That’s right.

As a dividend growth investor, you can look forward to consistent “pay raises” throughout the year.

What I mean by pay raises is dividend increases.

I can’t really think of anything, which is probably why that’s a rhetorical question.

But I don’t just talk the talk; I also walk the walk – I have almost all of my worldly wealth invested in such dividend growth stocks, as you can see in my portfoliowhich I publicly track.

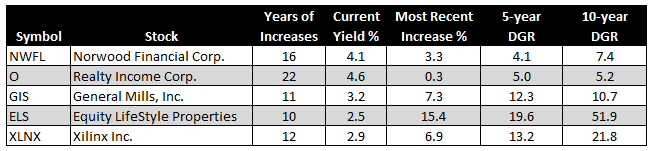

And true to their reliable nature, fivedividend growth stocks recently announced dividend increases.

Each one of these stocks is featured on David Fish’s Dividend Champions, Contenders, and Challengers list, which tracks and documents more than 600 US-listed stocks that have increased their respective dividends for at least the last five consecutive years.

So let’s see which five just handed their shareholders a pay increase…

( click to enlarge )

( click to enlarge )

Not a massive list, but more money is more money, right?

Not a massive list, but more money is more money, right?

To narrow down the focus a bit more, I’m going to highlight one specific stock today and see if there’s a present opportunity to pick up shares.

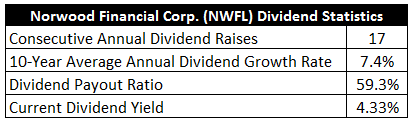

Norwood Financial just increased their quarterly dividend from $0.30 to $0.31 per share, an increase of 3.3%. The new dividend is payable on May 1, 2015 to shareholders of record as of April 15, 2015.

The stock now yields a sizable 4.33%.

What’s fairly impressive here is that even though NWFL is a very small bank, they’ve increased their dividend now for 17 consecutive years.

And over the last decade, that dividend has grown by an annual rate of 7.4%, though that rate has slowed as of late.

The payout ratio, after the new dividend is factored in, now stands at 59.3%, which is as high as it’s been over the last decade. That probably explains the slowing dividend growth rate.

Next, let’s take a look at some fundamentals.

Next, let’s take a look at some fundamentals.

We’ll first investigate growth over the last decade, which may explain why that payout ratio is so high.

Revenue has increased from approximately $19 million to approximately $30 million from fiscal years 2005 to 2014. That’s a compound annual growth rate of 5.21%, which is fairly healthy for a bank, especially considering the financial crisis happened during this period.

Earnings per share, meanwhile, grew from $1.75 to $2.10 over this time frame, which is a CAGR of just 2.05%.

This is why the payout ratio has been rising to its current state of moderately high – EPS growth hasn’t kept up with dividend growth. This is apparently due in part to the fact that the company has issued shares over this period, which can be explained by the fact that they paid a stock dividend in 2013.

The bank’s balance sheet is in line with peers and banks in general, which is to say there’s low leverage here with a long-term debt/equity ratio of 0.22.

However, one area that is potentially concerning is the deteriorating return on equity. ROE, a key measure for a bank’s profitability, has been steadily declining over the last decade. ROE was 8.02% last fiscal year, a significant decline from the 11.72% they posted in FY 2005. Margins have also declined since then as well.

Banking has long been a very profitable business model. The cost of capital is quite low and banks tend to make a good chunk of change from the spread between their cost of capital and what they’re able to lend capital out at. Low interest rates have no doubt constrained profitability, which you see here with NWFL. As such, with interest rates seemingly having nowhere to go but up, there could be a long-term tailwind in effect here.

Furthermore, local banking is seen by many as a great way to keep business local. As long as local branches provide the level of service and breadth of products that the community needs, they should do well and grow.

However, keep in mind that this is a very small bank. The market cap is only $105 million. As such, special risks are present, as it’s not completely uncommon for smaller banks to fail over time. That said, NWFL has built up an outstanding track record of stability and growth.

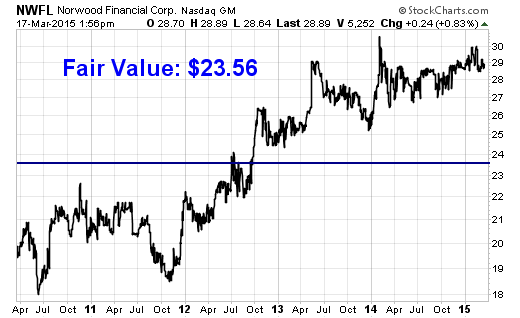

Shares are trading hands for a P/E ratio of 13.68 right now. That’s quite high, in my view, as it’s well above the five-year average for NWFL, which is 11.4. Furthermore, small banks traditionally trade at low P/E ratios due to the inherent risks. Meanwhile, this P/E ratio is on par with some of the larger national institutions.

I valued shares using a dividend discount model analysis with a 10% discount rate and a 4.5% long-term growth rate. That growth rate was used to factor in the bank’s fairly limited growth in EPS over the last decade and the moderately high payout ratio. It’s unlikely that future dividend growth will be much higher than this unless EPS growth substantially improves. In fact, it’s arguable that this is too aggressive. The DDM analysis gives me a fair value of $23.56.

Bottom line: Norwood Financial Corp. (NWFL) is a small bank with a big dividend. A lot to like with the yield and lengthy dividend growth record, but limited profit growth, special risks, and a high valuation leaves me on the sidelines here. That said, there are four other quality dividend growth stocks to consider on this list which also recently handed out pay raises to shareholders. Even better, you had to do nothing – other than own or buy shares – to collect that pay raise. Doesn’t get much better than that.

Bottom line: Norwood Financial Corp. (NWFL) is a small bank with a big dividend. A lot to like with the yield and lengthy dividend growth record, but limited profit growth, special risks, and a high valuation leaves me on the sidelines here. That said, there are four other quality dividend growth stocks to consider on this list which also recently handed out pay raises to shareholders. Even better, you had to do nothing – other than own or buy shares – to collect that pay raise. Doesn’t get much better than that.

– Jason Fieber, Dividend Mantra

No comments:

Post a Comment