Summary

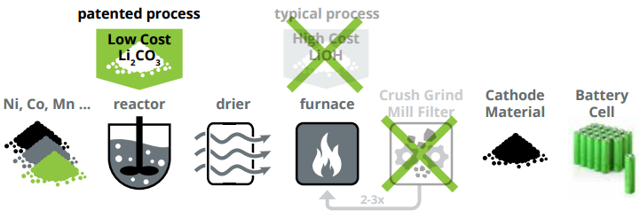

Developed a patented process and scalable manufacturing platform that is agnostic to different types of raw materials, creating a more robust product faster and cheaper than conventional methods.

Although the technology could apply to a variety of different materials, Nano One is currently focusing on the cost-effective production of nanostructured cathode materials for Li-Ion batteries.

Simple three-stage process with up to 75% fewer steps, less handling, lower capital costs, minimal waste solvents, 90-95% yield which could reduce costs up to 50% ($/kWh).

From a battery technology perspective, not much can be done to accelerate the rate of development – the real solution relies on improving the material constraints which Li-Ion currently faces.

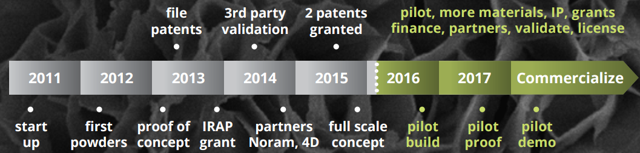

Management has stated they have enough cash on hand through 2016 and are utilizing it to complete pilot installation, commissioning, optimization and full scale battery testing.

Simple question. "Can you make a battery last longer?" In short, yes however the answer is more complicated than one may initially think.It depends on how smart phone and electric car manufacturers choose to leverage the improvements; they may want it to last longer, charge faster or drive more features; they may want to extend their warranty, improve mileage or reduce the size of battery packs.

This is the battery conundrum. Batteries do not follow Moore's Law, where the number of transistors on circuit doubles about every two years. They do occur, however at a decidedly slower pace (~7-9% annually in terms of energy density). Why does everything in your life seem to get better, faster, and cheaper, but your smartphone still dies in the afternoon? Choices and limitations in commercialization - manufacturers can only do so much with the current state of the battery industry, hampered largely by price and a lack of efficacious technology.

This is where a manufacturing platform that is agnostic to different types of raw materials, creating a more robust product faster and cheaper than conventional methods is the differencing component of this next company which believes that it has the technology that could enable a new generation of batteries and advanced energy storage materials.

COMPANY OVERVIEW

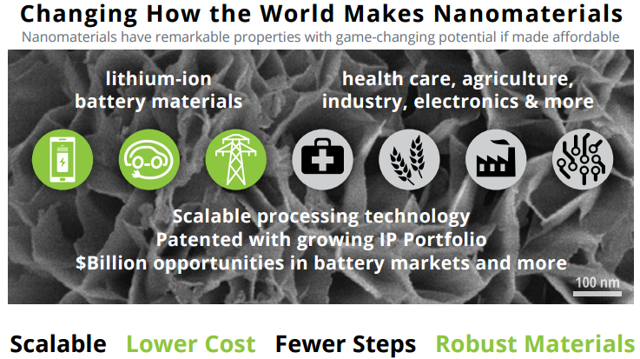

Nano One Materials Corp. ("the company" or "Nano One") (OTCBB: DDXFF, TSX-V: NNO or FRA: LBMB) is a Vancouver-based technology company with a scalable industrial process for producing low-cost high-performance energy storage materials for batteries and a wide range of advanced nanostructured composite materials for products in the energy storage, specialty ceramics, pharmaceutical, semiconductors, aerospace, industrial, food, agriculture and communications markets. Nano One uses a novel three-stage process and is engineering equipment for high volume production and rapid commercialization. The technology is particularly suited to growth markets where the commercialization of advanced materials is inhibited by costly and entrenched industrial fabrication methods. Nano One has 2 US patents granted and more than 10 pending in the U.S. and foreign jurisdictions.

Figure 1: Technology Summary

Source: Nano One Fact Sheet

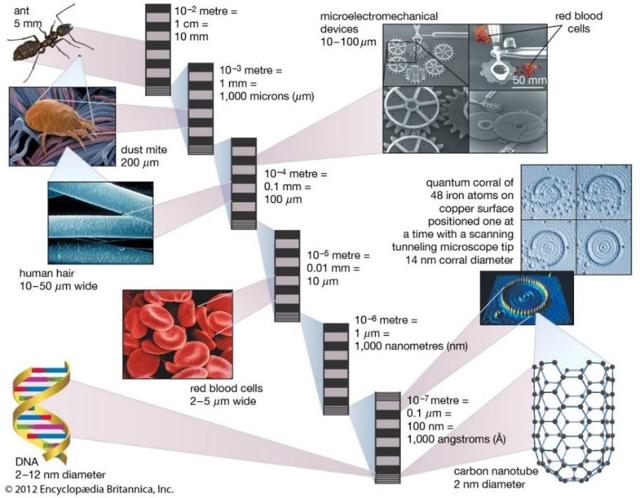

WHAT ARE NANOMATERIALS?

Nanomaterials are substances with structural features measured in nanometres, which is billionths of a meter or millionths of a millimeter, sized between molecular and microscopic. There can be nanometer-sized particles or crystals, or nanometer-sized structures within larger particles. Nanomaterials can be organic or inorganic; they can be made of metals, ceramics, semi-conductors, polymers or composites.

Figure 2: Scale of Nanomaterials

Source: Nano One

Nanomaterials are found in natural substances such as clays, gemstones, feathers and bones. For instance, they waterproof leaves, give iridescence to abalone shells, and provide grip for creatures like geckos to climb walls. If the properties of these materials can be harnessed, then the nanometer-sized features can effectively be programmed to behave in unique ways and have valuable optical, magnetic, electronic, mechanical and chemical properties.

Controlling the structure and size of these materials at the nanometer scale is too complex and too costly for most industrial applications. However, Nano One believes it has a manufacturing solution that will change the way nanomaterials are made and lead the industrial world into a new generation of affordable, high performance materials.

Figure 3: Made Affordable

Source: Nano One

The vast majority of today's materials are not nanoscale - to produce, they are generally too costly, complex and impractical for high-volume production of materials such as those used in batteries. The industry standard processes raw materials into fine or very fine powders by crushing, grinding, milling, blending, dissolving, precipitating, washing and filtering, sometimes in the presence of aggressive chemicals, high heat and pressure. For batteries, this impacts the structural integrity of the material, limiting complexity, uniformity, surface area, longevity, capacity, charging and cycling. These methods are widely used by industry and known as solid state, hydrothermal and co-precipitation.

