Biotech Trends: Analysts Expect Big Growth for Genetic Testing Industry

DNA tests - which can be used to measure a person's predisposition to cancers or Alzheimer's disease, or gauge how well a specific medicine will work in a specific patient - generated $5 billion in 2010. But with so many new tests being introduced every month, the industry has no doubt of the potential growth. (via Bloomberg)

In fact, the industry expects annual growth rates of 10% or more. "The ultimate number depends on how popular the tests grow, how expensive they get and insurers' willingness to pay, among other factors."

According to UnitedHealth, the biggest U.S. insurer by sales, three to five new tests are being introduced each month, and nearly 1,800 tests developed to identify or manage medical conditions still haven't been studied enough to prove their effectiveness.

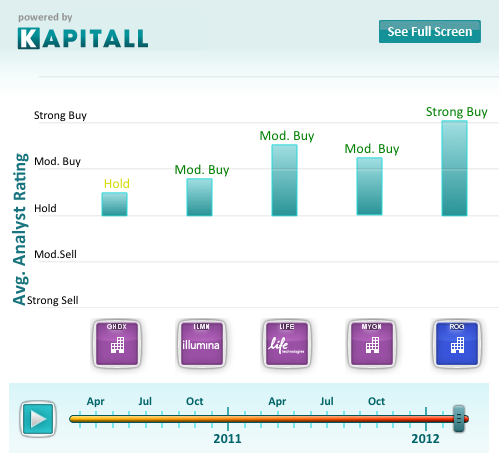

Interactive Chart: Press Play to compare changes in average analyst recommendation over the last two years for the stocks mentioned below.

Business Section: Investing IdeasSo who's behind these tests? We list below five of the diagnostic companies with leads in the field. Do you think they will see their value rise or is the speculation already priced in? (Click here to access free, interactive tools to analyze these ideas.)

1. Genomic Health Inc. (Nasdaq:GHDX): Focuses on the development and global commercialization of genomic-based clinical laboratory services that analyze the underlying biology of cancer allowing physicians and patients to make individualized treatment decisions. Market cap of $906.58M. Current price as of 3/12 at $30.69. The stock has had a good month, gaining 15.42%.

2. Illumina Inc. (Nasdaq:ILMN): Develops, manufactures, and markets integrated systems for the analysis of genetic variation and biological function. Market cap of $6.14B. Current price as of 3/12 at $50.18. Relatively low correlation to the market (beta = 0.55), which may be appealing to risk averse investors. The stock is a short squeeze candidate, with a short float at 21.01% (equivalent to 7.43 days of average volume). The stock has lost 22.26% over the last year.

3. Life Technologies Corporation (Nasdaq:LIFE): Operates as a life sciences company with a focus on improving the human condition worldwide. Market cap of $8.18B. Current price as of 3/12 at $45.88. The stock has lost 10.76% over the last year.

4. Myriad Genetics Inc. (Nasdaq:MYGN): Focuses on the development and marketing of novel predictive medicine, personalized medicine, and prognostic medicine products. Market cap of $2.09B. Current price as of 3/12 at $24.77. Relatively low correlation to the market (beta = 0.46), which may be appealing to risk averse investors. The stock has gained 32.18% over the last year.

5. Rogers Corporation (NYSE:ROG): Manufactures and supplies a range of specialty materials and components worldwide. Market cap of $618.74M. Current price as of 3/12 at $38.1. The stock has had a couple of great days, gaining 6.1% over the last week.

Use the Investopedia Stock Simulator to trade the stocks mentioned in this stock analysis, risk free!

Disclosure: Kapitall's Rebecca Lipman does not own any of the shares mentioned above.

No comments:

Post a Comment