Biotech has been strong over the past week or two. One of the trends helping this beaten-down sector have a nice bounce recently is a pickup in M&A activity.

A couple of small- and mid-cap plays have been purchased recently for 55% to 60% premiums, showing how cheap some of the names in this sector have gotten.

Here are two small biotech/biopharma plays that sell for less than $7 a share currently. Both are undervalued as standalone entities but also make logical buyout targets.

Note: Our Memorial Day Weekend promotion is now giving out free two-week trials to The Biotech Forum service until midnight EST on June 2.

Biotech has been strong over the past week or two. One of the trends helping this beaten down sector have a nice bounce recently is a pickup in M&A activity. Over the last week both Anacor Pharmaceuticals (NASDAQ:ANAC) and XenoPort (NASDAQ:XNPT) were acquired. Both were taken out for 55% to 60% premiums as well, showing how cheap some of the small- and mid-cap names have gotten in this sector during its long and brutal bear market sell-off since last summer. In short, there are a lot of bargains out there for the drug and biotech giants to acquire as they go shopping again.

There is a high likelihood M&A activity will continue to accelerate now that sentiment has started to improve on the sector and mega-mergers seem off the table after the government scuttled the tie up of Allergan (NYSE:AGN) and Pfizer (NYSE:PFE). These leaves the small and mid-cap space the likely focal points for new purchases. Here are two interesting biopharma stocks that currently go for under $10 a share that are very undervalued on a standalone basis. They also make logical buyout targets should M&A activity indeed pick up going foward now that biotech appears it is back in rally mode.

Company Overview:

Cara Therapeutics (NASDAQ:CARA) is a Connecticut-based emerging biotechnology company with a ~$175 million market capitalization. The stock is currently just over $6.00 a share. The equity has sold for north of $23.00 a share within the past year.

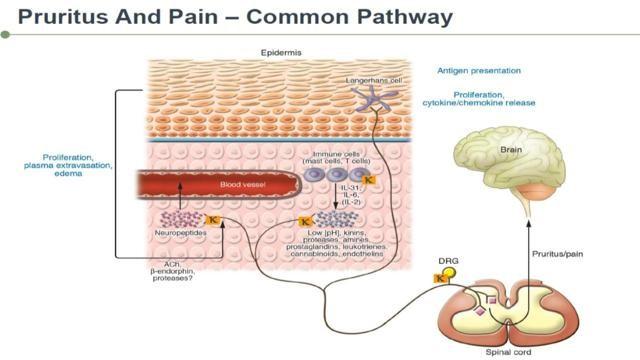

The company is focused on developing novel therapeutics to treat human diseases associated with pain, inflammation and pruritus. Cara possesses both near-term clinical development opportunities combined with proprietary approaches to developing first-in-class novel therapeutics.

Cara's most advanced compound, CR845, is currently undergoing clinical testing for acute pain and pruritus. This patented compound possesses analgesic, anti-inflammatory and anti-pruritic activities appropriate for multiple therapeutic applications. In addition, Cara aims to develop a future pipeline of first-in-class molecules at novel analgesic and anti-inflammatory targets using its proprietary drug screening technology.

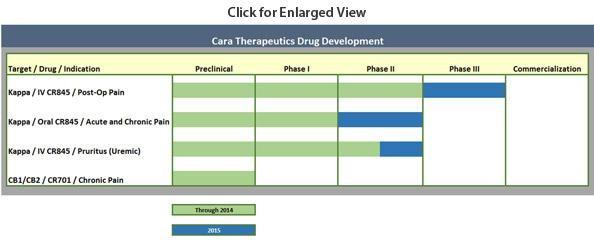

Pipeline:

As stated above, Cara's primary drug candidate is CR845 which is in mid to late stage trials for treatments in three distinct areas. Numerous milestones should be hit in 2016 which will be discussed in a section below. CR845 primary benefit is that unlike currently marketed opioids, this new compound does not produce inhibition of intestinal transit (ileus), does not induce life-threatening respiratory depression, nor does it elicit signs of addiction or euphoria. This is a key point as opioid addiction has recently become a national focus as well as a theme in various primaries this election season.

