Summary

- Ruthigen's IPO provides strong investment opportunity based on relative valuations and addressing unmet market need with potential multi-billion dollar market.

- Tetraphase Pharmaceuticals in turn presents a short opportunity as a potentially inferior comp a year ahead of Ruthigen with >10x the market cap.

- Long RTGN and short TTPH is set up to be an ideal pair trade with upside on both ends and decreased market exposure.

I first wrote about Oculus (OCLS) here on May 6, 2013 with the thesis of a strong short opportunity presenting itself. The stock went from $5.97 to as low as $2.34 within six weeks, allowing readers the opportunity for a short-term return of 61%. While a main part of my argument for shorting Oculus at the time ended up being correct, now that the Ruthigen (RTGN) spinoff IPO from Oculus has officially been completed I see very strong upside potential in Ruthigen. Ruthigen's IPO pricing was on the low side, due most likely to investor concerns about Oculus' ability to raise the total amount needed for it. Now that they have pulled it off, however, at just a $30 million valuation (not including warrants) it looks very cheap next to several comps. Perhaps the closest of these comps is Tetraphase Pharmaceuticals (TTPH), which looks overvalued in contrast and presents the setup for a strong pair trade of long Ruthigen and short Tetraphase.

Tetraphase, with its $325 million market cap, is approximately a year ahead of Ruthigen with the progress of its lead drug. A key difference, though, is that Ruthigen's product is for the prevention of infection during invasive surgery while Tetraphase's lead product is an antibiotic for the treatment of infection resulting from such surgery. This gives Ruthigen a larger potential addressable market, while Ruthigen's product also addresses a broader spectrum as it is effective against antibiotic resistant strains such as MRSA and VRE. Ruthigen's product addresses a $700 million initial market with a $3 billion+ potential surgical market.

(Note that I did not include the warrants in the calculation of initial market cap because I believe this IPO was structured creatively where, if all of the warrants issued are exercised, it would provide Ruthigen the capital needed to make it through phase 3 without ever needing to raise additional capital. So while it would increase the potential shares outstanding from 4.2 million to 8.6 million, the value it creates by getting the company through phase 3 needs to be considered as well in determining a proper valuation.)

Previous analysis correct; timing in Ruthigen's favor now with hot biotech IPO market in 2014

My initial analysis a year ago that the Ruthigen IPO would not occur as planned from a timing perspective turned out to be correct. The IPO was delayed and it almost seemed as if it may not happen as it pushed up against the March 31 deadline that was set. Looking back on the article I wrote about it at the time I referenced another biotech company, Harvard Bioscience (HBIO), that was looking to do the same type of spinoff IPO as Oculus was with Ruthigen. On April 9th, 2013 Harvard Bioscience delayed the IPO of its Harvard Apparatus Regenerative Technology (HART) unit due to market conditions. Similar to Oculus with Ruthigen, Harvard Bioscience desired to separate this development unit with large upside but the need for more capital from its revenue generating core business to help realize shareholder value. When Harvard Bioscience announced this delay a year ago, its sharesdropped 15%.

Harvard Bioscience spinoff of HART

Well, in November, Harvard Bioscience was able to complete the HART spinoff. Harvard Bioscience was unable to complete the spinoff via an IPO last year and either remained unable to or chose to go a different direction as they eventually completed it via a Form 10 filing. The share price of HART has since risen from $4.50 and a market cap of $35 million on its first day of trading to its current price of $10.22 with an $80 million market cap. I mention market cap along with share price because the initial market cap for HART is similar to the market cap given to Ruthigen via its IPO pricing. If Harvard Bioscience was still unable to complete its spinoff via IPO and hence chose the Form 10 route, it would make me feel even better about Ruthigen now garnering the demand to complete its IPO.

The market environment for biotech IPOs has certainly changed quite a bit from last year when both of these IPOs were delayed. The biotech IPO market could not be hotter in 2014, with life science companies that have gone public this year averaging a 35% return with several large triple digit percentage gainers. Ruthigen waiting until now for its IPO, whether by choice initially or not, appears set to reward both the company and early investors.

Tetraphase presents a good short as a potentially inferior comp with >10x Ruthigen's market cap

Tetraphase Pharmaceuticals is currently priced at $12.52 per share with a market cap of $325 million, up from its IPO pricing of $7 per share in March 2013.

The company's lead product, eravacycline, has initiated its phase 3 clinical program. Eravacycline is an antibiotic for use for the treatment of serious resistant Gram-negative infections. An important thing to note regarding antibiotics in the modern world found on an "antibiotic backgrounder" put together by Tetraphase located on its website:

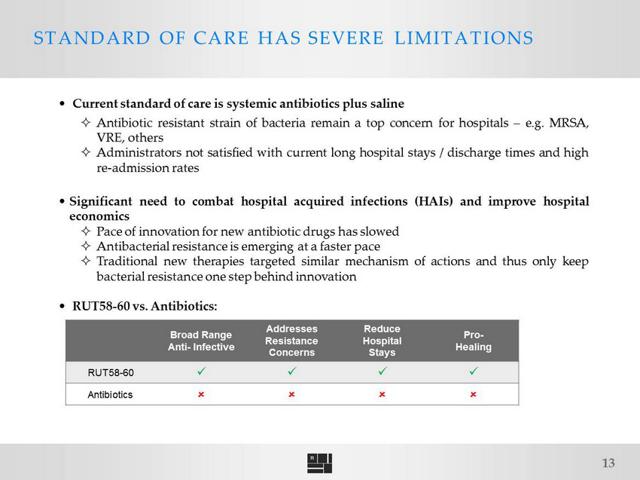

Antibiotics have been in widespread use for the treatment of serious bacterial infections for decades. However, the inherent ability of bacteria to develop resistance to antibiotics has become a growing threat to the modern world. Widely recognized as an urgent public health threat by the World Health Organization, the Centers for Disease Control & Prevention (CDC), and the Infectious Disease Society of America (IDSA), this resistance is seen in both community- and hospital-acquired infections.

