Biotech Stocks To Watch In 2012

Exelixis - More than a prostate cancer drug

Exelixis (EXEL) is starting to recuperate after last year's clash with the FDA regarding a registration trial for its lead agent, cabozantinib (cabo), in prostate cancer. The company, which still sticks to its original plan of conducting a Phase III trial using pain as a primary endpoint, is expected to announce it has enrolled the first patient in the study in the coming weeks. The trial will enroll 250 patients with bone metastases who are suffering from cancer associated pain and will evaluate cabo's effect on bone scans and pain.

Exelixis will start a more traditional Phase III study in prostate cancer in the coming months. The trial will recruit ~1000 patients who failed two or more approved agents and will look at overall survival as a primary endpoint.

As I previously discussed, cabo's prostate cancer program is controversial due to the dramatic resolution of bone scans in patients with bone metastases. This effect is something investors and analysts are still trying to digest, with some questioning the relevance of the observed scan resolution. Even if the drug can shrink bone metastases, which is something no other drug has been shown to do, the impact on survival is unclear due to the lack of a precedent. The only supporting evidence is Algeta's Alphadrin, a radioactive drug that targets bone mets and leads to increased survival. Moreover, prostate cancer has become an extremely crowded field with 5 new drugs that are either approved or on the verge of approval.

At ASCO 2012 (June), Exelixis is expected to present Phase II results in 150 chemo-pretreated prostate cancer patients. Although the trial is a single arm study, it will provide important information on the bone met effect and its durability in a large, more homogeneous group. Nevertheless, it seems that Exelixis must show a robust effect on overall survival in order to prove cabo is effective in prostate cancer.

What the market seems to overlook is cabo's potential beyond its bone met activity and even beyond prostate cancer. There is a growing body of evidence that shows that cabo is a promising drug even when excluding the bone met effect.

Exelixis will present Phase III results in medullary thyroid cancer (MTC) at ASCO, which are expected to be remarkable based top line results announced last year. As the trial was conducted under SPA (special protocol assessment), chances of approval are very high. The market opportunity in MTC is very small (~$200M WW) but the program is important as a validation of cabo's activity regardless of the bone effect. Cabo's results compare very favorably to AstraZeneca's (AZN) vandetinib, which recently got FDA approval for MTC. Financially, although Exelixis will have to find a partner that can distribute the drug globally, approval in MTC will put a minimal price tag of several hundreds of millions on Exelixis. The most intriguing (and potentially problematic) effect of such approval would be off label use, especially in patients with bone mets. One drawback could be a confounding effect in randomized trials, as patients on the placebo arm could subsequently get cabo after the study.

Cabo might be effective in many other types of cancer, including lung, ovarian renal and liver cancer. So far there are only early signs of activity, but these signs make it hard to ignore the drug's broad potential. Last year, investigators reported a tiny data set of cabo in only 6 patients, 2 of which achieved partial responses (interestingly, both had lung cancer). Last month, Phase II results in liver cancer included tumor shrinkage in 78% of patients and a PFS of 4.2 months. Last week, the company reported excellent activity in renal cancer patients in the form of a 28% response rate and a median PFS of 14.7 in heavily pretreated patients (64% of patients received cabo as a third line or beyond).

Taken together, these small uncontrolled data sets clearly show cabo is a promising drug beyond its bone-met effect.

Celldex - Important data in breast cancer

Celldex (CLDX) is up 80% year-to-date, thanks to positive sentiment towards its two lead programs. Celldex is one of a few biotech companies with two advanced oncology programs, which are of high demand in today's market.

The company's most advanced program is rindopepimut, a cancer vaccine for the treatment of glioblastoma multiforme (GBM), a deadly form of brain cancer. Last year, the company started a highly anticipated Phase III trial for this program after overcoming several technical issues. The vaccine generated positive consistent data in 3 Phase II trials, however, these were small single-arm studies. The most compelling evidence to date was generated in an analysis done by investigators who noted that patients who had been treated with rindo lost expression of rindo's target, EGFRVIII. As I previously wrote, this is an indirect but very significant evidence the vaccine is biologically active.

Celldex's second most advanced program, CDX-011, is an antibody-drug conjugate (ADC) that has already demonstrated activity in melanoma and breast cancer. It is currently in a randomized Phase II trial in breast cancer with data expected at ASCO in June. The trial randomizes patients who express CDX-011's target (GPNMB) on their tumors to receiving CDX-011 or any other drug chosen by the physician.

CDX-011 is garnering a lot of attention among investors since it has many attributes the industry likes:

- It is an antibody-drug conjugate (a hot field) that utilizes Seattle Genetics' (SGEN) proven technology.

- It has a potential biomarker for patient selection.

- It demonstrated activity in non-selected patients.

- It targets triple-negative breast cancer, where there are no good treatment alternatives.

- The licensing terms with Seattle Genetics are attractive compared to the more recent deals the company has signed.

The only thing missing is positive results in the Phase II trial.

