Magic Jack Is Solving The Home Phone Problem And Market Is Catching On

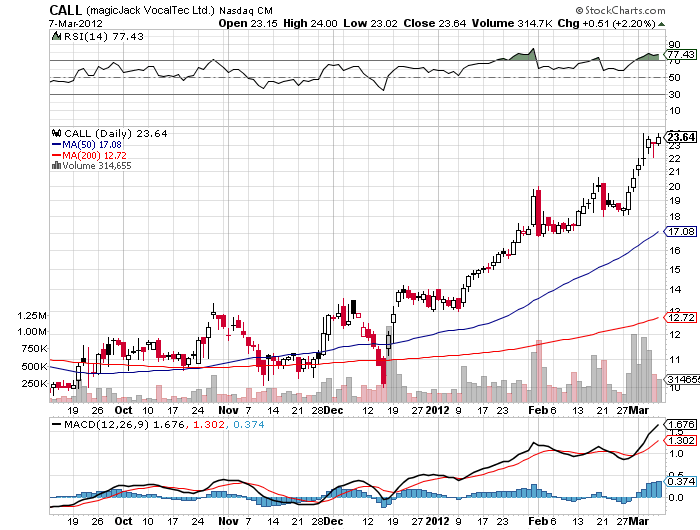

Apple and Salesforce stocks are having great years, but neither one is preforming as well as the company Magic Jack (CALL). Magic Jack is up 66.33% on the year and is poised to continue that trend. Magic Jack's prospects in the short-to-near-term look favorable; however their long-term outlook is still uncertain.

There are many encouraging pieces of evidence which support Magic Jack's continuing gains and analyst estimate beats. CEO Andrew MacInnes gives a rosy picture of the company and stated in the company conference call:

"magicJack may have the greatest potential for growth and value appreciation of any Company I have seen in my twenty years of working with private and public companies. I will work with Dan to help others understand our perception of the value of the Company and how we will build and grow the Company."

MacInnes was undoubtedly trying to flatter the shareholders but he has a point. There is potential for Magic Jack to grow. The VoIP (Voice-Over-IP) market is transitioning rapidly into homes and businesses. Magic Jack's growth is fueled by two factors:

A) Consumers can see the value of switching phone services.

- Low rates ($20 - $60 dollars a year) Magic Jack is simply cheaper

- Savings- Up to $1000 a year

- Extremely easy to install

- Low rates ($20 - $60 dollars a year) Magic Jack is simply cheaper

- Savings- Up to $1000 a year

- Extremely easy to install

B) Magic Jack's New Product: The Magic Jack Plus

- Eliminates the need for the computer to be active in order for the VOIP to work.

- Still Cheap - $60 a year

- Awarded 2011's product of the year

- Sold 8 million units the first year

- Eliminates the need for the computer to be active in order for the VOIP to work.

- Still Cheap - $60 a year

- Awarded 2011's product of the year

- Sold 8 million units the first year

Here at SeekingAlpha, Markos Kaminis wrote that Magic Jack has a near-term potential for a buy out. I agree with his conclusion, suggest holding Magic Jack for the short-to-near-term. I do not advise the long term. I am very uncertain about their customer churn rates and ability to satisfy their customer's needs. I need to see some earnings consistency to separate Magic Jack from Vonage (VG). As we all know, Vonage has flopped. It is down 8.6% YTD.

In the short-to-near-term Magic Jack is a winner. Look for them to beat analyst estimates in the first quarter and gain from there. In the first quarter of 2012 Magic Jack announced to be analyst estimates:

"magicJack VocalTec Ltd. Announced that it expects to beat analyst estimates for the first quarter of 2012. After reviewing January revenue figures, for the first quarter 2012, it predicts more than 20% and 4% upside to average analyst estimates for earnings and revenue respectively."

Small caps like Magic Jack are not largely followed. Only 1 analyst follows CALL at Reuters, and only 2 at Yahoo Finance. If 2 of the 3 are pennies off on their Qt. estimates, then CALL can beat by a large margin. Due to the low volume of news, a sizable analyst beat would sustain a short-to-near-term rally of the stock price.

CALL has beaten the analyst estimates in the last 2 Qt.

- 126% in Qt 3 2011 (EPS est. - 0.15, Actual - 0.34)

- 40% in Qt 4 2011 (EPS est. - 0.10, Actual - 0.14)

- 126% in Qt 3 2011 (EPS est. - 0.15, Actual - 0.34)

- 40% in Qt 4 2011 (EPS est. - 0.10, Actual - 0.14)

With Magic Jack's earnings being realeased on 3/12/2012 after closing. I suggest a bull call spread on Magic Jack:

Buy a Apr12 @ 25

Sell a Apr12 @ 30

Sell a Apr12 @ 30

Break-Even: 26.05

Max-Loss: $105

Max-Profit: $395

Reward on Risk %: 379.12%

Max-Loss: $105

Max-Profit: $395

Reward on Risk %: 379.12%

By Calder H Lamb"The stock market is filled with individuals who know the price of everything, but the value of nothing." - Phillip Fisher

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in CALL over the next 72 hours.

No comments:

Post a Comment