Buy Sprint: Results Prove Turnaround Is In Progress, And Business Is Healing

Successful corporate turnarounds are far less numerous than turnarounds that fail. But it is the successful ones that we tend to remember. And we think that Sprint's (S) turnaround will be one to remember.

Sprint, for the past several years, has been a company beset by problems. A lack of the iPhone, dual networks, and customer service issues. However, Dan Hesse, who became CEO in 2007, has been working tirelessly to turn the company around, and we think that he is succeeding.

Sprint's stock has lost almost half its value in the past year alone, dropping 44% as worries over its competitive position, financing, and product portfolio have plagued the stock.

click to enlarge

We think that the stock has bottomed, and the company's fourth quarter and full 2011 results, released on February 8, show that the company is steadily healing. Below, we break down the various parts of the results to show that Sprint's future is far brighter than its past.

Earnings

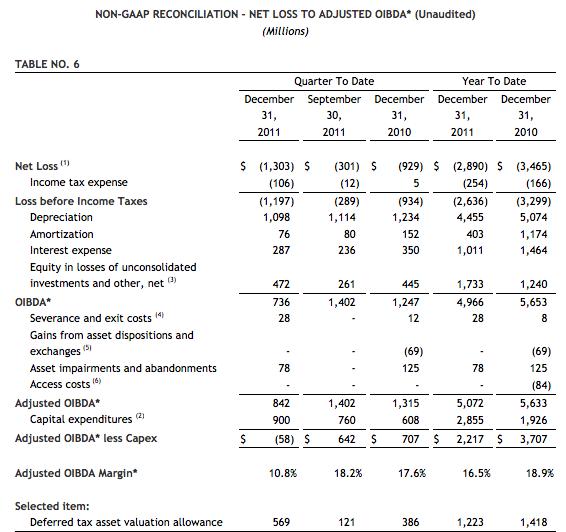

On a GAAP basis, Sprint posted a loss of 43 cents per share ($1.303 billion), continuing a tradition of posting losses without fail since 2007. However, investors need to look at earnings on a level deeper than GAAP. Through the magic of accounting, GAAP can both overstate and understate earnings, due to things like tax benefits, or unrealized investment losses. Although Sprint has posted yet another GAAP loss for the fourth quarter and all of 2011, it is important to look at what that loss consists of.

Of the $1.3 billion of Sprint's GAAP loss in the fourth quarter, $472 million of that was due to losses in unconsolidated investments, which in essence means Clearwire (CLWR). GAAP income (and losses) account for unrealized gains or losses on investments, and due to the tumble in Clearwire's stock in the fourth quarter, those losses accelerated. However, we think it is unfair to include losses on Clearwire when judging the "true" earnings picture at Sprint. These losses, while present, will never be realized, because Sprint will never sell its stake in Clearwire.

Such mark-to-market accounting makes sense at a company like Berkshire Hathaway (BRK.A), which makes investments under the assumption that they will be sold at some point in time. But for Sprint's investment in Clearwire, we do not think such accounting makes little sense. That investment was never designed to make money. It was designed to give Sprint access to Clearwire's spectrum, which it needs to run its 4G network and compete with AT&T (T) and Verizon (VZ).

Adding back depreciation expense and interest shows that the company is not suffering as much as bears believe it is. And the company's interest expense is falling. Sprint spend over $450 million less on interest payments in 2011 compared to 2010. And while capital expenditures in Q4 2011 was $900 million, thus being larger then adjusted OIBDA, it is important to note that figure is, as Sprint defines it,

an accrual based amount that includes the changes in unpaid capital expenditures and excludes capitalized interest. Cash paid for capital expenditures for each of the quarters in 2011, respectively, includes $99 million, $102 million, $103 million, and $109 million of total capitalized interest.

2011 also marked the first year, in a long time, that the company posted positive operating income.

For 2011, Sprint posted operating income of $108 million. While that pales in comparison to the numbers posted by AT&T or Verizon, it nevertheless marks a turnaround from years of operating losses. Sprint is turning the business around, and the numbers prove it.