Nano One's technology differs from these methods because it enables controlled assembly of inexpensive raw materials at mild temperatures under atmospheric pressures in fast acting, versatile conditions using simple, scalable and cost effective industrial equipment suited to high volume production.

MANUFACTURING BETTER BATTERIES

Although Nano One's innovative processing technology can be used to produce materials used in a wide range of markets, the first addressable market that the company has selected to pursue is for cathode materials that are used to store and discharge energy in lithium-ion rechargeable batteries.

There is growing demand in the lithium-ion battery market for more cost effective and higher performance energy storage solutions. Nano One believes that cost-effective production of nanostructured cathode materials can address pent-up global demand for better batteries and is around a $2-3 billion global market. Cathode materials are found in the lithium ion batteries that power consumer electronics, electric vehicles and industrial storage (to name just a few).

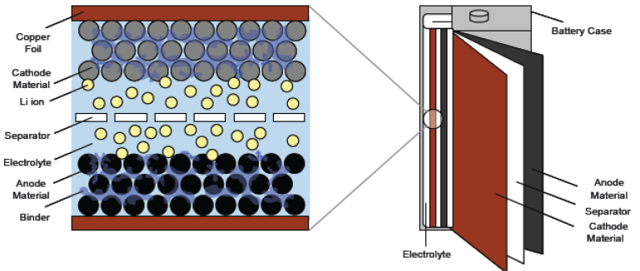

Lithium ion batteries have two electrodes, the anode and the cathode, that transmit lithium ions through an electrolyte with a porous membrane to separate the electrodes. The electrodes are thin foils coated with powdered materials that store and release ions during energy charge and power delivery. The anode material is most commonly made of graphite, while the cathode is of lithium and a matrix of other metals that can include cobalt, manganese, nickel, aluminum or iron in the form of oxides, phosphates, silicates and others.

Figure 4: Basic Structure of a Lithium-Ion Battery

Source: Taiyou Research

The Challenge

Cathode powders have great potential to change battery performance and also account for a quarter of the cost of a typical battery cell. The challenge with any advanced material is to boost performance and reduce cost. For batteries, this means reducing the cost of raw materials and processing while boosting capacity, charge and cycle life.

Cathode powders have great potential to change battery performance and also account for a quarter of the cost of a typical battery cell. The challenge with any advanced material is to boost performance and reduce cost. For batteries, this means reducing the cost of raw materials and processing while boosting capacity, charge and cycle life.

Some of the more promising cathode materials being developed in labs around the world are using processes with between 50 to 100 steps and production cycles of 4-7 days. Nano One's technology can use lower grade raw materials and could complete a production cycle in a day using a three stage process with up to 75% fewer steps. There is less handling, lower cost capital equipment, no waste solvents, 90-95% yield, many fewer failure points, higher safety and flexibility to run different material formulations in a controlled and sealed environment.

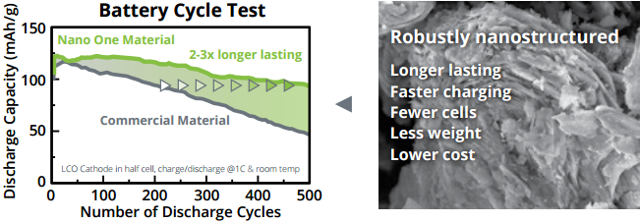

The Upshot

Nano One's technology could reduce costs by up to 50% ($/kWh) delivering robustly structured cathode materials that last 2-3 times longer, store more energy and deliver more power. For electric vehicles, this could translate into fewer battery cells, less weight, less cost extended range, longer lifetime or better warranties. For consumer electronics, this could mean greater storage, faster charging or more power.

Nano One's technology could reduce costs by up to 50% ($/kWh) delivering robustly structured cathode materials that last 2-3 times longer, store more energy and deliver more power. For electric vehicles, this could translate into fewer battery cells, less weight, less cost extended range, longer lifetime or better warranties. For consumer electronics, this could mean greater storage, faster charging or more power.

Source: Nature.com

LITHIUM ION BATTERY ("LIB") MARKET OVERVIEW

While Nano One can apply its scalable industrial process to upgrade a wide range of advanced nanostructured composite materials for products in the health care, electronics, industrial, food, agriculture, industry, catalyst and textile markets, its initial target market is energy storage for batteries.

There are a lot of underlying reasons that forecast a much greater adoption rate for energy storage systems, particularly lithium ion batteries in the years to come:

- Batteries are the unappreciated hero of electronic devices (mobile phones, laptops, tablets, smartphones, power tools, etc.)

- Global warming and climate change concerns have focused a spotlight on electric vehicles (NYSE:EV)

- Rising transportation demand, upstream costs and security over supply of oil have precipitated an urgent need for new sources of energy

- Green energy has made power grids more unstable, but energy storage systems (NYSE:ESS) can help

Why Lithium Ion?

Lithium Ion batteries offer capacity, charging, weight, and form-factor benefits all of which are attractive to EV manufacturers. Although costs are currently high, pricing will fall as battery and EV manufactures invest iningenious manufacturing processes rather than ingenious leaps in battery chemistry in order to meet the surging consumer EV demand and usher in the new electric age.

Lithium Ion batteries offer capacity, charging, weight, and form-factor benefits all of which are attractive to EV manufacturers. Although costs are currently high, pricing will fall as battery and EV manufactures invest iningenious manufacturing processes rather than ingenious leaps in battery chemistry in order to meet the surging consumer EV demand and usher in the new electric age.

According toTaiyou Research, lithium-based batteries are the most popular advanced batteries for use in portable consumer electronics, and EV manufacturers. However, this was not always the case for several years spanning the initial stages of the EV market due to the high cost associated with this battery type compared to its nickel-based counterpart. With the fall in prices of lithium after 2005, auto manufacturers started widely using it in their batteries which has expanded its application demand significantly (although prices for these vehicles are still relatively quite high).

