Summary

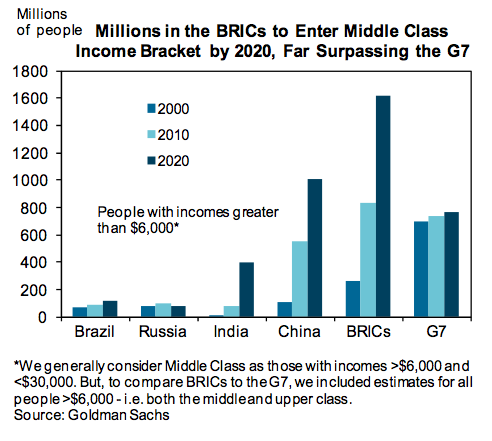

The Asian middle class is set to rise from around 600 million people now to 3 billion by 2030.

How will the Asian middle class spend its money?

My 3 ways to play the rising middle class.

Most of the rise will be in China and India, as the chart below clearly illustrates. However, other highly populous countries in ASEAN will also be part of this boom — think Indonesia, Philippines, Vietnam, Thailand, and Malaysia.

However, what's important as investors is how to capitalise on this incredible rise. To do this, I ask myself what the rising Asian middle class do with its greater disposable income. My thoughts are as follows:

- Buy food.

- Buy or rent housing (condo units, etc).

- Buy transport devices (mostly cheap motorbikes), clothes, cheap smartphones, internet service, online shopping, and entertainment.

Remember the Asian middle class will not be the same as the Western middle class that rose over the past 50 years. It will be a much larger group: billions. They will have lower incomes, so they will spend on essentials first; hence food is number 1 on my list.

My 3 ways to play the rising Asian middle class

1. Buy food-producing companies (consumer staples)

According to DBS: "Demand for food will hit nearly $3 trillion per year by 2020, double what it was a decade ago, opening up business and investment opportunities in food retailing, particularly in groceries".

Food ETFs to consider

PowerShares Dynamic Food & Beverage (NYSEARCA:PBJ) - Price: $31.89

The fund generally will invest at least 90% of its total assets in common stocks of food and beverage companies that comprise the underlying intellidex. The underlying intellidex was composed of common stocks of 30 U.S. food and beverage companies. These companies are engaged principally in the manufacture, sale or distribution of food and beverage products, agricultural products and products related to the development of new food technologies.

Holdings include McDonald's Corporation (NYSE:MCD), Starbucks (NASDAQ:SBUX), General Mills (NYSE: GIS), Kroger (NYSE: KR), Pepsico Inc (NYSE:PEP), National Beverage Corp (NASDAQ:FIZZ).

The downside is no local Asian food companies.

Current PE is 18.28, Price/Book 3.4, Yield 1.26%. The expense ratio is 0.58%.

Market Vectors Agribusiness ETF (NYSEARCA:MOO) - Price: $45.44

The Agribusiness Index is comprised of equity securities of companies that generate at least 50% of their revenues from: (1) agri-chemicals, animal health and fertilizers, seeds and traits, (2) farm/irrigation equipment and farm machinery and/or (3) agricultural products, aquaculture and fishing, livestock, plantations and trading of agricultural products. Top holdings are Syngenta AG (NYSE:SYT) (8.14%), Monsanto (NYSE:MON)(8.11%), and Deere & Company (NYSE:DE) (6.83%).

The ETF has been beaten down heavily in the recent rout and trading near 5 year lows, making a nice entry point.

Current PE is 15.06, Price/Book 2.01. Yield 3.05%. The expense ratio is 0.56%.

I chose MOO over iShares MSCI Global Agricultural Fund (NYSEARCA:VEGI) purely because the later has a higher PE of 21.8 (end of January 2016). However, for investors preferring a larger more liquid fund VEGI would be preferable. Their holdings are quite similar, as is their expense ratio with VEGI being the cheaper at 0.4%.

EGShares Emerging Markets Consumer (NYSEARCA:ECON) - Price: $20.72

As the name suggests this ETF tracks consumer stocks in the emerging markets, including 40% in Asia, and 33% in Latin America. Top holdings include Naspers (OTCPK:NAPRF), Fomento Economico Mexicano SAB de CV (OTC:FMXUF), Ambev SA ADR (NYSE:ABEV), and Tata Motors ADR (NYSE:TTM).

Current PE is 21.98, yield 1.18%. The expense ratio is 0.84%.

Of the three ETFs listed above ECON would be my choice, as it is more tiered towards emerging markets and Asia. I was not able to find a pure Asian food ETF, however it would be an excellent idea.