For 2011, Sprint posted operating income of $108 million. While that pales in comparison to the numbers posted by AT&T or Verizon, it nevertheless marks a turnaround from years of operating losses. Sprint is turning the business around, and the numbers prove it.

The Business

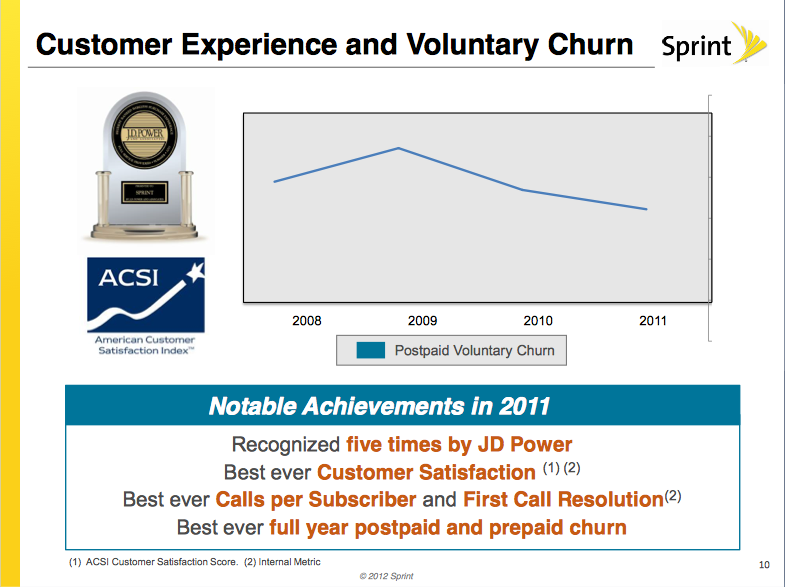

Since the arrival of Dan Hesse, Sprint has slowly but surely steadied its business, slowed customer defections, increased customer satisfaction, and grown core wireless revenue. Sprint has consistently been ranked as having some of the best customer satisfaction in the industry, and churn declined to its lowest levels ever in 2011.

While churn in the fourth quarter increased sequentially and year-over year to 1.98% from 1.91% and 1.86%, respectively, this is due to involuntary cancellations due to lack of payment on contracts. Sprint has stated that it tightened its credit standards to ensure that such cancellations become less common going forward. On the conference call, Dan Hesse stated that churn at Nextel will go up as the Nextel network is shut down and customers either migrate to the Sprint network or choose to leave the company all together. Going forward, however, it will be more important to watch churn at the Sprint brand than at Nextel.

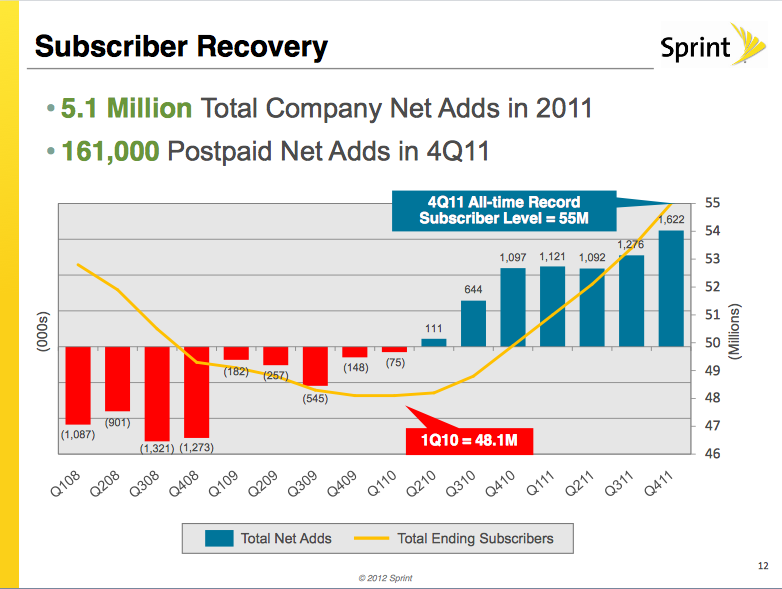

Sprint has managed to stem the subscriber losses that have plagued the company for years after its merger with Nextel. At the core Sprint postpaid segment, the company added 539,000 subscribers, and has added 1.853 million prepaid and wholesale subscribers. At Nextel, subscriber losses are continuing, however. Sprint lost 770,000 Nextel subscribers. While this is not an ideal situation, the Nextel brand will be irrelevant in just a few years. There are now just 6.246 million Nextel subscribers, compared to 48.775 million at the Sprint side. Sprint ended 2011 with over 55 million total subscribers, a record for the company.