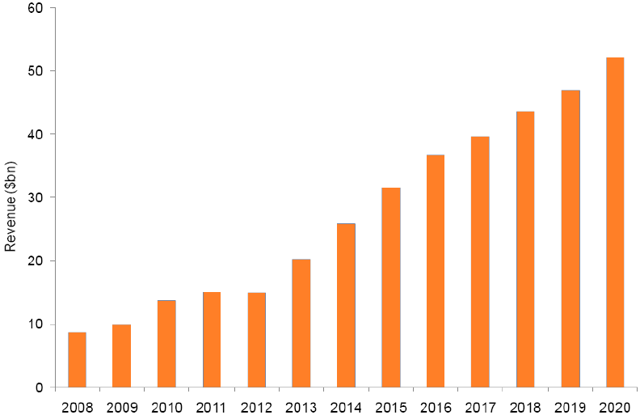

Figure 5: Revenues of the Global Lithium-Based Battery Market ($USD Billion), 2008 - 2020

Source: Taiyou Research

Lithium Prices: Supply & Demand

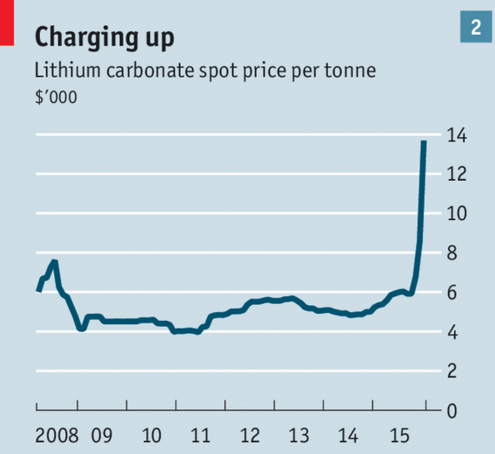

While the excitement for lithium is born of strong growth in technologies requiring lithium (mainly electric vehicles and energy storage), the real reason for investor excitement boils down to one issue: price. As arecent article in The Economist points out,

"Amid a surge in demand for rechargeable batteries, companies are scrambling for supplies of lithium… Lithium prices have spiked alarmingly of late and this gives us pause as historically any parabolic price spike typically ends in tears for investors. That said, while prices could soften somewhat, strong demand and increasing questions around supply lead us to believe that lithium price downside is limited."

Figure 6: Lithium Carbonate Spot Price Per Tonne

Source: The Economist / Citigroup

Have no doubt, there is currently a global scramble going on to secure supplies of lithium by the world's largest battery producers and by end-users such as auto manufacturers. These factors have arguably made it the world's hottest commodity. The price of 99%-pure lithium carbonate imported to China more than doubled in the two months to the end of December, to $13,000 a tonne. The spike mostly reflected concerns about the future liquidity of China's lithium spot market as China gets much lithium from spodumene rock in Australia, but is indicative of how critical of a resource it is being viewed as.

Tesla Motors is preparing to start production at its "Gigafactory" in Nevada, which it expects will supply lithium ion batteries for 500,000 cars a year within five years. J.B. Straubel, Tesla's chief technical officer, says the firm wants to secure supplies of many battery materials, not just lithium - hence Nano One's agnostic technology approach to raw materials so that it's always ready for the future. Other auto manufacturers have begun offering lithium ion batteries instead of an alternative, heavier nickel metal hydride option. Furthermore, the recent global emissions scandals in Europe and America are likely to increase automakers' interest (and need) in lithium.

Other highlights from the high growth battery materials market include:

- Concentrated in a few Asian and EU producers

- Cathode material accounts for ~23% of battery cell cost

- Large new entrants are eroding margins

- The market is vulnerable to disruptive technology

- Differentiating IP is critical

- $100-$500M/yr royalty opportunity

Battery Technology and Constraints

You have also probably seen or read about theincredible battery breakthroughs that are coming out of small labs that perform bench tests which yield incredible results. Certainly you've heard that graphene is the material of the future. Yet, why isn't this great technology everywhere? Long story short, scientists have yet to find a way to produce it in industrial quantities or at a price that would make it attractive enough to work with on a commercial scale.

You have also probably seen or read about theincredible battery breakthroughs that are coming out of small labs that perform bench tests which yield incredible results. Certainly you've heard that graphene is the material of the future. Yet, why isn't this great technology everywhere? Long story short, scientists have yet to find a way to produce it in industrial quantities or at a price that would make it attractive enough to work with on a commercial scale.

According to what history has dictated, as well as Elon Musk andJ.B. Straubel from Tesla have presented, battery improvements are roughly 7-9% every year in terms of energy density - in other words it takes around 10 years to double.

Check outthis incredibly interesting presentation showcasing energy density, safety and life parameters. In 2005, the volumetric parameter was 580Wh/l. In 2009 it was 675 Wh/l. Now, as we already know, there is lag between "bench" test batteries and mass produced versions of them. Let's say that lag is 3 years (which I think is actually being relatively optimistic), the mass produced 2009 batteries are in fact from 2006, bench wise. 580 * 1.073 = 711 Wh/l battery in 2006.

So given that we know with certainty that the battery capacity trend was about the same between 2005 and 2010 as it was in previous years. I have no reason to think that the trend isn't the same between 2010-2015 and beyond for the time being. Perhaps I am being optimistic, but it is based on clear, quantifiable historic yearly improvements/trends.

Hence, from a battery technology perspective, there is not too much that can be done to accelerate this process. Scientists have been working on it pretty feverishly, however they haven't had much luck as of yet. The real solution relies on improving the material constraints which lithium ion currently faces.

THE TECHNOLOGY

Nano One has developed a new method of producing high performance cathode materials, which uses equipment and simple methods that are known to scale in a wide range of industrial applications - the process can produce longer lasting composite materials using lower cost feedstock and simpler processing.

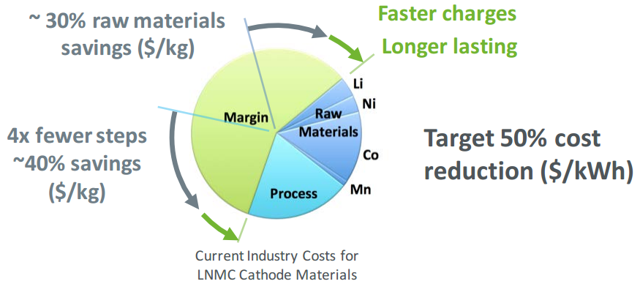

Figure 7: Nano One Solution

Source: Nano One, Deutsche Bank and FMC

Performance

Nano One materials have been assessed by Nano One, by Canada's National Research Council ("NRC") and by several undisclosed materials producers. Specifically, the NRC measured electrochemical performance of LNMC out to a thousand (1,000) cycles and results were similar to those measured by Nano One and another undisclosed group. The NRC also tested a comparable LNMC reference material prepared by a leader in battery material science and found that Nano One material performed with approximately 20% greater capacity than the reference material. Both the Nano One and NRC results show reasonable energy capacity fading to 85% after 500 1-hour charge-discharge cycles.

