Summary

- National property insurers continue to reduce their exposure to Louisiana and other coastal markets.

- Premiums have skyrocketed in certain states allowing Maison to cherry-pick high margin policies.

- The volatile insurance climate as it pertains to more weather losses has been overrated and biased by Katrina.

- Lower reinsurance rates should be a nice tailwind in the near-to-medium term.

For the most part I rarely look at IPOs as they are typically overvalued and difficult to accurately assess. However, in looking at this months' offerings, one did catch my attention as a great speculative play. 1347 Property Insurance Holdings (PIH) is a property insurance underwriter in the state of Louisiana. The company recently IPO'd at $8 per share on the first of April. One of the interesting things that piqued my interest was the reduction in the IPO price from a range of $10-$12 per share to $8.00 in a few weeks. A primary reason for the decline in price was likely the flood of new issues coming to the market during the time period. Since mid-November, over 100 IPOs have come on the market with many high-profile ones occurring in the last few weeks including IMS Health, TriNet, King Digital, and CBS Outdoors.

There are three large risks that are depressing the IPO and share price:

1) Concentrated risk focused solely on Louisiana

2) The company is not generating profits

3) Insurance climate is volatile within the state

4) Weather risks

Business Overview

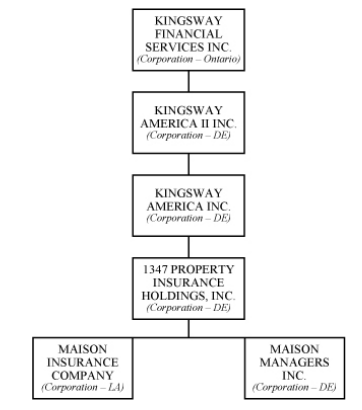

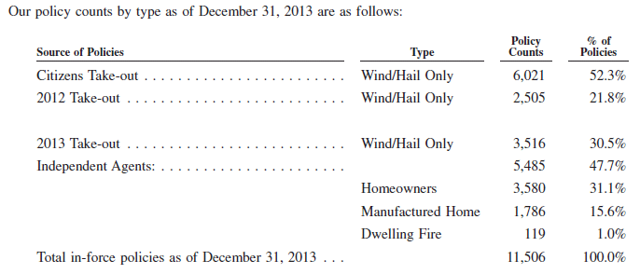

1347 is a property and casualty insurer in the state of Louisiana which operates through a wholly-owned subsidiary, Maison Insurance Company. They currently offer homeowners insurance, manufactured home insurance, separate wind and hail policies and fire insurance. As of the end of December, they had approximately 11,500 policies outstanding.

Prior to the offering, the company was a wholly-owned subsidiary of Kingsway Financial Services, listed on the NYSE and TSX listed holding company that functions as a merchant bank. After the offering, Kingsway will own approximately one-third of the company or 30.8% if the underwriters exercise their greenshoe.

The company insures personal property located in 62 of the total 64 parishes in the state. However, of the 11,500 policies, there is concentration in Jefferson Parish at 25.1% of all policies, Saint Tammany Parish at 10.9%, Orleans Parish at 9.6% and Terrebonne Parish at 6.9%. No other parish has over 5% of the policies and the remaining 58 parishes total to 47.5%.

At year end, approximately 52% of the company's policies comprised of wind/hail-only coverage, with another 31% written as homeowner multi-peril, 16% are mobile/manufactured home policies and approximately 1% fire policies.

(Source: Prospectus 3/26/14)

Background on the Market

As they note in their S-1, the market for homeowners insurance has undergone a structural change since Hurricane Katrina in 2005:

Historically, the Louisiana homeowners insurance market has been dominated by large national insurance companies, which began writing property and casualty insurance policies in Louisiana when rates were much lower than they are today. Following a period of unusual hurricane activity, it became apparent that the historical rates charged by these insurance companies were not adequate to cover the risks they assumed. Consequently, many insurers began to decrease the number of property and casualty insurance policies they wrote in Louisiana.

In 2004, the state of Louisiana created the Louisiana Citizens Property Insurance Corporation, a last resort insurance company. The state mandates that their policies be more costly than private property insurance companies. It's a non-profit organization created to provide insurance products for residential and commercial property applicants who are unable to procure insurance through the private insurance marketplace. Citizens is required by state statute to charge rates at least 10% higher than the rest of the private insurance market, or higher than the highest rate charged by insurers who underwrite in coastal parishes.

