Summary

- Cracker Barrel operates 633 stores and of that the company owns the land and buildings for 417 stores.

- Considering that Cracker Barrel owns a significant amount of real estate it seems logical that the company could improve its overall efficiency (capital structure) by unlocking real estate value.

- It would seem reasonable that a value investor would recognize the wealth that could be created by spinning the real estate into a REIT structure.

In recent Seeking Alpha articles I have written on the real estate components related to Darden Restaurants (NYSE:DRI) and Bob Evans Farms(NASDAQ:BOBE). Specifically in the Darden article (written in February 2014) I explained that "companies with the least real estate are the most profitable" and I weighed in on what I considered the most efficient for Red Lobster to monetize its real estate empire:

The only REIT that could possibly take down Red Lobster's real estate (by itself) is American Realty Capital Properties (NASDAQ:ARCP). Now that the Cole Real Estate merger has closed, ARCP has the size to swallow up the big "Lobster;" however, ARCP would be going against its policy of acquiring investment grade leased properties and further exposing itself to more restaurant concentration risk.

Needless to say, on May 16th my batting average went from 0 to 400 when ARCP announced that it was acquiring around 500 stores leased to Red Lobster. While the $1.5 billion sale/leaseback transaction with ARCP provided the Red Lobster chain with efficient long-term capital, Darden was able to capitalize on the real estate assets and focus capital on its primary revenue drivers.

In the more recent Bob Evans article I explained that "the most efficient structure for Bob Evans is to explore a strategic sale/leaseback transaction" since the 482 owned restaurant sites could be monetized to unlock considerable value for shareholders.

In both examples noted above - Red Lobster and Bob Evans - it's apparent that the real estate holdings are primary sources of wealth creation and by unlocking the value of the "brick and mortar" these companies offer a competitive advantage that's unique to many other national restaurant brand.

Could there be other chains that could unlock value from real estate holdings?

Cracker Barrel: A Uniquely-Positioned Restaurant Chain

When I opened up the balance sheet for Cracker Barrel (NASDAQ:CBRL) it became apparent that the value in owning shares in this 45-year-old chain is not for its restaurant potential, but for its real estate potential.

Over the last four-plus decades, the Tennessee-based chain has been actively evolving its "uniquely-positioned" real estate collection by growing beyond its Southeastern-based market. Today Cracker Barrel operates 633 stores and 75% of the new store pipeline is outside of its core Southeastern footprint.

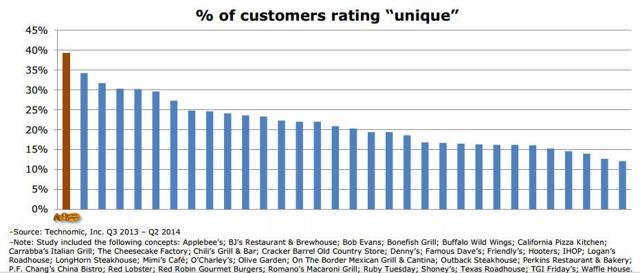

As Cracker Barrel acknowledges in its Investor Presentation, the company stands out for its "unique" operating model:

Cracker Barrel's store format "consists of a trademarked rustic, old country-store design offering a full-service restaurant menu featuring home-style country food and a wide variety of decorative and functional items featuring rocking chairs, holiday and seasonal gifts and toys, apparel, cookware and foods."

The freestanding facilities are subdivided into a dining room occupying approximately 28% of the total interior store space, a gift shop occupying approximately 22% of such space and the balance primarily consisting of kitchen, storage and training areas.

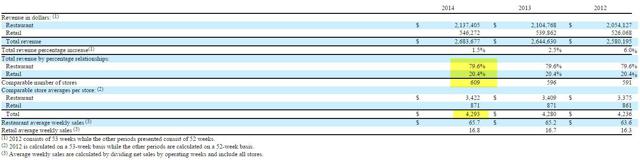

The "unique" model produces average annual stores sales of around $4.293 million where around 80% of revenue is derived from restaurant operations and around 20% from retail sales (approximately 4,000 SKUs per store).

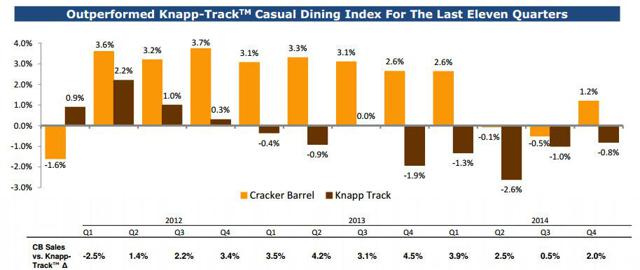

Cracker Barrel's differentiated business model has generated strong historical operating performance as evidenced by the Knapp-Track™ Casual Dining Index:

