Has Apple left behind a significant low? Here's how to trade the stock from here.

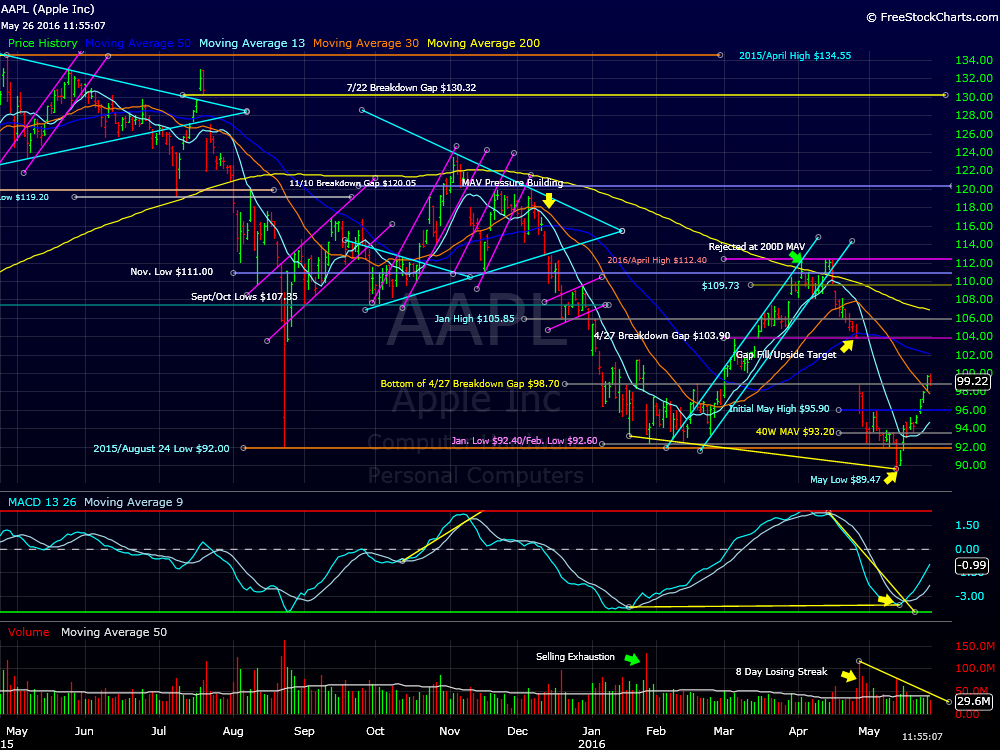

Shares of Apple (AAPL) have been tracing out an impressive rebound over the last two weeks. From the May 12 low, the stock has gained over 11%, leaving behind layers of support along the way. This powerful recovery took root near a major support zone, one that may prove to be a very important turning point for the stock.

Apple investors should take on a more positive view of the action as the current bottom develops further.

April was a brutal month for Apple. Almost immediately after closing at fresh 2016 highs on April 14, the stock went into a free fall. The next day Apple closed below its declining 200-day moving average as the route began. Heading into earnings, shares fell for the next six out of seven sessions -- and then came the earnings miss and a monster breakdown. Apple fell over 6% that day with the help of surging volume. As the month came to a close, the stock had returned to a major support zone.

SMALL INVESTMENT, BIG POTENTIAL. TheStreet's Stocks Under $10 has identified a handful of stocks with serious upside potential. See them FREE for 14-days.

Apple began to consolidate the massive April loses in early May. The downside pressure had eased as shares held in well near the $93-to-$92 area. This constructive pattern was very steady until a May 12 selling wave drove shares to fresh 52-week lows. Further damage was limited though, and with a divergent moving average convergence/divergence in place, the stock recovered quickly. Two days later, it appeared that the May 12 low represented a downside exhaustion. Apple has been drifting higher since.

In the near term, Apple bulls should consider the stock a buy on weakness. A very solid support zone is now in place between $96 and $93. The upper band of this key zone is marked by the initial May high, while the lower band is the 40-week moving average. A drift down to this area would produce a low-risk entry opportunity for patient bulls.

Currently Apple is a bit extended and may need a bit of back-and-fill action before the rebound continues. This may only require a minimal pullback and consolidation, most likely in the form of a flag or pennant, in place of a fade back down to key support.

By Gary Morrow

No comments:

Post a Comment