Summary

- At a price just above tangible book value and well below book value, Bank of America has 50% upside from current prices.

- 2014 was the year in which Bank of America finally relieved itself of its biggest liabilities stemming from the Financial Crisis.

- The balance sheet has never been better, which should allow for an increase in the dividend and stock buyback after the coming CCAR.

While the stigma and ramifications of the Countrywide acquisition have plagued the firm for the last 6 years, moving forward, Bank of America (NYSE:BAC) has one of the best business models in the banking industry and profits should begin increasing at an accelerating rate moving forward. Bank of America combines many of the strengths of the great consumer and commercial banks, with the premier wealth management operation in North America. There is a huge opportunity for Bank of America to benefit from another refinancing and mortgage origination boom in the short-term, while long-term increases in interest rates will bolster the normalized earnings power of the company. At a price just above tangible book value and well below book value, Bank of America has 50% upside from current prices.

2014 was the year in which Bank of America finally relieved itself of its biggest liabilities stemming from the Financial Crisis. Litigation expenses were an astounding $16.4 billion in the year, which clearly was devastating to profitability in the year. It is actually a testament to the strength of BAC's underlying business that the company was able to post full-year profits, given the size of these settlements. Management, under the leadership of Brian Moynihan, has done a wonderful job cutting expenses under Project BAC, which is absolutely essential given this historic low interest rate environment.

Bank of America has a lot of wonderful characteristics that lead me to firmly believe that it has the potential to generate 12-15% returns on equity over the course of a business cycle, assuming higher interest rates during part of that cycle. The company has one of the largest and lowest cost deposit bases in the industry, which will benefit dramatically when rates do finally rise. The vast branch network and relationship with both large and small businesses allow Bank of America to be fully exposed to the growth of America's business lending. BAC's mortgage operation has underperformed due to the rightful emphasis that had been placed on servicing troubled mortgages, as opposed to originations, but moving forward there is plenty of reason to believe that BAC can pick up market share if it chooses to. It intelligently exited the correspondent lending channel and is focusing on cross-selling mortgages within the branches. U.S. Trust provides a valuable resource for servicing the needs of baby boomers and, combined with Merrill Lynch, provides Bank of America with the finest wealth management business in the country. Wealth management is going to be differentiator for BAC moving forward, because the capital requirements are lower and the returns on equity are higher than either global banking or the retail franchise. I'd expect management to spend more energy on building these businesses up more and more as the legacy issues runoff.

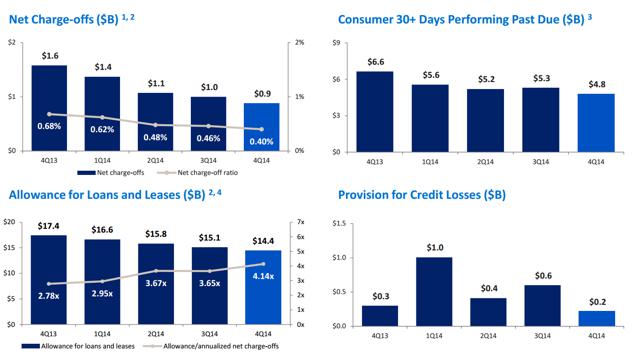

On January 15th, Bank of America reported 4th quarter net income of $3.1 billion, or $0.25 per diluted share. Results included a total of $1.2 billion in negative charges to revenue ($0.07 per share) for market-related net interest income adjustments, adoption of funding valuation adjustments (FVA), and net debit valuation adjustments (DVA). Revenue, net of interest expense, on an FTE basis was $19 billion, down from $21.7 billion in the 4th quarter of 2013. Noninterest expense declined from $17.3 billion in the 4th quarter of 2013, to $14.2 billion in the 4th quarter of 2014, which was the lowest quarterly expense reported since the Merrill Lynch merger. Much of this was due to lower litigation expenses in the quarter, but excluding litigation expense, noninterest expense decreased 8% YoY to $13.8 billion. BAC has made major headway in reducing the number of 60+ day delinquent loans, which are down to 189,000 from 325,000 at the same time last year, so expenses still have some room to come down moving forward. Some of those servicing troubled mortgages are shifting towards origination and I believe that BAC can improve its market share over the next several years, assuming regulators make it worthwhile to stay in that business.

(click to enlarge)

Net interest income, on an FTE basis, was $9.9 billion in the 4th quarter of 2014, down $1.1 billion YoY. The decline was driven by a $788MM negative swing YoY in market-related adjustments and lower loan balances and yields. These were partially offset by lower rates paid on deposits and lower long-term debt balances and yields. Excluding the impact of the market-related adjustments, net interest income was $10.4 billion in the 4th quarter of 2014, compared to $10.5 billion in the prior quarter and $10.8 billion in the year-ago quarter. Noninterest income decreased 15% from the year-ago quarter to $9.1 billion. Excluding the impact of the FVA in the current period, and net DVA and equity investment income in both periods, noninterest income was down 10% from the year-ago quarter, driven by declines in sales and trading results as well as mortgage banking. The company did see improvement in card income and higher investment and brokerage services income.

For the full year 2014, Bank of America reported net income of $4.8 billion, or $0.36 per diluted share on revenue of $85.1 billion. These numbers were down from 2013 net income of $11.4 billion, $0.90 per diluted share on revenue of $89.8 billion. Noninterest expense of $75.1 billion, was up from $69.2 billion in 2013. Excluding litigation expense of $16.4 billion in 2014 and $6.1 billion in 2013, noninterest expense was $58.7 billion in 2014, down $4.4 billion, or 7%, from 2013.

Bank of America's balance sheet has improved dramatically over the last few years, which in my opinion is Brian Moynihan's crowning achievement thus far. As of 12-31-2014, the estimated common equity Tier 1 ratio under Basel III was 10% and the estimated supplementary leverage ratio was 5.9%. The company has $439 billion of excess liquidity sources, which was up $63 billion from the same time last year, and time-to-required funding is at 39 months. Tangible book value per share increased by 5% YoY to $14.43 per share, while book value per share increased 3% to $21.32.

At a recent price of $15.22, BAC is ridiculously cheap and should be bought aggressively. The company's normalized earnings power is between $2.00 and $2.50 per share and most of the key issues have now been resolved. The balance sheet has never been better, which should allow for an increase in the dividend and stock buyback after the coming CCAR. The financial systems as a whole is quite strong, and issues such as Greece potentially exiting the Euro or the recent moves from the Swiss Central Bank breaking the peg to the Euro will not be enough to cause permanent damage to BAC. BAC's financial results are not sexy of late, but consistency of profitability and massive earnings power will show more and more over time, leading to strong investment results from current prices.

By Tim Travis

No comments:

Post a Comment