Seattle Genetics - Focus on new indications and partnered pipeline

In 2012 the market will focus on Seattle Genetics' Adcetris, which was approved in August of last year. Current estimates for 2012 Adcetris sales range around $150M in the US, based on strong demand and the drug's robust efficacy. While most of this figure is comprised of sales in the two indications that appear on the drug's label (Hodgkin lymphoma and ALCL), Adcetris could eventually be used for additional indications.

Last month, investigators reported positive results in 2 additional types of blood cancers, where Adcetris demonstrated impressive efficacy. Adcetris had a response rate of 65% in 17 patients with cutaneous T cell lymphoma (CTCL), an indication for which Celgene's Istodax was approved based on a 34% response rate. Investigators also reported 2 case studies of heavily pretreated PTCL patients who achieved durable responses with Adcetris. Although the numbers are small, these trials imply Adcetris could enter new markets representing a global market opportunity of ~$250M, assuming approval only in late stage patients. There are additional indications that might be relevant to Adcetris based on expression of the CD30 protein, Adcetris' target.

On top of Adcetris, Seattle Genetics has a growing partnered pipeline comprising 12 active programs: 7 programs developed by Genentech, 3 programs developed with Astellas (ALPMF.PK) (Agensys), Celldex's CDX-110 and Progenics' (PGNX) anti-PSMA ADC. At the moment, the only program with compelling data to which investors can assign value is CDX-011 which is expected to generate results from a randomized study at this year's ASCO. As data begins to emerge from these programs, initial signs in one or two programs could have a major impact on the stock.

Array Biopharma - Many irons in the fire

Array Biopharma (ARRY) remains an undervalued stock, with more clinical programs than any of its peers and a market cap of just ~$176M. As Idiscussed last year, Array's depressed price is a result of the fact that none of its drugs has a clear route to market, combined a long term debt overhang (due 2015).

Its pipeline includes 4 wholly owned programs and 10 partnered programs, many of which are expected to generate meaningful data in 2012.

The most important data set will be from a randomized Phase II trial of selumetinib (a MEK inhibitor developed by AstraZeneca) in lung cancer. The trial evaluated selumetinib when added to Taxotere in 90 patients with KRAS mutation. Although the trial was technically a failure, the results might still be good enough to merit advancing the drug to Phase III.

Selumetinib led to a statistically significant increase in progression-free survival (PFS) as well as response rate. It also led to a numerical difference in overall survival but this difference was not statistically significant, which is not surprising given the relatively small size of the trial (this is why the trial was defined as a failure). Actual numbers will be disclosed at ASCO, and if positive, could make selumetinib the first of Array's programs with a clinical proof of concept as well as a clear route to market.

Selumetinib is being evaluated in two additional randomized studies in B-RAF mutated melanoma and ocular melanoma, respectively. The first study evaluates selumetinib when added to chemotherapy and is expected to report data in the coming months. Even if the trial is positive, it will be hard to beat Zelboraf, which is the current standard of care for BRAF mutated melanoma. The ocular melanoma study, which is sponsored by the NCI, evaluates selumetinib vs. chemotherapy in 200 patients. Timelines for this study are unclear, but it could generate topline data this year as well.

Array has licensed another MEK inhibitor (MEK162) to Novartis 2 years ago. This program is much earlier than selumetinib, currently in multiple combination Phase I studies. The only Phase II trial is in melanoma patients with BRAF or NRAS mutations, where the drug as given as monotherapy. Results from this trial are expected at ASCO and could be important as they will probably include BRAF mutated patients who progressed on Zelboraf or NRAS mutated patients who are not eligible for Zelboraf. Both of these populations represent a fast route to market. Earlier this month, Array announced the drug achieved clinical proof of concept according to Novartis.

Another program expected to generate important data is ARRY-520, a KSP inhibitor. The drug, which is fully owned by Array, already demonstrated signs of efficacy in heavily pre-treated multiple myeloma patients. The activity is superior to other targeted agents that are now in Phase III trials but still appears too low to justify pursuing ARRY-520 as monotherapy. Array is conducting two combination trials with dexamethasone and Velcade, respectively. Both studies are single arm trials, but they could be relevant in putting ARRY-520 in perspective compared to other investigational agents.

Another program that could reach a clinical milestone is ARRY-797, Array's p38 inhibitor for pain. As pain is more complex from a development perspective given the large number of generic pain-killers, Array has been trying to identify an indication for this molecule for several years. ARRY-797 already demonstrated analgesic activity in a dental study reported in 2008 as well as in a trial in rheumatoid arthritis, but neither indication represented an attractive development opportunity. The company recently initiated a randomized trial in osteoarthritis of knee where ARRY-797 is compared head to head with an opioid or placebo. The study's goal is proving ARRY-797 is at least as effective as the opioid analgesic, with the intent of replacing opioids that are associated with side effects and addiction issues. Results are expected later in 2012.

Synta Pharmaceuticals - Selling Asian rights for lead product

Synta (SNTA) is looking at a busy 2012 from a clinical as well as business development standpoint.