Sprint has not only been adding subscribers at an accelerating rate, it has been increasing ARPU as well. Postpaid ARPU, the most crucial revenue metric at Sprint, increased to $58.59, a new record for the company. Even the bearish R.W. Baird, which has a $2 price target on Sprint, conceded that ARPU was "solid", and that it came in above expectations. Below, we break down the ARPU at Sprint's various divisions for the quarter.

Sprint ARPU by Division

| Q4 2011 | Q3 2011 | Q4 2010 | 2011 | 2010 | |

| Sprint Postpaid | $61.22 | $60.20 | $57.53 | $59.76 | $57.01 |

| Sprint Prepaid | $25.16 | $25.35 | $24.16 | $25.43 | $21.64 |

| Nextel Postpaid | $41.91 | $42.78 | $44.74 | $43.25 | $46.32 |

| Nextel Prepaid | $34.91 | $35.62 | $35.07 | $35.17 | $35.32 |

| Total Postpaid | $58.59 | $57.65 | $55.26 | $57.27 | $54.94 |

| Total Prepaid | $26.62 | $27.19 | $27.95 | $27.40 | $27.76 |

While prepaid ARPU dipped slightly in Q4 2011 (and 2011 as a whole), the prepaid business is inherently more volatile that the postpaid business. Sprint increased postpaid ARPU by $3.69 over 2010 levels, which as Dan Hesse noted in the call, is a record increase in the wireless industry.

Analysts opinions on the operational figures for the quarter are mostly on the positive side. Citi analyst Michael Rollins said that,

net additions of post-paid CDMA subscribers, the bulk of the post-paid net additions, was above his estimate, at 539,000 versus 495,000...Overall, wireless results were encouraging with total net adds of 1.62 million vs. our est. of 1.18 million, which was helped by more wholesale and prepaid vs. our estimates.

Rollins reiterated his $6 price target on Sprint, which represents upside of almost 149% from current levels. Wells Fargo, in reiterating its own outperform rating, noted that Sprint was much more transparent than in the past, and that despite the "noise" this quarter, there was a great deal of positives. On the flip side, Sanford Bernstein saw no reason to change its $2.50 price target. The firm's skittishness is due to the lack of concrete and specific visibility on OIBDA and cash flows to 2014, even though it said that most, if not all of the negative have played out. R.W. Baird, however, maintained its bearish stance, and $2 price target. This is due to the fact that Sprint posted net subscriber additions of 1.6 million, below their expectations, and iPhone sales of 1.8 million were also below expectations.

We would like to address iPhone sales at this time, for we think that many in the investment world are forgetting a key detail that affects Sprint's iPhone sales. As the last major carrier to begin selling the iPhone, Sprint, for years, had to attract and retain subscribers with devices besides the iPhone. As a result, it is natural for Sprint to sell less iPhones to its own subscribers. If these subscribers stayed with Sprint all these years, even without the iPhone, it stands to reason that they may not want the iPhone to the same extent that subscribers at AT&T or Verizon do. Still, Sprint reported that 40% of iPhone customers were new to the company.

Finances, Network Vision, and Guidance

A large part of the decline in Sprint's stock in 2011 was due to worries over the company's finances and its investment in its Network Vision upgrade.

