit into our critical care pipeline strategy." Notable biotech institutional investors are on board with RA Capital, Broadfin, and Sabby all holding significant stakes.

While the above-provided information is certainly compelling enough to consider a small position, I do want to acknowledge that I remain slightly skeptical as the stock seems to have some odd relationship with penny stock pumpers, with the most recent pump occurring on November 24th. The Pump Stopper wrote an interesting piece on the name in June 2014 before it changed its name to Tenax Therapeutics. While I remain skeptical given the uncertainties that are pretty well highlighted in Seeking Alpha article from June, I think the numerous positives and the notable institutional holders highlight that this is a compelling opportunity. At the very least, the stock has an attractive risk/rewards heading into readouts later in the year.

Dara Biosciences (NASDAQ:DARA) - 7.5% Allocation. I initially highlighted Dara as a buy on December 11th, highlighting what I believed could be a rosy future for the company's lead product, Gelclair. I followed this up last week by reiterating my buy recommendation as I felt the stock presented very little downside with catalysts on deck for 2015. Since my buy recommendation in December, the stock is down 2.5%. The stock is down 2.4% since I purchased stock on March 19th and March 20th.

DARA data by YCharts

My Dara thesis centers on three main points:

1. Product suite with growing revenues led by a product in Gelclair that has expansion opportunities.

2. A program in KRN5500 with fast track status and orphan drug designation in two indications

3. An estimated cash balance of over $11.1 million as of Q1 end.

Shareholders get all this for a market cap of only $15.6 million. In my most recent piece, I can up with a downside target of $0.71 and upside targets of $1.29 and $1.80, suggesting minimal downside and high potential upside. While I was feeling very good about the company, I was not at all happy to see the company file an S-3 after market on Friday.

As a reminder, a direct quote from the most recent corporate update:

DARA believes that its currently available funds, together with projected sales of Gelclair®, an FDA-approved bioadherent oral rinse gel for treating the painful symptoms of oral mucositis (OM) and Soltamox®, (tamoxifen citrate) oral liquid solution, will enable the Company to fund its current operations and to meet its obligations through the first quarter of 2016.

My issues with this include:

1. Per the most recent corporate update, the company has enough funds for at least the next year or so. Why are you filing an S-3?

2. Dara is a company with a $15.6 million market cap that just filled an S-3 for $30 million, almost double the size of its current market cap. Why? The company has been very adamant that it is a commercial-stage company that will be partnering KRN5500.

3. Why has management not communicated that this is something they were considering doing? Communication is key, and there is no reason to catch shareholders by surprise with something like this.

4. If there is indeed a good reason for this filing, why is the company filing the S-3 after market on Friday? Everyone knows that seeing your small cap biotech company trying to hide an S-3 filing on Friday afternoon when many are gone for the weekend is not a good sign.

Hopefully for shareholders, this S-3 is a non-event and merely just something the company is doing to be prepared to sell stock when it would be advantageous to do so given pps and when the company has guided it would need money. I will be chatting with management on Tuesday and hope to gain more clarity. I am continuing to hold my position in Dara and think the stock has much potential, but I am not thrilled with the lack of communication in regards to this most recent filing.

Conclusion

While many investors choose to invest in biotech through high-fliers, I continue to believe that my more unique investment process of focusing on names with solid balance sheets presents less downside and better risk/reward opportunities than the average investment strategy in the biotech space. This opinion was supported by 49.2% return (and outperformance of the XBI by over 31 percentage points) of my 2015 Top Biotech Value Picks so far in 2015. While there are less underpriced stocks available now compared to three months ago when the biotech indices were more than 10% cheaper, there are still some names to get excited about, presenting great opportunities for investors starting in the second quarter.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

By Daniel Ward,

No comments:

Post a Comment