Nano One materials have been assessed by Nano One, by Canada's National Research Council ("NRC") and by several undisclosed materials producers. Specifically, the NRC measured electrochemical performance of LNMC out to a thousand (1,000) cycles and results were similar to those measured by Nano One and another undisclosed group. The NRC also tested a comparable LNMC reference material prepared by a leader in battery material science and found that Nano One material performed with approximately 20% greater capacity than the reference material. Both the Nano One and NRC results show reasonable energy capacity fading to 85% after 500 1-hour charge-discharge cycles.

Figure 8: Validated Performance

Source: Nano One Fact Sheet

Raw Material Costs

Nano One's liquid phase reaction is tolerant of raw material impurities and irregularities, enabling the use of lower grade feedstock (carbonates at 98-99% purity) instead of battery grade (hydroxides at 99.9%) for an estimated ~30% reduction in terms of dollars ($) per kilogram (kg).

Nano One's liquid phase reaction is tolerant of raw material impurities and irregularities, enabling the use of lower grade feedstock (carbonates at 98-99% purity) instead of battery grade (hydroxides at 99.9%) for an estimated ~30% reduction in terms of dollars ($) per kilogram (kg).

Processing Time and Costs

Nano One believes it can reduce the number of manufacturing steps by 75% and reduce throughput from several days to less than a day, when compared with state of the art methodologies described in patents and literature, such as solid state, hydrothermal, co-precipitation, solgel, spray pyrolysis and deposition methods.

Nano One believes it can reduce the number of manufacturing steps by 75% and reduce throughput from several days to less than a day, when compared with state of the art methodologies described in patents and literature, such as solid state, hydrothermal, co-precipitation, solgel, spray pyrolysis and deposition methods.

The overall savings in process costs is projected to be ~40% in terms of dollars ($) per kilogram (kg). Furthermore, improvements to the nanostructure are showing 200-300% longer lasting material that can charge faster or store more energy. Nano One believes the product of these improvements can deliver a 50% reduction in the cost of storing energy in terms of dollars ($) per kilowatt-hour (kWh).

The Process

Figure 9: Nano One Industrial Process

Source: Nano One Fact Sheet

The process consists of three (3) stages, and the major innovations lie in the first (1st) stage where a special mode of combining reactants controls crystal nucleation and growth of particles. Nucleation is the self-assembly of molecules into an organized structure. The desired nano-scale or superfine structure is formed in the first (1st) stage of the production cycle and eliminates many steps common to the dominant industrial processes.

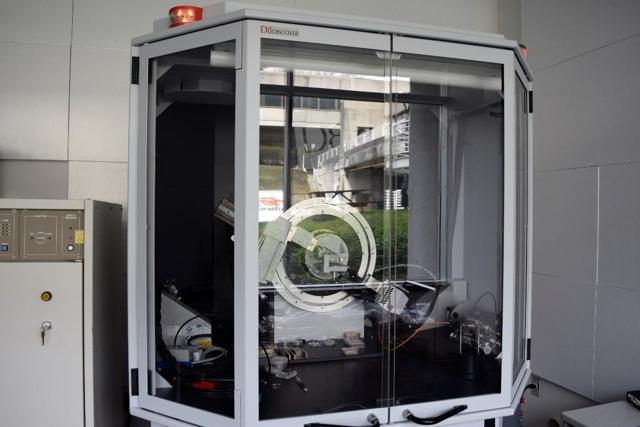

Figure 10: Workstation

Source: Photo from my lab tour

In the first (1st) stage, salts or other reactants are added to an aqueous (water-based) or other solution located within a proprietary liquid phase reactor system. Nucleation occurs upon the presentation of feedstock and takes place rapidly. The proprietary system allows for control of structural growth and reaction kinetics, with the source materials provided either from bulk or from a continuous flow preparation process. The process is suitable for operation at mild temperatures and atmospheric pressures.

This reactor stage avoids grinding, milling, classification, supercritical conditions, filtering, separation and many other steps that are used in existing industrial methods. Reactants need not be high purity, as less expensive technical grade (as opposed to battery grade) chemicals can be used to achieve a quality output. Nano One's system is less sensitive to impurities and irregularities than other known manufacturing methods and can accommodate, for example, carbonates, hydroxides, and acetates of lithium, cobalt, nickel and manganese graded at 98% and 99% purity. These materials are less costly and more widely available than battery grade feedstock (99.9% and purer) that is commonly used to prepare cathode materials. The reactor operates at mild temperatures and atmospheric pressures, and can be sealed for inert or other environments, allowing for a much safer and simpler laboratory environment. The reactor stage also avoids complexing agents, surfactants, templates, and emulsifiers that are categories of chemicals typically used to initiate nucleation and control growth of structures. Nano One avoids these chemicals and is therefore able to deliver the desired structure using simpler methods and pass them on to the second (2nd) stage of drying and the third (3rd) stage of firing in a furnace.

In the second (2nd) stage, the reactor liquids are passed to an industrial drying system such as a spraying, freezing, evaporating, microwaving or other system.

In the third (3rd) stage, dried powders are fired in a conventional furnace such as a rotary kiln, fluidized bed, plasma or other type of furnace. This final stage is known as calcination, where the dried materials are heated to 800-900ºC in either an atmospheric or inert environment and are thermally decomposed into, for instance, lithium manganese oxide, steam, ammonia and/or carbon dioxide. The formation of the underlying nano-structure is completed during calcination and the resulting powder is ready for assembly into a battery cell or other application.

The underlying structure and morphology of the materials is preserved through a wide range of thermal processing steps, eliminating the need for long and repeated firings and indicative of a robust and long lasting material. The process produces materials with stable phase composition and high porosity, but which is configurable to meet a variety of density requirements.

The presence of nano-structures early in the process and prior to calcination simplifies processing and is advantageous for performance, throughput and scale-up. Characterization of the materials by electron microscope and x-ray characterizes the size, the composition and the kind of structure, providing evidence of a robust structure that withstands the rigours of drying and calcination and maintains the integrity of its advantageous structure through thousands of charge cycles.