Two glaring things stand out immediately in comparison to Ruthigen. A treatment for an infection by definition is going to have a significantly smaller market potential than a prevention for the same infection. A prevention has a potential market of every patient undergoing a certain procedure. A treatment only has the potential market of the smaller percentage of patients who undergo that procedure and get the infection. Ruthigen has an immediately addressable potential market of $700 million just for abdomen surgeries, with its entire potential addressable market estimated at >$3 billion.

Numbers regarding the potential addressable market for Tetraphase's eravacycline were not available on the company's website.

The second thing standing out is that Tetraphase's product is an antibiotic, and Tetraphase itself notes the risks inherent with antibiotics today and the inherent ability of bacteria to develop resistance to antibiotics. Even if Tetraphase's product does get through phase 3 it could still become obsolete if more bacteria become resistant to the product.

Ruthigen notes in its filing that antibiotics are not effective in the prevention of infections after surgery, and that its own product is targeting a large unmet need. Ruthigen is the first to develop and potentially market a hypochlorous acid drug candidate for invasive use. Note that Oculus' Microcyn products, which have received FDA approval and are generating sales, are for topical use and thus classified as a medical device. This is in comparison to Ruthigen's RUT58-60 which is invasive and designed for compatibility with internal organs for prevention of infections during abdominal surgery. The key clinical drivers for RUT58-60 are that it covers a much broader spectrum of bacterial and viral infections as it is effective against antibiotic resistant strains such as MRSA and VRE, and it may be used prophylactically as it does not promote resistance. Both of these drivers would take away market share from Tetraphase as well as eravacycline is an antibiotic that is not effective against as broad a spectrum and cannot be used prophylactically as it may promote resistance.

Tetraphase is currently about a year ahead of Ruthigen in the development of its lead product. Tetraphase has completed its phase 2 trials and begun phase 3. Ruthigen projects having phase 1/2 results in 1Q 2015. If all of Ruthigen's warrants are exercised by that time, giving the company a fully diluted share count of 8.6 million shares with no further need to raise capital, a $325 million market cap would equate to a share price of $37. Having no need for additional capital aspect if all warrants get exercised presents a unique situation for a biotech company as well, as Ruthigen needs $50 million in total to get completely through phase 3. This differs from Tetraphase, whom as of December 2013 had received an aggregate of $217 million in proceeds from the issuance of equity securities and borrowings under debt facilities, to go along with losses incurred since inception of $119 million and the stated need to raise additional capital at some point in the future.

Here is a snapshot of several other comps for Ruthigen in varying stages of development that gives a good look at some current valuations in the space:

Ruthigen's tight share structure could help it capitalize on biotech IPO momentum

The tight share structure in Ruthigen is an attractive scenario. This could help generate a momentum upswing in the stock on its own if there are not enough shares on the float to satisfy investor demand in the open market once it begins trading, as has been the case with several biotech IPOs recently. There are a total of 4.2 million common shares outstanding, with 2 million of these shares held by Oculus that have a one-year lock-up period. This leaves the 2.2 million shares on the float that were issued in the IPO for which Dawson James served as the bookrunner. I believe that since Dawson James is largely a retail broker, many investors who participated in the IPO through Dawson James are in it to see RUT58-60 through the finish line and the potentially larger gain that would come with it if this happens. This is in contrast to some institutional funds in other IPOs looking to flip their shares shortly after the stock starts trading. If this is the case with several of the IPO investors being in it for the long haul, the float is even less than 2.2 million shares. Either way, with this type of low float, the way biotech IPOs have fared recently, Ruthigen's relatively low valuation based on comps, and Ruthigen's multi-billion dollar potential addressable market, there is a very strong case for the long side of Ruthigen. Matching it with a short trade on Tetraphase, which appears relatively overvalued, should help balance exposure to market risk and provide upside on both ends of the trade. The last pair trade I recommended of going long Energy Fuels (UUUU) and shorting Uranium Resources (URRE), while in a different sector, was up 42%within two months.

Risks

A risk potentially facing investors in Ruthigen is that if the stock does not trade well, the warrants would possibly not get exercised along the way and Ruthigen would need to raise additional capital to make it through Phase 3. I believe the risk of bad data in Ruthigen's clinical trials is mitigated by Oculus' derivative product having already received FDA approval for topical use along with validation via more than 30 clinical studies. The risk on the short Tetraphase side of the trade is if the company continues to progress through its Phase 3 clinicals and the market rewards it an even higher valuation than its current market cap as a result. This should be more than mitigated by the fact that if this does happen, Ruthigen should appreciate exponentially as its market catches up to Tetraphase on a relative basis. Thus the attractiveness of a pair trade in this situation.

Additional disclosure: I am short TTPH.

No comments:

Post a Comment