Summary

- ACAD's Nuplazid will soon be reviewed by FDA, and sooner after the latest FDA approved antipsychotic.

- With its safety profile and efficacy, Nuplazid could very well follow the dozens of antipsychotics before it, right to blockbuster sales.

- Given the patent protection lost on competing drugs, ACAD might very well be the most sought after biotech of this year.

It has been well over two years since Acadia Pharmaceuticals (NASDAQ:ACAD) announced a successful Phase III trial for Nuplazid in treating Parkinson's disease psychosis (PDP). And it has been nearly two years since Acadia disclosed that the data from that trial was good enough to file an NDA with the FDA. So, after nearly two years of completing pre-commercial activities, and earning a Breakthrough designation from the FDA - which has historically solidified a drug's FDA approval - Acadia is expected to file its NDA early this year, and Nuplazid will then enter the market by the end of year as the latest antipsychotic drug. The fact that Nuplazid is finally about to enter the market might make Acadia the most sought after company this year, at least by acquirers.

Must Read:http://www.utsandiego.com/news/2014/dec/29/acadia-pharmaceuticals-psychosis-drug-Nuplazid/

First, Nuplazid is a drug that works. In treating PDP, Nuplazid's average change in positive symptoms was a 37% improvement in patients versus a 14% change with placebo. Further, Nuplazid proved to have a significant improvement in secondary efficacy measures like daytime wakefulness and nighttime sleep. This strong efficacy is why the FDA decided that no further studies were needed before review, and gave Nuplazid a Breakthrough designation. This sets Nuplazid up to be the first FDA approved drug to treat PDP.

What makes Acadia the biggest goldmine for acquirers in 2015, though, is the drug's safety profile, the monetary success of other effective antipsychotic drugs historically, and its opportunity to be a widely used drug beyond PDP. As for safety, Nuplazid has no major side effects, just minor headaches and such. The serotonin inverse agonist is far different from competing drugs that activate the nucleus accumbens and have a dopaminergic effect that compromises motor control in many instances. Other antipsychotic drugs, like Abilify, have even been linked to death, heart failure, and other horrible effects.

Abilify is not alone in having major side effects, as Seroquel has been linked to significant weight gain and diabetes while Risperdone has been known to cause strokes in older adults and form breasts in younger boys. Therefore, finding a drug that's effective with a safety profile like Nuplazid has never been accomplished in the antipsychotic market.

Yet, despite these health risks, patients have proven over the years that living with a psychotic disease is worse than the alternative side effects associated with these noted drugs. That's why Lexapro and Risperdone earned nearly $3 billion at their peak, Seroquel created almost $6 billion by 2011, and in 2013, Abilify earned $6.4 billion. These sales numbers alone suggest that Nuplazid will be very successful commercially.

It is also important to mention that large sales with antipsychotic drugs in the past have been created with off-label use. There is no treatment for PDP, so patients who suffered from the disease would often take Abilify or a similar drug that treated the effects of schizophrenia or depression. The reason is because psychosis tends to share effects across a number of different diseases. These include neurological diseases like Parkinson's, Alzheimer's, and Lewy Body Dementia, but also psychiatric diseases such as Schizophrenia, depression, and mania. Only when a drug is linked to specific side effects in certain patient populations does off-label use become a problem in this industry, such was the case for Johnson & Johnson (NYSE:JNJ) and Risperdal. Back in 2013, its ongoing off-label marketing cost the company a fine of more than $2 billion, along with a criminal charge.

Nonetheless, Nuplazid's efficacy and safety makes it a prime drug candidate for off-label use in treating diseases of psychosis. While PDP has a relatively small patient population of one million in the U.S., other diseases like Alzheimer's and Schizophrenia are far larger markets. Acadia is currently in trials to test Nuplazid on these diseases, and it is not until several years from now that Nuplazid would be FDA approved to treat these far larger patient populations if proven successful in clinical studies. Therefore, if Nuplazid achieves blockbuster sales status with several billion dollars of revenue annually, most investors don't think it will occur until Nuplazid is approved to treat diseases like Alzheimer's and Schizophrenia. However, I think Nuplazid's commercial success could be instant, due to off-label usage.

That said, aside from diseases where Acadia is testing Nuplazid in trials, where Nuplazid might be used off-label, there is also potential use in treating even more common diseases like depression and anxiety. This is due to the lack of side effects and the common connection to psychosis that all these diseases share.