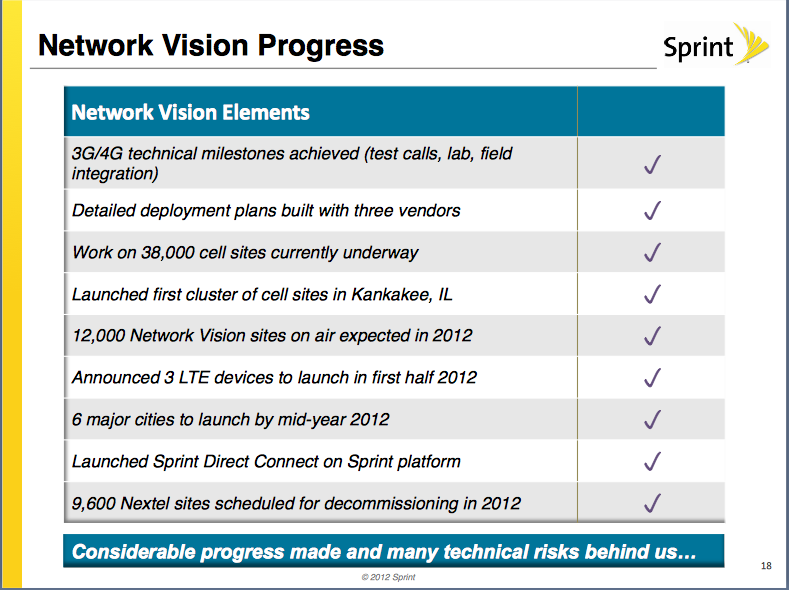

The Network Vision project remains on track. 9,600 Nextel cell sites will be decommissioned this year (per the conference call), and Steve Elfman, President of Network Operations said that some benefits of that will begin to be seen in 2012, and that most will begin in 2013. Sprint expects to migrate all Nextel customers away from that network by the middle of 2013. Sprint achieved a great deal regarding Network Vision in 2011.

The migration to LTE is progressing well, with 6 markets set to launch by the end of June. With regards to the financial impacts of Network Vision, CFO Joseph Euteneur was asked on the conference call when the "bottom" in expenses relative to savings would occur. Euteneur said that although the timing is somewhat fluid,

OIBDA will happen first, so it will be probably towards the latter part of 2012. And then sort of a quarter, give or take, we'll see then the free cash flow follow it. But it will clearly be definitely in a U pattern versus a V.

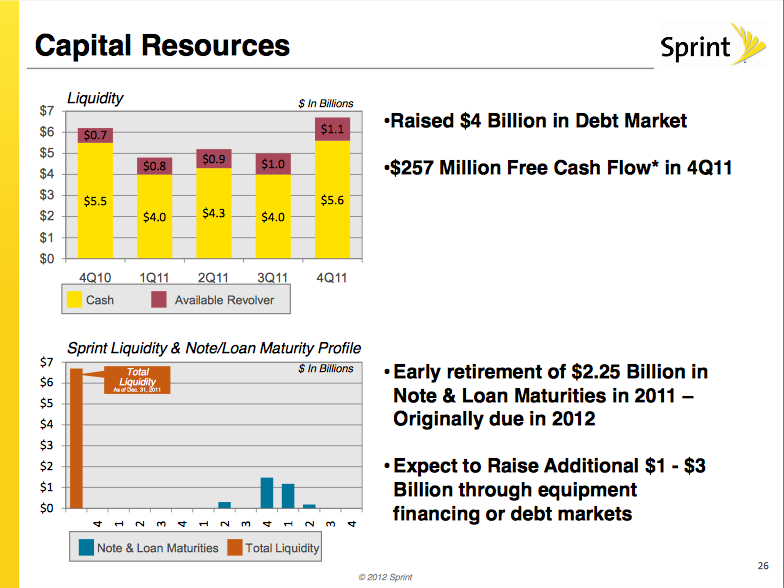

And even with the surge in subsidy costs related to the iPhone and expenses due to Network Vision, Sprint still posted free cash flow of $257 million in the quarter.

Turning to the balance sheet, Sprint is working hard to improve its financial position and ensure long-term stability. Sprint raised $4 billion in debt in 2011, and repaid $2.25 billion in debt that was due in 2012 in 2011. Sprint plans to raise a further $1-$3 billion in additional financing to fund Network Vision.