This innovative approach can reduce the complexity and cost of materials production, through lower cost feedstock and fewer steps, while providing nanostructured materials with superior performance characteristics. The reactor, drying and calcination stages can be easily integrated to enable materials to flow from start to finish in a continuous manner and under controlled environmental conditions. In this way, Nano One's system can be configured for many different composite materials and Nano One believes the three (3) stage process can be rapidly scaled and configured for high volume production.

Typically, synthesis of nano-materials at the benchscale are performed in small quantities anywhere from milligrams to grams of material. Subsequent scale-up from these small quantities often leads to detrimental changes in thermodynamics (heat, temperature, energy, work) and reaction kinetics (reaction rates and chemical change). Nano One recognizes that synthesis of materials must begin at a larger scale where the properties of the system are much closer to production conditions. For this reason, Nano One designed a 6-liter bench scale reactor that is capable of producing up to 150 grams per hour (150 g/hr) or 3 kilograms per day (3 kg/day), with drying and firing stages easily scaled to match. At this scale, there is sufficient enough volume to emulate the thermodynamic and reaction kinetics expected in pilot and full-scale production.

Figure 11: Another Photo From My Lab Tour

Source: Photo from my lab tour

PARTNERSHIPS

Nano One has secured several strategic partnerships with government agencies and private institutions and has also had interest from some of the biggest players in the battery and materials space - in fact, management is aggressively pursuing building relationships with some of the biggest players.

Figure 12: Nano One Partners

Source: Nano One Website

BC Research and NORAM Engineering

Nano One has an industrial commercialization partnership with BC Research Inc. (BCRI) and its parent NORAM Engineering and recently completed the conceptual design of a full commercial facility. This will bring credibility to commercialization discussions with strategic investors and will also inform the design of their 10kg/day pilot scheduled to begin in 2016. The pilot will demonstrate scale and provide a platform to develop new materials.

Nano One has an industrial commercialization partnership with BC Research Inc. (BCRI) and its parent NORAM Engineering and recently completed the conceptual design of a full commercial facility. This will bring credibility to commercialization discussions with strategic investors and will also inform the design of their 10kg/day pilot scheduled to begin in 2016. The pilot will demonstrate scale and provide a platform to develop new materials.

NORAM and BC Research help early stage companies like Nano One develop and commercialize by providing laboratory, incubation and piloting facilities along with scale-up experience, engineering design and fabrication support. Interaction is easy and fast because Nano One shares their facility in British Columbia and both groups can quickly pose and answer questions as the technology and scale-up evolves. Nano One has access to NORAM engineers, chemists, senior staff and industrial know-how, which compliments Nano One's own expertise in materials, batteries and electrochemistry. NORAM and BCRI are translating commercial concepts into a demonstration pilot plant, offering Nano One services to scope, design, construct and operate the pilot.

Furthermore, Nano One benefits from the commercialization credibility that BCRI brings to the project and BCRI has an interest in providing commercial design/build services to materials producers that may license Nano One's technology. The recently produced engineering report and support from NORAM significantly de-risks uncertainties in scaling the technology, adds market value and provides confidence to potential licensees of the technology that Nano One's path to commercialization is advantageous, viable and cost-effective.

4D Labs

4D LABS is an applications- and science-driven research institute at Simon Fraser University, located in British Columbia, Canada, offering access to multiple facilities housing state-of-the-art analytical equipment for academic, industrial and government researchers. 4D LABS focuses on accelerating the Design, Development, Demonstration and Delivery of advanced functional materials and nanoscale devices.

4D LABS is an applications- and science-driven research institute at Simon Fraser University, located in British Columbia, Canada, offering access to multiple facilities housing state-of-the-art analytical equipment for academic, industrial and government researchers. 4D LABS focuses on accelerating the Design, Development, Demonstration and Delivery of advanced functional materials and nanoscale devices.

Canada's National Research Council

The Canadian Government is providing grants to Nano One as part of theNational Research Council Industrial Research Assistance Program (IRAP). IRAP is Canada's premier innovation assistance program for small and medium-sized enterprises. For over 60 years, IRAP has been stimulating wealth creation for Canada through technological innovation.

The Canadian Government is providing grants to Nano One as part of theNational Research Council Industrial Research Assistance Program (IRAP). IRAP is Canada's premier innovation assistance program for small and medium-sized enterprises. For over 60 years, IRAP has been stimulating wealth creation for Canada through technological innovation.

Nano One has received and completed three (3) grants from NRC-IRAP totaling $320,000, whereby NRC-IRAP funded a non-repayable contribution of up to $320,000. IRAP requires that the proceeds from these grants be applied towards specific projects and a portion of employee salaries and contractor fees involved in the projects.

Sustainable Development Technology Canada

Sustainable Development Technology Canada (OTCPK:SDTC)has approved Nano One for a $2.08-million technology commercialization grant.

Sustainable Development Technology Canada (OTCPK:SDTC)has approved Nano One for a $2.08-million technology commercialization grant.

"Sustainable Development Technology Canada is incredibly proud to support Nano One," said Leah Lawrence, president and chief executive officer. "Our mission is to help Canadian cleantech entrepreneurs move their groundbreaking technologies to commercialization by bridging the funding gap between research and market entry. Nano One's battery materials pilot plant is the kind of technology that has the potential to generate jobs, growth and export opportunities, and to bring lasting economic, environmental and health benefits to Canadians and the world."

BUSINESS MODEL

Nano One's vision and mission is to establish their patented, core technology as a dominant process for the production of high-performing nanostructured materials. Through partnership and licensing of its technology, Nano One plans to engineer its system for high volume production and rapid commercialization.

Although the technology could apply to a variety of different materials, for the time being Nano One has chosen to focus specifically on the cost-effective production of nanostructured cathode materials for lithium-ion batteries. "The battery space is something that everyone recognizes,"said Dan Blondal, CEO of Nano One in an interview with Investing News Network. "Every investor out there knows that we need better batteries. There's a big hockey stick of demand coming up, there's a lot of pent-up demand for improvements to this space, and we think we can address that."

Everyone can relate to the need for better batteries - increased democratization of mobile phone ownership as well as electric vehicles are poised to drive tremendous growth. Nano One's technology can improve the energy storing structure in lithium-ion materials using simple low cost manufacturing technology and the battery space is a natural place to seek capital and prove the technology.

In terms of results, the company has seen improvements to charging, cycling, capacity and cost. Tests to date have proven that their technology can deliver robust and efficient nanostructures while reducing raw material costs and simplifying the process. Results from comparisons with commercially available materials have shown improved cycle life of up to 2-3 times . For electric vehicle battery packs, this could translate into fewer cells, faster charges, less weight and less cost - all benefits that can boost adoption rates. For consumer electronics this could mean faster charging, longer lasting batteries and lower cost of ownership.

