Summary

- PCs remain the cornerstone of Intel's profitability, and the market appears to be stabilizing.

- Intel's investments in mobile, coupled with Microsoft's pricing changes on tablets and phones, should drive traction.

- Improvements in mobile profitability will drive significant share price upside.

- Data center and IoT will be the engines of revenue growth.

Intel (INTC) released earnings this week. This analysis looks at Intel's operations by segment to come up with a sum-of-the-parts valuation.

PC Client Group (PCCG)

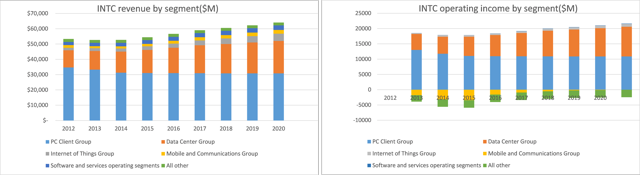

The PC client group (PCCG), which represents over 60% of revenue and virtually all of its operating income, saw signs of stabilization with a 1% decline in revenue and unit growth of 1%. ASPs declined 3%. Operating income in the PCCG group actually grew 13% YoY, which appears to indicate lower R&D and/or marketing expenses, as well lower cost of sales. The ASP decline seems a bit surprising this quarter as commercial PC shipments outpaced consumer and commercial PCs tend to have higher-margin Intel Core processors.

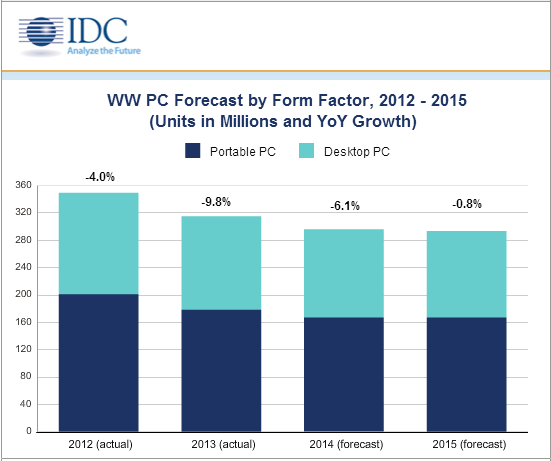

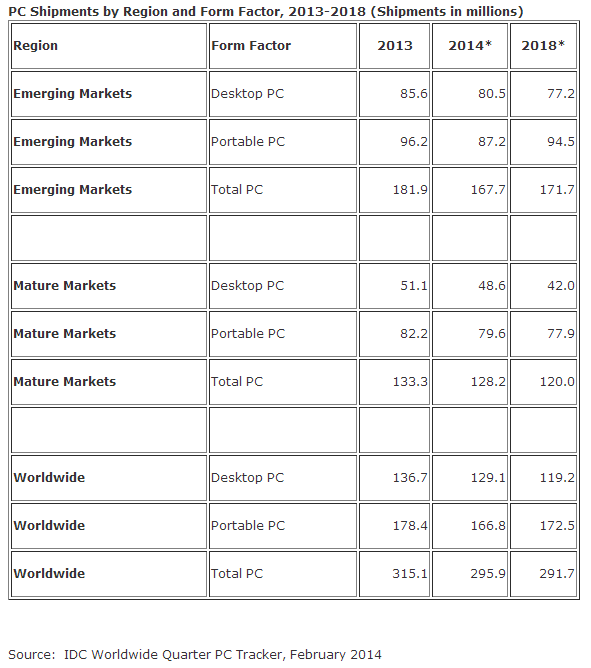

PCCG Outlook: Intel is forecasting PCCG revenue to decline mid single digits in 2014. This is inline with the recently published IDC forecast, whichprojects PCs to decline 6.1% in 2014 but then more or less stabilize (see chart).

Using IDC forecasts, we model revenue of $31.3B for PCCG in 2014, declining 0.8% in 2015 and remaining relatively flat thereafter in line with the PC market. Operating margins are forecasted to remain flat at 35%.

Data Center Group

Data Center Group revenues rose 11% YoY, driven by a 3% increase in volume and 8% ASP increases. The move toward cloud computing and expansion in data center capacity requirements will continue to fuel growth in this segment. Intel is forecasting low double-digit growth for 2014. My fairly conservative revenue forecast for this segment assumes 13% growth in 2014, 10% for the next 3 years and 5% thereafter through 2020. Intel was actually more optimistic at its investors' day, where it forecast low to mid-teen revenue growth for 2014 with margin expansion and 15% longer-term growth CAGR. This segment actually has the highest operating margin of Intel's businesses at 46%, which makes sense as the chipset is a relatively small portion of the total cost of ownership in the server asset. I am not assuming any margin expansion, so again I'm being more conservative relative to Intel's view.