The compound was in a Phase 3 trial for a treatment for acute post-op pain before a recent clinical hold which was just lifted (see below). Post op pain treatments is roughly a $9 billion annual market in the United States. Obviously just a small percentage of that market would be a significant potential revenue and earnings stream for Cara.

The company is also testing an oral version of CR845 for acute and chronic pain. The company plans a multiple dose Phase 2b study in OA patients in the second half of this year which will be an upcoming milestone when it commences. An oral CR845 Phase 2a study in osteoarthritis ("OA") patients showed in December of last year that CR845 exhibited a dose related reduction in main baseline pain score to the end of the two-week treatment period with up to an approximate 34% reduction for the highest dose group.

Finally, in the third quarter of last year Cara provided data from their Phase 2 trial where CR845 treatment resulted in statistically significant reductions in both the primary endpoint of worse itching or pruritus in uraemic pruritus ("UP") and dialysis patients as well as secondary endpoints assessing quality of life measurements in these patients. This is an unmet need in the market with no approved treatments either in the United States or Europe for UP. The next step is a two-part Phase 2/3 adaptive design in haemodialysis patients exhibiting moderate-to-severe uremic pruritus that should commence in the second half of 2016.

Clinical Hold:

The stock started the year at around $15.00 a share but then tanked to less than one third of that less than three months into 2016. One of the primary causes driving the stock down is the company in February announced a critical Phase 3 trial has been placed on a clinical hold, following a limited number of patients reaching a pre-specified stopping rule related to increases in serum sodium concentrations to the mild to moderate hyponatremia level that is greater than or equal to 150 Millimoles Per Litre. To put in perspective, the normal range expected in this population without treatment is 135 Millimoles Per Litre to 145 Millimoles Per Litre. The company met with the FDA and on April 20th the government agency lifted the hold on this critical trial. The stock ran up some 50% in anticipation of this news but is still far below where the shares began the year.

Balance Sheet:

As of the end of the 2015 fiscal year, cash and cash equivalents and marketable securities totaled $106.7 million compared to $52.7 million at the end of FY2014. The increase in the balance of cash, cash equivalents and marketable securities resulted primarily from a receipt of the net proceeds of $75.2 million from the follow-on offering of common stock which closed in August of 2015. This will fund all three areas of trials of CR845 for two years and beyond. Given the current lack of demand for secondary offerings in this sector at the moment, having no funding needs for the foreseeable future is a huge positive for this late stage developmental biotech concern.

Analyst Commentary:

After the clinical hold was lifted, Needham reiterated their Buy rating and whopping $27.00 a share price target noting the shares were significantly undervalued given the likely success of CR845 as a treatment for acute post-op pain whose Phase III trial will now resume in May thanks to the FDA action. Results should be known either late this year or early 2017. Cantor Fitzgerald also reissued their Buy rating and slightly less optimistic $24 price target on the same day. $24 is also the median price target of the seven analysts that currently cover the company. Price targets range from $17 to $30 a share, all substantially above CARA's current price to say the least.

Outlook:

The company recently took any need to raise additional funding to fund trials off the table earlier this year. However, if and when successful CR845 will need the company to hire and train a sales force. This might make a buyout with a substantial premium one avenue management might consider. Given the interest in this part of pain management and the cheap valuations CARA currently sells at, a larger drug giant with an established sales force could easily make a purchase easily accretive even by offering at least what the company was selling for earlier this year, or $15 a share if not more.

As a standalone entity, Cara Therapeutics is still highly attractive and deeply undervalued. The company also has a couple of trial milestones over the coming year. Combined with increasingly positive analyst support and cash balance sheet that equates to more than half of its current market capitalization; CARA seems to offer a very positive risk/reward profile at just over $6 a share.

Progenics Pharmaceuticals (NASDAQ:PGNX) is another deeply undervalued biopharma stock that makes an attractive buyout candidate at the moment.

Company Overview:

Progenics Pharmaceuticals is a small cap that has a market capitalization of just north of $350 million and a current stock price of approximately $5.00 a share. Progenics is developing a stable of products consisting of imaging and therapeutic agents to better detect and treat various forms of cancer and its associated effects. It also has one approved product on the market as well. This compound has huge potential and will bring Progenics significant royalty revenues, sales milestones and also could make it an attractive buyout target.