The current market is still dominated by the national insurance companies who account for approximately 76% of home and fire policies in the state. Citizens currently writes approximately 8% of all the policies. Many of the insurers have also begun underwriting policies that exclude wind and hail as that risk of loss is greater than multi-peril.

Market Opportunity

According to the Louisiana Department Of Insurance, the market in the state for homeowners insurance and home policies represents annual premiums of $2.5 billion. Homeowners direct premiums accounted for $1.7 billion in fiscal 2012 covering a total of 1.7 million households and 4.6 million people.

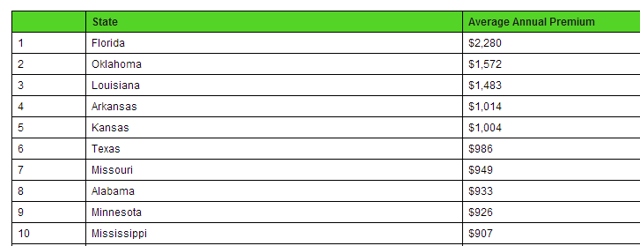

The company believes the Louisiana property and casualty market is underserved due to weather-related risks. National insurers have been reducing their exposure to the state creating an opportunity for small, regional players to gain market share and pricing power. The state has among the highest overall property insurance rates in the country.

(Source: Home Insurance LLC )

Unlike Florida, there is no mandatory catastrophe-cost overhang in Louisiana. The state of Florida has the Florida Hurricane Catastrophe Fund which requires insurers to purchase coverage from the fund. It offers insurance companies reinsurance at prices generally lower than those in the private market. The reasoning was to keep private insurers from leaving the state. The state also has their own Citizens Property Insurance Corporation, a non-profit whose sole purpose is to provide insurance protection to property owners in the state. The corporation insures hundreds of thousands of homes, businesses and condominiums whose owners otherwise might not be able to find coverage.

An insurance take-out program was implemented to reduce the number of properties insured by Citizens of Louisiana. Under the program, insurance companies within the state have the opportunity to purchase insurance policies written by Citizens. According to the S-1, Maison has only purchased wind and hail policies from Citizens despite the fact that they write mostly full peril protection. As of the end of 2013, the company has in force approximately 6,000 take-out policies from Citizens, of which approximately 3,500 were from the latest take out program that occurred in early December, 2013.

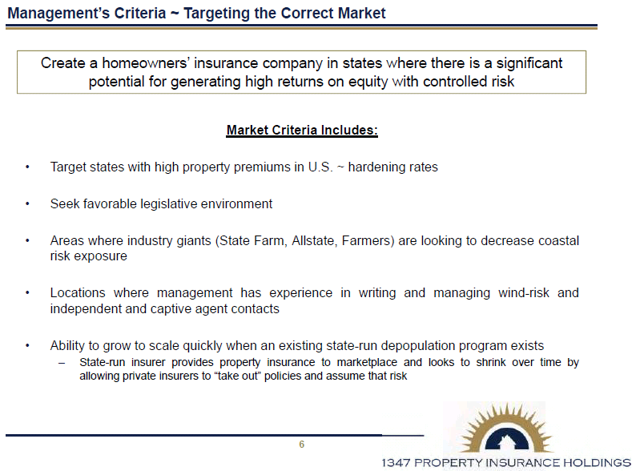

Below is a presentation slide detailing their growth strategy going forward:

(Source: Company Presentation 04/07/2014)

The company believes it possesses a number of competitive advantages that provides it with outsized growth opportunities. The primary strength is their local market expertise. This stems from the CEO on down with Chief Executive Douglas Raucy having more than 33 years experience serving within the insurance industry in Louisiana. In addition, their executive officers have, on average, more than 35 years of experience within the property and casualty industry as well as strong relationships with both independent agents and regulators within the state. In general, they believe their strength in management will allow them to achieve lower loss ratios. Other competitive strengths include their outsourced policy administration system and their underwriting approach.

Concentrated Geographic Risk

The current diversification of their policies presents a large risk for the firm. One large storm can cause the firm a significant loss. One of the primary uses for the IPO proceeds will be to fund growth of their operations into neighboring coastal states with high property insurance rates. Management has stated that they will explore the potential acquisition and start-up possibilities to rapidly expand into other states. Their primary states of possible expansion are Texas, Florida and Hawaii.

(Source: Company Presentation 04/07/2014)

The company laid out their reasoning for targeting these locations. For one, they see these states possessing a favorable (or improving) legislative environment that would favor insurers and contain better margins than higher regulated states. Second, they can focus solely on wind-only policies and underserved markets that the national players are reducing exposure to or contain massive margins ripe for competition.