Internet Of Things Group (IOT)

IoT is the latest buzzword in the industry, with wildly diverging estimates of the market. What all these estimates have in common is that the opportunity is huge (9B Internet-connected devices in 2013 growing to 15-25B by 2015, and to 50B by 2020) and largely untapped. Intel's IoT business grew revenue by 32% YoY and operating income grew 84%. This business has the potential to be the growth driver for years to come. Intel has fairly high operating margins of 31% in this segment, which I believe will decline as it invests to capitalize on the opportunity. I am pretty bullish on this segment and I'm assuming 15% annual revenue growth rates through 2020. This is consistent with guidance communicated at Intel's investor day in November 2013. I assume that operating margins decline from the current levels to 20% by 2015 and stay flat thereafter.

Mobile and Communications Group

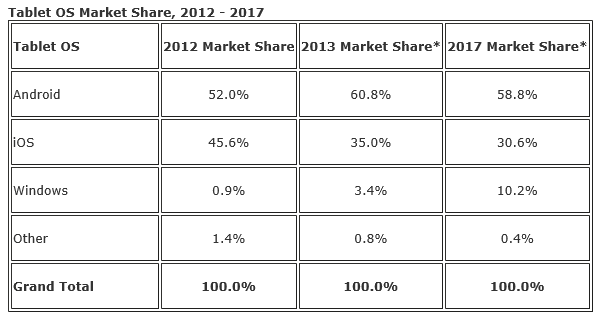

Worldwide tablet shipments are forecasted to reach 270.5M in 2014, growing to 386.3M units by 2017 and peaking there. The following chart shows the market share estimates by platform (source: IDC).

Intel has been investing heavily in this segment as well as substantially reducing prices to compete with ARM in the whitebox market. Intel communicated that operating losses in this segment will widen while revenues stay flat as it invests to gain share on tablets. Intel's target for 2014 is 40M tablets, which represents a share of 15% of tablet shipments. With the pricing changes that Microsoft (MSFT) has recently announced (zero royalty on Windows tablets below 9"), Intel/Microsoft have a good chance of gaining a reasonable share of the market. If we assume Intel's market share grows to 20% by 2017 that would represent a volume of 77M units for a CAGR of 25%. I am assuming a more conservative revenue growth rate of 15% over the next three years, tapering to 5% thereafter. As Intel gains volume share on tablets and starts to reduce production costs, operating losses should narrow. To be conservative, I assume that Intel eventually gets to breakeven on an operating income level in this segment only by 2020.

Software and Services Group

This segment has been running at breakeven profitability from an operating income standpoint over the last couple of years. Intel indicated during its investor day that it expects low double-digit growth in 2014 and some profit. To be conservative, I am growing this business 7% in 2014, 5% through 2017, and 3% thereafter. I'm assuming modest operating margins of 3%.

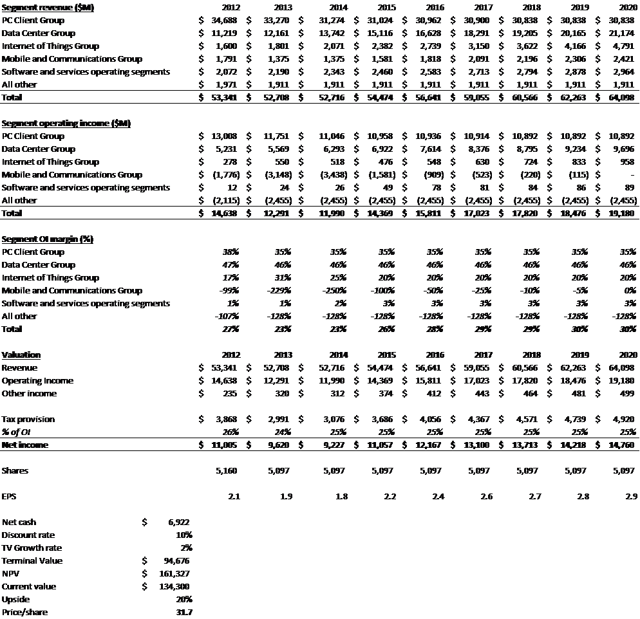

Here is a chart showing the development of Intel's revenue forecast by segment as well as the forecast of operating income:

Valuation

Taking together all the pieces, and applying a discount rate of 10% with a terminal value growth of 2%, I get to a fair market value of $31.7/share for Intel, which is an upside of 20% to the current share price, and with a fair degree of conservatism built in. This thesis obviously hinges on how quickly Intel is able to reduce operating losses in the mobile segment - however, as long as they are able to get to breakeven by 2020, there is little downside to the valuation. For simplicity, I have assumed capex=depreciation, however the model is not very sensitive to minor variations between the two.

The complete valuation model is attached below:

Summary and Conclusion

Intel has had a tough couple of years with the decline of the PC market, perhaps even more so than Microsoft, due to its reliance on the PCCG segment for all its operating income. However, the PC market is stabilizing and both Intel and Microsoft are responding to the challenge through aggressive pricing and other marketing investments. IoT and Data Center are growing at a robust clip and are poised to be the future engines of growth and profitability. Even before accounting for any profit from the Mobile group, Intel shares are 20% undervalued. The dividend yield of over 3% makes it an ideal stock for patient, long-term investors. Intel is a strong buy.

Additional disclosure: I do not own INTC shares, but am short INTC puts.

No comments:

Post a Comment