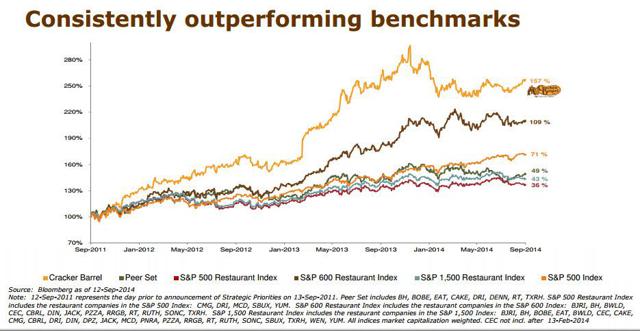

Accordingly, Cracker Barrel has consistently outperformed benchmarks:

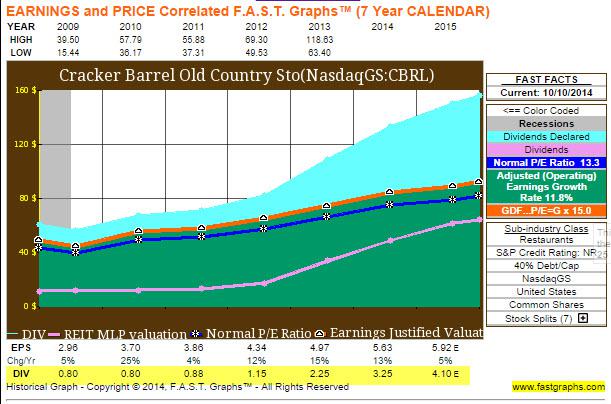

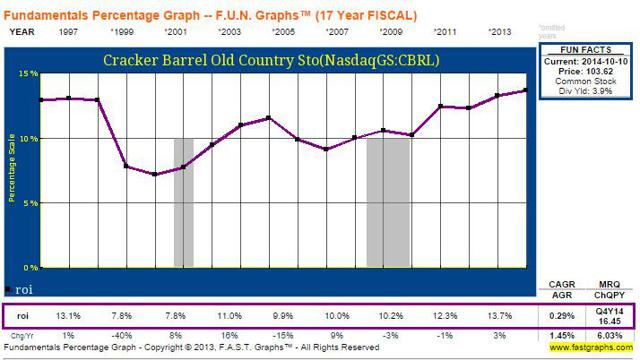

The FAST Graph below illustrates a steady earnings history and strong dividend growth. The current dividend payout is $3.25 per share.

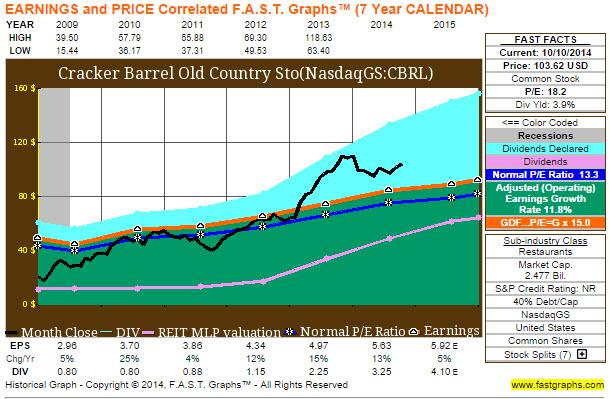

Adding back the price line (black line), it's evident that Cracker Barrel's strategy of boosting the dividend has sparked shareholder value (Cracker Barrel closed at $103.02):

Here's a more recent price history (6 months):

Cracker Barrel: You're Not Buying a Restaurant Chain Though

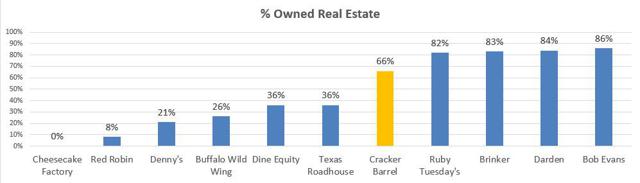

As referenced above, Cracker Barrel operates 633 stores and of that the company owns the land and buildings for 417 stores, while the other 216 properties are either ground leases or ground and building leases. So the company owns the "direct" real estate for around 66% of its locations.

Land costs for the Cracker Barrel stores (opened during 2014) averaged $950,000 per site if owned. Building, site improvement, furniture, equipment and related development costs for stores opened during 2014 averaged $2.9 million.

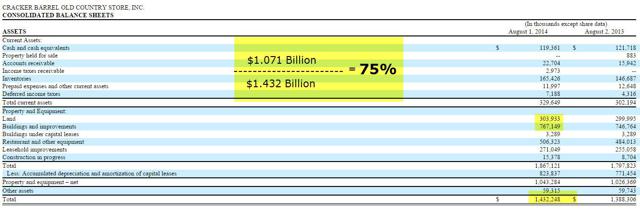

Examining the balance sheet (below), we see that Cracker Barrel has invested around 75% of its total assets (or $1.07 billion) in real estate (land and buildings):

Considering that Cracker Barrel owns a significant amount of real estate, it seems logical that the company could improve its overall efficiency (capital structure) by unlocking the value of the "brick and mortar." One of the ways to measure efficiency is to examine Cracker Barrel's Return on Invested Capital (or ROIC). (There is an excellent video on ROIC you can view on Investopedia's website HERE).

