Fortunately, the introducing broker kept my ear by saying this: "This is not a Chinese firm doing business in China, while listing in the US. This is an American company, taking American knowledge and understanding to China, and is trading on NASDAQ."

This immediately piqued my interest, and the following analysis is why I chose to get involved

OVERVIEW

You On Demand (NASDAQ: YOD) is the only company to have been granted a national Pay-per-view (PPV) and Video-on-demand (VOD) license in China. The issuing entity is CCTV-6/CHC, the Chinese Government channel dedicated to movies. This license has roughly 17.5 years left until renewal. This license is exclusive - it is very easy to understand the Chinese government not wanting to give control over content distribution to larger firms. Therefore, it seems unlikely many other entrants will emerge, and even less likely a market ready platform will present as a competitor.

For many years, Hollywood has sought a way to enter its catalog of movies into China, while not falling prey to piracy. Thus far, this has been a losing proposition. This is where YOD comes along. With the strength of the national PPV/VOD license, YOD has inked revenue-sharing agreements to distribute the content of most major US studios. These include Paramount, Warner Bros., Disney, NBC-Universal, Miramax, Lions Gate, and Magnolia Pictures. Sony and Fox are the two remaining majors, but these should be expected to sign favorably with YOD as there really is no other choice.YOD has also gained distribution rights for Chinese domestic content through the partnership with CCTV-6/CHC.

According to the company's presentation, the Chinese spent $6 billion on pirated DVDs in 2010. YOD is pricing their VOD/PPV in-line with the cost of pirated DVDs. At this cost level, it is easy to see how at least some people will choose to simply click their remote button for a high-quality PPV/VOD rental instead of picking up a pirated DVD on the street.

OPPORTUNITY: CABLE

Enter YOD. The company has revenue-sharing distribution agreements in place covering 18.2 million cable households, and an additional 1.5 million IPTV (Internet protocol TV, i.e. similar to Verizon FiOS). Combined, between 5 - 5.5 million have converted to 2-way digital cable.

To put this number in context, as of 2012, Time Warner Cable had 12.2 million subscribers, and Cablevision had 3.2 million. (Source) This means YOD has an immediately addressable base as large, or larger, than major US cable companies that have little future growth prospects. YOD subscriber base potential is expected to grow quickly from the 18.2 million current number.OPPORTUNITY: MOBILE

According to market research firm IDC, China's smartphone market is now the world's largest, with 2014 shipments projected to be 450 million units.

In the last few months, YOD signed an agreement with smartphone maker, Huawei, the number three largest OEM manufacturer globally. (Source)

The disclosed terms of the agreement are such that Huawei will pre-load the YOD app on to one of their phones that will now be branded as a "movie-phone." YOD receives a fee for every phone activation, as well as the normal revenue-share agreement arrangement for videos accessed through the app.

ETF Alternatives

Further, as the Huawei deal is non-exclusive, company commentary has made it clear they are very much engaged in discussions with other device makers / OEMs. I would not be surprised if we got further announcements for similar deals in the not-too-distant future.

The sheer size of the mobile market in China is obviously tremendous, making projected numbers almost meaningless. Enter: C-MEDIA

C-MEDIA: The Strategic Investor

In the last few days it was announced that C-Media completed phase 2 of its strategic investment in YOD, to the tune of $19 million, almost twice what was originally envisioned. The implications for YOD will be discussed next, but first, about the strategic.

According to YOD, C-Media is a private company, in China, that specializes in short-form mobile video (think music videos, vines, user generated videos, etc), that went from zero revenue 2 years ago to over $100 million in revenues last year. They were also ranked 3rd and 6th in Deloitte Technology's China Fast50TM and Fast500TM lists, respectively, for 2012. C-Media helped YOD finish the Huawei app, and is seemingly very excited about mobile possibilities in general.

The CEO of C-Media is also now Executive Chairman of YOD, while Shane McMahon continues as Chairman and Principal Executive Officer. This structure essentially guarantees C-Media will be operating closely with YOD for the foreseeable future

PRO FORMA CAP STRUCTURE, OWNERSHIP, and CASH

The implications of this strategic investment are enormous for YOD. According to the last financials, in the first 9 months of 2013, YOD had a cash burn rate of roughly $650k / month. Now, this was during the launch (02/13) and subsequent heavy promotional activity of their offering, so the current cash burn is likely less. But, let us assume that same cash burn: 19m / 650k = ~2.5 years of fully-funded run-way. I cannot make this point clearer - this is 2.5 years of cash, given at a time when the product has already launched, when the mobile app is live, and promotional activity has already passed. This assumes no revenues generated going forward. TWO AND A HALF YEARS (though likely a fair bit more).

Prior to the investment, Shane McMahon and the current CEO, Weicheng Liu, each owned just under 15% of the equity. Fidelity, a long time holder, owned 7.3%. This investment amounted to 41% of the pro forma fully-diluted equity, of which C-Media will retain 27% ownership. They had a number of other Chinese entities/corporates get involved, accounting for 14% combined ownership. The net result of this is that YOD is now heavily tied into the Chinese corporate networks with the right people.