Since battery material production costs are based on raw materials, operating costs and performance metrics such as energy density, capacity, cycling and charging. Nano One is able to achieve cost-savings in the battery sector by using low cost feedstock and simple scalable methods to assemble atoms into robust long lasting structures that store energy efficiently over a greater number of cycles.

What differentiates the Nano One production process from existing industry methods is that the company's method differs because it assembles the atoms of each raw material before the final firing stage. This produces longer lasting crystal structures that can store more energy. Nano One's solution based process operates at mild temperature and atmospheric pressure and avoids costly feedstock, surfactants, additives, filtration and damage from grinding, milling, contaminants and repeated firing.

All of this results in Nano One: reducing the number of manufacturing steps by 75%, reducing throughput from several days to less than a day; overall savings in process costs is projected to be ~40% in terms of dollars ($) per kilogram (kg), and through further improvements potentially a 50% reduction in the cost of storing energy in terms of dollars ($) per kilowatt-hour (kWh); and 200-300% longer lasting material that can charge faster or store more energy.

Recent Activities

Nano One spent the latter part of 2015 optimizing its process and its materials with the goal of demonstrating long lasting high energy density batteries and validating four (4) key areas of uncertainty: (NYSE:I) performance; (ii) novelty; (NASDAQ:III) scalability; and (iv) cost. Management believes that they have now substantially de-risked these uncertainties and are now working on scalable pilot production of Nano One materials.

Nano One is focusing its efforts on strategically important, next generation cathode materials for the electric vehicle market, such as lithium nickel manganese cobalt oxide (NMC) and lithium manganese rich lithium nickel manganese cobalt oxide (LMR-NMC). The most recent cell tests have improved cell-to-cell consistency and some materials have shown commercially viable reversible capacity up to 240 mAh/g (milliamp-hours per gram), which is in line with industry targets. Longevity is measured cycle to cycle and Nano One has seen about 0.03% capacity fade per cycle in some materials when charging and discharging once per hour. This is up to 10 times longer lasting than benchmarks used by key players in the battery space.

Furthermore, Nano One successfully doubled the density of its battery materials with some samples reaching well over 2 g/cc (grams per cubic centimetre). Higher energy storage per cell is usually associated with higher density materials and could enable further improvements to capacity, efficiency, cost, weight and performance.

Nano One's bench-scale apparatus is considered very productive at about 100 grams per hour and will require a modest scale-up, in the neighborhood of tenfold (1kg), to demonstrate pilot production. With commercialization partner, BC Research and NORAM, having completed the conceptual design and cost estimate for a commercial pilot facility in November, Nano One is confident that its technology is scalable for piloting and full production. Outcomes of this study included process flow diagrams (NYSE:PFD), a versatile chemical stream model and cost estimates of equipment, installation and operation of a full commercial system operating at approximately 10,000 kg/day.

Through collaboration with 4D LABS, Nano One is using a number of analytical tools to characterize the structural properties, chemical composition, porosity, surface area and mass of Nano One's materials. Electron microscopy is showing unique structures with beneficial shape, size and distribution. X-ray analysis of the NMC, LMR-NMC and other materials show a high degree of crystallinity and layered structures that support efficient transport of lithium-ions in and out of the structure.

Figure 13: FEI Tecnai Osiris (Scanning) Transmission Electron Microscope

Source: Photos from my tour of 4D Labs

Figure 14: Bruker D8 Discover (XRD2) X-ray Diffraction and Elemental Analysis Machine

Source: Photos from my tour of 4D Labs

As a result of this research, Nano One has identified a number of battery materials to take to the next level of evaluation in full-cells, where the cathode is paired with a graphite anode, as it is in commercial batteries. Nano One will evaluate these materials in battery tests and anticipates that third party testing will follow, with known battery industry players.

Future Plans

Figure 15: Roadmap

Source: Nano One Fact Sheet

Activities in 2016 will revolve around pilot installation, commissioning and optimization, with demonstration of pilot production towards the latter half of the year to provide materials for third party evaluation in 2017. These activities are expected to lead to discussions regarding partnership, licensing and commercialization.

Performance will be evaluated in full scale battery testing which will take place through 2016 with concurrent modifications to existing materials and synthesis of new materials. Third parties require a minimum of one kilogram (1 kg) of cathode materials for these tests and Nano One is preparing to modify existing apparatus to address immediate needs and is working on building a pilot line to address needs for the larger volumes of test materials.

Novelty will be validated through the assessment of the published patent applications and through demonstration of production in the laboratory and piloting facility.

INTELLECTUAL PROPERTY

Nano One has two US patents granted and ten more pending in the US and foreign jurisdictions. The U.S. Patent and Trademark Office granted and issued U.S. Patent No. 9,136,534 entitled Complexometric Precursor Formulation Methodology For Industrial Production Of High Performance Fine And Ultrafine Powders And Nanopowders For Specialized Applications" and U.S. Patent No. 9,159,999 entitled "Complexometric Precursor Formulation Methodology For Industrial Production Of Fine And Ultrafine Powders And Nanopowders Of Lithium Metal Oxides For Battery Applications".

Patent No. 9,136,534 is directed to a revolutionary method for forming powders particularly well suited for use as a lithium ion cathode material in next generation lithium ion batteries. Patent No. 9,159,999 is specific to the formation of lithium metal oxides using the proprietary methods described in Nano One's U.S. Patent No. 9,136,534.

The two patents were issued in about two and a half years, which was sooner than expected giving Nano One a broad set of claims that have undergone only minor revisions. This indicates a technological edge with freedom to operate and gives Nano One fertile ground to expand IP protection.

Early recognition of the novelty of the Complexometric Methodology validates the unique reaction chemistry developed at Nano One and positions Nano One as an emerging leader in advanced cathode material innovation. The granted patents also move Nano One closer to strategic objectives of partnering with leading manufacturers to create commercialize its technology for batteries.

Related applications are pending throughout the world with recent filings in Canada, the United States, Europe, China, Japan and Korea.

Intellectual Property Policy

Nano One is focused on building a portfolio of intellectual property and technology "know-how" for applications used in lithium-ion batteries and other markets, including energy storage, specialty ceramics, pharmaceutical, semi-conductors, aerospace, dental, catalysts and communications.

Intellectual property development and protection are cornerstones of Nano One's business and Nano One adheres to internal confidentiality with a strict disclosure framework as a first line of defense, followed by patents and trade secrets.