Third, each state has a risk overhang that is leading to a mispricing of the risk, and thus higher premium for homeowners. In Hawaii, the property market is priced as a 'Hurricane-prone' state. However, the last hurricane to hit the state was in 1992, Hurricane Iniki, and it only struck one island, Kauai.

Texas and Florida are both fast growing states with high property insurance rates. Florida, in particular, is of certain interest given the favorable state-run depopulation program which will provide Maison with significant take-out opportunities similar to the system they are using in Louisiana.

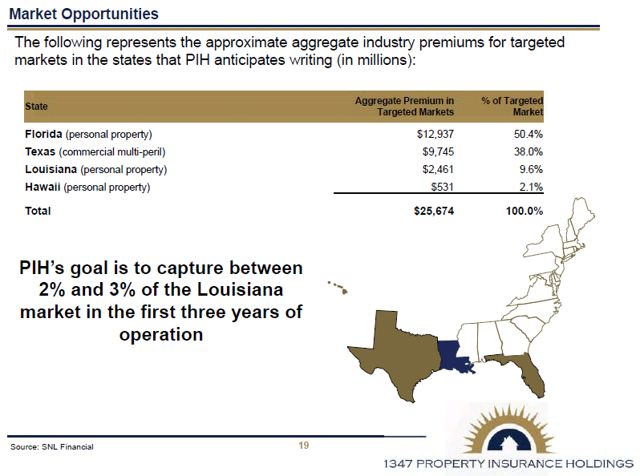

Below is a representation of the approximate premiums within the industry in the states they are targeting:

(Source: Company Presentation 04/07/2014)

Unprofitable Company

One of the knocks on the company is that it isn't making money. Of course, if one looks at most of these technology and social media IPOs, they will see that they do not earn a profit, and most do not have a prospect of doing so. It is correct that Maison isn't generating profits, but according to the prospectus, from October 2, 2012 (the inception of the firm) through the end of December, 2013, they incurred a total of $6.8 million in losses and expenses on revenues of $5.5 million. They incurred a total net loss of $0.9 million over the 15 month period. However, they did realize a single hail storm event that cost the firm $3.3 million, without which they would have achieved a $1.4 million profit. Reinsurance on the policies did help the firm recover $1 million of the losses.

The second reason for the absence of profits is the lack of scale within the business. They incurred expenses of $2.5 million in general and administrative expenses which mostly go towards management costs including salaries and overhead expenses. The total was 45% of aggregate revenue over the time period. While I would expect these expenses to continue higher, it should fall dramatically as a percentage of revenues as they scale their operations and expand their policy base.

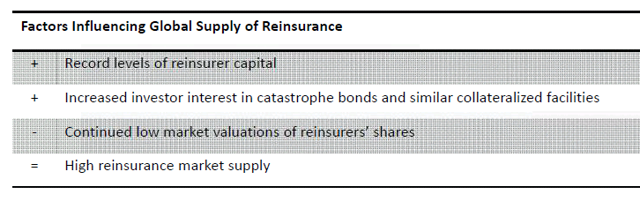

One of the largest costs in homeowners insurance premiums are the reinsurance rates. Reinsurance is insurance purchased by an insurance company as a means of risk management. For example, as I noted above, a significant amount of the loss experienced last year occurred from one hail storm event. However, reinsurance rates continue to fall as the high margin business sees an influx of new companies.

(Source: Company Presentation 04/07/2014)

From the Insurance Journal earlier this month:

Reinsurance rates began to fall last year," said Willis Re's Chairman James Vickers in a telephone interview. The January renewals "saw more reductions, and this has continued in April."Vickers outlined three principle reasons: 1) 2013 was a benign year for natural catastrophes with relatively low losses. According to Swiss Re's latest sigma report economic losses totaled $140 billion last year, down from $196 billion in 2012. As a result primary carriers have more capital and see less need for reinsurance.2) Those primary carriers, especially the larger companies, are also "more sophisticated, employing more accurate models," Vickers said. This also results in those companies perceiving that they have less reason to reinsure certain risks.3) Alternative capital remains ready and willing to make investments in reinsurance risks, mainly collateralized reinsurance, cat bonds and sidecars, which reduces the role of traditional reinsurers.

This can be looked at in two ways, either the firm can reinsure a larger percentage of their business for the same cost as last year or they can increase their reinsurance coverage and assume less risk, although earn less profits.

