Majesco Poised To Beat Street Estimates On Monday Night

Majesco Entertainment (COOL) will report fiscal Q1 earnings (for the quarter ended January) after the close on Monday afternoon. According to Pipeline Data's proprietary model, the company will exceed consensus estimates of $54.9M in revenue and $0.20 of EPS.

There are many other reasons to expect strong results and guidance:

- Zumba 2, the follow-up to the multi-platinum Zumba Fitness, was released in the November. Subsequent to that, Zumba Rush, an Xbox Kinect exclusive was released in February. In conjunction with the exclusive release, COOL landed a valuable marketing agreement with Microsoft.

- The Zumba phenomenon is still accelerating. Looking at the Google Insights stats for Zumba Fitness, you can see that interest is at an all-time high. More importantly, Google's data extrapolation algorithms forecast a continued rise. This is a clear sign that COOL has a hit franchise on its hands.

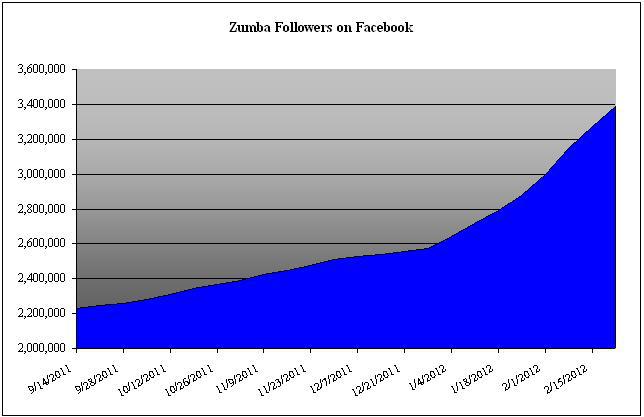

- Zumba is also exploding on Facebook. The fitness craze has attracted nearly 3.5 million "Likes", with the most recent million occurring in just the last three months (click to enlarge image):

- This surge in popularity is raising the attractiveness of Zumba as a cross-marketing partner. Most recently, Zumba landed a deal to help Nestle promote its line of fitness cereals.

- Zumba isn't the only fitness title gaining popularity for COOL. BothJillian Michaels and Harley Pasternak have also been moving up the Google charts.

Now, with conservative estimates for 2012, COOL is positioned to reward patient investors with quarter after quarter of earnings beats. We anticipate that this is why earnings will be announced on Monday evening. Usually, we would expect a Thursday earnings date. However, the company will be presenting at the ROTH investor conference on Tuesday. Presumably, management will be discussing good news with a new crop of potential mutual fund investors.

Beyond Monday's report, there's reason to continue accumulating shares. At $3.50 a share, COOL will likely be added to the Russell 2000 in a few months. This will force dozens of institutions to buy shares for their Russell ETFs. Dozens more will have to investigate the company, since it will become a component of their performance benchmark.

As the story gets out, early investors will benefit as the stock starts to attract a P/E that better reflects the company's growth prospects. This could result in several quarters of positive investment returns.

Looking at the company's strategy, COOL appears poised to deliver several quarters (if not years) of outperformance.

Majesco is establishing itself as an early leader in the interactive fitness segment of the video game industry. This segment has demonstrated the same life-cycle characteristics as many video game mega-franchises. For example, Take-Two's (TTWO) "Grand Theft Auto" sold just 2 million copies, but the sequel sold 3 million. However, the third installment was the charm, selling well over 10 million units. The GTA franchise continues to sell and is now approaching 100 million lifetime units.

With "Guitar Hero", Activision (ATVI) proved that innovative interfaces (in this case, a guitar "joystick") could help to replicate TTWO's success. Guitar Hero's popularity curve was similar to that of GTA. The first Guitar Hero sold just 2 million units and the sequel sold 6 million. As was the case with GTA, Guitar Hero's third installment was the big catalyst. The rest is history -- the Guitar Hero franchise went on to sell over 50 million units.

More recently, the unique interfaces offered by the Nintendo Wii and Xbox Kinect have spurred the emergence of the interactive fitness genre. Ubisoft (UBSFY.PK) has seen this success with its "Just Dance" franchise. Its first installment initially sold 4 million units. The sequel initially sold 8 million units and helped to sell an additional 2 million units of the original. But as was the case for GTA and Guitar Hero, Just Dance 3 sent the franchise into overdrive. In just five months, JD3 has sold 10 million copies. It has also driven additional sales of its predecessors. As a result, lifetime sales of the Just Dance franchise are now approaching 30 million units.

Majesco's Zumba seems to be taking the same path. Its first installment sold 4 million units before the sequel was released in November. Within a few months Zumba 2 had sold over a million units, much faster than the original had. Simultaneously, Zumba 1 sold an additional million units. Incredibly, the last million units of Zumba 1 sold faster than its first million did. In other words, the entire franchise continues to build momentum.

Best of all, this segment of the video game market has proven to be among the most lucrative. Titles like Zumba cost less to produce than today's mega-hits. However, they are consistently among the industry's top sellers. High sales and low costs equals high profits.

This suggests that Majesco is well on its way to beating the Street's 2012 estimate of $136.5M and $0.35, giving investors a company that is at the forefront of an emerging trend, topping Street expectations, and trading at just 8 times earnings.

Best of all, Zumba 3 won't be released until later in the year. If the franchise continues along its current path, the best is yet to come. It is now clear that interactive fitness is the next evolution of the fitness video industry. Given its success with Zumba and Jillian Michaels, investors can bet that Majesco is searching every corner of the fitness world for the next big winners.

To those who understand its path, Zumba isn't a one-trick pony -- it's a mega-franchise, still early in its growth phase. Most importantly, it's likely just the first of many for Majesco Entertainment.

Pipeline Data believes that Monday's earnings report will bear this out, justifying COOL's spot on our 2012 list of Stocks That Are Poised to Triple.

By Mark Gomes seekingalpha.com

Disclosure: I am long COOL.

No comments:

Post a Comment