Products:

The company's lead product is called Relistor which was approved in 2014 to treat opioid-induced constipation ('OIC') in patients with chronic non-cancer pain. This drug has been developed in partnership with Salix Pharmaceuticals (NASDAQ:SLXP) and the approval for the injectable form of this drug for this new indication triggered a $40 million milestone payment to Progenics. Valeant Pharmaceuticals (VRX) bought Salix in 2015 and now is Progenics' partner on Relistor.

The oral form of Relistor has significant potential but recently had its PDUFA date pushed back to July, due to the recent problems with Valeant; the approval is still highly likely. Approval will trigger an additional $50 million milestone payment to Progenics. The company earns a royalty of 15% to 19% on sales of Relistor depending on annual global sales.

In addition, the company could receive up to $200 million in additional milestone payments on the commercialization of Relistor. These include a $10 million payment upon calendar-year net sales in the U.S. exceed $100 million and $75 million when such sales first exceed $1 billion. Salix had annual peaks sales of $300 million penciled in for the current approved injectable version of relistor and $1.3 billion as its forecast for the oral version. In the fourth quarter of 2015, relistor had sales of $23 million and continues to show good growth. At its current pace, Progenics should garner its $10 million milestone payment as sales for relistor should be significantly above $100 million even before revenues from the oral version kick in later this year assuming approval.

Other drugs in early stage development for Progenics include Azedra and PSMA-ADC. Azedra is an ultra-orphan product in late stage development. Azedra is being developed for the treatment of malignant pheochromocytoma and paraganglioma. Pheochromocytoma is among a class of malignancies occurring in the thyroids, the kidney, adrenal glands and elsewhere.

It is owned 100% by the firm without any partnerships, and the company is projecting about $100 million in peak sales from just for one indication. The product contains a radioactive isotope which means the product will never go generic. The company just completed enrollment for this pivotal trial in December. Top line results should be announced late this year or early 2017. The company believes given previous results, if this Phase II trial is successful Progenics believes based on conversations with the FDA it will be able to go straight to a submission for approval without conducting a Phase III trial.

In late July of 2015, the FDA granted Breakthrough Therapy status to Azedra for the treatment of patients with certain forms of adrenal cancer. This status provides for more intensive guidance from the FDA, the involvement of more senior agency personnel and a rolling review of the New Drug Application (NDA). Orphan Drug status provides for a seven-year period of market exclusivity for the indication, if approved.

PSMA-ADC is being look at as both from an imaging and therapeutic perspective for prostate cancer. Prostate cancer is the second most common form of cancer affecting men in the United States: an estimated one in six will be diagnosed with prostate cancer in his lifetime. The compound produced encouraging Phase II trials earlier in 2015.

The company also has a couple of other compounds in very early stage development that represent additional "shots on goal" at some point in the future. However, given their stage of current development we will not factor them into our valuation on Progenics.

Progenics ended 2015 with just under $75 million in net cash on the balance sheet. The company should continue to receive an increasing royalty stream as relistor sales continue to expand. In addition, it should be able to count on another $50 million payout when oral relistor is approved in July and a $10 million sales milestone sometime late in 2016 in all likelihood

Outlook:

The analyst community has been quite active around their commentary on Progenics recently. In April & May Needham, Jefferies and Brean Capital have reiterated Buy ratings with price targets ranging from $9 to $14 a share on PGNX.

I think Progenics will do great as a standalone company and is undervalued at current levels given its growing relistor royalty stream, the upcoming approval of oral relistor, developing pipeline and large cash balance. However, given the need of Valeant to sell assets to pay down its large $30 billion debt load which now carries a non-investment grade credit rating; I would not be surprised if someone like Allergan bought the relistor franchise from Valeant at a good price. It then could be most interested to acquire Progenics as well. That would eliminate the need to pay royalties on relistor that could easily be a $1 billion to $1.5 billion drug. Not to mention the approval and sales milestones it could then avoid paying. The other compounds in Progenic's pipeline would then just be "gravy" or sold to offset the cost of acquisition. Even paying a substantial premium, an acquisition would be very attractive in this scenario.

Disclosure: I am/we are long AGN, CARA, PGNX.

No comments:

Post a Comment