Insurance Climate Volatility

The IPO was not really successful in the final offering price received mostly due to the perception of a volatile insurance climate. This primarily stems from the perceived susceptibility of the state to extreme weather, namely hurricanes. However, the statistical likelihood of the coastal parishes experiencing a catastrophic hurricane is not very high.

Major hurricanes are classified as category 3 or higher on the Saffer/Simpson Wind Scale. This measure is used primarily to gauge the potential damage and flooding a hurricane will cause if it makes landfall. The company states that hurricanes of category two or less have wind speeds of less than 110 mph and do not present a significant risk of major property damage.

The National Hurricane Center lists the types of damage due to certain levels of hurricane-force winds. Within the category 1 classification, they note that most damage will occur due to downed power lines and tree branches. However, given how the region has been exposed to such winds already, the amount of damage to coastal Louisiana will likely be minimal within a category 1 storm. In category 2, there is more likely to be damage to homes, mostly to roofs with shingles being blown off. Unanchored mobile homes become susceptible to these types of winds although the number that are unanchored is relatively low in hurricane and tornado prone areas of the country. In conclusion, the insurers only believe that category 3 storms and larger pose any significant risk for major property damage to the state.

Of the 30 most costly mainland US hurricanes since 1900, nine struck Louisiana either directly or indirectly. Since 1969, there have been three landfalls of major hurricanes that were category 3 or larger with the last being Hurricane Katrina in 2005. The last hurricane to hit the state was Hurricane Isaac in 2011 which hit New Orleans with category one winds.

Since 2003, Louisiana homeowners insurance rates have jumped an average of 58.6% through 2010, the most recent year data is available. It has the third highest rate increase over the time period behind only Florida and Rhode Island. For comparison, rates in Florida have increased 91%. This has pushed up, and compares to, the nationwide average increase over the same time period of 36%. - nearly double the rate of inflation.

Given the losses sustained by property and casualty insurers from Hurricane Katrina, Superstorm Sandy, and earlier from Hurricane Andrew, the underwriters began placing a significant premium for these hurricane-prone areas of the coast. In addition to looking backward and reassessing risk premia, the insurance underwriters are looking forward at possible climate-change induced weather extremity. Although there is no concrete data to support more extreme hurricane activity, given the increased populations residing near the coast, the insurers have been boosting rates in order to protect against future potential losses.

The hail storm even that occurred last year and that reduced operating income by $2.3 million net of reinsurance reimbursement was also a fairly low-probability occurrence. Here is a list of the top most costly hail storms in the US. You'll notice that none are situated on the southeastern coast. Management has stated that hail storms in New Orleans and the coastal parishes is much more rare than compared with the interior of the state. Recall that Maison exposure is primarily situated in the southeastern coastal parishes around New Orleans.

The increases in rates provides a larger cushion for underwriters when the weather data doesn't back up the necessity and provides an opportunity for small, mobile players to enter the space and capture share. Management believes they can outperform by using a disciplined underwriting process. This includes tailoring insurance products for the Louisiana market specifically, utilizing technology to better assess insurance to value, inspecting independent agent policies while managing catastrophe risks through reinsurance.

Not only is Maison able to cherry pick markets that are underserved with over-priced risk premium, they also are realizing higher deductibles helping to cushion any potential loss. Insurers are increasingly moving towards charging a percentage-based deductible, which could cost some policyholders thousands more if a storm were to occur. Unlike a flat deductible which is based on a specific amount, a percentage based deductible is based on the insured value of the home. Most are set between 1% and 5% (2% is most common), where a 2% deductible on an insured home value of $200,000 would equate to a $4,000 deductible. As home prices have risen nationwide, and even more so on the coasts, deductibles continue to increase helping to mitigate claims.

Expansion of Policy Base

The company has six strategies for expanding their property and casualty writings in Louisiana. These include:

1) Increasing the number of voluntary policies. This includes capturing the market share ceded by the national insurance companies creating an opportunity to both underwrite new policies for customers and also acquire existing policies from the larger companies.

2) Increasing the assumption of policies held by Citizens. As I noted above, 8% of the outstanding policies are written by Citizens, the state insurer. They operate a take-out program in early December every year and Maison intends to continue to participate and selecting policies from these programs.

3) Strategic acquisitions is another growth opportunity. One of the primary ways the company is expanding their policy base is through renewal rights transactions. These typically occur when an insurance company needs to raise capital quickly or exit an existing product line. Essentially, Maison will be able to re-underwrite policies and cherry pick the book of business. Their underwriters will be able to pour over the historical loss data and other risk criteria to make accurate determinations on the underlying policy. This is a great way for smaller insurers to gain share and access to niche markets, especially when the larger players are scaling down their operations within a certain market.