The intellectual property was developed and is wholly owned by Nano One and plans are in place to continue filing patents to further strengthen Nano One's intellectual property portfolio and technology position. Frequent invention, patent improvements, continuations and trade secrets are the most essential components of Nano One's strategy on intellectual property, and are crucial to protecting its intellectual property and maintaining its competitive advantage.

FINANCIAL OVERVIEW

Nano One appears to run a very tight ship with a relatively low overhead compared to other companies building a business that is R&D dominant. In terms of costs that the company has incurred to date, since 2011, Nano One has spent three million dollars to take an idea from concept to patents pending to patented and receiving outside validation. As part of the RTO that the company completed last year, it raised another three million dollars and has provided guidance that the money should carry it through 2016. As of the most recent financial statements, there was $1,796,032 in cash on September 30, 2015.

Last week the company closed an oversubscribed, non-brokered private placement and intends to use the net proceeds from this private placement for technology and corporate development, and general working capital.

As part of various agreements that Nano One has had with NRC-IRAP, it has received non-repayable contributions of up to $320,000, that fund a portion of salaries paid to employees and fees paid to contractors involved in completing each project.

Furthermore,the company announced just yesterday that it has been approved for a $2.08 million technology commercialization grant from Sustainable Development and Technology Canada (OTCPK:SDTC). The proceeds will be non-dilutive and non-repayable, and will help finance the design, construction, optimization and demonstration of Nano One's demonstration pilot plant. The project will commence as Nano One and SDTC agree on project details, and funds will be disbursed in installments, over a series of milestones, subject to an investment of matching funds from Nano One and other sources.

The company has stated that it will continue leveraging its treasury through Canadian government granting programs and is on track to reach its two-year goal to demonstrate scale pilot production and performance in full size batteries. Once cost, scale-up and performance are proven and validated, Nano One expects strategic engagement to follow shortly thereafter.

SHARE STRUCTURE & RECENT PERFORMANCE

Fully Diluted: 61,367,282

Funds, brokers and institutions that have participated in financing Nano One in the past include Pathfinder Capital, Mackie Research Capital Corp., Haywood Securities Inc., Wolverton Securities Ltd., Raymond James Ltd., Canaccord Genuity Corp., and RBC Dominion Securities Inc.

Figure 16: Recent Stock Performance

Source: Stockwatch

Nano One is currently trading near its 52-week high, largely based on investor sentiment towards when the company announced that BCRI and NORAM had completed and approved the conceptual design study of a commercial scale facility, as well as the recent financing and announcement of the grant from SDTC

While there are a lot of catalysts right around the corner for Nano One, investors should be aware that there is some overhang dampening short-term expectations asthe company recently extended and repriced 12,396,328 warrants.

Figure 17: Warrant Amendment Details

Source: Nano One

Investors can view this both as a plus and a minus in my opinion. A large portion of those warrants would most likely have expired in the near term, preventing dilution but not adding to the company treasury while now they have a slightly more likely chance that they're executed (from Feb.-Mar. to now mid-April). If this happens, the company can generate up to $3.72 million and attain significant financial security.

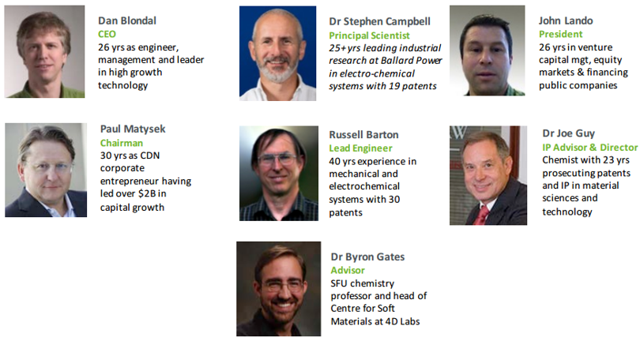

MANAGEMENT TEAM

The management and technology teams consist of individuals seasoned in financing, capital growth, technology management, chemistry, materials science, batteries, process engineering and intellectual property.

Figure 18: Nano One Management

Source: Nano One Investor Deck

Although I find the entire team at Nano One very accomplished and capable of achieving the milestones they laid out, I wanted to highlight one particular individual, Chairman & Director Paul Matysek. Paul is a legend on Bay Street for developing, marketing and attracting investors as well as facilitating the sales of Potash One, Lithium One and was Founder, President & CEO of Energy Metals Corporation, which was acquired by Uranium One (increasing its market capitalization from $10 million in 2004 to approximately $1.8 billion when it was acquired in 2007). Mr. Matysek is a proven company builder and believes that "Nano One has game-changing technology in one of the fastest growing spaces in the world. I like the management team and I hope to be able to add considerable value through my network and 30 years of market experience."

Before Paul agreed to even consider joining the company, he conducted a considerable amount of due diligence. The process took almost a year from initial contact with the founders of Nano One (known as Perfect Lithium at the time) to the close of the transaction. During that time, he extensively researched the space, the opportunity and the people involved. And lastly, he made sure that he could help formulate and execute their business strategy. He considers himself to be an active and involved Chairman of Nano One, providing mentorship, contacts and advice to management.

If you would like to read an entire interview with Paul Matysek, please visit Peter Epstein s website here.

COMPETITION

In terms of competition to Nano One, ironically its competition is also its target market. Management wants to license its technology and partner with those that have credibility in sourcing, manufacturing and distributing raw materials. There are many groups working on specific formulations of materials but the company doesn't view them so much as competitors, but as potential users or licensees of its process.

If you would like to take a look at how some companies participating in the lithium sector have been performing as a quantitative benchmark against the necessity for Nano One's technology, please take a look at the following companies:

ALB

|

NWR.L

|

BCN.V

| |||

FMC

|

RVR.AX

|

NMX.V

| |||

SQM

|

DJI.V

|

AJM.AX

| |||

ORL.TO

|

LIX.V

|

NMT.AX

| |||

GXY.AX

|

ILC.V

|

PE.V

|

The industry is fairly concentrated, which adds current lack of global supply and recent commodity price increase. Last year Albermarle, the world's biggest lithium producer, bought Rockwood, owner of Chile's second-biggest lithium deposit. It and three other companies-SQM, FMC of America and Tianqi-account for most of the world supply of lithium salts, according to Citigroup.