Synta's lead agent, ganetespib, is an Hsp90 inhibitor for the treatment of cancer. Last year, the drug demonstrated encouraging signs of activity across a wide variety of indications. Interestingly, in some cases it was possible to associate the drug's efficacy with specific biomarkers that can be used for patient selection. The best example was the drug's activity in lung cancer patients with ALK mutation, which occurs in ~4% of NSCLC cases. When given to 8 patients with ALK mutated tumors, ganetespib led to tumor shrinkage in 6 patients, 4 of which achieved an objective response.

Synta is expected to announce a Phase III trial in ALK mutated NSCLC. Despite the recent approval of Pfizer's (PFE) Xalkori for these patients, the company intends to recruit Xalkori-naïve patients which might prove challenging in the US. The decision not to go after patients who progressed on Xalkori might also imply that ganetespib is not potent enough in this population although no data has been published.

Synta is exploring ganetespib for the entire NSCLC population with a 240-patient randomized Phase II evaluating ganetespib in combination with Taxotere in NSCLC patients, regardless of their mutation status. At ASCO, the company will report top line results from the trial, which could serve as the basis of a Phase III trial, depending on the data and the drug's activity in different subsets.

The company is expected to announce a licensing deal for ganetespib, in the coming months. The deal, which the company has been talking about for almost a year, is expected to include rights to ganetespib in Asia and provide Synta with much needed cash to support US and EU development. As I discussed last year, Synta should be able to get a lucrative deal given the similar high premium deals in the field. The market expects Synta to announce the deal in the coming months, so if no deal is announced, the market will interpret it as a lack of interest in the ganetespib.

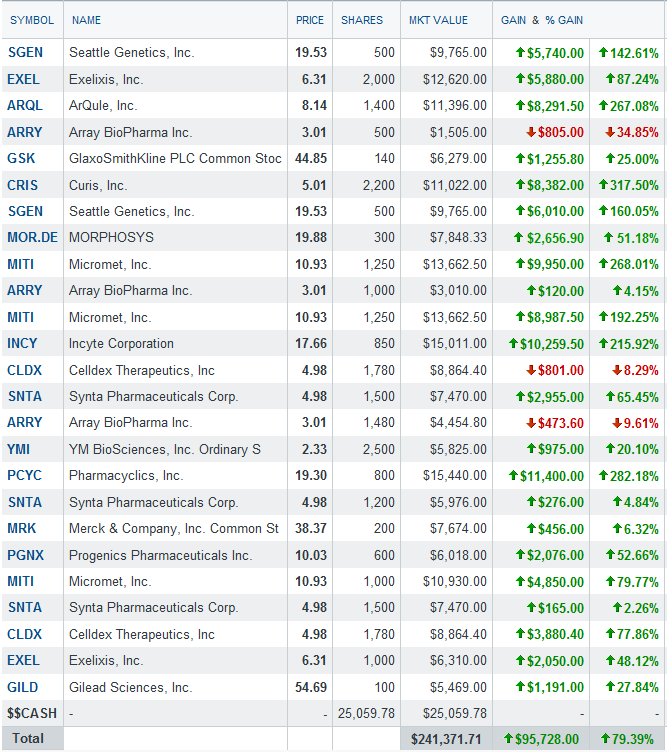

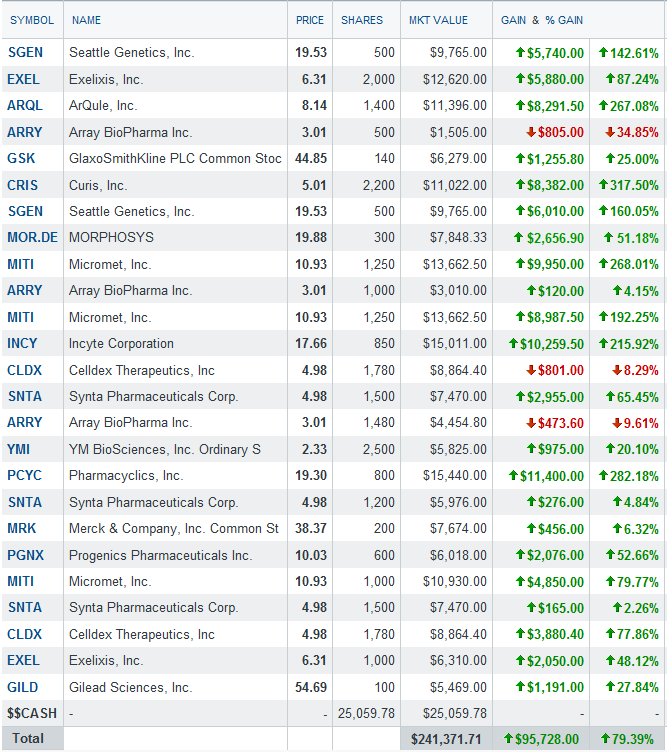

Portfolio holdings as of Feb 5th, 2012

Portfolio holdings as of Feb 5th, 2012

No comments:

Post a Comment