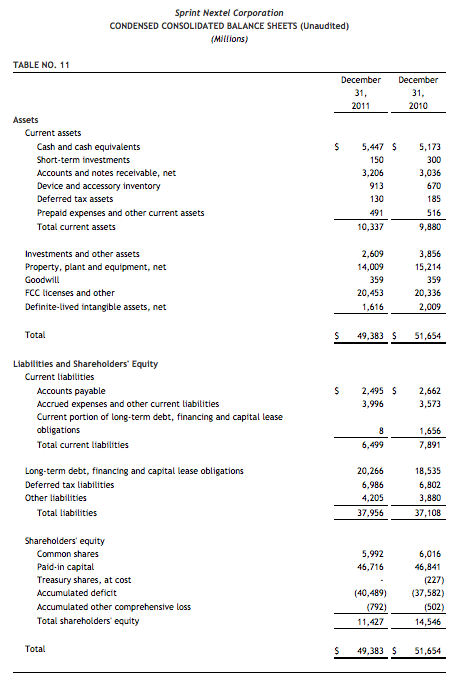

Sprint has ample liquidity and its debt maturities are well managed. Ironically, for all the worries in 2011 over Sprint's debt and its financing capabilities, Sprint actually DECREASED net debt in 2011 versus 2010, to $14.677 billion from $14.718 billion. Sprint may be more leveraged than its competitors, but it has proven that it is able to manage its debt in a prudent manner. A look at Sprint's balance sheet shows that the company is greatly undervalued on a book value basis.

Sprint's book value is $3.81 as of the end of 2011, over 58% above where the stock is currently trading.

For 2012, Sprint expects adjusted OIBDA of $2.7 to $3.9 billion, capital expenditures of around $6 billion, and net service revenue growth of between 4% and 6%. Sprint's guidance includes the assumption that the next iPhone is released sometime in October.

Perceptions of Sprint Relative to Peers

Part of what makes Sprint seem as an unappealing investment is the inevitable comparisons investors make to AT&T and Verizon. It is true that at the present, these 2 companies are performing on an entirely different financial level than Sprint. Both companies are solidly profitable, and pay investors great dividends. Inevitably, investors see Sprint, look at its finances and lack of a dividend, and assume the company is simply unsuitable to invest in. We think, however that over time, this perception will improve. Sprint has aired most of the dirty laundry it has, and the negatives surrounding Sprint are well-known at this point.

Sanford Bernstein cautioned investors of AT&T and Verizon against complacency. Craig Moffet, the analyst covering this sector, wrote that he

fear[s] investors [in AT&T and Verizon] are utterly unprepared for upcoming weak wireless margins on the back of staggering iPhone subsidies.

It is important to note that both AT&T and Verizon missed consensus earnings estimates in the fourth quarter, as both companies boosted spending and phone subsidies. While Sprint is not immune to this trend of increased subsidy spending, we think that the increased scrutiny the company receives from investors means that most of this weakness is priced in at these levels.

Furthermore, in the long run it is a net positive for Sprint to have the iPhone, as it is far better to be within the Apple ecosystem than outside it. Should investors become unsettled by an erosion of profitability at AT&T and Verizon, we think Sprint's perception on Wall Street will improve. And often, perception of a company's fundamentals is just as important as the fundamentals themselves.

Conclusions

Sprint is a company in full turn-around mode, and all the signs suggests that it is firmly on track. Dan Hesse is steadily righting the company, and sooner or later, the company will become profitable once again. Investing in Sprint is not a bet in the short-term, for the company will not be able to heal itself in 2012 alone. But, in the long run, we think that investors who buy into this turnaround at this point in time will be amply rewarded for their faith.

Currently, the Reuters average price target for Sprint stock is $3.91, representing upside of over 62% from current levels. The stock has limited downside from these levels, in our opinion, and the upside is clear. Successful turnarounds are rare occurrences in the corporate world. But, history has shown that the companies that are able to turn themselves around have amply rewarded their investors. Based on this quarter and what we have seen in 2011, we think that Sprint is well positioned to reward long-term investors.

No comments:

Post a Comment