According to a report by energy consultant Navigant Research, LG Chem of South Korea, Johnson Controls (NYSE:JCI), and privately owned AESC are leaders in the battery technology space. Following these companies are Panasonic, Hitachi (OTCPK:HTHIY), Toshiba (OTCPK:TOSBF), Samsung (OTC:SSNLF), and EnerSys (NYSE:ENS).

Batteries for electrical power have always been important in the modern era. However, with the advent of mobile computing and electric cars, their importance will only continue to grow. Because of their growing importance, research into newer and better rechargeable batteries is gaining momentum. The fact that Nano One has a patented manufacturing platform that is agnostic to different types of raw materials gives it a distinct advantage over competition - moreover, its recent innovations to the Nano One process have been developedto augment manufacturing efficiencies.

RISKS

Nano One is an early stage development company, as such there are a number of risks associated with making an investment at this point in time, including but not limited to:

- Cash flow and future financing

- Delays in performance and scalability

- Intellectual property protection

- Competition

- Management of growth

- Economic conditions

(1) The company enough cash in its treasury right now to sustain itself through 2016; management is continuing to pursue further grant and partnership opportunities; and warrants may be executed if the share price continues to rise which can generate up to $3.72 million.

(2) The company does not currently have the inventory or the capacity to supply kilograms of cathode material that are typically required to prototype full size battery cells, however that is the current focus - completing the prototype pilot line and becoming operational. BCRI and NORAM recently completed and approved the conceptual design study for a Nano One commercial scale facility.

(3) Nano One cannot provide any assurance that any intellectual property applications will be approved, and even if they are approved, such patents, trademarks or other intellectual property registrations may be successfully challenged by others or invalidated. However, the speed with which the company received its first two patents gives Nano One a broad set of claims that have undergone only minor revisions, indicates a technological edge with freedom to operate and gives Nano One fertile ground to expand IP protection. As of the latest corporate filing, the company is not aware of any claims asserted by third parties that its intellectual property infringes on their intellectual property.

(4) Despite efforts by Nano One to protect its proprietary rights on which its business is dependent, competitive products may be developed in the future which could adversely affect its ability to acquire market share. However, as I previously asserted the proprietary process offers the company lots of flexibility as its manufacturing platform is agnostic to different types of raw materials and its process has been developedtoaugment manufacturing efficiencies.

(5) The company could experience growth that could put a significant strain its managerial, operational and financial resources which investors should be aware, however the Nano One management team is extremely seasoned and experienced in growing companies.

(6) Current and future unfavorable economic conditions could negatively impact Nano One's financial viability. Unfavorable economic conditions could increase financing costs, decrease net income, limit access to capital markets and negatively impact any of the availability of credit facilities to the company. That said, the market outlook is seems very positive and the Nano One technology has been designed to adapt to change. Certainly the difficult market environment on the TSX Venture exchange has effected the number of qualified investors participating in Canada, but Nano One has ambitious plans underway to gain exposure in Europe and the U.S.

There is an inherent risk involved with investing in any small cap company, let alone one that is an early stage developmental company, however management at Nano One has been working hard to mitigate these risks. In the near-term, technicals signals, the warrant overhang and emotions may overshadow fundamental developments, but that creates attractive investment entry points.

CONCLUSION

Nano One changes the way the materials are made and addresses cost, performance, and commercialization limitations in manufacturing. Think of Nano One's approach as a chemical assembly line; a manufacturing platform that is agnostic to different types of LiB materials.Using lower grade feedstock (~30% less) and easier processing (~75% fewer steps and 3 to 4 times higher throughput) to produce cathode materials withimproved charging, cycling, and capacity. The company's material takes a faster charge and has been shown to store 2 to 3 times more energy over the lifetime of the battery. For complex materials, Nano One's technology can complete a production cycle in less than a day, compared to four to seven days using traditional methods. These combined produce 90 to 95% yields, fewer failure points, longer lifetime, consume fewer harmful solvents, and create a safe product compared to peer processes.

The company has validated materials at Canada's National Research Council and reportedly with other first and second tier battery materials producers. The conceptual design of a full commercial facility that was recently completed by NORAM brings credibility to commercialization discussions with strategic partners and also details the design of a pilot plant scheduled to be completed in 2016. The pilot will demonstrate and de-risk scale-up while providing a platform to develop new materials and generate revenue.

Nano One Materials has made big strides recently to ensure that it continues to meet milestones and provide investors with good communication as its share price nears an all-time high. The company issued some fantastic news last week and newsflow looks very encouraging going forward. The company continues to present small-cap value investors with a unique investment opportunity. It's an interesting research and development story with little following and limited downside risk if past trends of management delivering are what matters to you.

Other investment highlights include:

- The company has a patented technology that combines elemental materials creating a more robust product faster and cheaper than conventional methods

- Management and technical staff with a track record of success. The battery and nano specialists have extensive success and industry experience with well over 50 combined patents issued

- Paul Matysek is the Chairman having built and sold three companies valued at over $2 billion dollars

- The technology is receiving patents and core patents were approved months ahead of schedule demonstrating a strong technology position

- The technology has been validated by the National Research Council inclusive of a research grant

- They have reportedly tested materials with a few tier one and tier two players and continue to see interest from key players in the battery space. They have their eyes on key battery integrators Tesla, Google, Apple; key battery manufacturers Samsung, LG Chem, Panasonic, Johnson Controls, Boston Power; and key materials suppliers Umicore, Toda, BASF, 3M, Johnson Matthey; and multiple tier two companies.

- They are pursuing a licensing and partnership model and hopefully won't need much money or suffer much dilution given their exceptionally low burn rate

- Their facility is located at NORAM Engineering's R&D division and the NORAM engineering on a large scale industrial facility

- The completion of the NORAM report confirms the scalability and cost of a commercial facility

In the near-term, shareholders should continue to get steady news from management, as this group is very diligent in their reporting and keeping the market informed about operations. With so much cash on hand, expect to read news soon about further development of the company's pilot facility and technological advances.

Looking ahead, Nano One's processing technology could enable a new generation of batteries by making it economically viable to produce a wider range of advanced energy storage materials.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

(For additional liquidity, DDXFF trades in Canada on the TSX Venture as "NNO" and in Frankfurt as "LBMB".)

Please feel free to comment below or send me an inbox message if you have any questions or comments about this article.

Long and Strong.

*If you like what you've read here please click the "+Follow" button and subscribe to my real-time alerts. I just started using the StockTalk function which I find is an excellent resource to communicate real-time trades that I'm making, due diligence that I'm conducting and article alerts.

Disclosure: I am/we are long DDXFF.

No comments:

Post a Comment