As you can see (above), Cracker Barrel generates an average ROIC of around 12% and that tells me that the company could redeploy its real estate resources (cap rates of sub 7%) and practically double its ROIC.

Think of it like this: Cracker Barrel is now their own landlord to around 66% of its real estate. The majority of the company's assets are sitting idle and by unlocking the value in the company's real estate holdings, the shareholders could harvest considerable wealth in the form of buying stock, growth, or paying out a special dividend.

In addition, Cracker Barrel's after tax "intercompany rents," if multiplied by the company's current cash flow multiple, would be hard-pressed to arrive at a valuation equal to the real estate's actual cost. However, I'm not certain a sale/leaseback is the right vehicle for Cracker Barrel because as a C-corp, Cracker Barrel would have to pay Uncle Sam too much.

That leads me to what I consider to be the best alternative for Cracker Barrel…

The Cracker Barrel REIT

Before you throw darts at me, remember that many net Lease REITs started out with one or two tenants. Think EPR Properties (NYSE:EPR) - a net lease REIT that launched with AMC Theatres or Canadian Tire (TSX: CRT.UN ) - a Canadian net lease REIT that owns free-standing automobile store.

By spinning off its real estate into a REIT, Cracker Barrel could maximize the tax efficient mechanism to own the real estate. As it stands today, Cracker Barrel is not being rewarded for its depreciation and remember, a C-corp gets graded on net income (not Funds from Operations) so depreciation is a drag to earnings.

Also, by utilizing the REIT structure, the Cracker Barrel REIT could continue to access investment-grade borrowings, or could employ other secured debt strategies that would give it access to highly competitive funding costs.

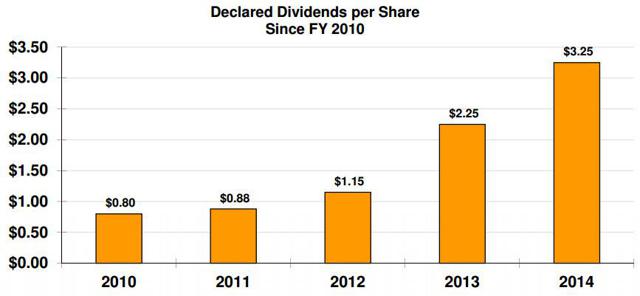

As we examine Cracker Barrel's historical dividend performance, we see that the company has grown its payout considerably; however, at some point the dividend growth gets "tapped out."

By spinning its real estate into a REIT, Cracker Barrel can maximize its earnings potential and reward investors by paying out higher dividends. For one thing, the REIT would get a tax deduction for the dividends paid. Cracker Barrel, on the other hand, does not and pays approximately 30% of its corporate income in taxes. Secondly, The REIT would likely have a higher dividend payout ratio.

Cracker Barrel's largest investor (19.89%) is a company called Biglari Holdings Inc. (NYSE:BH), based in San Antonio. Founded by Sardar Biglari, the publicly-traded company appears to be a Berkshire Hathaway "wanna-be" and its other major investments are restaurant chains Steak 'n' Shake andWestern Sizzlin.'

I spent a few minutes on Biglari's website (almost identical to Berkshire's "plain Jane" layout) and found a few interesting tidbits (in the 2013 Letter to the Shareholders):

We purchased the 20% stake in Cracker Barrel for $241 million. The market value at the end of our fiscal year 2013 was $485 million. Along the way, we have collected a total of $18.4 million in dividends.

Dear Mr. Biglari: If you think that's special, why not force to unlock the recognizable value of Cracker Barrel's real estate empire.

Biglari went on to explain:

Our subsidiaries are cash machines - generating cash beyond their capital requirements - with cash sent upstairs to fund the growth of Biglari Holdings, a dynamic value-building machine.

Again Mr. Biglari: Cracker Barrel is a cash cow. I get it. Why not force the real estate off the operating balance sheet so significant "alpha" can be unlocked for investors. I for one know the value of Cracker Barrel's "brick and mortar" and it would seem reasonable to conclude that a value investor would recognize the wealth that is possibly derived by spinning the real estate into a REIT structure.

Biglari writes:

The person who adheres to conventional wisdom is almost certain to achieve merely conventional results.

Yes indeed. Mr. Market seems to agree that Cracker Barrel's dividend juice has created a healthy appetite for capital appreciation. Why not super-size the dividend by spinning off the real estate into a REIT? After all, that's called "Seeking Alpha" (a terrific website for promoting sound investment ideas).Let's go milk the cow...

In my REIT newsletter, I provide high-level analysis so that investors can attempt to find an adequate margin of safety. Remember the number rule of investing: Protect Your Principal at ALL Costs. Subscribe here.

Sources: FAST Graphs, Yahoo Finance, Cracker Barrel Investor Presentation,Cracker Barrel 10-K

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

No comments:

Post a Comment