A larger list of consumer staples ETFs can be found here.

Food stocks to consider

Robinsons Retail Holdings Inc (OTCPK:RRETY) - Price: $12.80

Robinsons operates as a retail company in the Philippines. The company operates in six segments: supermarkets, department stores, DIY stores, convenience stores, drug stores, and specialty stores. As of December 31, 2014, it had a portfolio of 1,327 stores, which included 111 supermarkets, 42 department stores, 161 DIY stores, 450 convenience stores, 320 drug stores, and 243 specialty stores.

The Philippines is just entering the demographic window with a booming economy (it grew 6.3% in 4Q 2015), driven by Overseas Foreign Workers (OFW) remittances, and the BPO sector (call centers etc). Robinsons and SM dominate the shopping market sector. On that note SM Investments (OTCPK:SMIVY) (which will soon own 77.3% of the expanded SM Retail group), is also a good investment. SM also own some shopping centers in China.

Robinsons current PE is 19.6, with a dividend yield of 0.11%.

Starbucks - Price: $60.04

I choose Starbucks because they are currently expanding rapidly (especially into Asia), and should benefit from the rising Asian middle class. Their brand name ensures their cafes are always busy.

In 2015, there were 21,366 Starbucks stores in 64 countries around the world. Starbucks plans to open 500 stores in China every year until 2021, an expect to increase China store count by at least 30%. In 2016, they plan to open1,800 new stores, of which 70% are expected outside the US.

Coffee is a legal addictive drink, and meeting friends in Starbucks is very trendy in Asia. Finally, there is talk Starbucks may introduce some alcoholic beverages (at night time) and drive through, starting in their US stores.

I choose Starbucks ahead of, say, McDonald's as it is earlier in its development, and coffee is quite addictive.

Starbucks current PE is 31.44, with a yield of 1.36%. Saxo consensus analyst is an 80% buy, 20% hold, 0% sell. Analyst consensus target is $68.13. A great stock to accumulate on dips.

San Miguel Corporation (OTCPK:SMGBY) - Price: $17.50

SMC is Southeast Asia's largest publicly listed food, beverage and packaging company as well as the Philippines' largest corporation in terms of revenue, with over 17,000 employees in over 100 major facilities throughout the Asia-Pacific region. San Miguel Beer is their flagship product, and it is exported globally. COO Ramon Ang is world class. My only concern would be the thin net profit margin of 1.88%. PE is a reasonable 20.61. Unfortunately the US listing looks a bit illiquid.

Some of the top ten global food and beverage companies below are definitely worth considering.

The Coca-Cola Co (NYSE:KO) - Price = $43.77, PE 26.21.

Coke is popular in Asia, however the carbonated beverages are sometimes viewed as unhealthy.

Nestlé (OTCPK:NSRGY, OTCPK:NSRGF) - Price = $43.77, PE 26.21.

Milk powder, coffee etc. A global powerhouse.

Unilever (NYSE:UL) - Price = $43.37, PE 22.85.

Sells over 400 brands globally such as Axe/Lynx, Dove, Omo, Becel/Flora, Heartbrand ice creams, Hellmann's, Knorr, Lipton, Lux, Magnum, Rama, Rexona, Sunsilk and Surf.

You can read here about the top ten global food giants. For me I prefer to pick more Asian based food and beverage companies trading on lower PEs such as San Miguel Corporation discussed above.

I have not chosen any Asian food producers such as the pork, poultry or fish companies, as I view that area as too competitive.

2. Buy Asian property

Direct Property

I discussed Asian direct property in my previous Seeking Alpha article here. I have chosen to buy direct as I am based in Asia. Properties can be bought in Manila on PEs of around 12, with a net yield of 8%pa. Certainly a lot cheaper than buying the property developers I list below.

Asian Property Funds or Stocks

It is not easy to find emerging Asian property funds. In fact that seems to me to be a huge business opportunity for a fund management firm to create. There are many developed Asian REITS, and some specific Asian country REITS, but I have not yet found an "Emerging Asian REIT".

I am cautious on Chinese property stocks while their market is still in oversupply. I would favor the Philippines or Indian property sectors.

SM develops, conducts, operates and maintains modern commercial shopping centers in the Philippines. It has four business segments: malls, residential (SMDC), commercial and hotel and convention centers. SM shopping centers are part of the big three (Robinsons, Ayala and SM), that get strong reoccurring revenues. SM has the largest land bank of all the Philippines property developers.

Ayala Corp (OTCPK:AYYLF) - Price = $13.36, PE 23.51.