4) Since the company's founding several years ago, they have worked to establish a network of agents throughout the state of Louisiana. They have locations now in all the major cities in the states with a network of over 130 independent agencies. These agents can represent several insurance companies in order to provide various insurance products to their customers. The company has realized steady organic policy growth since entering this market.

5) Increasing operating efficiency through the reduction of the ratio of operating expenses to net premiums. This is underway currently as they scale up their operations and hold more policies.

6) Evaluating appropriate levels of reinsurance and potentially the creation of their own reinsurance subsidiary. Management has significant experience in the industry and state of Louisiana and they will continuously evaluate the proper levels of reinsurance that will limit their loss exposure in the most cost-effective manner. A new offshore reinsurance subsidiary is also being contemplated in order to reduce their largest expense.

The company estimates they will receive approximately $11.3 million to $13.1 million (if greenshoe is exercised) from the offering. They expect to use the net proceeds as follows: $5 million to provide further capital to their existing insurance underwriting subsidiary Maison Insurance, approximately $2 million for other general corporate purposes, including settlement of payables with KFSI, investment for business development, sales and marketing, and working capital. The remainder is to be used to form a new subsidiary, which will allow for the expansion of their insurance products into new markets. Management also cited that they may use a portion of the net proceeds from this offering to pursue acquisitions, or to capitalize an offshore reinsurance subsidiary that they intend to form.

Valuation

Unlike most small insurers, Maison has a clean balance sheet with no debt and approximately 72% of all liabilities are unearned premium reserves- an accounting term that is simply the proportionate of premiums that have not been earned and represents the premium corresponding to the time period remaining on the policy.

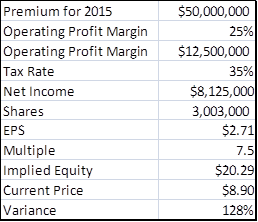

Their goal is to capture 2% to 3% of the Louisiana market in the first three years of operation. If the market as a whole is approximately $2.5 billion in annual premiums, then the goal would represent between $50 million and $75 million in annual premiums owned. This is a significant ramp in revenues that they expect to achieve over the next few years. I did confirm those estimates with management as they expect to hit $39 million by the end of this year so $50+ million is very attainable for fiscal 2015.

As I noted above, one of the current headwinds is that the firm is not making any profit, which is true. However, if you look at the prospectus, it notes the fourth quarter profit of $689k. The company has just over 3m shares outstanding following the IPO offering. Of that total, 1m shares are held by KFSI with insiders owning another 691k of shares. (see Risks section for lock-up details). So the fourth quarter profit is immaterial really on a per share basis. But using it as a run-rate, we can ascertain an annual profit of approximately $2.75 million or $0.92 per share. At the current price, that is 9.6x ttm earnings. Additionally, the operating profit in the fourth quarter was 27%.

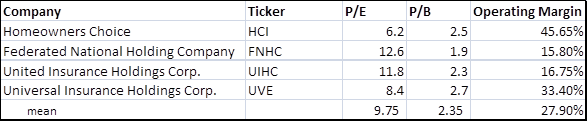

Below is a table of their most direct competition and the prices their stock are trading:

(Source: Author's calculation)

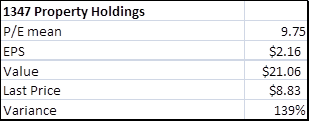

Examining the prospects further and using the company's own estimate compared to industry averages, we get operating profit for the firm. At $50,000,000 in revenue, the goal for 2015, applying an operating profit of just 20% to that (remember they generated 27% in the fourth quarter) gets us $10,000,000 in pre-tax income or $6,500,000 in profit after-tax. That equates to $2.16 per share. Applying a 6.5x multiple to that, well below the mean of the four comparable companies, gets us an intrinsic value of $14.07 or 58% above the current trading price.

I could use that as a base case scenario given the use of an operating margin assumption that is 700 bps below the current run rate of the fourth quarter. Additionally, I used a multiple that is one-third below the comparable average. Below would be a more optimistic case scenario:

(Source: Author's calculation)

Valuing based on the mean of the most direct comparable insurance companies illustrates the potential value if they reach their goal of $50m in premium revenue by the end of next year.

(Source: Author's calculation)

Even if the firm achieves only half of its 2% to 3% goal for market share over the next three years, they would still be earning close to $1.50 per share, which after applying the 6.5x multiple, equates to a $9.47 share price or a 6.5% gain from the current price over the next year. This clearly demonstrates the asymmetric risk-reward payoff potential with the company.