Further, despite likely registration, these shares are not going to be hitting the open market any time soon. Between rule 144 and corporate insider laws, and the business tie-ups likely to occur going forward - make no mistake, these shares should not be considered part of the free-float.

Shane McMahon has invested at least $4mm directly in the company, and loaned the company $3mm additionally, in the form of a convertible note. This note is yet to be paid or converted, though it is my understanding the note can be converted into the same series of preferred received by C-Media for its investment. Further, the company's SEC filings make it abundantly clear that Mr. McMahon has continually waived and extended the repayment and maturity schedules. My strong feeling is that he will convert these into pure equity.

VALUATIONS

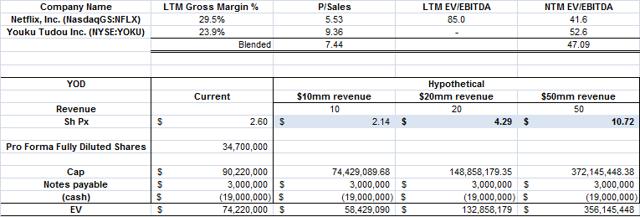

YOD has divested itself of all non-core assets. So, revenues for primary services are all that is considered going forward - though as of right now, these revenues have been de minimis. Thus, we look to comparables.

Note: YOD is targeting 20-25% initial gross margins, in-line with both NFLX and YOKU. They will not disclose operating margin targets, but according to the company (and which I believe makes sense) they have a fairly fixed cost structure, meaning there is high operating leverage inherent in their potential earnings.

(click to enlarge)

*Source: Capital IQ, company filings

The company has not disclosed the revenue-share split arranged between itself, the government, the cable providers, and the studios. However, the fact is, these Hollywood studios do NOT do revenue-share - willingly. That YOD has negotiated this arrangement with them is, in itself, tremendous.

It is easy to see how a not unrealistic ramp in revenues will lead to significant share price appreciation very quickly. I will leave this to you to discount at whatever rate you feel most appropriate. For reference, ThinkEquity has a $4.00 target and Chardan Capital Markets has a $6 price target using a DCF model.

MANAGEMENT AND THE BOARD

Shane McMahon: Chairman, Shane is the son of World Wrestling Entertainment legend Vince McMahon. As EVP of Global Media, he helped to build up the WWE into a media/entertainment giant. And yes, he knows the Ultimate Warrior (I know, right??).

Weicheng Liu: CEO, Weicheng has held senior positions with Nortel, TSCI, DSI, and Tollbridge.

The strength of this management team rests with the brand recognition and experience Shane brings to the table, and the huge level of ownership by insiders. The title of CEO was conferred to Mr. Liu in the last year, as Chinese cultural reasons necessitated having a C-level title on the ground in China. Shane is 100% actively engaged with the company.

That the CEO of C-Media is essentially a co-Chair following the strategic investment, to me, speaks to how excited they are for this tie-up.

FUTURE PROSPECTS

In the near term, and as we will see on or around the end of March on their call, we need to see the ramp up in Transactional VOD and Subscription VOD. However, at 5 million two way boxes installed in their service area, and already-passed promotional activity (with Chinese New year fast approaching again), is it hard to believe some portion of this base won't be spending $1 on a movie once a month?

In the medium to further future, this same system can and will very easily be transferred into other Asian markets. The combined movie-loving masses of India, Malaysia, and Indonesia number in the billion plus range. With the strength of China ties and successful execution behind them - you can imagine the optionality is tremendous.

RISKS

Until last week, the largest risk in this name was the cash burn. This has been addressed. Now that the balance sheet has been taken care of, what remains is entirely Execution Risk. Thus far, the ramp in revenues has been slower than any of us imagined. As with most things in life, there is a learning curve, and YOD certainly has been working its way up. Is it possible this ramp takes longer than expected? Yes, of course. To answer this for yourself, I encourage you to take a look at the finished product that is live in Chinese households right now, at yod.com (you may want to translate it).

Is it also possible the Chinese government one day does not adhere to its agreements in place? The answer is yes. There is no way to handicap what an authoritarian regime will do. The logic here though, is that the Chinese government always wants to maintain control over what its population sees. As CCTV/CHC is government owned, and YOD is a small company, their control is theoretically very large, so that puts them very much at ease.

CONCLUSION

So, in conclusion, YOD is:

1) The only nationally permitted VOD/PPV platform in China, with Chinese government partnership,

2) Has revenue-sharing agreements with most major Hollywood studios and distribution rights to Chinese domestic content,

3) Addresses over 18 million households, and over 5 million already digitally converted,

4) Is already live in a major mobile-device maker offering and in continued talks with others,

5) Is fully-funded for at least 2.5 years, ceteris paribus,

6) Has very large insider ownership,

7) Has tremendous barriers-to-entry for anyone trying to replicate or compete, and

8) Is already passed system implementation mode, with revenues expected imminently.

Additional disclosure: I have held these shares for 1.5 years and do not intend to sell in the near

future.

By Always Incredulous

Source:http://seekingalpha.com/article/2004371-you-on-demand-the-netflix-of-china

So now Netflix china is in demand.. Finally, something good is happening. Let see how will Netflix react over this success.

ReplyDeleteThank You for this wonderful and much required information Guidewire Implementation Services In USA

ReplyDelete