Philippines premiere property developer. The major developer to establish Makati city - Manila's financial district.

DLF Ltd. (DLF) - Price = INR 106, PE 35.02.

DLF is the largest real estate player in India. It builds retail, office and residential properties. It is now present in 24 cities in India. It is also well known for developing IT and ITES parks. DLF has about 25 million sq ft of leased office space creating reoccurring revenue.

Omaxe Limited (OMAXE) - Price = INR 141

Omaxe is in 27 cities across 8 states in India. Their portfolio includes group housing, shopping malls, office spaces, integrated townships, SCOs and hotel projects.

The company has 39 ongoing projects- 13 group Housing, 16 townships and 10 other commercial spaces. They currently have a land bank of nearly 4000 acres.

Currently a bit expensive on a PE of 34. A P/B of 1.1.

Indiabulls Real Estate Ltd - Price = INR 51.25

Indiabulls Real Estate was incorporated in the year 2005 with a business interest in development of residential and commercial projects across major cities in India and London. It is one of largest real estate companies in India by net worth and assets. It has two built two iconic towers in Mumbai. One is the Indiabulls Centre and the other the Indiabulls Financial Centre.

The company has its presence in key Indian metros like Mumbai, Delhi and Chennai. It has thirty one ongoing projects.

Current PE is 32.85.

NB: Asian banks in the emerging Asian middle class regions will do well also as customers borrow to buy a car or a house.

State Bank of India (SBID on the LSE) - Price = $26.40

SBID is listed on the London Stock Exchange but trades in USD. It is my top pick in the Asian banking sector. The stock has been smashed down since I last wrote about it here, as I was 6 month too early, and the non performing loans were not yet worked out of the system. The Indian Government recently announced in their latest budget that they will recapitalise the state banks such as SBID, causing SBID to pop up just under 10%.

Currently it has a PE of just 5.71, and Saxo analyst consensus recommendation is 80% buy, 10% hold, 10% sell. Consensus target price is $60.56, representing a 129% upside.

3. Buy transport devices (mostly cheap motorbikes), cheap smartphones, Internet service and available online shopping (consumer discretionary).

So many choices here, that I will just give a very brief reason for each choice.

Honda Motor Co (NYSE:HMC) - Price = $26.71.

Honda is a good way to play the Asian middle class rising as many Asians will buy a Honda motorcycle. They are the second most popular bike in India after Hero. The stock has been beaten down lately and trades on a PE of just 10.1. Analyst consensus target is $34.63.

Hero Motocorp (HMCL:IN) - Price = INR 2,826

India's Hero is the world's largest two wheeler maker. The company has recently made it in headlines by creating world's most fuel efficient bike called Splendor iSmart. The bike offers mileage of around 102 km/L. The stock however may not be very liquid in US markets.

Tata Motors (TTM) - Price = USD 23.73.

India's number one car maker, currently trading on a PE of just 9.46, and an analyst target price of $31.78, and a 90% buy rating.

Samsung (OTC:SSNLF, SSNLY) - USD 499.80

Not a cheap smartphone, but the number one selling smartphone company globally, trading cheaply on a PE of just 8.87. Very popular in Asia. Risk is losing market share to cheaper brands.

China Mobile (NYSE:CHL) - Price USD = 55.03

810 million mobile subscribers (at 2015-midpoint) or around 63% of China's entire mobile subscriber base, and still growing. Will benefit a lot financially from increased data usage by Chinese internet users. $68.8 billion in net cash, and a tidy 17% net profit margin. Current PE just 12.9, and 90% analyst buy rating.

Alibaba (NYSE:BABA) - Price = USD 71.33

China's and the world's largest online seller of goods, who will benefit from a larger consumer base buying goods online. Strong net profit margins of31.84%. A forward PE of 21.4, with strong buy ratings and a target price of $91.88.

Baidu (NASDAQ:BIDU) - Price = USD 176.50

The "Google" of China, will benefit from the rising Chinese middle class advertising their businesses online. The dominant search engine in China. Strong net profit margins of 26.78%. A forward PE of 19.3, with strong buy ratings and a target price of $213.64.

Conclusion

For those investors not wanting to take the above approach, investing in an emerging Asia Fund can still achieve good outcomes with less effort, and less risk. In that case the iShares MSCI Emerging Markets Asia ETF(NASDAQ:EEMA) is a nice choice, currently trading on a PE of 18.4 as of January 31, 2016.

As usual, all comments are welcome.

Disclosure: I am/we are long BIDU, BABA, SBID:LSE, SMSN:LSE.

By Matt Bohlsen

No comments:

Post a Comment