All things considered, it is quite simple to see how Nuplazid's revenue could become very large long-term. It works just as good as competing drugs without the side effects, and given the revenues created from competing drugs like Abilify, it would be quite foolish to assume that Nuplazid won't achieve blockbuster sales status. This makes Acadia a viable acquisition target for the many large companies that sell drugs in this industry.

The list of companies that might acquire Acadia is rather large. It could be a company like AstraZeneca (NYSE:AZN), who saw U.S. sales of Seroquel fallfrom $5.8 billion in 2011 to under $1.7 billion when it lost patent protection for Seroquel IR. Given Seroquel's success, AstraZeneca already has a network of sales reps in place with success at marketing such drugs, which means that acquiring Acadia would be painless from an operational standpoint. Another company that could gain marketing synergies is AbbVie (NYSE:ABBV). Its orphan designated drug Duopa just won FDA approval to treat motor fluctuations in patients with advanced Parkinson's disease. While Duopa and Nuplazid are two different types of drugs, the fact that both drugs will be marketed to the same physicians makes the acquisition interest quite possible.

Otsuka Pharmaceuticals is another that might show interest. The company manufactures Abilify, which is expected to lose patent protection this year, and when it does, 40% of Otsuka's revenue will be at jeopardy. Moreover, Bristol-Myers earns about 50% of the U.S. sales on Abilify thanks to a partnership with Otsuka. However, that partnership ends this year, and even Bristol-Myers might be looking to replace that revenue with either an acquisition or partnership with Acadia.

The key takeaway is that many companies might show interest in Acadia as either a marketing partner or as an acquisition target. The proof is in the size of the mental health psychosis market, the safety profile of Nuplazid, and the fact that every blockbuster antipsychotic of the last decade has lost patent protection with the exception of Otsuka and Bristol-Myers with Abilify, and that'll happen this year. These pharma companies already have the manufacturing capabilities, the sales force in place, and all pertinent infrastructure to market a drug like Nuplazid. Therefore, I fully expect that one will be willing to pay big money for Acadia Pharmaceuticals.

Granted, there is always a risk that Nuplazid won't prove successful in treating diseases outside of PDP. While I consider this doubtful, it is a possibility, and if so it would significantly alter the drug's off-label appeal and would limit its revenue to the smaller PDP patient population. Of course, it'll be several years until that data is known, and my belief is that the FDA's favoritism of Nuplazid (Breakthrough, accelerated review, expedited NDA) will be appealing to physicians and is a sign of future efficacy in treating other diseases.

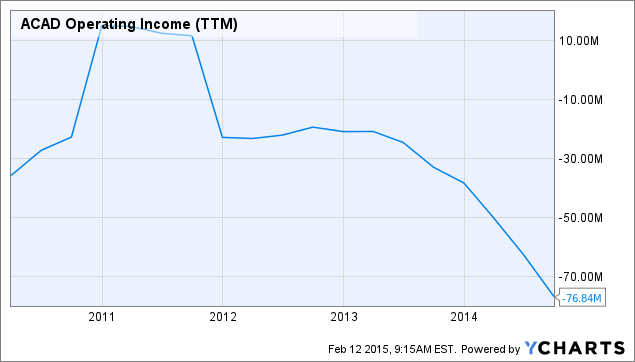

In my opinion, the only way Acadia is not acquired is if the company chooses to market the drug itself, and sees more long-term investment value in doing so. As seen in the chart below, Acadia's operating loss has worsened over the last few years, and if it decides to market Nuplazid alone, it will require significant expenses and will lead to higher expenses. With $337 million of cash and equivalents, it is possible that Acadia could launch Nuplazid with no further dilution, but more than likely, the company would dilute shares and raise capital to create a cushion during the 12-month launch phase. Seeing as how no other drug is FDA approved to treat PDP, Acadia won't have a great deal of competition in treating this indication, which should limit marketing-related expenses.

Given the long period that management spent in pre-NDA preparations and its plan to hire 135 sales reps following FDA approval, the company might very well plan to remain solo, or at least is preparing for that scenario. Regardless, with Abilify's base price at $13,000 annually, and Acadia's management already saying that Nuplazid will command a premium price based on efficacy and safety, the drug has all the makings of a largely successful drug. Either way, acquired or not, I think Acadia's investors will come out on top long-term, as its market capitalization of $3.3 billion is not an appropriate reflection of the sales that other highly effective antipsychotics have created in the past.

By Investing HealthcareSource:http://seekingalpha.com/article/2910846-acadia-pharmaceuticals-could-be-the-most-sought-after-company-of-2015

No comments:

Post a Comment