Catalysts

The following are the upside catalysts:

- The stock was not a high profile IPO amidst a plethora of new issues coming to the market which marked down the offer price

- The company has an overhang by operating within the Louisiana market where investors still think about Katrina first and foremost. The statistical probability of that occurrence is actually fairly low.

- The hail storm that occurred in the first part of the year is also a fairly uncommon occurrence in New Orleans.

- The fact that they didn't generate a profit in 2013 also depressed the desirability of the IPO but profits should ramp significantly.

- High premiums and the national players reducing exposure should depress competition and increase profitability

- Reinsurance rates are declining

Risks

Clearly the primary risk for the firm stems from weather-related losses. While the firm attempts to mitigate those claims through reinsurance and strong underwriting processes, it cannot now the future with any certainty.

One of the primary risks investing in an IPO is the headwind from insider selling after the lock-up period expires. Kingsway (KFSI) and all of the directors and executive officers have signed lock-up agreements with Aegis, the underwriter, agreeing not to sell any shares of stock for a period of 180 days. This will expire at the end of September. There is the potential that we could see significant selling pressure once that lock-up expires as with any IPO. Kingsway currently own 30.6% of the outstanding shares and FMG holding another 9.6%. (FMG is an entity to which Gordon Pratt, the chairman of the board, is the managing member and controlling equity holder)

The next largest risk is whether the firm has adequate capital to sustain itself in case a large weather event strikes its policy region. Given the IPO proceeds, lack of debt, and cash on hand, they are very adequately funded currently. That could change as they invest that capital.

From the prospectus:

A risk-based capital (RBC) formula is used by the NAIC to identify property and casualty insurance companies that may not be adequately capitalized. Most states, including the domiciliary states of the Company's insurance subsidiary, have adopted the NAIC RBC requirements. In general, property and casualty insurance company surplus as regards policyholders below 200% of the authorized control level, as defined by the NAIC, at December 31 is subject to varying levels of regulatory action, including discontinuation of operations. As of December 31, 2013, surplus as regards policyholders reported by MIC exceeded the 200% threshold. As of December 31, 2013, the surplus as regards policyholders was reported at $7,722, while the 200% of authorized control level risk based capital was at $2,818, excluding catastrophe risk, hence MIC exceeded the 200% threshold by $4,904.Louisiana statutes provide that the ratio of net premium written to policyholders' surplus for Maison Insurance should not exceed 4-to-1. The ratio of annual statutory net premium written by Maison Insurance to combined policyholders' surplus was 1.7-to-1 as of December 31, 2013. Our current levels of policyholders' surplus are adequate to support current premium writings based on this standard. We monitor premium and statutory surplus levels of Maison Insurance in an effort to ensure that the subsidiary maintains adequate premium to surplus ratios. Failure of Maison Insurance to maintain adequate levels of policyholders' surplus could negatively impact our ability to write additional premiums.

Lastly, they are an 'emerging growth company' as defined by the Jumpstart Our Business Startups Act signed by the Obama administration two years ago. As such, they have more relaxed requirements for financial reporting. For instance, just two years of audited financial statements are required instead of the customary three. Also, they do not need an auditor to attest to their internal financial controls, a Sarbanes-Oxley rule that was put in place a decade ago.

For a complete list of risk factors, please read their S-1.

Conclusion

Maison is a small, regional insurer with a deep bench of experienced managers who have clearly found an opportunity within the market they've operated within for decades. The national insurers have been reducing their exposures and massively raising rates for the coastal homeowners for over a decade. Couple that with the higher perceived weather-related risks than is warranted by statistics and you have a ripe market for expansion. The stock is clearly undervalued especially given their stated goal of reaching $39 million in premium this year and $50 million next year. The true stock value will likely be realized later this year as the growth model starts coming to fruition. With no sell side coverage and a lack of much interest by investors given other higher-profile IPOs, a significant mispricing has occurred. I think the upside potential here is conservatively 50% to 100% with a share price in the mid-to-high teens over the next 18 months a distinct possibility.

*It should be noted this is a microcap stock. Please also notice that the market cap value from Yahoo Finance is incorrect as they are using a shares outstanding of just 1.0 million shares instead of the correct 3,003,000.

Editor's Note: This article covers a stock trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Additional disclosure: These opinions are my own. You should do your own due diligence and make your own best judgments about the company.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiourcate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment